OM has experienced an impressive 70% rise in the past ten days, breaking out of a two-month-long consolidation phase. The altcoin recently posted a new all-time high (ATH) at $6.29, reflecting strong bullish momentum.

However, some signs suggest that the continued rise might face challenges in the near future.

MANTRA Holders Are Booking Profits

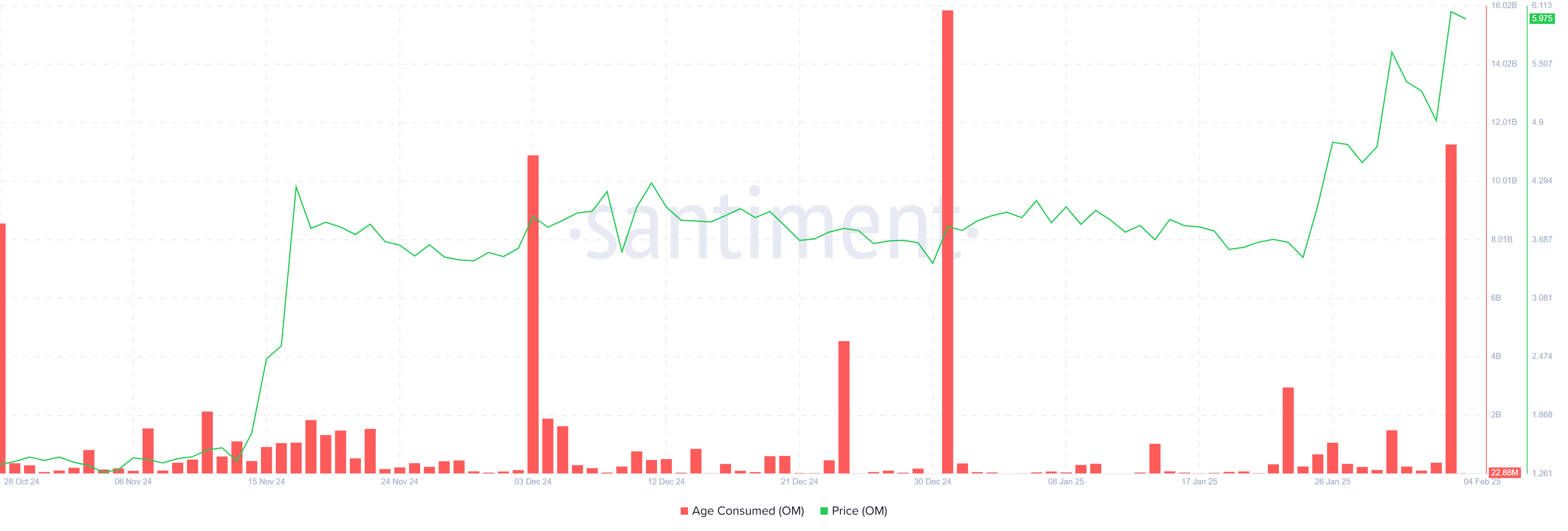

The recent surge in OM’s price has been met with increased activity from long-term holders (LTHs). The “Age Consumed” metric has spiked, indicating that long-term holders are starting to sell their positions.

LTHs are often seen as an asset’s backbone, and selling them can signal a shift in market sentiment. As these investors book profits, it suggests that the rally may take a breather and that the price might face some resistance in the short term.

The fact that LTHs are cashing out could indicate that the current price level is considered attractive enough for these holders to secure their gains. While this behavior is typical in a strong uptrend, it also suggests that the rally may not be sustainable without renewed buying pressure from new investors or retail traders.

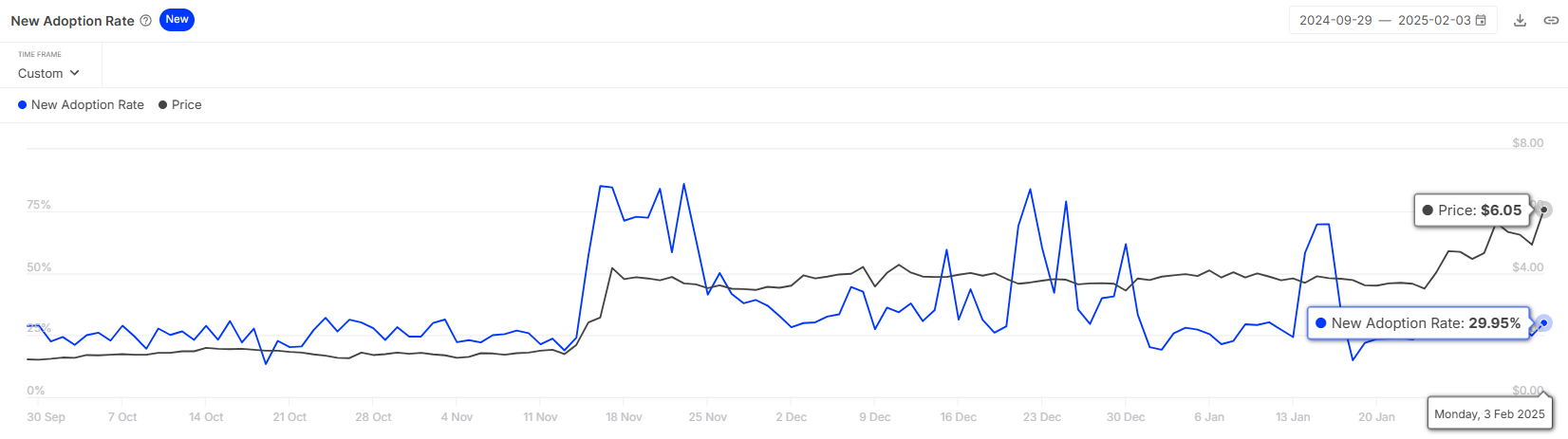

OM’s adoption rate, which tracks the percentage of new addresses making their first transaction, is not seeing a significant spike. This lack of momentum could indicate that the altcoin isn’t gaining as much traction in the market compared to other coins. A higher adoption rate usually signifies growing interest and confidence in an asset. Without it, OM may face difficulty sustaining its current price levels.

The relatively flat adoption rate suggests that the rally could be driven more by speculative trading than by fundamental growth. For a sustained upward movement, the altcoin would need to attract more long-term interest from new users and investors. The absence of a significant adoption spike may pose a challenge to OM’s long-term bullish outlook.

OM Price Prediction: Continuing The ATH Rally

OM’s price has surged by 70% over the last ten days, reaching $5.98. It recently formed a new ATH at $6.29, confirming the strong upward momentum. The price action indicates that OM has broken out of its consolidation phase and could see further gains, but potential resistance looms.

While continued growth is possible, the aforementioned factors suggest that sustaining the recent price increase may prove difficult. However, maintaining $6.00 as a support floor could keep the ATH rally intact, potentially pushing OM toward $7.00. If the market sentiment remains positive, the altcoin could continue its upward trajectory.

On the flip side, a reversal in market sentiment could lead OM to lose key support levels. If the price falls below $6.00, it could test the support at $4.27, and further declines might bring the price down to $3.47, invalidating the bullish thesis and erasing the recent gains.