MANTRA (OM) price is looking at a bullish couple of weeks owing to the upcoming launch of its mainnet. The highly anticipated event is expected to mark a crucial development for the Real World Asset (RWA) focused blockchain.

As the broader market conditions improve, the bullish momentum could continue to push OM upwards, potentially forming a new all-time high.

MANTRA’s Mantra to Success

OM price is looking at a potential surge over the next few weeks as the MANTRA blockchain prepares for the launch of its mainnet. According to a press release shared with BeInCrypto, the mainnet is scheduled to arrive in October,

It aims to offer a comprehensive and customizable set of tools, enabling developers to tailor solutions to meet their specific needs. This suite streamlines the process of bringing real-world assets on-chain while ensuring compliance with regulatory requirements.

In an interview with BeInCrypto, John Patrick Mullin, CEO of MANTRA, stated that the launch of the mainnet will be the culmination of years of work for the team.

“By providing on-ramps for tokens and stablecoins with world class stability and reliability, we believe MANTRA Chain will be the leading global destination for businesses and industries to access onchain financing and asset tokenization,” Mullin told BeInCrypto.

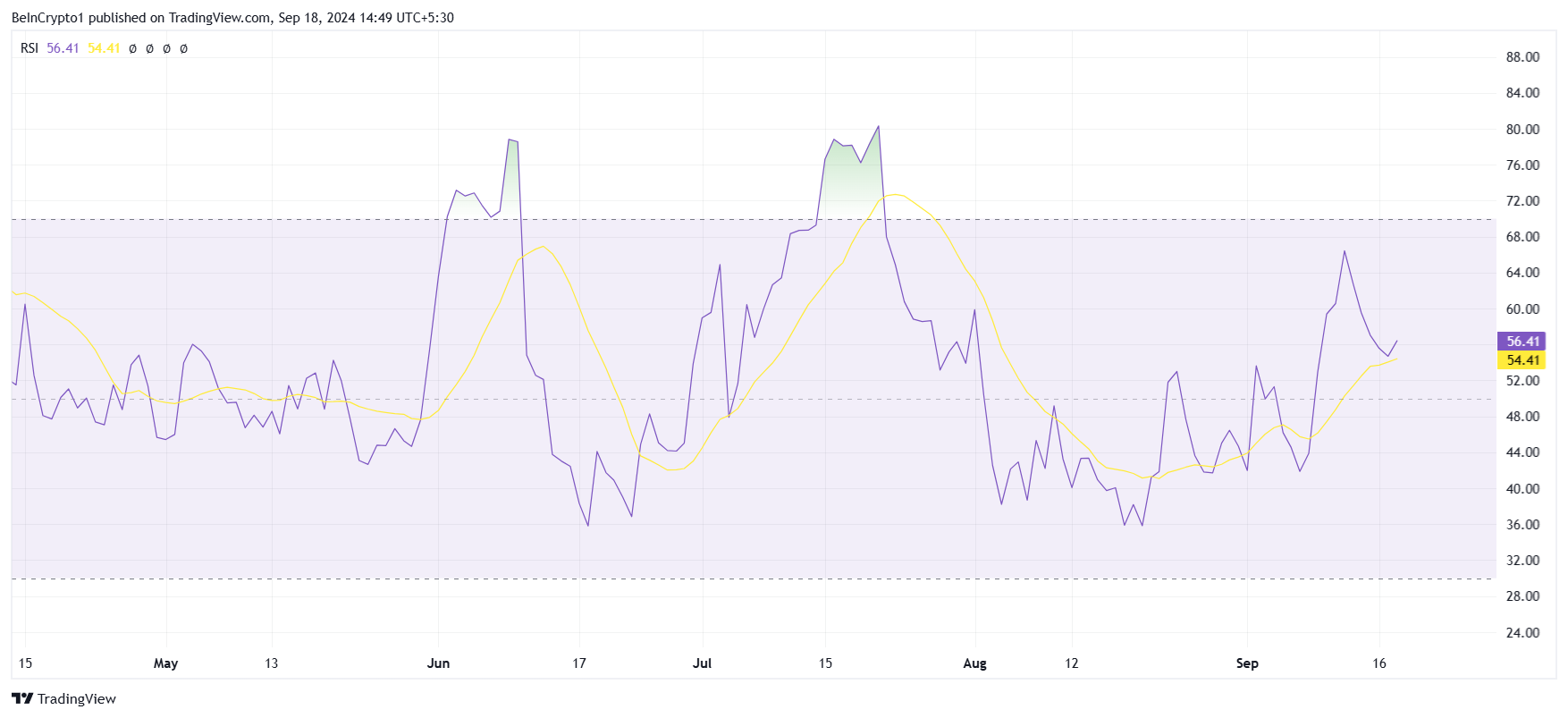

Given this would mark the beginning of a new era for MANTRA, its native token OM will also likely benefit from the mainnet launch. OM’s macro momentum has also been bullish, which is evident in the Relative Strength Index (RSI).

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It helps identify overbought or oversold conditions in an asset.

Since the RWA token is far from being overbought, it has room to continue an uptrend. This will support the rise of OM’s price.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

OM Price Prediction: New Highs Ahead

OM’s price has declined by 9.5% over the past five days but is currently holding above the support level at $1.04. This support could provide a foundation for the altcoin to recover, with the potential to climb toward its all-time high of $1.41.

The upcoming mainnet launch is expected to be a significant catalyst for OM. If bullish momentum continues into October, the altcoin could break its current high and surpass $1.41. This would mark a potential 33% rise for the crypto asset.

Positive sentiment around the launch will be crucial in driving this increase.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

However, if the bullish momentum fades, OM could fall below the $1.04 support level. In this scenario, the altcoin might drop to $0.95. Losing this support would invalidate the bullish thesis, leaving investors susceptible to losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.