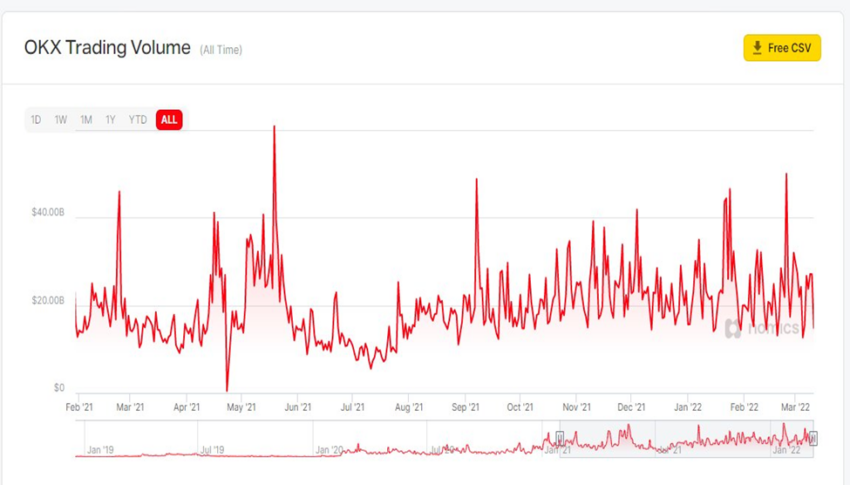

OKX, like several cryptocurrency exchanges, took a hit in trading volume during February after the exchange saw more than $100 billion wiped off the trading volume that it recorded in January 2022.

February proved to be a tough month for the entire crypto market, especially cryptocurrency exchanges. OKX (formerly OKEx) took a massive hit but managed to record approximately $658 billion during the second month of 2022, according to BeInCrypto Research.

OKX retests December 2021 volume

OKX faces strong competition from the largest exchange by daily volume worldwide, Binance, and as well as the largest exchange by daily volume in the United States, Coinbase.

Aside from these two, OKX competes with Mandala Exchange, Kraken, Gate.io, HitBTC, ZB, CoinFLEX, and many others. As a result, the decrease in volume in February could have a great effect on the fortunes of the exchange in 2022.

With that said, OKX experienced a year-over-year monthly increase of 16% in February 2022. The exchange recorded approximately $562 billion in February 2021, according to BeInCrypto Research. This means that there was an increase of $95 billion over 12 months.

Due to the bullish nature of the crypto market in May 2021 that saw several coins reach new all-time highs, trading activity increased significantly on the cryptocurrency exchange.

By the end of May 31, 2021, OKX had a total trading volume of approximately $828 billion. The difference between this all-time high and February’s statistic is $170 billion, a 20% decrease.

The latest volume recorded in February is a retest of the $600 billion to $699 billion mark experienced by the platform in December 2021. The total trading volume of OKX by the close of December 2021 was approximately $694 billion. In comparison to current data by the close of February 2022, OKX dipped by 5% in the span of two months.

OKX volume declines

Declining cryptocurrency prices can be considered as the primary factor that has led to a decline in trading volume in OKX. The top markets on OKX in 2022 are its stablecoin pairings.

In January, the biggest market on OKX, BTC/USDT, opened on Jan. 1, 2022, with a trading price of $49,930 and closed the month by changing hands at $39,604.

In February, BTC/USDT opened on Feb. 1, 2022, with a trading price of $39,895 and closed on Feb. 28 at $39,555.

From the statistics provided, it could be seen that a huge market such as BTC/USDT had relatively higher prices that equated to relatively higher volumes in January (traded above $40,000 several times) than the price and its related volume in February 2022 (traded below $40,000 several times). This largely explains the decrease in volume within the last two months.

As of March 16, 2022, the exchange’s trade volume was more than $290 billion.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.