The WallStreetBets DApp (WSB) token was trending as traders panicked following its delisting from centralized exchange OKX. OKX removed the token because of the concentration of WSB trading on its platform and the WSB team’s need for access to the Treasury.

OKX announced yesterday that it had begun to wind down the WSB/USDT pair trading according to its Token Listing Determination and Deprecation Rules. The action comes after the WSB team complained of a need for access to the Treasury, which r/WallStreetBets subreddit creator Jaime Rogozinsky currently controls.

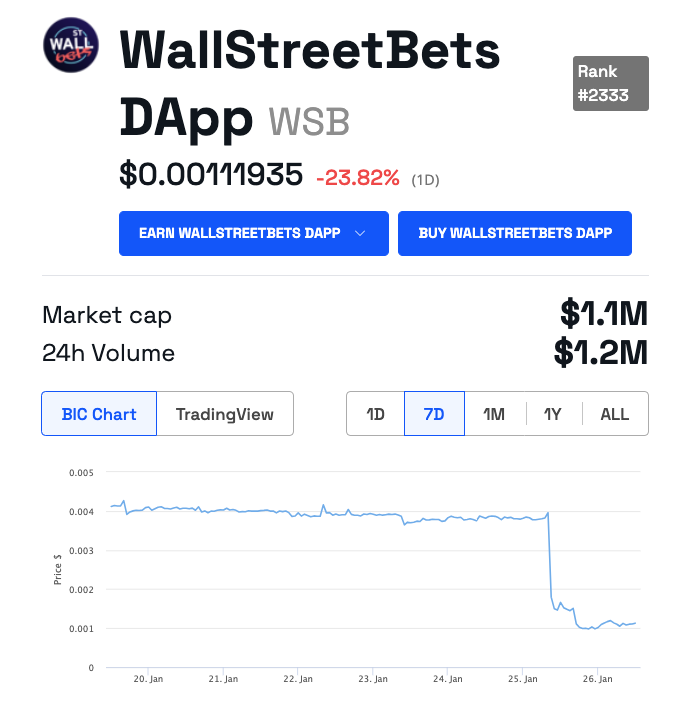

WSB Altcoin Tanks After OKX Delisting

According to OKX, the WSB trading pairs will be removed on Feb. 2, 2024. The exchange stopped WSB deposits on Jan. 23, 2024.

The price of WSB dropped 50% after the announcement. It is down 73% in the past seven days to $0.0011935.

Read more: What Are Altcoins? A Guide to Alternative Cryptocurrencies

The OKX team said the WSB trading volume was too concentrated on its platform. Exchange data suggests that around $1.1 million out of $1.2 million of WSB/USDT trading occurred on OKX in the past 24 hours. BNB Chain’s PancakeSwap (V2) accounted for roughly $69,000 in additional WSB volume.

Another factor influencing the delisting decision was the team’s unease at Jaime Rogozinski’s control over the project’s Treasury. Rogozinski created the r/WallStreetBets subreddit to divest big companies of the power to make investment decisions.

The project eventually culminated in a blockchain finance platform governed by the WSB token. The WSB meme coin enables community members to vote on allocating assets in investment products, among other things.

How the OKX Crypto Exchange is Reinventing Itself

OKX’s WSB delisting also accompanies a shift in its business priorities. On Friday, the crypto exchange stopped accepting sign-ups to its cloud mining pool and plans to wind down operations by Feb. 25, 2024. The pool has served Chinese crypto miners since 2017 but has recently come under the scrutiny of the Chinese government.

Last week, the company’s native OKB token experienced a 48% “flash crash” that resulted in measures to harden its operations.

Read more: OKX Review 2024: A Comprehensive Guide to the Leading Crypto Exchange

“…On 23 January 2024 the price of OKB dropped from 50.69 to 48.36 USDT, causing several margined positions to liquidate automatically. As a result, OKB experienced high volatility for about three minutes, reaching a low of 25.1 USDT before the market stabilized…we will work to continuously improve OKX’s margin position tier rules, risk management controls, and liquidation mechanism to avoid any future abnormal liquidations,” The company’s statement read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.