Nubank, a prominent Brazilian neobank, recently announced the integration of Bitcoin’s layer-2 (L2) Lightning Network.

This initiative aims to enhance transaction speed, reduce costs, and improve scalability for its users.

Nubank Partners with Lightspark to Enhance User Experience through Lightning Network

The move is part of a strategic partnership with Lightspark, a company renowned for its blockchain solutions. Integrating with Lightspark’s tools will optimize transaction success rates and liquidity requirements. This provides Nubank with powerful tools to enhance end-to-end transaction experiences via blockchain.

By incorporating the Lightning Network, Nubank enables its customers to conduct everyday payments, transfers, and international purchases with Bitcoin (BTC). This development aligns with Nubank’s continuous efforts to innovate and improve its digital banking services. Thomaz Fortes, Executive Director of Nubank Cripto, emphasized the institution’s focus on efficient customer solutions.

Read more: Beginner’s Tutorial to Start Using the Lightning Network

“The future integration of Lightning Network underscores Nu’s ongoing mission to offer more efficient services with greater speed and lower costs through blockchain technology,” Fortes added.

Echoing Fortes’ sentiment, David Marcus, CEO and co-founder of Lightspark, also expressed his excitement about their part in introducing Lightning Network to Nu’s 100 million customers.

“We’re delighted to enable Nubank to keep evolving their crypto solutions,” Marcus stated.

In addition to the Lightning Network, the partnership with Lightspark will introduce Universal Money Addresses (UMAs), which function like email addresses for sending money. This feature simplifies financial transactions for Nubank’s users. While specific product details remain undisclosed, Nubank promises further announcements in the near future.

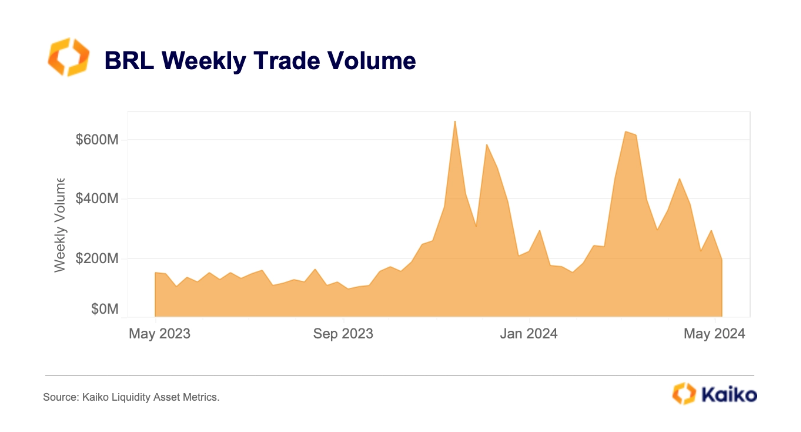

Nubank’s latest crypto-related expansions align with the current market in Brazil. According to a report from research firm Kaiko, the Brazilian crypto market has experienced substantial growth this year.

Read more: The Best Bitcoin Lightning Network Wallets In 2024

Brazilian real-denominated crypto trading volumes reached $6 billion from January to early May 2024. This growth positions Brazil as a leading player in the Latin American crypto market and highlights the increasing interest in stablecoins, Bitcoin, and other cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.