Notcoin (NOT), the cryptocurrency associated with the Telegram-based clicker game, has seen a 5% price increase in the last 24 hours. This rise followed speculation on social media that Telegram founder Pavel Durov had been released by French authorities.

However, the rumor turned out to be inaccurate. Given this, an on-chain analysis suggests that Notcoin’s recent price increase might be short-lived.

Notcoin Bulls Continue to Play Second Fiddle

On August 28, French authorities laid several charges against the founder, specifically related to illicit activity on the app. While Durov was released on a €5 million bail, the Telegram founder is restricted from leaving the country.

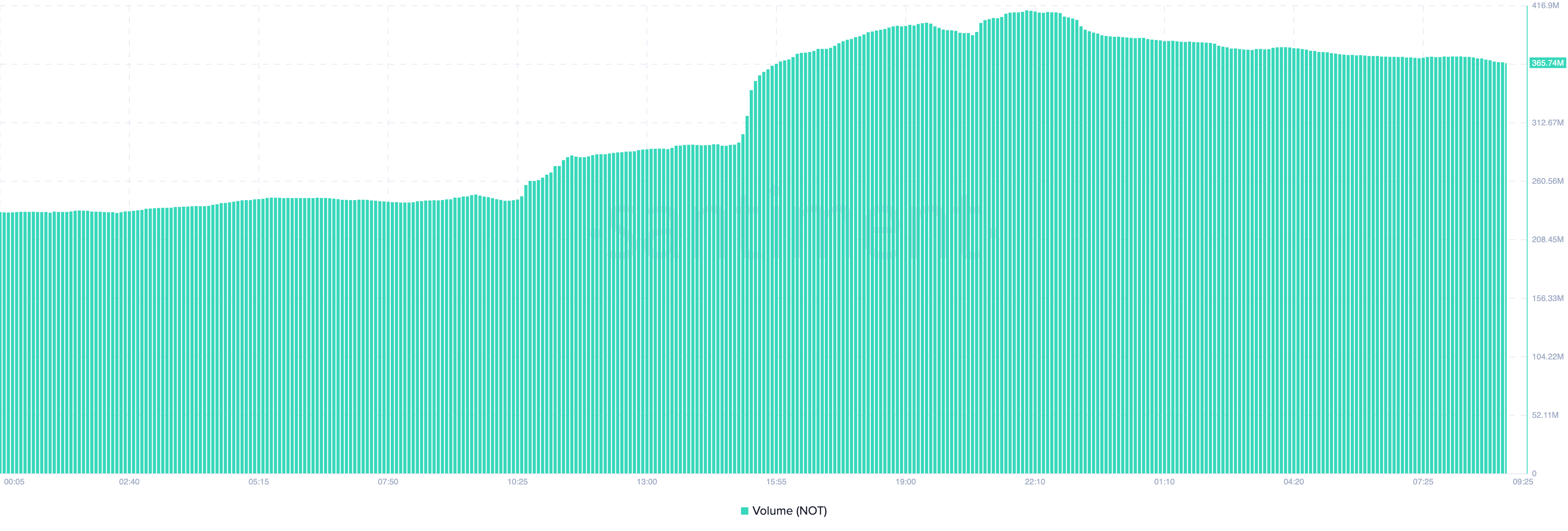

Following this judgment, Notcoin’s price surged to $0.0092. Like the cryptocurrency’s market value, the volume jumped by 50% within the last 24 hours, reaching a peak of $412.84 million.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Volume is a key indicator of market interest, and the initial surge in Notcoin (NOT) suggested that speculation surrounding Durov’s situation led to increased buying and selling activity. However, the combination of declining volume and a falling price now suggests that interest in the cryptocurrency may be waning. If this trend continues, it could halt the recent rally.

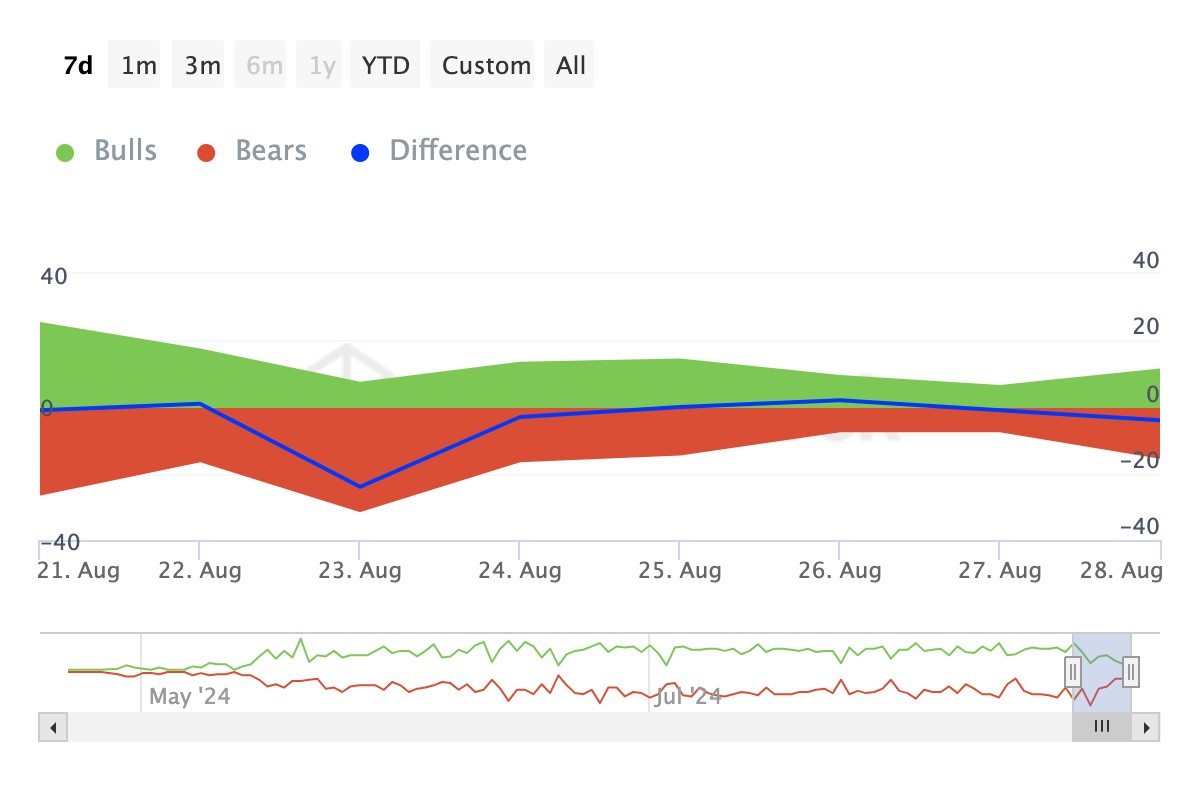

Supporting this outlook, on-chain data from IntoTheBlock’s Bulls and Bears indicator reveals that more participants are selling NOT than buying it. This indicator tracks whether participants who bought at least 1% of the total trading volume (bulls) are pushing the price up, or if those who sold the same amount (bears) are dragging it down.

As of now, there are four more bears than bulls, indicating higher selling pressure. If this selling pressure persists through the end of August, NOT’s price may struggle to recover and could potentially slide toward an all-time low.

NOT Price Prediction: The Increase Is a False Alarm

Notcoin’s brief price increase has helped with the formation of a bearish flag on the daily 4-hour chart. This pattern typically emerges after a downtrend with increasing volume, followed by a period of consolidation with decreasing volume, which eventually leads to a further price drop.

If NOT fails to break above the upper trendline of this bearish flag, the price could drop to $0.0085. Moreover, the Relative Strength Index (RSI) remains below the neutral line, indicating that bears currently control NOT’s price trend.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

The low RSI reading suggests a lack of bullish momentum, which could push the price lower. However, if buying pressure increases, NOT might climb toward $0.0095, potentially invalidating the bearish outlook.