Since the arrest of Telegram’s CEO Pavel Durov on August 24, Notcoin’s (NOT) price has plummeted. Trading at $0.0088 at press time, the altcoin’s value has since declined by 20%.

With rising selling pressure, NOT is at risk of falling toward its all-time low of $0.0046, last recorded on May 24.

Notcoin Whales See an Opportunity

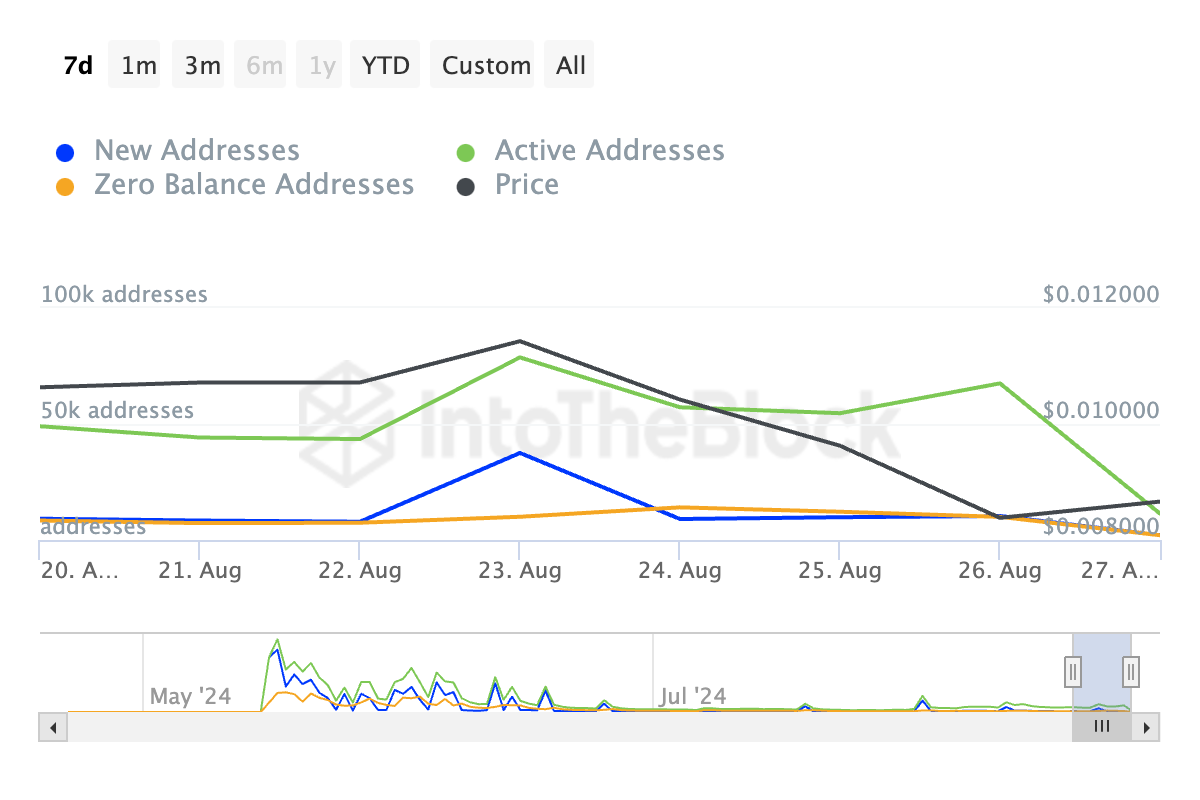

Due to NOT’s recent price struggles, the number of active addresses trading the altcoin has steadily declined over the past seven days. Data from IntoTheBlock shows a 76% decrease in unique addresses that have completed at least one NOT transaction during this period.

Similarly, demand for the altcoin has waned. The on-chain data provider reports that the number of new addresses created to trade NOT has dropped by 77% over the past week.

When an asset experiences a drop in daily active and new addresses, it signals a decline in interest, with fewer people engaging with the cryptocurrency and indicating weakening market sentiment.

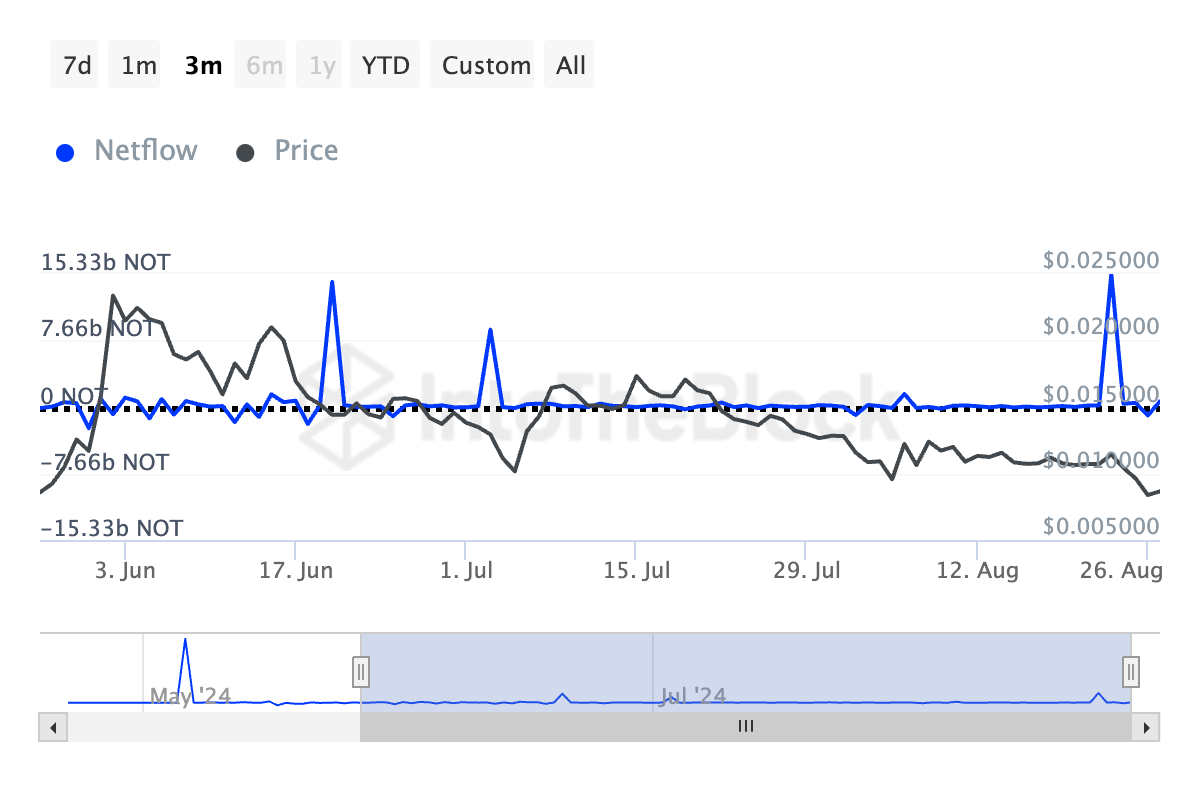

Interestingly, despite this decline, NOT whales have taken advantage of the situation by increasing their accumulation. The token’s large holders’ netflow has surged by 312% over the past seven days. For context, this metric reached a three-month high of 15.33 billion NOT on August 24, following the news of Durov’s arrest, which caused the prices of Telegram-based assets to plunge.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

Large holders are addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the amount of coins they buy and the amount they sell over a specific period. When the large holder netflow surges, it indicates that whale addresses are accumulating more of the asset, increasing their overall holdings.

NOT Price Prediction: Bad Times Are Not Over

NOT’s technical setup points to a potential further decline in the token’s value. The Chaikin Money Flow (CMF) remains in a downtrend, hitting a 30-day low of -0.22.

The CMF measures the flow of money into and out of an asset. A value below zero indicates market weakness, suggesting that liquidity is exiting the market, which is often seen as a precursor to further price declines.

Moreover, the token’s Relative Strength Index (RSI) is currently below its neutral 50 mark, sitting at 35.50. This indicates that selling pressure is stronger than buying activity, reinforcing the bearish outlook.

If NOT’s selloffs persist, the altcoin’s value could retreat to its all-time low and potentially drop further to around $0.00031. On the other hand, if market sentiment shifts and demand for NOT surges, its price could rally toward $0.013.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.