Telegram coin Notcoin’s (NOT) price is aiming at recovery, but this might not come easily for investors as the market remains slightly bearish.

Further dampening potential bullishness is the increase in short-term holders, who could hinder a rise.

Notcoin Is Not Safe From Selling Pressure

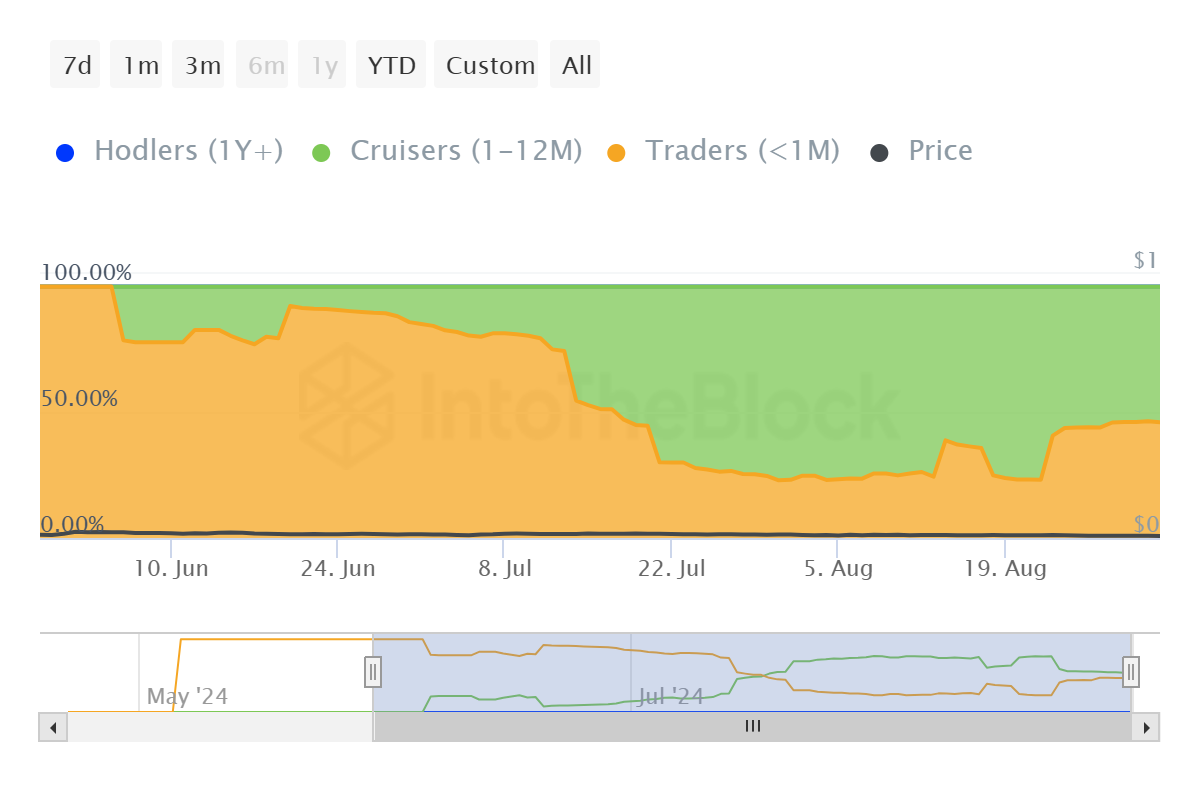

One of the biggest threats to Notcoin’s price right now is the dominance of short-term holders (STH). These investors control 46% of the circulating supply and are prone to selling, as they typically hold their assets for less than a month.

STH’s dominance grew after August 22, when mid-term holders (MTH) decided to offload their supply. This was in response to news about Telegram CEO Pavel Durov being detained.

Within 48 hours, over 21 billion NOT, worth more than $176 million, moved out of mid-term holders’ hands. Short-term holders picked up this supply, leading to their increased dominance.

Mid-term holders, who hold assets for one to 12 months, act as pillars for an asset. While these holders still control 53% of the supply, the short-term holders pose a significant threat of selling.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

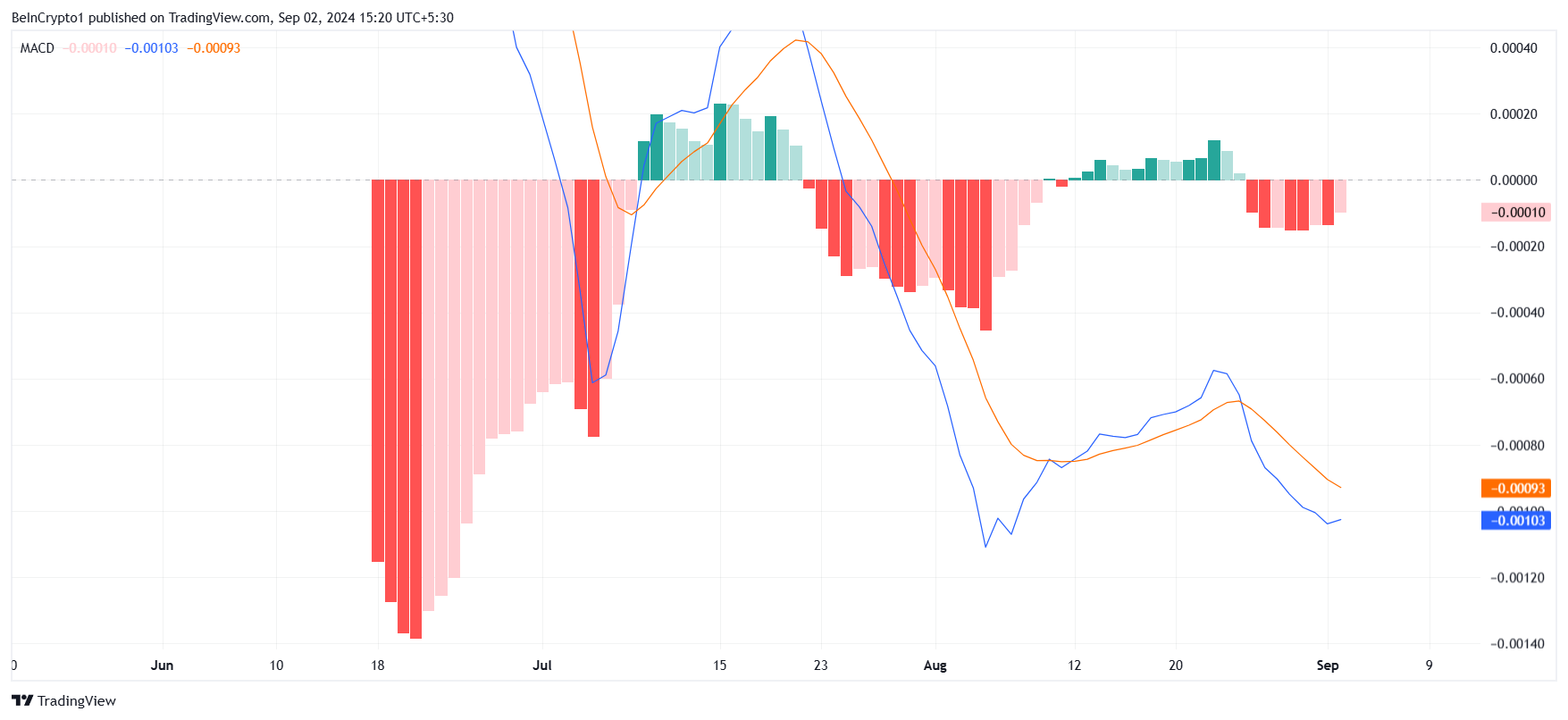

Secondly, the Moving Average Convergence Divergence (MACD) indicator suggests that the bearish momentum for Notcoin (NOT) is starting to weaken. The selling pressure is gradually subsiding, which is a positive sign for the cryptocurrency. However, this does not necessarily mean that a bullish reversal is imminent.

For Notcoin to transition from its current bearish trend to a bullish one, strong market support is essential. Unfortunately, broader market conditions do not currently favor such a shift. Without significant buying interest or a catalyst to drive demand, the potential for a bullish breakout remains limited.

NOT Price Prediction: Breach Likely, Not a Breakout

Notcoin’s price has been stuck under a downtrend line that first appeared back in June. Over the last three months, NOT has made multiple attempts to break above this line and initiate recovery.

However, these attempts have failed each time, with the most recent setback triggered by Durov’s arrest. Given the current conditions, bullish cues may take a while to materialize. As a result, the likely outcome is sideways movement within the range of $0.0094 to $0.0076.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

A drop below $0.0076 could send NOT on a path toward its all-time low of $0.0045. On the other hand, if bullish cues arrive sooner than expected, the altcoin could flip $0.0094 into a support floor, leading to recovery. Either scenario could invalidate the current consolidation thesis.