The number of Bitcoin network addresses created over the past 24 days has hit its highest point since January 2018. This is according to data published by on-chain market intelligence firm Glassnode.

Writing on Twitter, GlassNode stated that the number of new addresses created on Nov 18 contributed heavily to the spike.

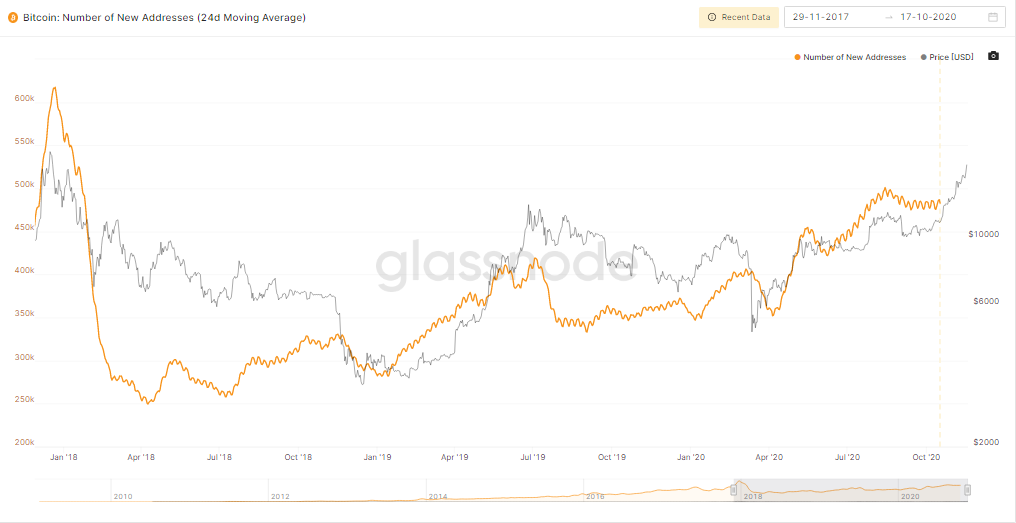

In January 2018, shortly after Bitcoin’s all-time high of $19,783, interest in Bitcoin was at its highest ever level. This could be surmised from the 24-day moving average number of new addresses created, which rose above 600,000.

The latest data shows that this number has now reclaimed the 500,000 level.

In the past hour we observed the highest number of newly created addresses in the #Bitcoin network since January 2018 📈

Chart: https://t.co/fTmoH5ezNw pic.twitter.com/INq7sEEtoM

— glassnode (@glassnode) November 18, 2020

New Bitcoin Addresses Exceed 500,000

According to Glassnode’s data, the 24-day moving average of new Bitcoin addresses created has risen from just over 350,000 in April 2020 to just under 550,000 as of Nov 18.

As visualized below, the data shows a gentle but sustained upsurge in this metric since falling off to a bottom of 250,000 in April 2018.

Unlike the last peak in January 2018 which came after Bitcoin had already dropped over 17 percent from its all-time high, the current spike comes while Bitcoin is still building up momentum on its way to another possible high.

On paper, this could mean that if the address creation statistics correlate positively with individual investments and adoption figures, the current bull market could last significantly longer than that of 2017.

Possible Implications

The most obvious implication of this data is the possibility that new levels of adoption and investments are coming in to potentially broaden the support base driving the current push. The entry of a large number of individual adopters and investors would theoretically support the notion that this is an organic surge that is not substantially driven by fickle institutional money.

This point of view is shared by on-chain analyst Willy Woo who believes that a de-coupling from institutional capital is taking place.

On Sep 27, BeInCrypto reported on Woo’s position that internal adoption is driving Bitcoin’s surge and those adoption fundamentals will become the single most important factor in securing a fruitful Bitcoin future.

If you want to see data behind the upcoming decoupling of BTC from the stock markets powered by BTC's internal adoption, here's some @glassnode data. This is the active users of BTC after filtering for unique players (ignores multi wallet addresses belong to one entity). https://t.co/FvGWUUlSc8 pic.twitter.com/gEweb9vYOY

— Willy Woo (@woonomic) September 26, 2020

On Oct 28, BeInCrypto also reported that Woo’s Network Value Transaction Ratio (NVT) calculation placed Bitcoin at an all-time high. According to Woo, this high would likely soon be followed by the real market price as the asset moves into a sustained bull phase.