If you want to see data behind the upcoming decoupling of BTC from the stock markets powered by BTC's internal adoption, here's some @glassnode data. This is the active users of BTC after filtering for unique players (ignores multi wallet addresses belong to one entity). https://t.co/FvGWUUlSc8 pic.twitter.com/gEweb9vYOY

— Willy Woo (@woonomic) September 26, 2020

Background of Woo’s Prediction

Woo’s prediction comes against a backdrop of a significant correlation between bitcoin and stocks. This has led to fears in some quarters that macroeconomic factors such as interest rates, unemployment and inflation could exert influence over the bitcoin price — and by extension the entire crypto market, which largely defers to bitcoin.Not every analyst, however, agrees that there is in fact a correlation. Heisenberg Capital founder Max Keiser believes that in fact “bitcoin…is inversely correlated to the USD — not the stock market.” He adds, “Don’t be fooled by randomness.” The charts below illustrate an apparent correlation between stocks and bitcoin over a five-year period#Bitcoin, like Gild, is inversely correlated to the $USD – *not* the stock market.

— Max Keiser (@maxkeiser) September 22, 2020

Don’t be fooled by randomness https://t.co/UIbu7hiW5m

Woo’s Decoupling Prediction

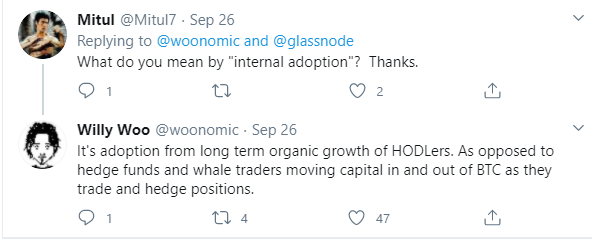

According to Woo, bitcoin is nearing a point in its life cycle where something he describes as “internal adoption” is exerting greater influence over market movements than investment from external sources. Explaining what “internal adoption” means, he wrote in a tweet:“It’s adoption from long-term organic growth of HODLers. As opposed to hedge funds and whale traders moving capital in and out of BTC as they trade and hedge positions.”

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.