Neo (NEO) has been moving upwards since Feb. 23. However, it has not been confirmed that the upward move is the beginning of a new impulse and not a correction.

SushiSwap (SUSHI) dropped after reaching a new all-time high on March 3. Despite regaining the majority of its losses, the increase looks corrective.

Curve Dao Token (CRV) has broken out from a descending resistance line.

Neo (NEO)

NEO has been struggling to retrace since dropping to a low of $31.56 on Feb. 23. Despite creating a long lower wick, a sign of buying pressure, it is not yet certain that NEO has begun a new bullish impulse.

Technical indicators have not confirmed the bullish trend, though they are turning bullish. The MACD is increasing but needs another bullish close to confirm the bullish reversal. Similarly, the Stochastic oscillator has not yet made a bullish cross. The RSI is above 50; hence it is considered bullish.

A closer look at the movement shows that NEO is potentially trading inside a parallel channel, in what could be a corrective movement.

However, even if the movement was corrective, NEO would still be expected to reach the top of the potential parallel channel at $46, also being the 0.618 Fib retracement of the entire move.

Highlights

- NEO has bounced at the 0.5 Fib retracement support.

- Indicators are gradually turning bullish.

SushiSwap (SUSHI)

On Mar. 2, SUSHI reached a new all-time high price of $20.72 but dropped almost immediately afterwards.

While daily indicators are gradually turning bullish, the MACD has yet to give a bullish reversal signal. Furthermore, the Stochastic oscillator has not yet made a bullish cross.

Both of these need to occur for the trend to be considered as bullish.

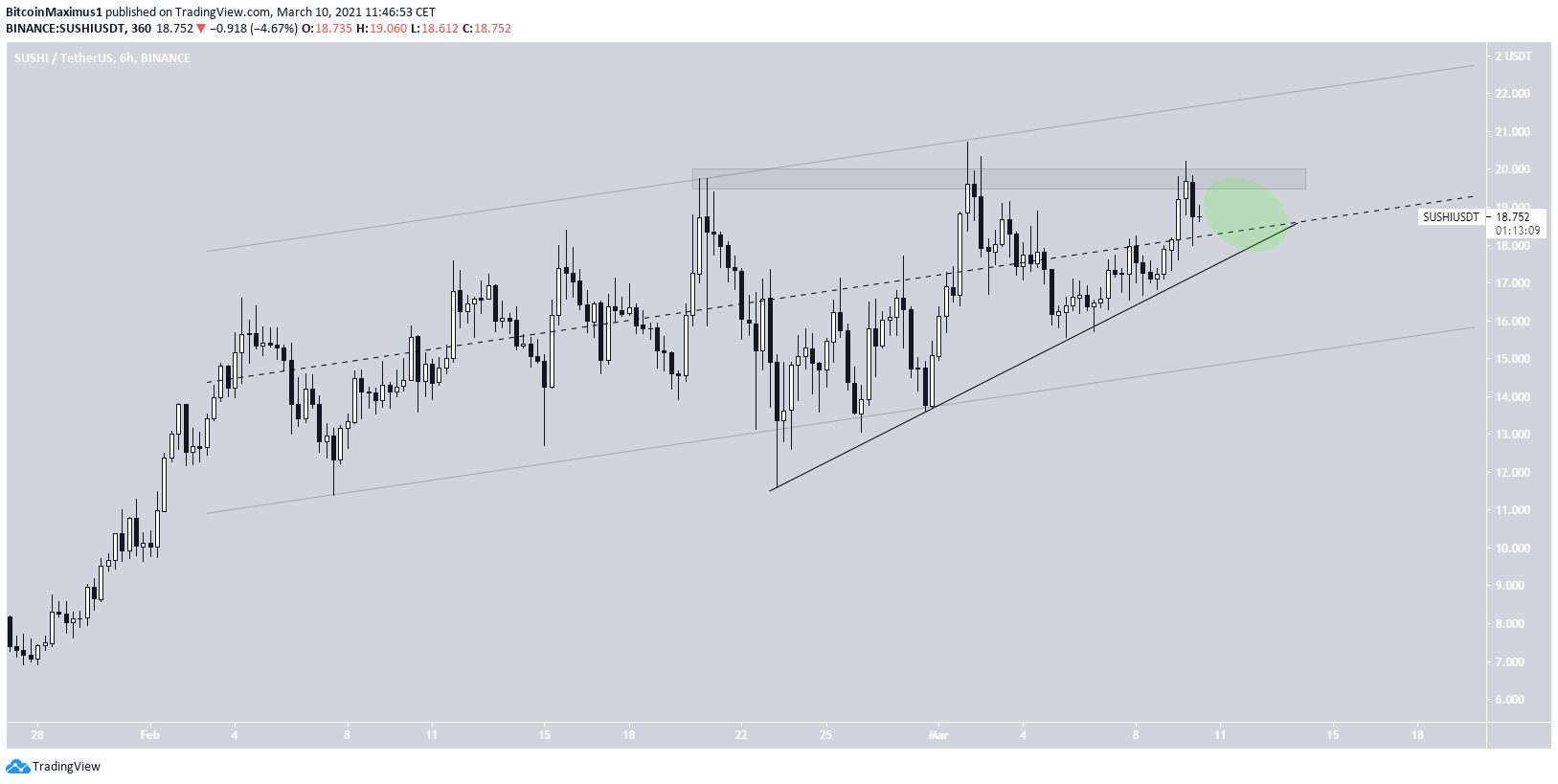

However, the possibility that SUSHI will soon decrease considerably remains. SUSHI is trading inside an ascending parallel channel, in what could be a corrective movement.

Currently, it is right at the resistance line of this channel.

The shorter-term movement shows a strong resistance at $20, and an ascending support line that SUSHI has been following.

The next few days will be crucial, since SUSHI will reach the point of convergence between this line/area.

Unless SUSHI manages to move above this area, a breakdown from the ascending support line and then the channel seems to be the most likely option.

Highlights

- SUSHI reached a new all-time high price on March 2.

- It is trading in a ascending parallel channel.

Curve Dao Token (CRV)

CRV has been moving downwards since Feb. 6, when it attained a high of $3.66. However, on Feb. 28, it bounced at the 0.618 Fib retracement level at $1.63 and has increased since.

The increase also caused a breakout from a descending resistance line, which had been in place since the aforementioned high.

Technical indicators have nearly confirmed the bullish trend. The MACD has already done so, while the Stochastic oscillator & RSI are very close.

Therefore, CRV is expected to resume its upward movement, potentially increasing towards the previously mentioned $3.66 high.

Highlights

- CRV has broken out from a descending resistance line.

- Technical indicators are bullish.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.