For some reason, Bitfinex longs for Ethereum are dominating. Almost 90% of all margin traders are longing ETH on the exchange.

The overwhelming amount of longs for ETH has some speculating that we could see a massive long squeeze shortly—or maybe these traders know something the rest of us don’t. There is confusion over why Bitfinex margin trading is skewing so overwhelmingly towards margin-longs.

Bitfinex Traders Bet on Gains

At the time of writing, close to 90% of margin traders are now long on Bitfinex, totaling some $314M. On BitMEX, only 47% are long but the volume is many times smaller than Bitfinex.

According to lowstrife (@strife), some 1.975M ETH was margin-long on Bitfinex alone. That’s about 1.8% of the circulating supply.

1.975 million ETH (1.8% of total circulating supply) is now marginlong on Bitfinex. Just Bitfinex.

+250k just got filled over the last 4 hours. pic.twitter.com/xOOrxNR8gw

— lowstrife (@lowstrife) April 10, 2020

These longs have stayed despite the relatively anemic price movement as Bitcoin (BTC) continues to bleed lower. The majority of BTC margin calls, 61% at the time of writing, are long as well.

Despite the S&P 500 pushing higher today by 1.5% at the time of writing, Bitcoin has not followed. The leading cryptocurrency has fallen below the $7,000 price point and is currently down 5.25% on the daily. Perhaps traders are expecting BTC and ETH to follow traditional financial markets today which, thus far, has not happened.

Confusion Over What’s to Come

The overwhelming amount of margin-longs on Bitfinex has caught the attention of traders. Some are speculating that ETH has formed a long-term bottom. Trading volume plummeted in March and price activity has been choppy since but may be bottoming out. Still, others are seeing this all merely as a ploy to squeeze margin-longs. The macroeconomic outlook continues to cause unease.

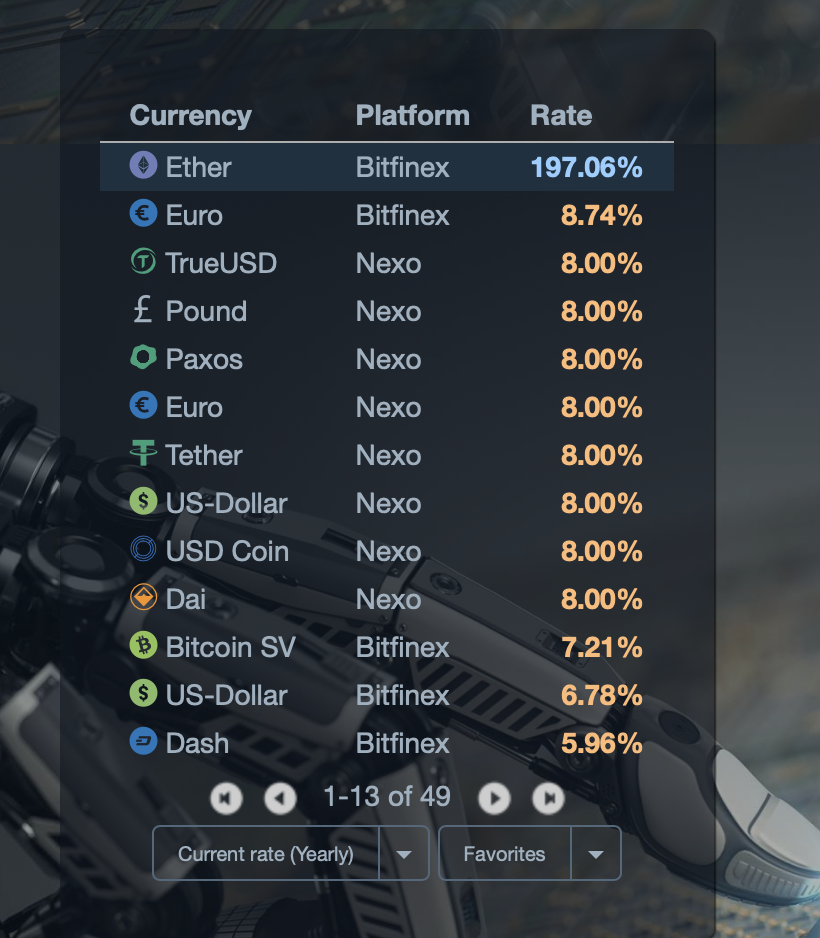

As of now, the annualized interest rate for ETH on Coinlend is at a stunning 197%. The spike may be related to the margin-longs for ETH on Bitfinex.

Many traders are opting to wait on the sidelines to see how this plays out. There is also some speculation that this is a run-up to the release of ‘phase 0’ of ETH 2.0, expected to be rolled out in July. It should be noted, however, that even with the release of ‘phase 0,’ Ethereum 2.0 won’t be fully functional for many years.

Perhaps this will be the beginning of Ethereum leading the market for a short while instead of Bitcoin.