A new Messari report on the Layer 2 NEAR Protocol has revealed that the network progressed toward greater decentralization as the number of daily active accounts reached an all-time high of roughly 64,000 in Q, 2023.

According to the report, new accounts decreased for the third consecutive quarter. Transaction volumes slowed to 393,000, down 13% from Q4 2022.

USN Stablecoin Volumes Healthy Amid Wind Down

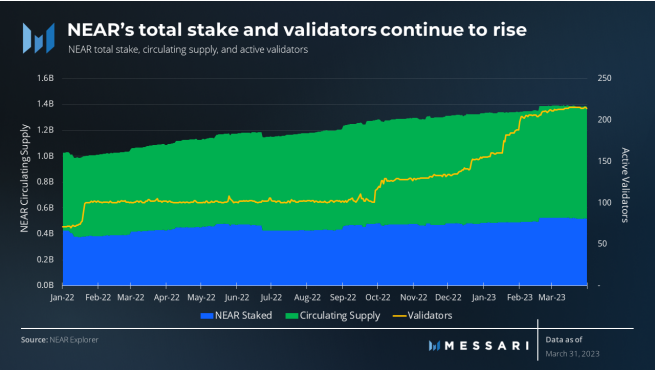

NEAR is a so-called thresholded proof-of-stake blockchain that can run decentralized applications. Originally conceived as a community-driven cloud, it is secured by a group of validators who stake the chain’s native NEAR token for a chance to validate transactions. The network determines transaction fees by computing requirements and network bandwidth.

At press time, the network had 200 validators.

Last year, the NEAR Foundation contributed $40 million to aid in the winding down a NEAR-native stablecoin, USN, issued by Decentral Bank.

Before that, Circle announced it would launch its stablecoin on NEAR to enable USDC fund flows on NEAR’s decentralized applications. Stablecoins are cryptocurrencies pegged to the value of a government-issued currency through on-chain or off-chain assets.

Circle’s USDC briefly lost its peg across several exchanges during mid-March as investor panic resulted in a flurry of withdrawals from Silicon Valley Bank. The company held $3.3 billion in cash reserves supporting USDC’s peg to the U.S. dollar at the failed institution. Circle competitor Tether started issuing its USDT stablecoin on NEAR in September 2022.

USN, USDC, and USDT are the top three stablecoins on the network, with market caps of $37.99 million, $29.99 million, and $19.54 million.

NEAR and Arbitrum Decentralization Shifts Power Away From Foundations

As of Q1 2023, NEAR holds about $316 million in its treasury. The NEAR Foundation will allocate funds toward several internal decentralized autonomous organizations, including Marketing DAO, Developer Governance DAO, Creatives DAO, and the NEAR Digital Collective.

The NEAR Digital Collective is a new governance body using a House of Merit to represent voters proposing network changes. A council of advisers will guide the direction of the House of Merit.

The recently-launched Arbitrum DAO has spotlighted the challenges of DAO governance.

Community members opposed the Arbitrum Foundation’s decision to earmark 750 million ARB tokens for grants to the Foundation. A later proposal suggested greater transparency for the tokens granted to the Foundation’s “Administrative Budget Wallet.”

Another proposal, AIP-1.2, lowered the barrier to entry for those wishing to participate in the governance of the Arbitrum DAO.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.