Hardly a week goes by without news of some country preparing to launch a digital currency. It’s not necessarily good news for the crypto industry and in most cases, these currencies have nothing to do with crypto.

Financial regulators have a love-hate relationship with crypto. On the one hand, they realize the advantages: speed, low costs, and reliability. Again, they can’t stand the fact that cryptocurrencies are issued by independent, or even anonymous, developers and that crypto revenue is so hard to tax.

So it’s only natural that a central bank would come up with the idea of a national cryptocurrency, or a digital currency of some sort. An asset that is as fast and cheap as XRP, for instance, but issued by the state.

Just think of the opportunities. You could instantly pay for imports without using the US dollar. Or let your citizens abroad send remittances home without Western Union. Or even list your national coin on crypto exchanges and reduce your government debt as its value grows.

Of course, there are stumbling blocks. If the “state crypto” turns out to be too volatile, it can hurt your economy. And if you dare to issue a decentralized coin, there’s a risk that it will be used for money laundering, shady offshore operations, and other legally questionable activities. How does one avoid these pitfalls?

Setting the record straight on CBDCs and cryptocurrencies

When you see headlines like “Country X to Issue Its Own Cryptocurrency,” don’t get excited. Most of the time it’s not a cryptocurrency but rather a CBDC, or a “central bank digital currency.” A CBDC is fiat money in digital form, recognized as legal tender, and with each unit carrying a unique identifier. In terms of technology, a CBDC can use a distributed ledger, or not. Even if it does, it will be a permissioned blockchain, and the regulator will decide who gets the permission to read and write information on it. In other words, it’s a centralized system. With a blockchain, or without, regular users won’t feel the difference. It’s businesses and merchants that will benefit most. For instance, by not having to pay acquiring fees for card payments or wait days for a bank transfer to clear. Now that we’ve seen that a CBDC doesn’t have to be a cryptocurrency, let’s check what’s happening with national digital currencies.Reality check: who’s really working on a CBDC?

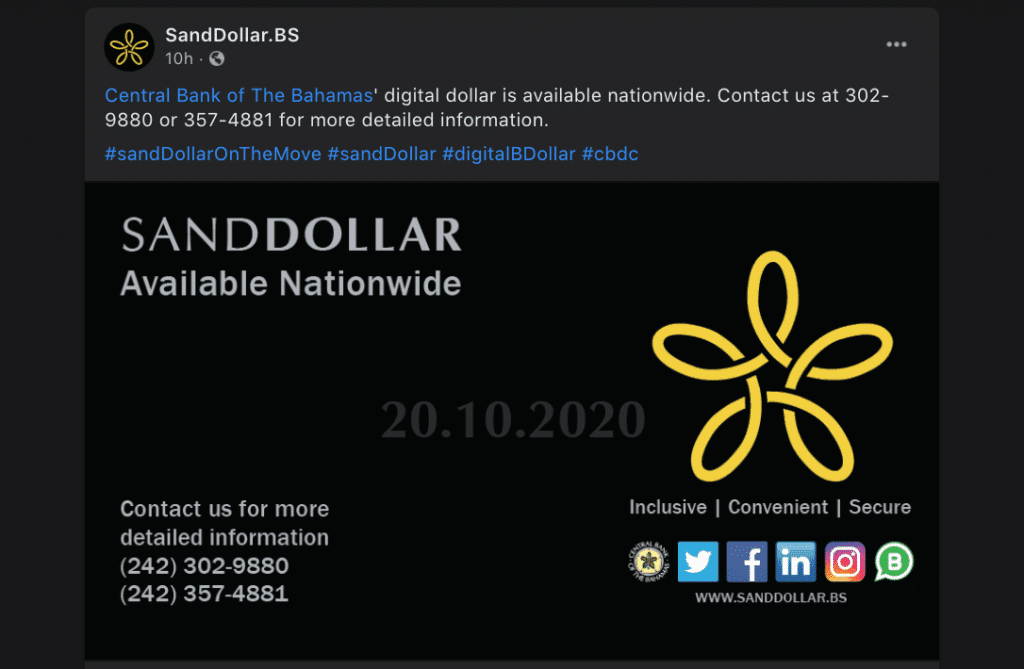

Frequent headlines mention Japan, Thailand, South Korea, Sweden, Hong Kong, and the European Union in conjunction with CBDC projects, but there’s nothing tangible yet. Sure, the central bank of Hong Kong chose to work with ConsenSys on its digital currency, and South Korea plans to run some tests in 2021. But the truth is that only two countries are doing anything significant by talking, considering, and studying.The Bahamas: “Sand Dollar” (pegged to the USD)

Source: Finance Magnates

Status: live. Blockchain: no. Significance: It’s a great promotional story for the Bahamas, and the first live CBDC (i.e. not just a pilot). Still, the real value will remain small until all merchants in the country start to accept it.China: DCEP, or “digital yuan”

Source: Ledger Insights

Status: pilot. Blockchain: apparently not, though there are similarities. Significance: This is the CBDC that everyone’s watching – not a crypto, not even a real blockchain project, but a potentially revolutionary digital asset, nonetheless. With the US-China trade war, the PRC needs a way to decouple from the US dollar, and DCEP is it. In October, the Shenzhen city government handed out $1.5m in DCEP to 50,000 users, who could spend them in 3,000 retail outlets. This means that a full-scale launch is close.Are CBDCs a good thing for the crypto industry?

Crypto media tend to present updates on national digital currencies as good news. But is it? Imagine a regular consumer – not a blockchain enthusiast, not a libertarian digital anarchist, not a “be-your-own-bank” idealist. This user’s key concerns are convenience and saving money. Being able to pay for things instantly with one’s phone, without having to handle a plastic card, preferable via a single app. A non-blockchain CBDC lets you do all of that. If done right, it can be the easiest, fastest way to pay or send remittances home. Who needs crypto wallets, blockchain addresses, and block explorers? CBDCs won’t help mass blockchain adoption – if anything, they can stifle it. Especially if national digital currencies allow businesses to accept payments without acquiring fees.Some users will still prefer crypto

I run one of the largest crypto payment processing platforms, so I know what motivates merchants to accept crypto. The single greatest advantage is being able to save up to 70 per cent on processing costs because there is no acquiring bank involved. Any CBDC solution that can achieve the same effect, especially with cross-border payments, will be a very tempting alternative. Of course, some categories of users will still prefer cryptocurrencies, which are:- Overseas customers who can’t pay with their national card or a CBDC in online stores in other regions.

- iGaming users, because gambling transactions in fiat often get blocked.

- All those who want to keep their payments private for some reason, including blockchain enthusiasts and libertarians.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Max Krupyshev

Max has been in Bitcoin since 2013. He is the founder of Satoshi Square and Bitcoin Foundation Ukraine. Being a member of the Blockchain Working Group, an organization lobbying crypto in governments of different countries, he also participates in the annual Europol Cryptocurrency Conference. Having vast experience in working with Cex.io and Ghash.io, Max leads one of the leading cryptocurrency payment services, Cryptoprocessing.com.

Max has been in Bitcoin since 2013. He is the founder of Satoshi Square and Bitcoin Foundation Ukraine. Being a member of the Blockchain Working Group, an organization lobbying crypto in governments of different countries, he also participates in the annual Europol Cryptocurrency Conference. Having vast experience in working with Cex.io and Ghash.io, Max leads one of the leading cryptocurrency payment services, Cryptoprocessing.com.

READ FULL BIO

Sponsored

Sponsored