The Monero (XMR) price is currently in the process of moving above a long-term Fib resistance level at $200.

Monero is expected to move above this level and gradually increase towards $305.

Sponsored

Monero Long-Term Resistance

At the beginning of January 2021, XMR reached a high of $190 but was almost immediately rejected.

Despite the drop, XMR began another upward movement and is currently trading at $200.

This area is important since it’s the 0.382 Fib retracement level measuring from the all-time high price of $475 from December 2017.

If XMR were to break out above this level, the next important resistance area would be found at $305 (0.618 Fib retracement level).

However, technical indicators are undecided. While the MACD and RSI are both bullish, they are losing momentum. The Stochastic oscillator has made a bearish cross.

Therefore, a closer look at lower time-frames is required in order to determine the direction of the trend.

Current Movement

The daily chart shows that the previous resistance area is found at $187, and XMR is trading considerably above it.

Sponsored SponsoredIn addition, technical indicators are bullish. The Stochastic oscillator has made a bullish cross and the RSI has just moved above 70.

Therefore, as long as XMR is trading above the $187 area, the trend is considered bullish and XMR is expected to move higher.

Wave Count

Cryptocurrency trader @CryptoTony_ outlined an XMR chart, stating that it looks to be in a long-term wave three, and could gradually increase above $400.

The wave count does suggest that XMR is in a long-term wave three (white) of a bullish impulse that began in March 2020. Wave three seems to have extended.

SponsoredThe most likely target for the top of this move is found at $305, which would give waves 1:3 a 1:1.61 ratio. Furthermore, it would coincide with the long-term 0.382 Fib retracement resistance.

The sub-wave count is shown in orange, indicating that XMR is in sub-wave three.

XMR/BTC

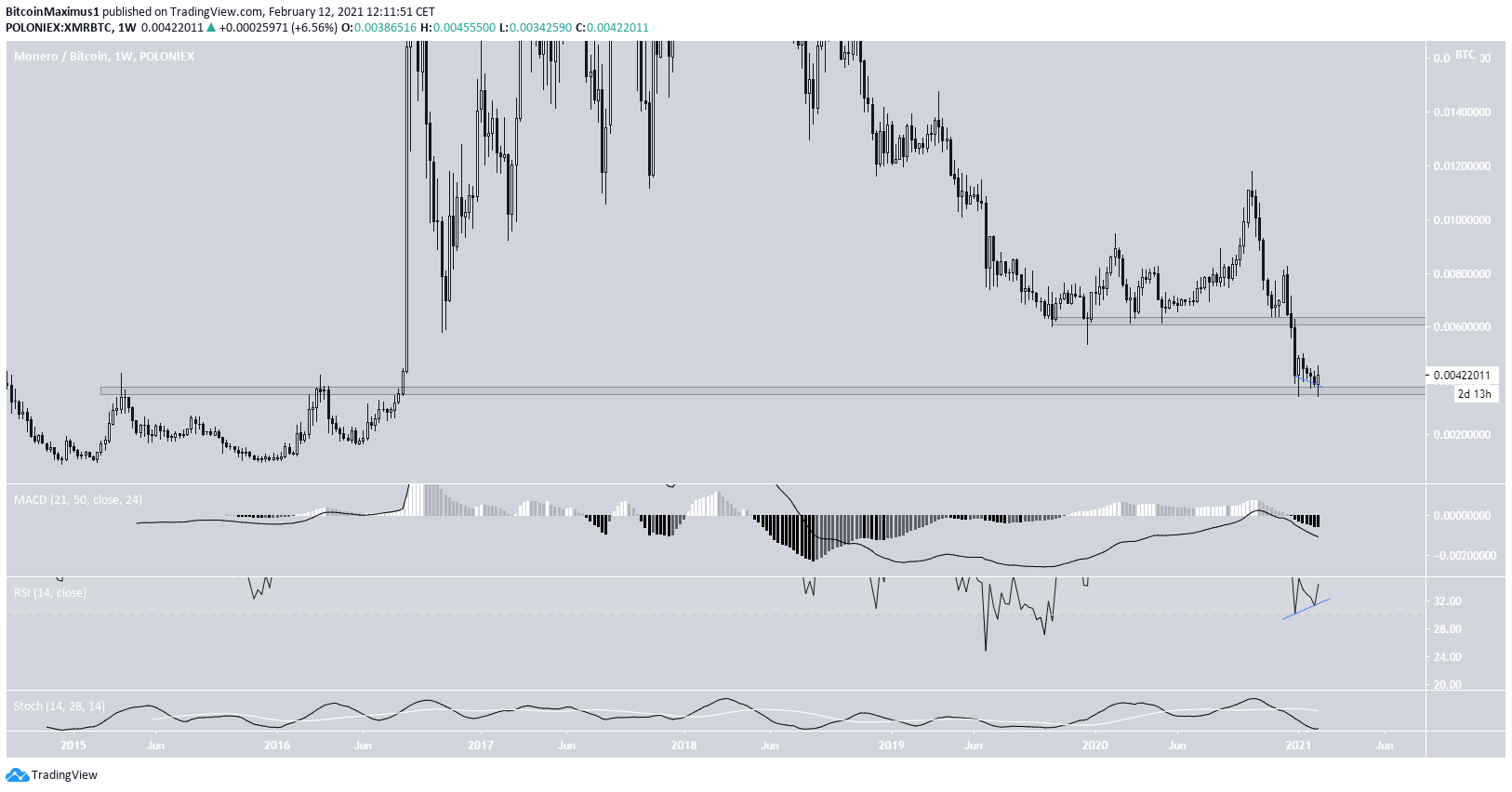

The XMR/BTC chart shows a completed double bottom pattern, which has also been combined with a bullish divergence in the RSI. Furthermore, the Stochastic oscillator has made a bullish cross and the MACD is increasing.

Therefore, XMR/BTC is expected to continue moving upwards towards the closest resistance area.

When zooming out, we can see that XMR has bounced at the ₿0.0037 area, which previously acted as resistance back in 2016. However, there is strong resistance at ₿0.0062, the previous breakdown level.

Until XMR/BTC manages to reclaim this area, we cannot consider the long-term trend bullish.

Technical indicators are undecided. While the RSI has generated a bullish divergence, the Stochastic oscillator has made a bearish cross.

Therefore, while an upward move towards ₿0.0062 is likely to occur, we cannot yet determine if XMR will break out.

Conclusion

Monero is likely in wave three of a bullish impulse and is expected to increase to $305.

While XMR/BTC is expected to increase towards ₿0.0062, we cannot yet determine if it will break out above this area.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here