Since MicroStrategy announced the sale of its convertible senior notes on November 18 to acquire more Bitcoin, the company’s stocks have surged by nearly 40%. This has pushed MicroStrategy among the top 100 publicly listed businesses in the US market, overtaking Intel and Dell.

The firm used the funds from this sale to acquire $4.6 billion worth of Bitcoin on the same day as their announcement of $1.75 billion in convertible notes. Two days later, high demand pushed the firm to expand its offering to $2.6 billion in notes.

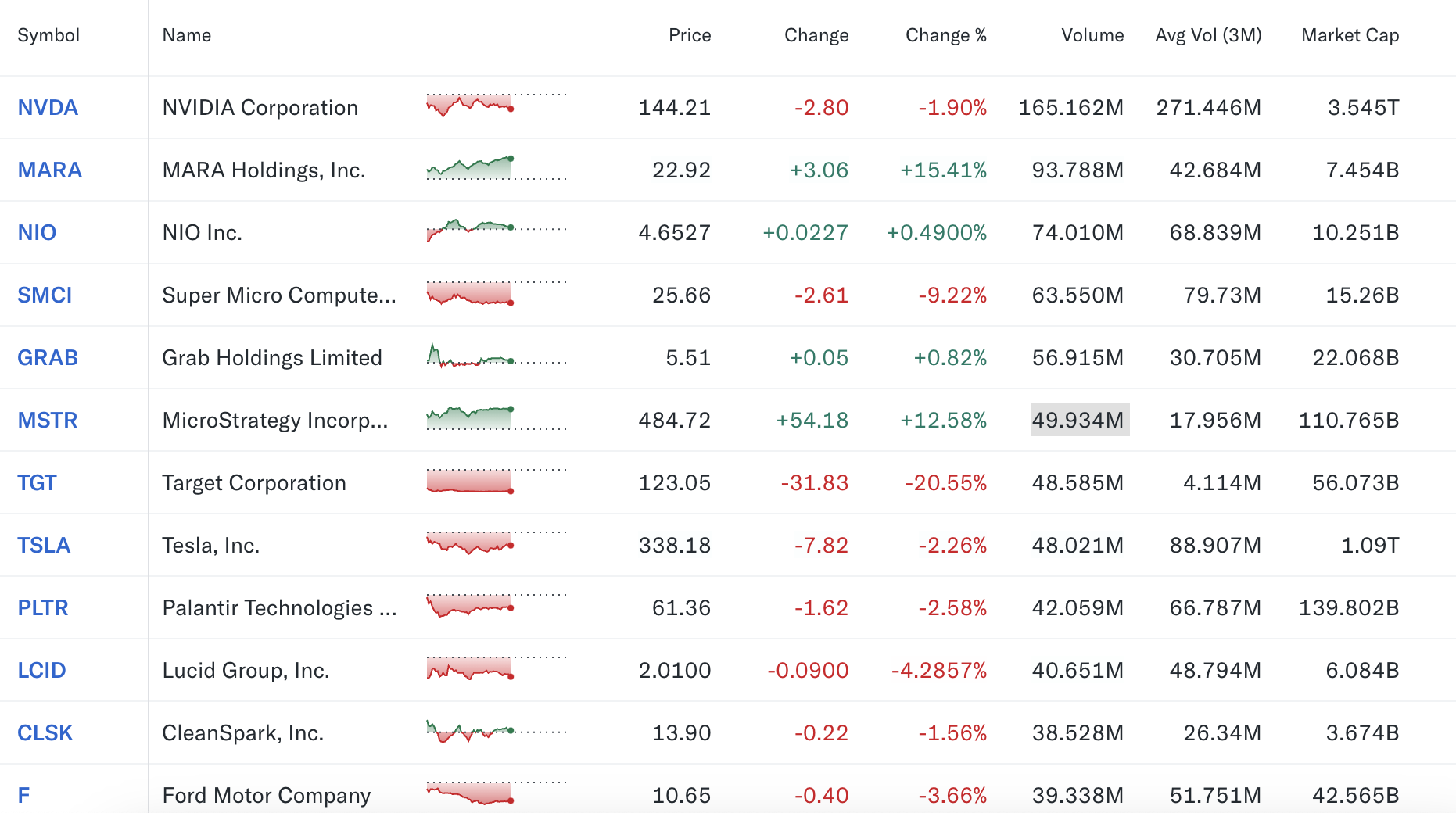

MicroStrategy Market Cap Nears $110 Billion

The latest purchase and Bitcoin’s ongoing bullish cycle have driven MicroStrategy’s stock market cap to over $110 billion. However, the firm’s bulk purchase was no surprise. Just one week earlier, it had bought $2 billion in BTC.

This latest cycle of upward stock performance is a strong reflection of how Michael Saylor’s Bitcoin-focused policy has benefited the firm, more so in the post-election period. Since its first purchase in 2020, the company has been steadily building its Bitcoin reserves.

Because of Saylor’s BTC-first approach, the company has significantly outperformed other notable firms in the US stock market. MicroStrategy was among the highest-performing stocks today. MSTR even appeared at the top of the list at one point, which was picked up almost immediately by analysts.

“Wow MSTR is the most traded stock in America today… to best TSLA and NVDA is crazy. It’s been years since a stock has traded more than one of those two (it may have actually been GME to last do it). It’s also about double SPY! Wild times,” senior ETF analyst at Bloomberg, Eric Balchunas, shared on X.

MicroStrategy’s bull run landed it within the top ranks at number 87 at the time of writing. Over the course of 2024, the company’s stock saw a stunning 915% price jump. MicroStrategy’s Bitcoin strategy aligns with a growing trend of institutional adoption.

Some analysts view MicroStrategy’s approach as visionary, while others caution against putting all the eggs in one basket. Despite the recent rally, MicroStrategy’s Bitcoin-heavy balance sheet exposes it to significant risks. A sharp downturn in Bitcoin’s value could lead to substantial losses, raising concerns among risk-averse investors.

On the other hand, MicroStrategy’s giant Bitcoin purchases have significant implications for the crypto market, contributing to increased liquidity and price stability.

Due to its sheer size, its massive BTC purchases create a positive feedback loop that reaffirms itself. The firm’s actions also signal growing confidence in Bitcoin among traditional investors.

Looking ahead, MicroStrategy’s approach will serve as a valuable use case for whether diversification or loyalty is the way to go.