The scrutiny of Maximum Extractable Value (MEV) by regulators is intensifying, spotlighting the need for oversight in the crypto ecosystem.

Although some experts argue for the efficiency benefits of MEV, the regulatory gaze sharpens on its darker implications.

Why Regulators Are Concerned About MEVs?

The European Securities and Markets Authority (ESMA) has recently marked MEV as a concern under the MiCA regulations, hinting at its potential for market manipulation. MEV allows blockchain operators to reorder transactions for profit, often disadvantaging regular users.

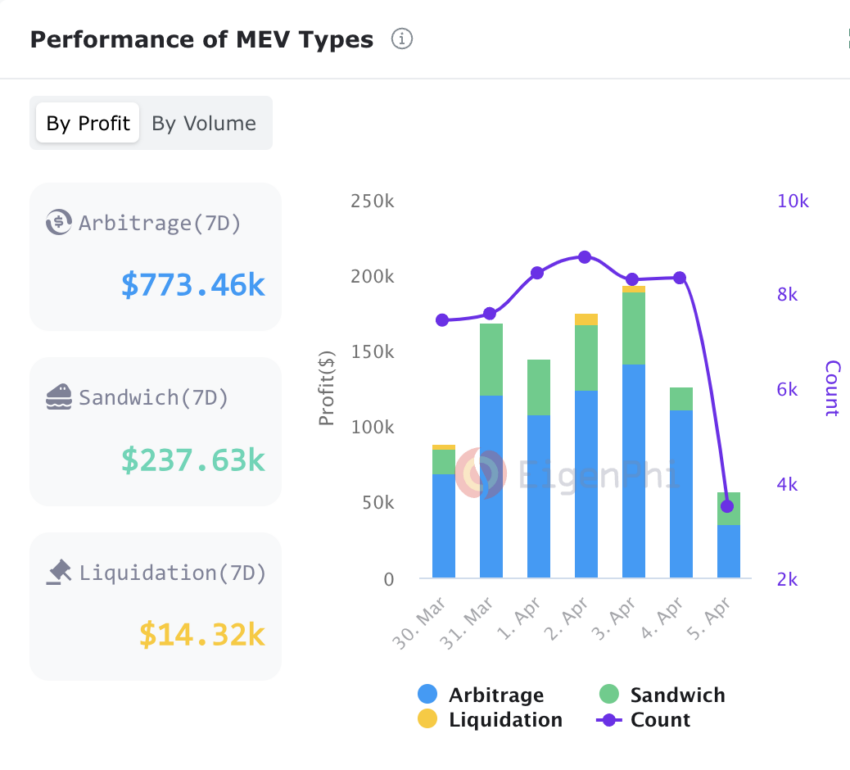

In the past seven days, traders made nearly $1 million in profits, utilizing various types of MEV techniques.

Read more: What Is Maximal Extractable Value (MEV)?

MEV, sometimes termed an “invisible tax,” can lead to practices like frontrunning, undermining transaction order integrity. Consequently, ESMA, within the MiCA framework, is examining the extension of market abuse rules to cover blockchain operation activities.

This development has sparked industry discourse, with some questioning MiCA’s coverage of MEV. However, incidents such as the MEV bot’s flash loan attack, stealing $1.27 million from the BlackHole token (BH), underscore the urgency for regulatory clarity.

Anja Blaj from the European Crypto Initiative stresses the need for nuanced understanding, distinguishing harmful MEV tactics from benign ones. ESMA’s consultations aim to pinpoint which MEV actions might indicate market abuse, thereby guiding effective regulation.

“There are very limited scenarios and tactics that have similar effects to those of market abuse. This should be emphasized over and over again as MEV’s purpose in the first place is to compensate the good actors for the validation work they do,” Blaj told CoinDesk.

The regulatory spotlight on MEV is part of broader efforts to ensure digital asset market stability and fairness. For instance, an MEV bot’s malfunction last year led to over $400,000 in losses, further emphasizing the risks of unregulated MEV practices. These incidents demonstrate the tangible dangers and financial impacts of MEV without adequate oversight.

Read more: What Is Markets in Crypto-Assets (MiCA)?

The European Union’s proactive stance in digital asset regulation, spearheaded by the MiCA framework, paves the way for clear MEV guidelines. This dialogue between regulators and the crypto sector is vital for establishing the limits of acceptable MEV practices.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.