The past year has been a challenge for Mark Zuckerberg and his social media company, Meta. Despite reaching a market value peak of $1.1 trillion in August 2021 due to increased online activity during the COVID-19 pandemic, Meta faced its first-ever decrease in quarterly revenue in July 2022.

This was followed by another decline three months later, causing concern among investors about Zuckerberg’s decision to invest $10 billion annually into the untested world of the metaverse. The company’s market value dropped 60% by November, leading to the layoffs of 11,000 employees, or 13% of the workforce.

Sales Down, Optimism Up

On Feb. 1, Meta reported a 4.5% year-on-year decrease in sales for the last three months of 2022. Although the decrease was smaller than expected, the company expressed optimism for the current quarter, projecting revenues to reach $28.5 billion, higher than the first three months of 2021 before Apple’s privacy rules for iDevices made it more difficult for advertisers to track online customers.

Zuckerberg indicated that expenses were being managed carefully and that the company would be more proactive in cutting non-profitable or less critical projects. The company also announced plans to buy back an additional $40 billion worth of Meta shares.

In a further bit of good news for Meta, a judge in California dismissed a lawsuit filed by the Federal Trade Commission opposing Meta’s acquisition of Within, a leading virtual reality fitness app producer.

Meta Investors Respond Positively

Investors reacted positively to the news. Following a 70% increase in share price over the past three months, Meta’s stock price recently jumped another 20%. This brought its market capitalization to $484 billion, indicating a possible resurgence for the struggling tech giant.

Despite challenges, Zuckerberg remains optimistic. Meta has found ways to work around Apple’s privacy regulations, and its Artificial Intelligence capabilities are advancing. And particularly in ‘Reels,’ where algorithms deliver short videos on Instagram and Facebook, Meta’s main revenue sources. This is in response to TikTok, a short-form video platform.

TikTok Boom

TikTok has rapidly gained a massive following, particularly among young people, with its short-form video format and entertaining content. This has put pressure on Facebook to find new ways to engage and retain its users, particularly younger ones.

To compete with TikTok, Facebook has introduced new features such as Reels, a short-form video platform that mimics TikTok’s style, and is now integrating Instagram with similar videos in the main Facebook app.

Yet, TikTok has a distinct advantage over Meta’s Facebook. TikTok is a standalone platform that is much less weighed down by a history of privacy scandals and other controversies. To compete, Facebook must offer similar features and address privacy and data security concerns.

TikTok, owned by a Chinese company, is also facing scrutiny in the US. Some lawmakers are calling for a boycott of the app citing national security concerns.

Obstacles Ahead for Meta

Besides TikTok, there are more obstacles. The once-stable digital advertising market is becoming more cyclical, and the economic outlook is uncertain. Even if Meta’s western countries avoid a recession, advertisers may become more cautious with their spending. Or worse, spend with Meta’s rivals.

And despite calls for a TikTok ban, legislative action in Washington (where nothing ever happens quickly) is unlikely in the near future.

Meta still faces challenges from regulators at home, where another FTC lawsuit calls for its breakup. In Europe, stringent regulations for large digital agencies are being drafted.

Perhaps most importantly, few people have shown enthusiasm for moving to the metaverse, as evidenced by a decrease in users for Horizon Worlds, Meta’s main virtual world attraction, at the end of last year.

Other Virtual Worlds Already Have Billions of Players

Meta faces an even bigger challenge when it comes to competition in the Metaverse market. Existing (and thriving) virtual worlds already host billions of player accounts in the top ten games.

At any given time, 2.5 billion gamers exist in these virtual realms. This number surpasses the combined users of Facebook, Instagram, and WhatsApp.

Dominance of Tencent

The top three virtual worlds, Player’s Unknown Battlegrounds, Crossfire, and Dungeon Fighter, with 3.5 billion player accounts, belong to Tencent, the largest gaming company in the world.

Tencent owns WeChat, QQ, and Spotify, providing them with a massive online social payment system, which Meta lacks. Tencent also owns 40% of Epic, which operates the largest online virtual concerts on Fortnite with an additional 350 million players.

Minecraft and Roblox Lead the Way

Microsoft’s Minecraft has 600 million players, making Microsoft the fifth-largest gaming company in the world. With the Xbox console, Microsoft HoloLens, and its vision for the metaverse, even Microsoft is far ahead of Meta.

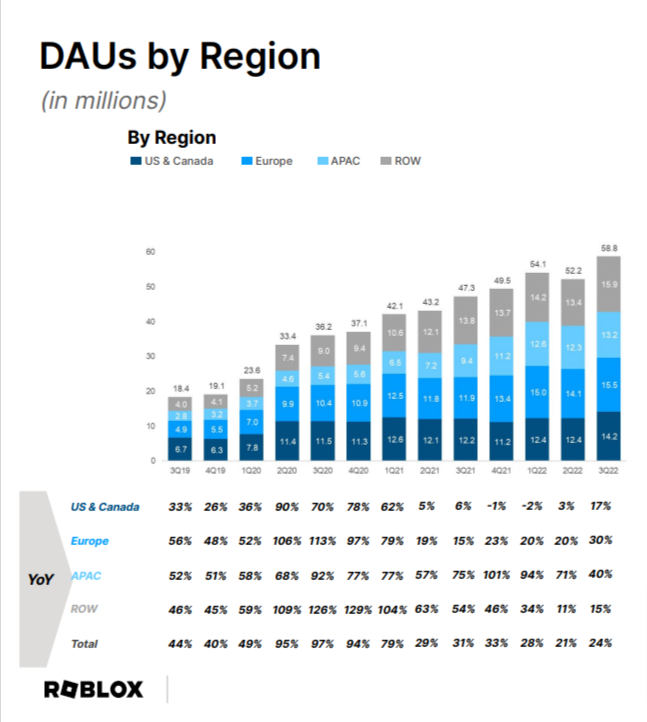

Another metaverse, Roblox, surpasses Meta as well. Currently, 50% of 9 to 12-year-olds in the U.S. are playing either Minecraft or Roblox. This poses a threat to the future adoption of Meta’s metaverse. Roblox has grown to nearly 60 million daily players.

Meanwhile, Meta has just 5 million users with its Oculus, Horizon Home, Horizon Worlds, and Horizon Workrooms.

This means Meta is facing significant challenges in the rapidly growing metaverse market. The metaverse already boasts a massive player base with games like Minecraft, Roblox, Tencent’s Crossfire, PUBG, and Dungeon Fighter leading the charge.

Furthermore, the metaverse is being built on engines like Unity and Unreal Engine, both of which have become multi-billion dollar businesses with thousands of projects in development. And Meta’s Horizon Worlds is built with the Unity engine—not in-house.

Social Networks Are Key

Meta is facing significant competition from platforms like TikTok and Pinterest. Meta must evolve and adapt to remain relevant and competitive, addressing privacy and security concerns. And focusing on providing a visually appealing and engaging user experience.

Whether or not Meta can successfully navigate these challenges will determine its future success in the social media market.

Metaverse

The dominance of Microsoft, Tencent, Roblox, and Unity is threatening Meta’s aspirations for the metaverse. These companies have established a strong foothold in the virtual reality market and have the resources and expertise to continue to innovate in the field.

Given the current landscape, it may be difficult for Meta to gain a significant market share. It also needs to continue to boost revenue through its profitable Facebook and Instagram platforms to fund Zuckerberg’s grander metaverse vision.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.