Decentralized Finance (DeFi) analyst Stacy Muur has warned that the surge in meme coin popularity may signal the end of the current crypto bull run.

Following Messari’s meme coin investing research, Muur speculates that investors should consider securing profits.

Why Stacy Muur Speculates Market Top

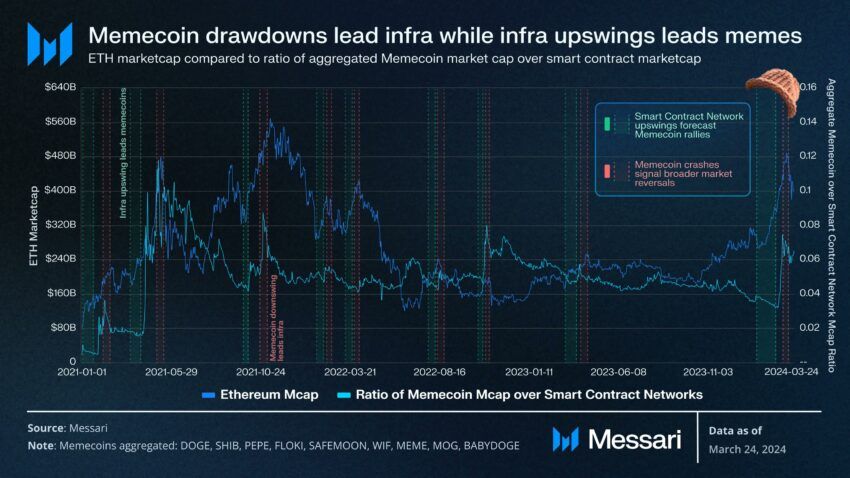

Messari’s analysis reveals a pattern in the crypto markets that typically starts with major investments in crypto infrastructure projects.

“This is very logical: Crypto bull markets usually begin with BTC or smart contract platforms due to factors like liquidity, risk-reward profiles, and technological breakthroughs. These assets signal that “crypto isn’t dead,” attracting speculation and development,” Muur explained.

The investment trend then shifts toward more volatile assets like meme coins, which are known for their potential rapid gains. However, Muur warns that meme coins are usually the first to fall, marking the end of a speculative wave across the crypto spectrum.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Currently, Muur notes a decline in meme coin activities pointing to reduced trading volume on platforms like pump.fun, which supports the creation and trading of these assets.

“In their research, Messari suggests the following investment framework based on this pattern: Buy memes when classic DeFi/crypto plays start rising. Then, move the entire portfolio to cash and freeze trading when meme coins decline beyond a threshold,” Muur elaborated.

Muur’s thesis has sparked debate among her followers. Some critics on her X (formerly Twitter) thread argue that the current cycle deviates from the past.

“The framework for this entire thesis is wrong. Memes were the first to pump this cycle, unlike in the past. We are now moving into a higher liquidity cycle with interest rate cuts. We are nowhere near close to the peak,” an X user said.

Other analysts share further skepticism. This month, BeInCrypto reported insights from an analyst who pointed out three market top signals:

- Celebrity endorsements of meme coins.

- A surge in new meme coins and,

- A flood of PnL screenshots on social media.

The increasing celebrity involvement in meme coins, with figures like Caitlyn Jenner, Iggy Azalea, and Andrew Tate launching their tokens, mirrors past market peaks in 2017 and 2021.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Additionally, the creation of over one million new meme coins in April alone indicates extreme market speculation. This situation, combined with the widespread sharing of PnL screenshots, suggests the market might be nearing a turning point.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.