MANA token has gained 10% on the heels of the recent Metaverse Fashion Week event. On-chain data suggests that Decentraland is poised to build on the recent price surge. Will the bears fight back?

On March 28, Decentraland (MANA) price increased as the much-anticipated Metaverse Fashion Week kicked off. The event featured multiple brands looking to engage new audiences and set up shop in the metaverse. In addition to the MANA price surge, critical on-chain data suggests that the event was well-received by Decentraland investors.

Decentraland Long-Term Investors Show Renewed Confidence

After a brief spell of profit-taking in February, Decentraland long-term investors appear to have regained confidence in MANA’s future price prospects. According to on-chain data analytics firm Santiment, MANA investors hold their tokens longer.

The chart below shows how MANA Mean Coin Age has increased for two consecutive months since the last cliff-off on Feb 21. And since the recent downswing to 29.99 recorded on March 14, it has surged 34% to 39.39 as of April 7.

The Mean Coin Age tracks the average number of days current investors have held on to their tokens. The rising values of Mean Coin Age (90d) suggest long-term investors are growing confident of a future MANA price upswing.

Furthermore, the decline in Network Value to Transaction Volume (NVT) ratio is another key indicator of a potential bull rally. The chart below shows MANA NVT ratio declined considerably from 693.64 to 132.66 between March 26 and April 7.

The NVT ratio weighs the current transaction volumes against the underlying market capitalization of a crypto asset. A considerable decline, as observed above, suggests that MANA is undervalued at current prices and may be due for an upswing.

In summary, with NVT ratio at such low levels, MANA holders can expect more upside if long-term holders remain optimistic.

MANA Price Prediction: Good to Go $0.70

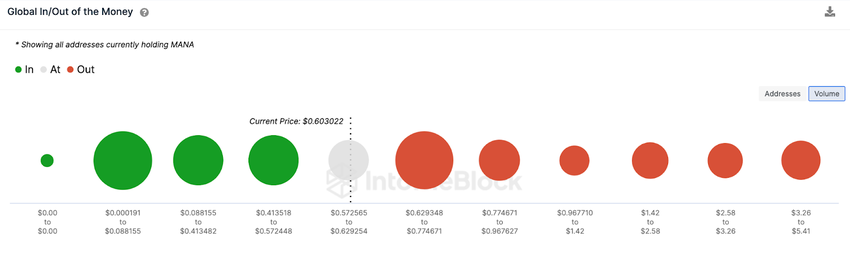

IntoTheBlock’s Global In/Out of Money data shows that MANA has a clear path to $0.70. As depicted below, MANA will likely break out of its current resistance at $0.62, the maximum price 10,000 addresses had paid for 177,000 tokens.

If that happens, MANA could tear above $0.70. But 30,000 addresses that bought 473,000 tokens around that price could take profit and inadvertently impede the rally.

Still, the bears could force a downtrend if MANA loses the $0.57 support. But here, the 10,000 addresses that hold 177,000 tokens will look to prevent the drop. However, if it happens, the Decentraland native token could drop as far as $0.47. At that point, the support from 23,000 addresses that hold 324,000 tokens can trigger a rebound.