The crypto market has taken a beating in the past few days, with some DeFi vaults facing liquidation if ETH continues to drop.

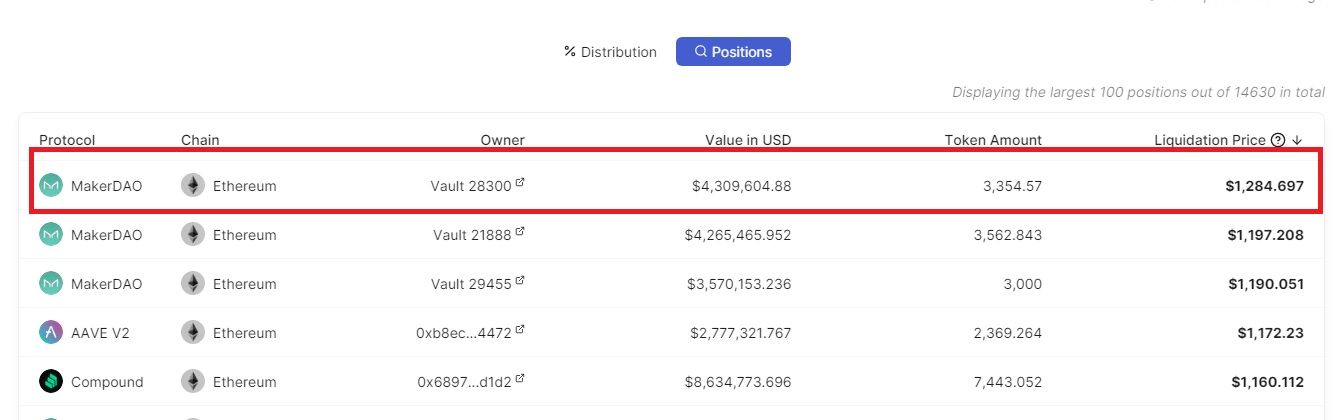

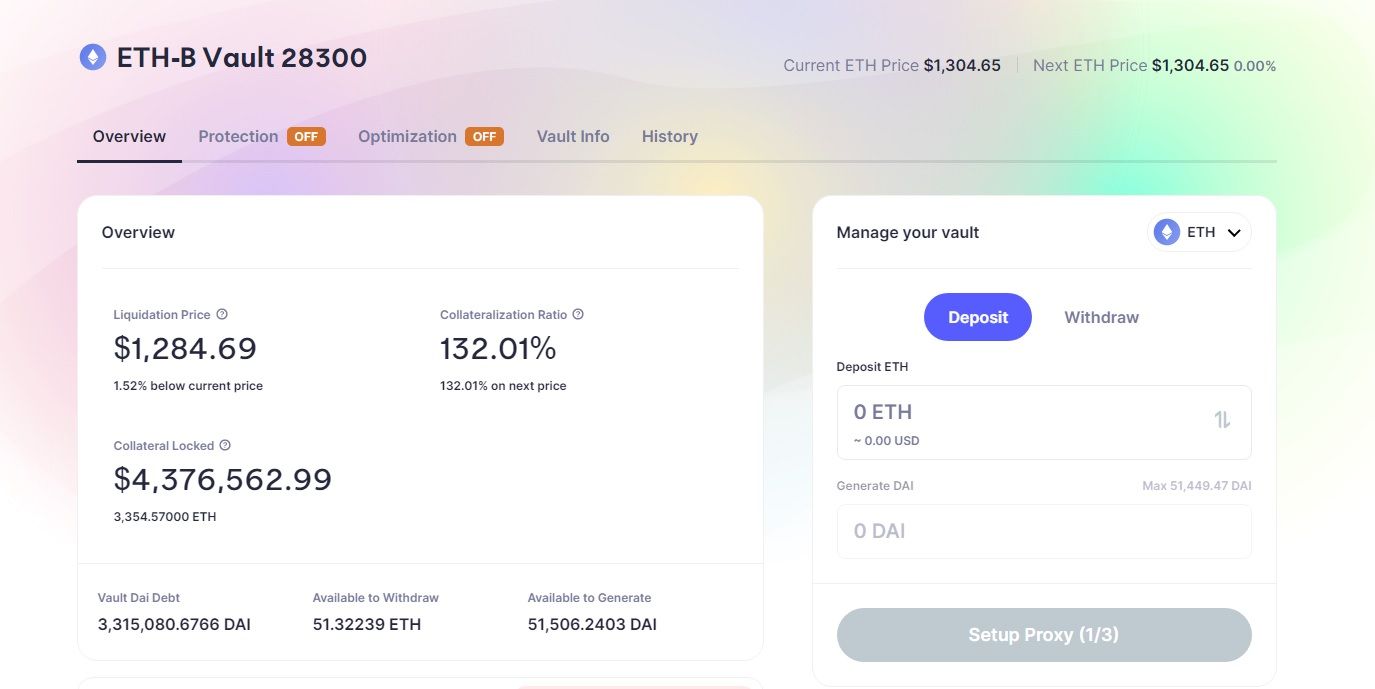

The drop in prices in the crypto market is seeing some potential liquidations looming. Available data pointed to a MakerDAO vault that faces liquidation at $1,284. The value is about $4.3 million, as seen on DeFi Llama.

According to the data platform, the liquidation levels in DeFi are about $1.5 billion in total, with $109.8 million within 20% of its current price. The vault with the $4.3 million worth of collateral locked can be seen on the Oasis DApp.

The crypto market has been enduring some pain over the past few days, as a string of bad news hits the market. It’s certainly upsetting for investors, who have been waiting for the market to pick back up after a rough year. There is hope yet, though there are some developments that may not allow the best possible ending as the year closes.

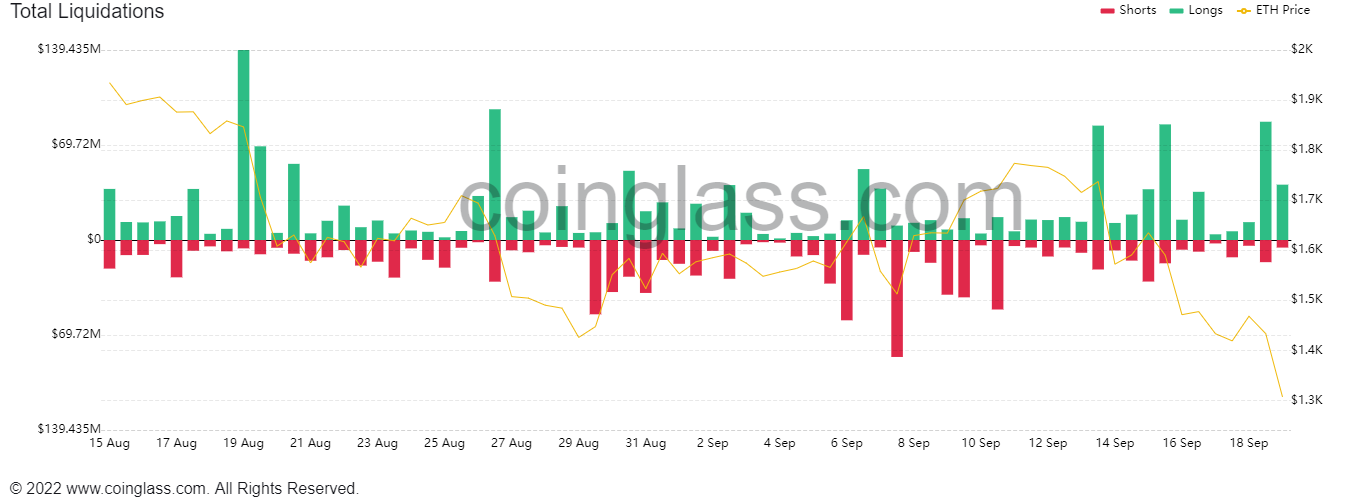

ETH total liquidations top $165 million

Total liquidations for ETH have crossed $165 million, according to data from Coinglass. Nearly $140 million of that came from those who went long. The price of ETH continues to remain volatile, and there may be more liquidations in store yet.

There may be multiple reasons as to why the price has dropped, though it’s hard to say definitely why it might have happened. In any case, investors will want to keep a close eye on ETH in the weeks ahead.

Post-Merge uncertainty

Many investors were hoping that Ether would receive some positive price action as a result of The Merge, but that does not appear to be the case. Ether and the Ethereum network have been the talk of the town this last week, though not always for the best reasons.

SEC Chair Gary Gensler has said that the staking model may more likely make ETH a security, which perhaps has contributed to the price drop. Meanwhile, the United States Federal Reserve is also expected to increase interest rates in an upcoming meeting.