Magic Eden has surpassed Blur to become the leading NFT marketplace regarding trading volume, signaling a significant shift in the dynamic NFT landscape.

This highlights Magic Eden‘s growing influence and traders’ and collectors’ evolving preferences.

Magic Eden Exceeds Blur’s NFT Volume

This development demonstrates Magic Eden’s success and underscores the increasing importance of the Bitcoin ecosystem.

According to DappRadar’s April 2024 Dapp Industry Report, Magic Eden’s trading volume exceeded Blur’s by $108 million. Runestone, a significant Bitcoin Ordinals inscription, has played a crucial role.

“Magic Eden, now allowing the trading of Bitcoin Ordinals, holds the top spot, with Bitcoin Ordinals trading accounting for 70% of the marketplace’s total volume. This underscores their growing popularity,” DappRadar noted.

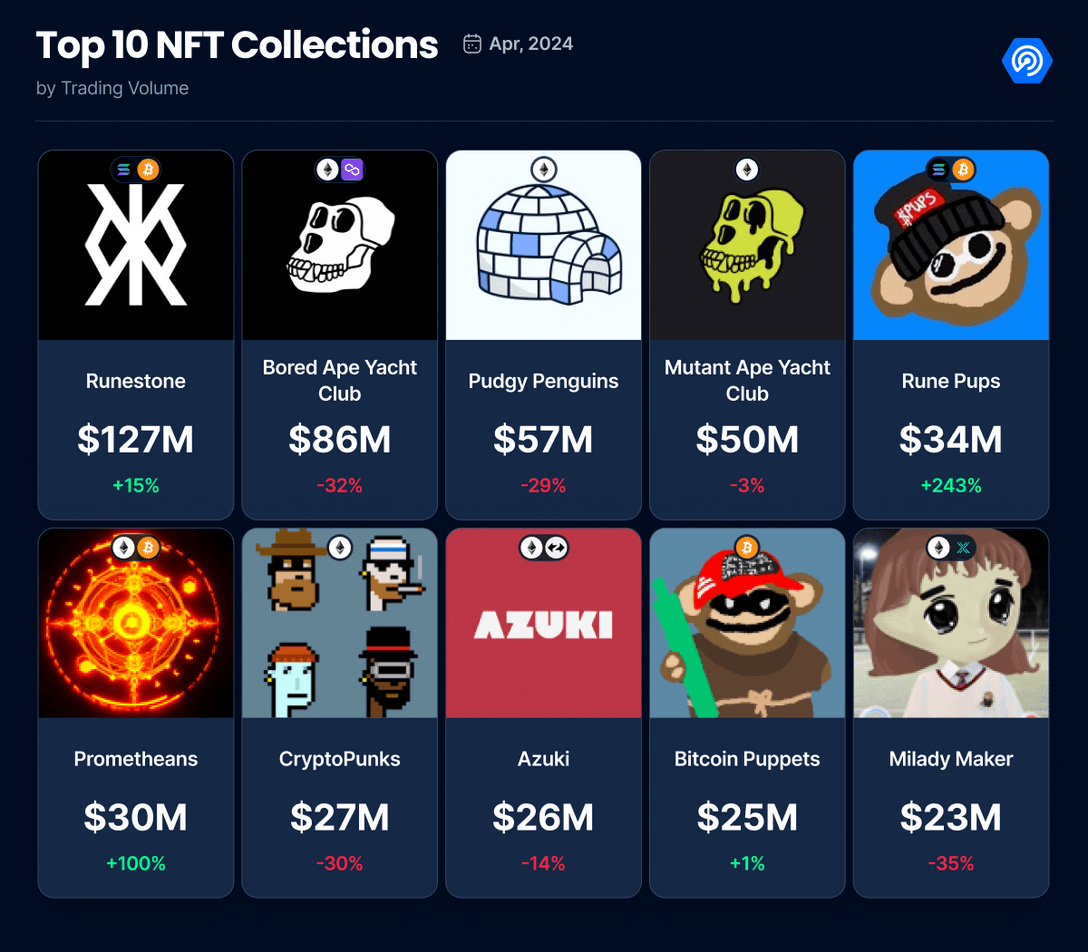

By leveraging Bitcoin’s UTXO model to minimize blockchain data, potentially reducing transaction fees compared to traditional Ordinals, Runestone has become the NFT collection with the highest trading volume in April.

It surpassed the iconic Bored Ape Yacht Club. This underscores Bitcoin collections’ impact on the NFT market, a trend likely to continue.

Read more: How To Start NFT Trading: A Step-by-Step Guide

Bitcoin collections have witnessed a 32% increase in trading volume, reaching an impressive $675 million this month. This surge has propelled Bitcoin to become the blockchain with the highest trading volume, outpacing the industry stalwart Ethereum.

Magic Eden’s ascent stems from its strategic embrace of the Bitcoin ecosystem and comprehensive platform features. Low transaction fees, a user-friendly interface supporting multiple blockchains, and continuous platform enhancements have enabled Magic Eden to capture and sustain a substantial market share.

While Magic Eden’s rise is remarkable, the broader NFT market has experienced a 13% decline in total trading volume to $1.35 billion in April, although sales increased by 20%. This dichotomy results from Runestone’s rising popularity and the overall surge in Bitcoin collections.

Despite the overall market downturn, Bitcoin collections have emerged as resilient. Four of the top eight collections in sales volume were Bitcoin-based, collectively recording $423 million in sales.

In contrast, Ethereum collections like CryptoPunks and Bored Ape Yacht Club recorded relatively low sales volumes of $26 million and $25 million, respectively.