Litecoin’s (LTC) price looks at recovery following a bearish couple of days, which also validated a 30% decline.

However, how far the potential recovery will take LTC is the question as investors’ participation grows.

Litecoin Bullish Signals Arise

Litecoin’s price is looking at potential recovery, considering the altcoin has been reeling from the recent decline. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) signal positive outcomes.

RSI measures the speed and change of price movements, while MACD indicates trend direction and momentum strength through moving averages’ convergence or divergence.

The former is on the verge of breaching past the neutral line at 50.0 to register a bullish development. MACD is also exhibiting rising bullishness at the moment, which could propel LTC towards recovery.

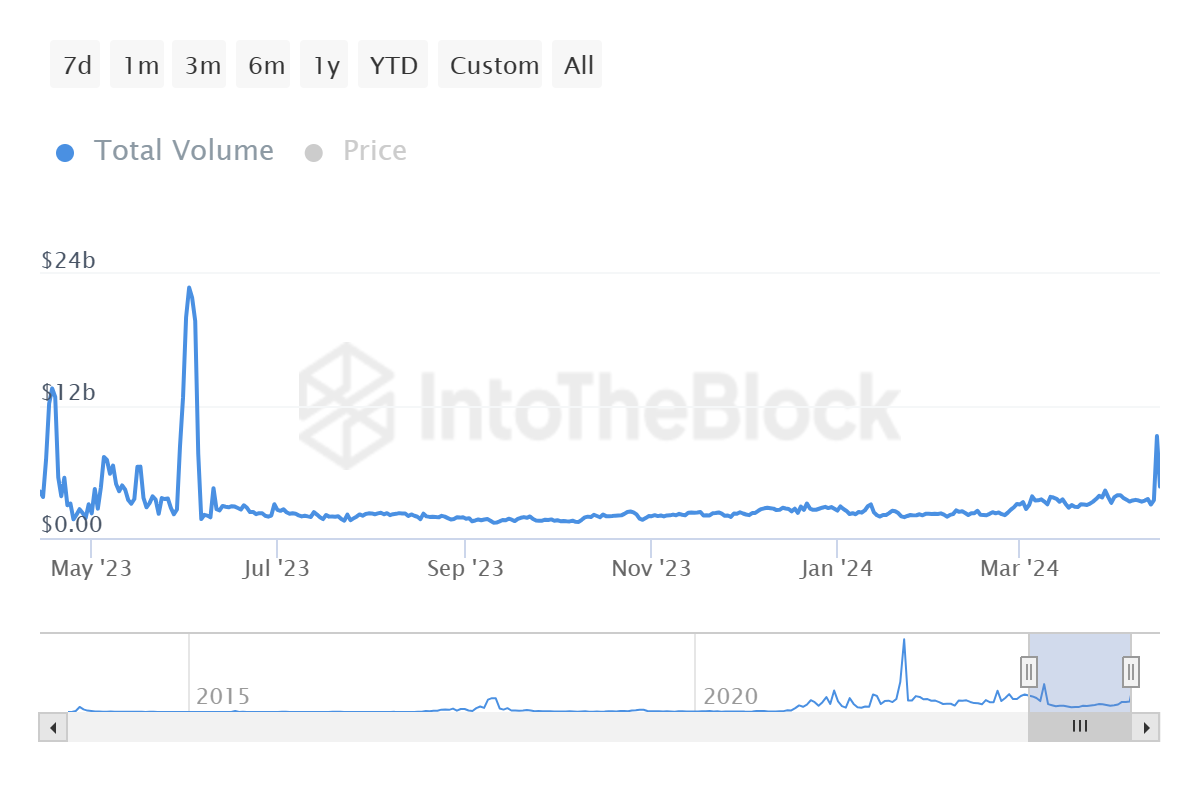

Investors are also seemingly very optimistic about a recovery. Over the last 72 hours, the total volume of transactions on the chain has noted a surge for the first time in almost a year.

Read More: How To Buy Litecoin (LTC) and Everything You Need To Know

Transactions amounting to $9.27 billion were recorded daily, a 168% rise from the average volume. This shows that interest is rising among LTC holders, which could support the expected recovery.

LTC Price Prediction: Crossing $86 Next?

Litecoin’s price is trading at $81 after bouncing back from the local support of $77 in the last few days. At the time of writing, the altcoin nearly flips the 38.2% Fibonacci Retracement of $115 to $57. Marked at $79, this support floor would provide LTC with a boost to breach $86.

The Fib level of 50% coincides with this price, and reclaiming it as support would confirm a recovery rally.

Read More: Litecoin (LTC) Price Prediction 2024/2025/2030

However, losing the support of $79 and $77 would result in LTC’s price falling to test the 23.6% Fib level at $71. This would invalidate the bearish thesis, extending and potentially validating the 30% correction target of the rising wedge.