Litecoin (LTC) price has surged 13% after a difficult start in the first week of May. An in-depth on-chain analysis provides insight into the potential LTC price swings ahead of the upcoming halving event. What are the chances LTC will reclaim the $120 price prediction in the coming weeks?

The upcoming Litecoin (LTC) halving, slated for August 2023, is one of the most anticipated events in the blockchain space this year. New price peaks have followed each of the last two LTC halvings.

But with whales selling and miners depleting their reserves, how will Litecoin price respond in the coming weeks?

Litecoin Miners Are Selling

The upcoming halving event will see block rewards issued to Litecoin miners for validating transactions slashed in half, from 12.5 LTC to 6.25 LTC. Typically, when a halving date approaches, crypto miners look to stock up on their reserves.

But interestingly, that has not happened on the Litecoin network. With the next halving less than 70 days away, on-chain data shows that LTC miners are still depleting their reserves.

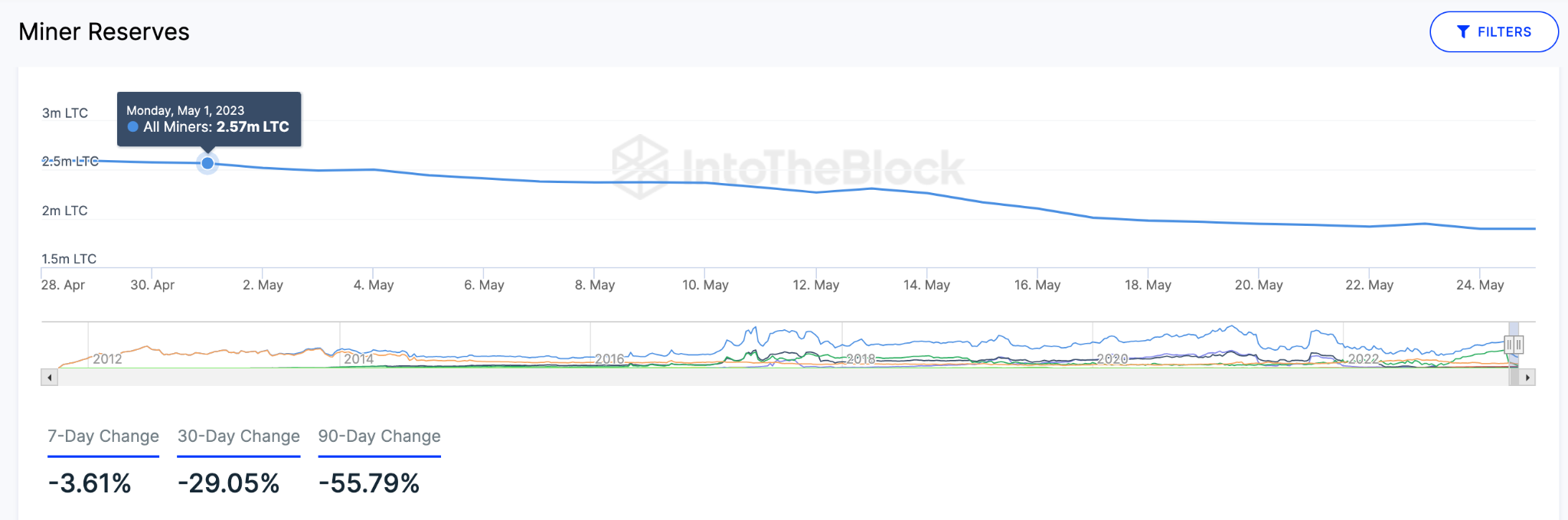

According to the chart below, Litecoin miners have offloaded nearly 680,000 coins from their reserves in May 2023.

As seen above, the miners are taking advantage of the current high prices to book some profits. Likewise, rising global energy prices and a crackdown on crypto mining activity by regulators have also made mining costs skyrocket in recent months.

If these factors do not abate, LTC miners are likely to continue selling in the build-up to the halving.

Ultimately, this could slow down a potential Litecoin rally in the coming weeks, despite bullish momentum from other investors.

Whales Have Entered Another Profit-Taking Cycle

Litecoin has outperformed Bitcoin and Ethereum in the last 3 weeks. And the bullish trading activity of the crypto whales holding balances of 10,000 to 100,000 LTC has been a critical factor.

However, the whales seem to have entered a profit-taking cycle this week. Between May 23 and May 26, they offloaded 110,000 LTC.

At the current market price of $87, those 110,000 tokens sold are worth $9.5 million. Quite notably, the historical trading activity of this whale cohort has been closely correlated to price.

This suggests that they could prompt another LTC price correction if they continue selling.

LTC Price Prediction: The Bears Could Target $80

Considering the bearish activity among Litecoin miners and whale investors, LTC might drop below $80 in the coming days.

IntoTheBlock’s Global In/Out of The Money (GIOM) data suggests that LTC will currently face a relatively stronger resistance at $90 compared to the next support cluster at $85.

As seen below, LTC will get initial support from 346,000 investors that bought 1.62 million LTC at an average price of $85.

However, if the bearish momentum prevails as expected, the price could slide further toward $78.

On the other hand, the bulls could invalidate the bearish Litecoin price prediction if it breaks above the critical $90 resistance level.

But a potential sell wall from the 623,000 investors that purchased 5.97 million LTC at an average price of $90 will likely prevent that.

Although unlikely, LTC could rally toward $120 if that resistance level is breached.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.