In recent weeks, the price of Bitcoin (BTC) has risen to its current level of $36,300. Of course, this all has to do with the enthusiasm surrounding the arrival of the spot Bitcoin exchange-traded fund (ETF) in the United States, which really seems like a matter of time at this point.

However, the strange thing about all this growth is that liquidity is currently very low and hovering at Q4 2022 levels.

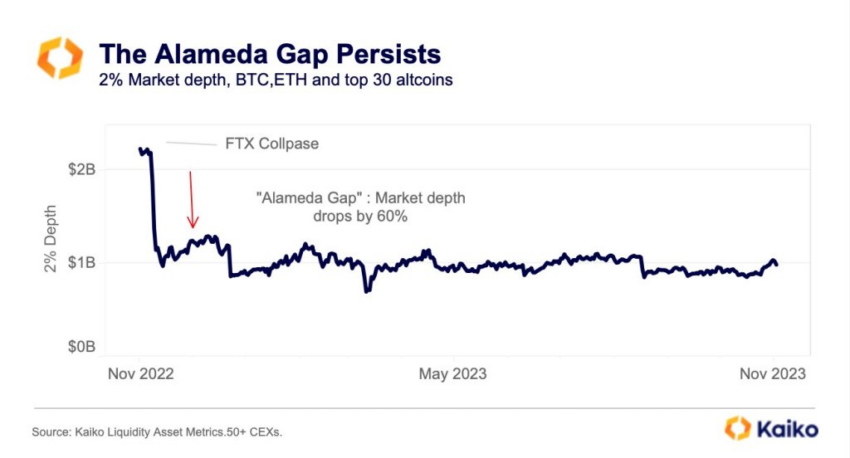

Bitcoin Liquidity Yet to Recover After FTX Collapse

According to Kaiko data, Bitcoin liquidity is currently at the level after the November 2022 collapse of FTX. Along with market liquidity, BeInCrypto previously reported that the trading volume has also not recovered significantly.

Kaiko posted:

“Although BTC rallied more than 20% in October, the ‘Alameda gap’ has persisted. Market depth remains well below its pre-FTX levels.”

After the collapse of FTX, Alameda Research, the trading arm of Sam Bankman-Fried’s empire, also collapsed. As a result, “market depth” dropped by 60%, and Bitcoin has still not recovered.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

What Does it Mean?

This mainly means that smaller amounts of capital can generally result in larger price movements. Now, this is not entirely a positive phenomenon, as a small amount of short selling can also push the Bitcoin price down. So, market participants need to be especially vigilant regarding Bitcoin.

However, some anticipate that the liquidity will return if the Bitcoin spot ETF is approved. Slowly, but surely, liquidity is starting to return to past levels. In the meantime, it increased from 60% to 50%.

The possible approval of a spot Bitcoin ETF could mean another improvement in market liquidity. This increase in liquidity is important because it is particularly important for large investors.

The more capital circulating in the market, the less likely unexpected price movements will occur. In this respect, the emergence of a spot Bitcoin ETF could also be good for Bitcoin’s stability.

Do you have anything to say about Bitcoin liquidity or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.