A lead Ethereum developer has highlighted some of the risks that liquid staking derivatives pose to the Ethereum ecosystem.

On June 1, Ethereum developer Danny Ryan posted a recent article on liquid staking derivatives (LSDs). Those above “critical consensus thresholds” pose risks to the Ethereum protocol, he noted.

“With withdrawals enabled, it’s time to reshuffle,” he said.

Are Liquid Staking Platforms a Danger to Ethereum?

Liquid staking derivatives are protocols such as Lido that offer flexible ETH staking. However, their “decentralized” governance is questionable and could lead to centralization.

Ryan stated that LSD protocols are a “stratum for cartelization” that induce significant risks to the Ethereum protocol. Those allocating capital to these protocols should be aware of the risks associated, he added.

“LSD protocols should self-limit to avoid centralization and protocol risk that can ultimately destroy their product.”

In an extreme scenario, consensus can be exceeded with the staking derivative achieving outsized profits compared to non-pooled capital. This could be due to coordinated MEV (maximal extractable value) extraction, block-timing manipulation, and/or censorship, he said.

“And in this scenario, staked capital becomes discouraged from staking elsewhere due to outsized cartel rewards, self-reinforcing the cartel’s hold on staking.”

Furthermore, deciding who can become a node operator is another avenue for cartelization.

If you want to learn more about the best liquid staking platforms to watch in 2023, check out our guide here!

In the case of Lido, the LDO governance token may be the deciding factor, and this could threaten Ethereum. This is because whales and VCs often manipulate DeFi governance.

“Thus the governance token deciding NOs [node operators] can become a self-reinforcing cartelization and abuse of the Ethereum protocol,” Ryan noted.

He concluded with a recommendation that Lido and similar LSD products self-limit for their own sake, and stakers should also have limits.

“Capital allocators should not allocate to LSD protocols exceeding 25% of total staked Ether due to the inherent and extreme risks associated.”

On May 22, Ethereum co-founder Vitalik Buterin cautioned on the dangers of “overloading” Ethereum’s consensus past its core functions. “We should instead preserve the chain’s minimalism, support uses of re-staking that do not look like slippery slopes to extending the role of Ethereum consensus,” he said.

ETH Staking Update

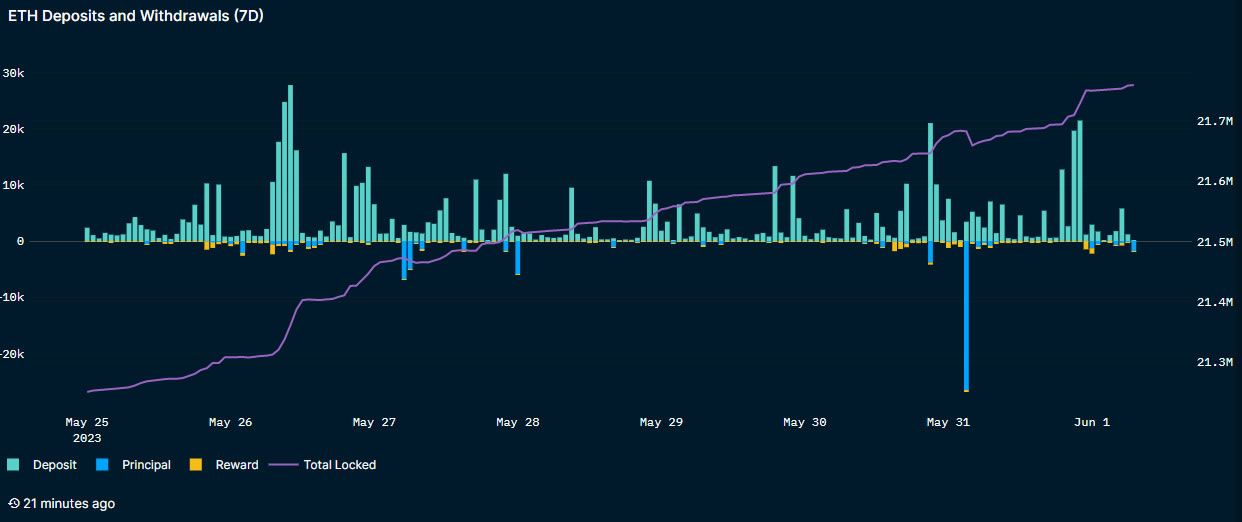

21.7 million ETH are currently staked, according to Nansen data. However, Beaconcha.in reports a much lower figure of 19.1 million.

Lido has the lion’s share of this, which is why it is the biggest threat. Lido currently has 6.95 million ETH staked on the platform, valued at $12.6 billion. This equates to around a third of the total amount of Ethereum staked.

Withdrawals have slowed and are currently outpaced by deposits, according to Nansen data.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.