Investors entered a sell-off frenzy after Chainlink (LINK) price lost the critical 7% support level on May 1. But on-chain data suggest that bullish stakeholders may now have their sights set on a bullish LINK price prediction.

Chainlink looks set for a price rebound, as social media opinions have fluctuated wildly in recent weeks. But will it be enough to move the needle for investors to pile on more demand?

Chainlink Social Media Perception Fluctuates

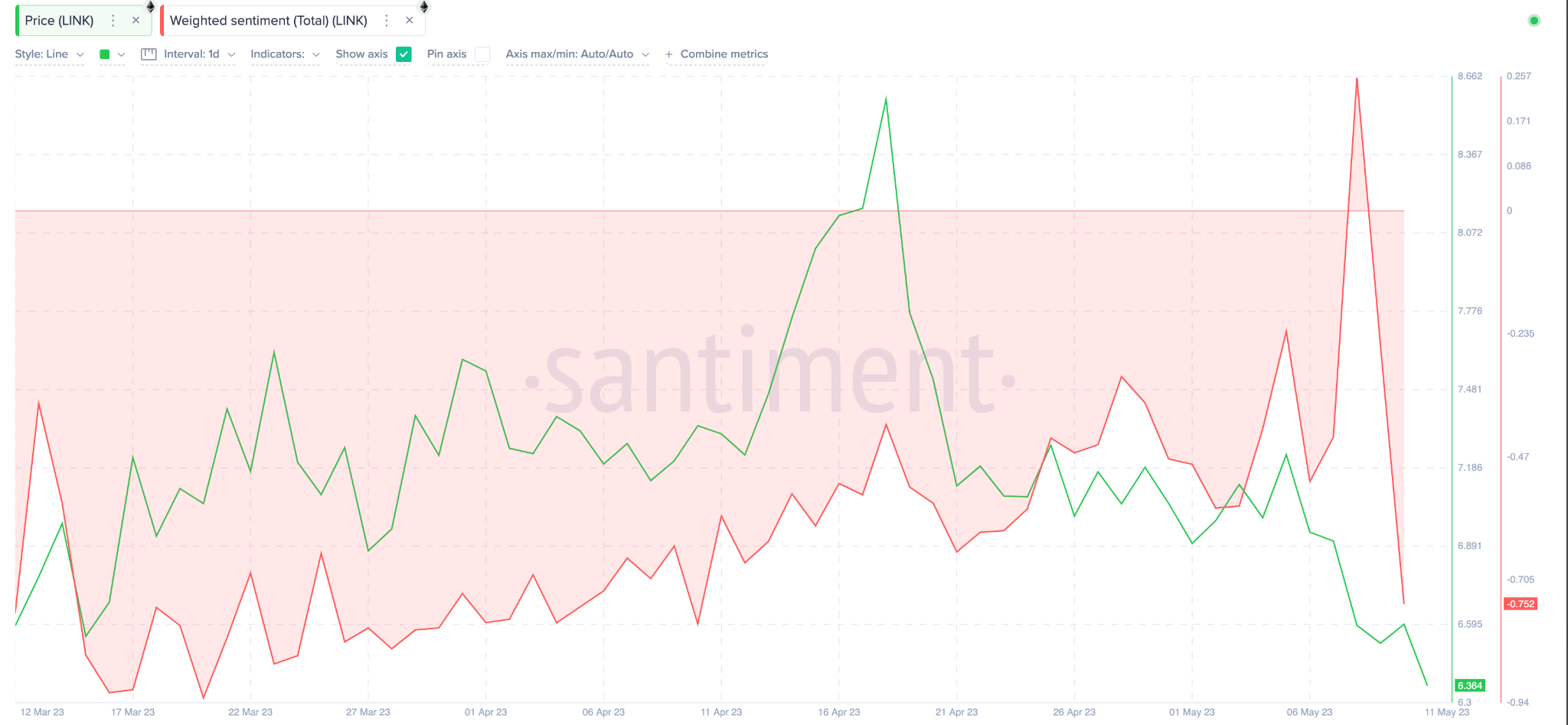

After trending negatively since March, the social media perception surrounding Chainlink turned positive for the first time on May 8.

This could be attributed to the recent partnership announcements that will see Chainlink price feeds integrated into Prime Protocol and MakerDao-backed Spark Protocol.

As the news filtered across social media, the Weighted Sentiment spiked in positive figures reaching 0.25 on May 8. While it has since dropped to -0.75 on May 10, investors could interpret this wild fluctuation as a premise for a positive LINK price prediction.

The Weighted Sentiment, which evaluates the ratio of positive mentions to negative mentions, currently shows that most LINK stakeholders are currently pessimistic.

But, when Weighted Sentiment spikes into positive numbers, as seen above, it often attracts the attention of strategic investors looking to buy at the perfect turning point.

Increase in Market Demand

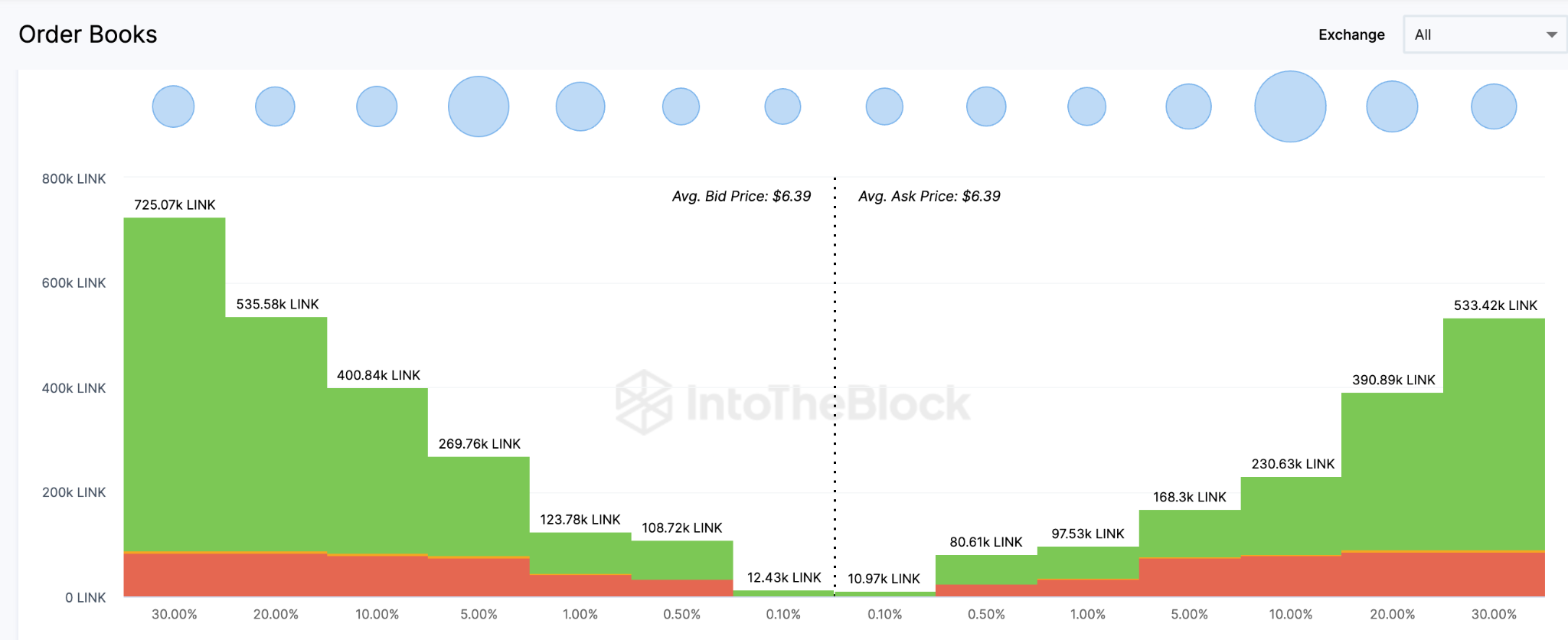

Moreso, it appears that the recent spike in social sentiment has translated into increased demand for LINK. Specifically, the aggregate order books of exchanges presented below show that LINK buy-orders have now exceeded the market supply.

Currently, investors have placed limit orders to buy 2.17 million LINK tokens. But, in confirmation of the bullish stance, Chainlink traders have only put 1.5 million tokens around the current prices.

With the current excess market demand of 670,00 LINK, prices will likely rise as buyers compete to fill their orders.

In summary, if the social sentiment turns bullish, demand for LINK could increase further. Ultimately, the bullish Chainlink price prediction will likely be validated.

LINK Price Prediction: Will the $6.86 Resistance Cave?

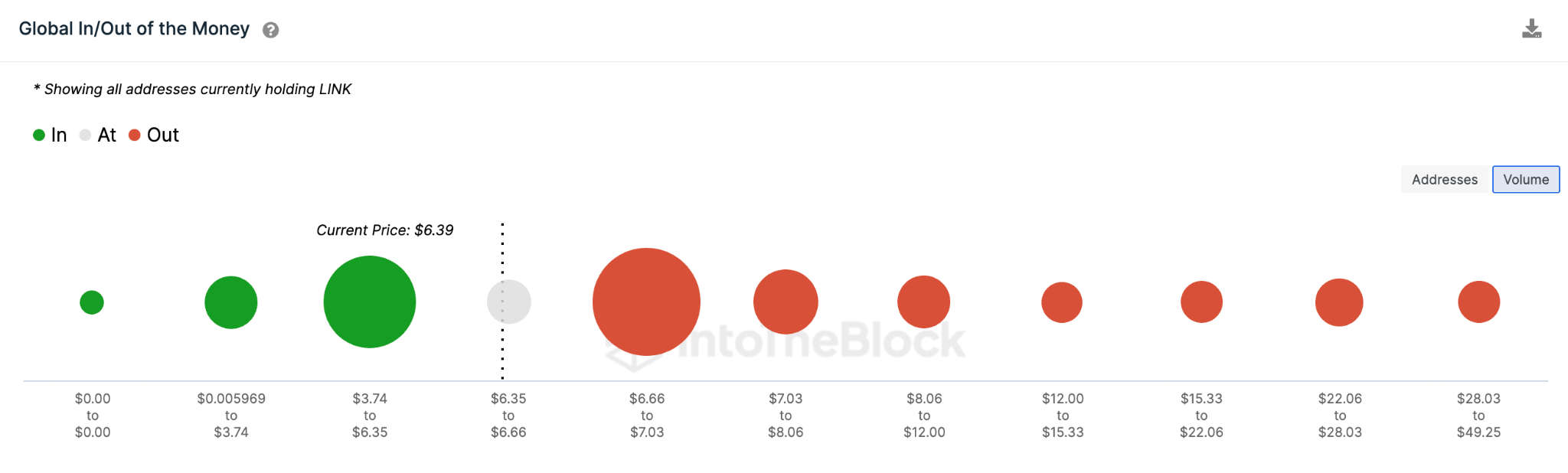

IntoTheBlock’s In Out of Money Around Price data shows that Chainlink’s next bull rally could reach $8. But first, it must first clear key resistance levels.

Key clusters of buyers can be seen at $6.52, $6.86, and $7.39. These clusters represent a total of 142 addresses holding 536 million LINK – This equates to $3.4 billion.

Should all these levels of previous buyers be reached, this could propel the price towards higher prices with fewer holders in the way. If this happens, then the positive LINK price prediction of $8 could be actualized.

Still, the bears could invalidate the positive outlook if LINK sinks unexpectedly below $6.35. Although, as seen above, the bullish support from 23,000 addresses that had bought 24 million Chainlink for a minimum price of $6.35 will likely prevent the drop.

But if that support level fails to hold, the bullish Chainlink price prediction could be effectively invalidated and trigger a drop toward $5.60.