Chainlink (LINK) price has been in a freefall since reaching a 2023 peak of $8.7 on April 18. A deep dive into the underlying on-chain data shows that the bearish trend could linger. Can LINK stay above $6?

Chainlink (LINK) is a decentralized abstraction layer blockchain network to integrate off-chain data into smart contracts. Since approaching the $9 milestone on April 18, the LINK price has been on a losing streak.

The on-chain data analysis below outlines some underlying reasons for the bearish trend and potential price action for the coming weeks.

Whale Investors Are Selling

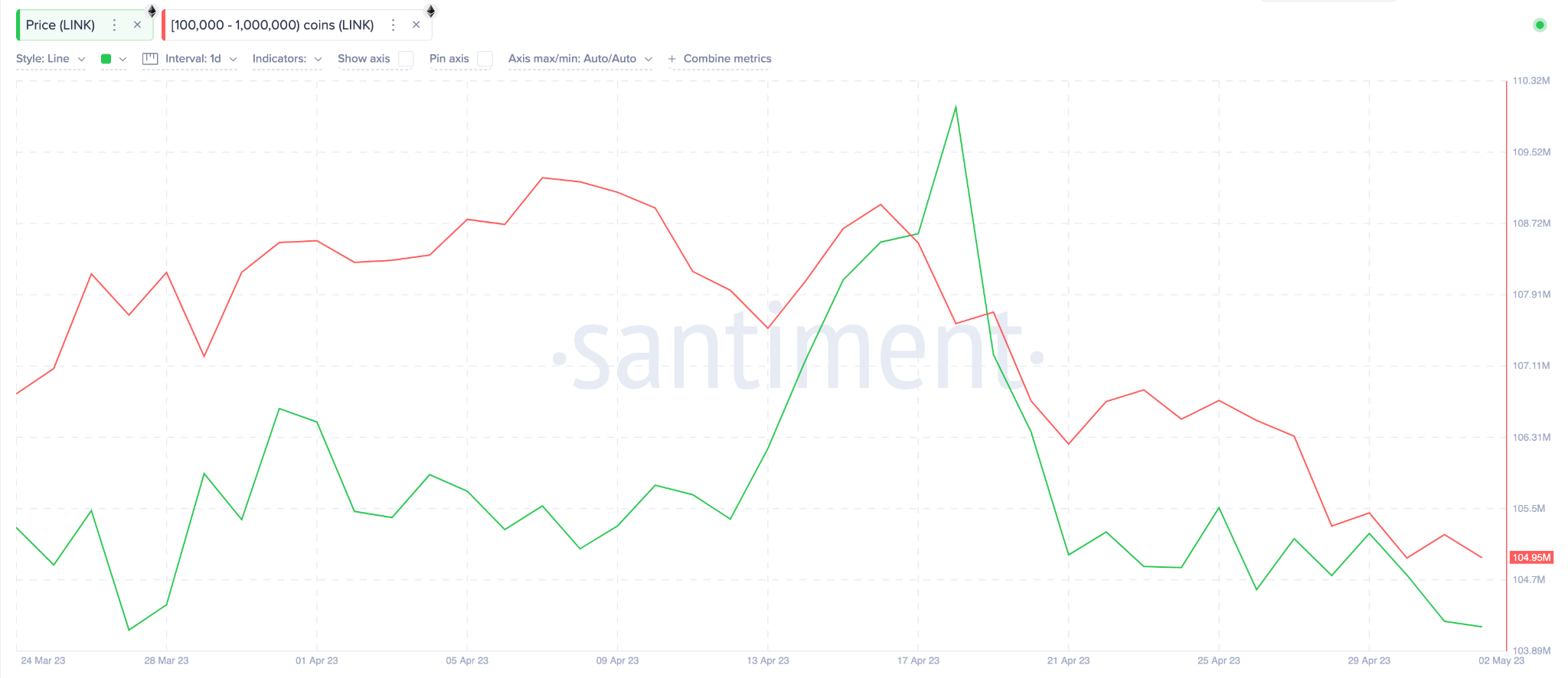

Chainlink (LINK) current bearish price trend can be attributed to the sell-action of large investors on the network, according to Santiment’s on-chain data.

A cohort of crypto whales holding 100,000 to one million tokens began a sell-off frenzy just before LINK price peaked on April 17. The chart below depicts how they sold four million tokens between April 16 and May 2.

At current market value, the tokens they offloaded are worth $27 million. Whale investors have huge financial power and influence in the crypto ecosystem.

And when they start to sell a large number of tokens within a short period, it sends a bearish signal to existing and prospective investors.

Furthermore, historical data shows that this whale cohort has a knack for timing trades accurately. If this pattern repeats, LINK holders can expect more price downswing in the coming days.

DeFi Users Are Un-Staking LINK

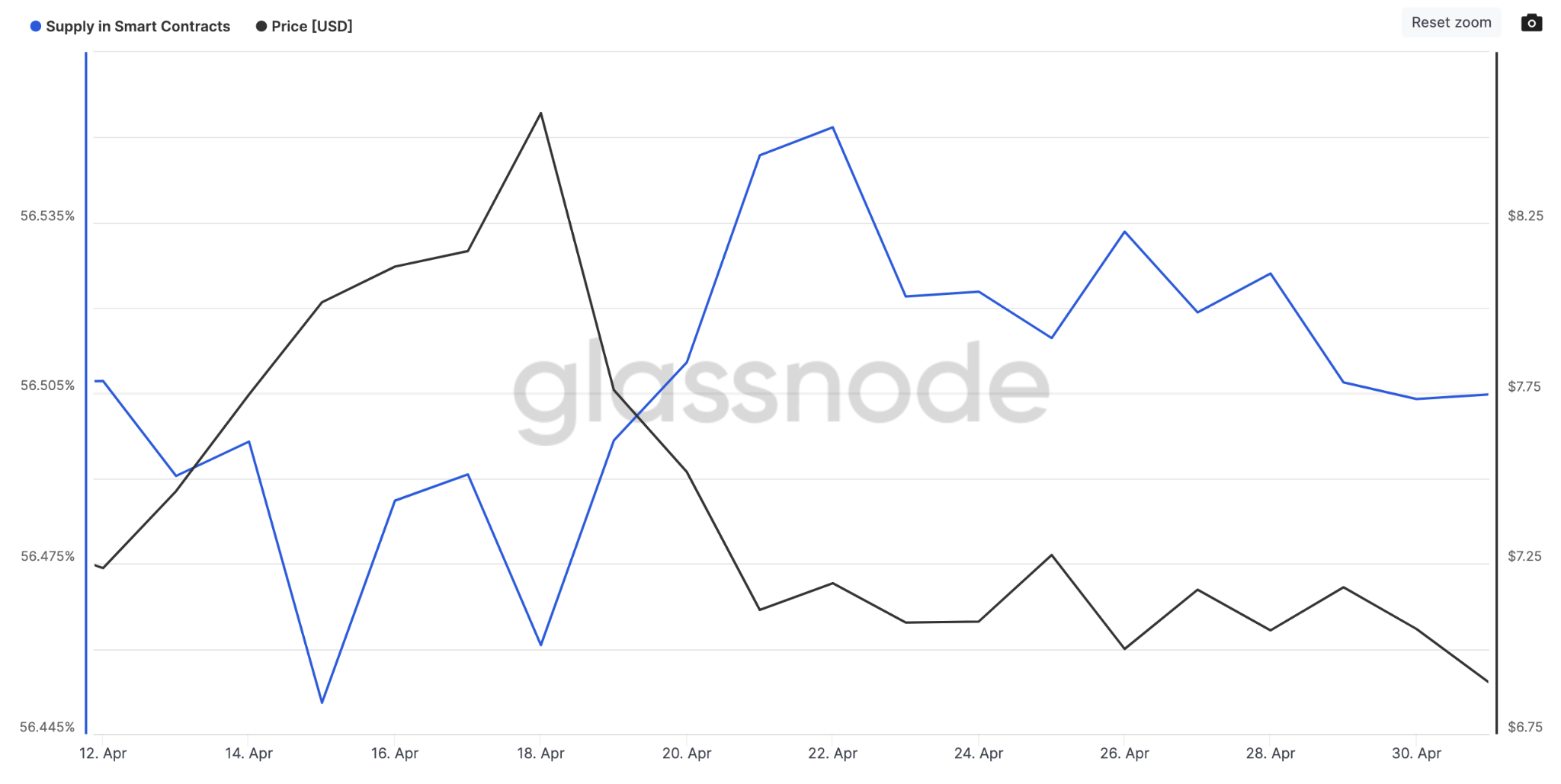

Chainlink incentivizes network participants by offering subsidized BUIDL services, rewards, and exclusive product offerings to stakers. However, in recent weeks, many users have un-staked their LINK tokens from DeFi protocols.

The Glassnode chart below shows that the Supply of LINK in smart contracts has reduced by 243,036 LINK (0.047% of total circulating supply) between April 22 and May 2.

Supply in Smart Contracts tracks the percentage of a token’s total circulating supply that holders have locked up across various DeFi protocols. When it decreases, it indicates an increase in the supply of tokens available to be traded on exchanges.

The recently unlocked 243,036 LINK tokens are worth approximately $1.7 million. This could add considerable downward pressure on the Chainlink price if it is all placed on the market.

LINK Price Prediction: Bears Are Eyeing a Drop Below $6

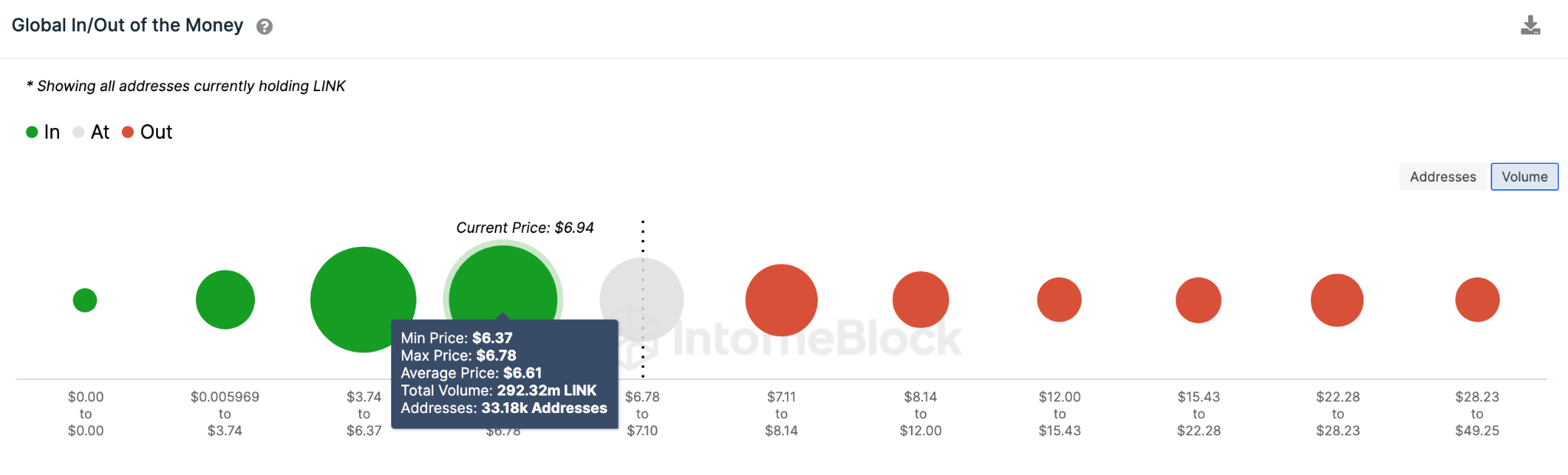

Looking closely at the Global In/Out of Money Around Price data, Chainlink price looks likely to drop below $6. But first, the bears will have to contend with potential bullish support from 33,000 wallets holding 292 million around the $6.6 price level.

However, if the bearish outlook plays out as expected, the LINK price could continue to drop until it reaches another significant support level at $5.62. The next cluster of 71,000 investors holding 275 million tokens could stand firm here.

Yet, if the bulls manage to push the LINK price above $7, they can invalidate this bearish narrative. But they would have first to overcome the potential sell-pressure from 44,000 addresses holding 147 million tokens.

If they successfully breach that resistance, then LINK holders can anticipate a price rally toward the $8 zone again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.