The price of Chainlink (LINK) shows long-term bullish signs by reclaiming a long-term horizontal level. It is attempting now attempting to clear a long-term diagonal resistance level finally.

While long-term readings indicate that the LINK price will eventually break out from the resistance line, short-term ones suggest that a retracement will occur before the price breaks out.

Chainlink Price Attempts Breakout from Long-Term Resistance

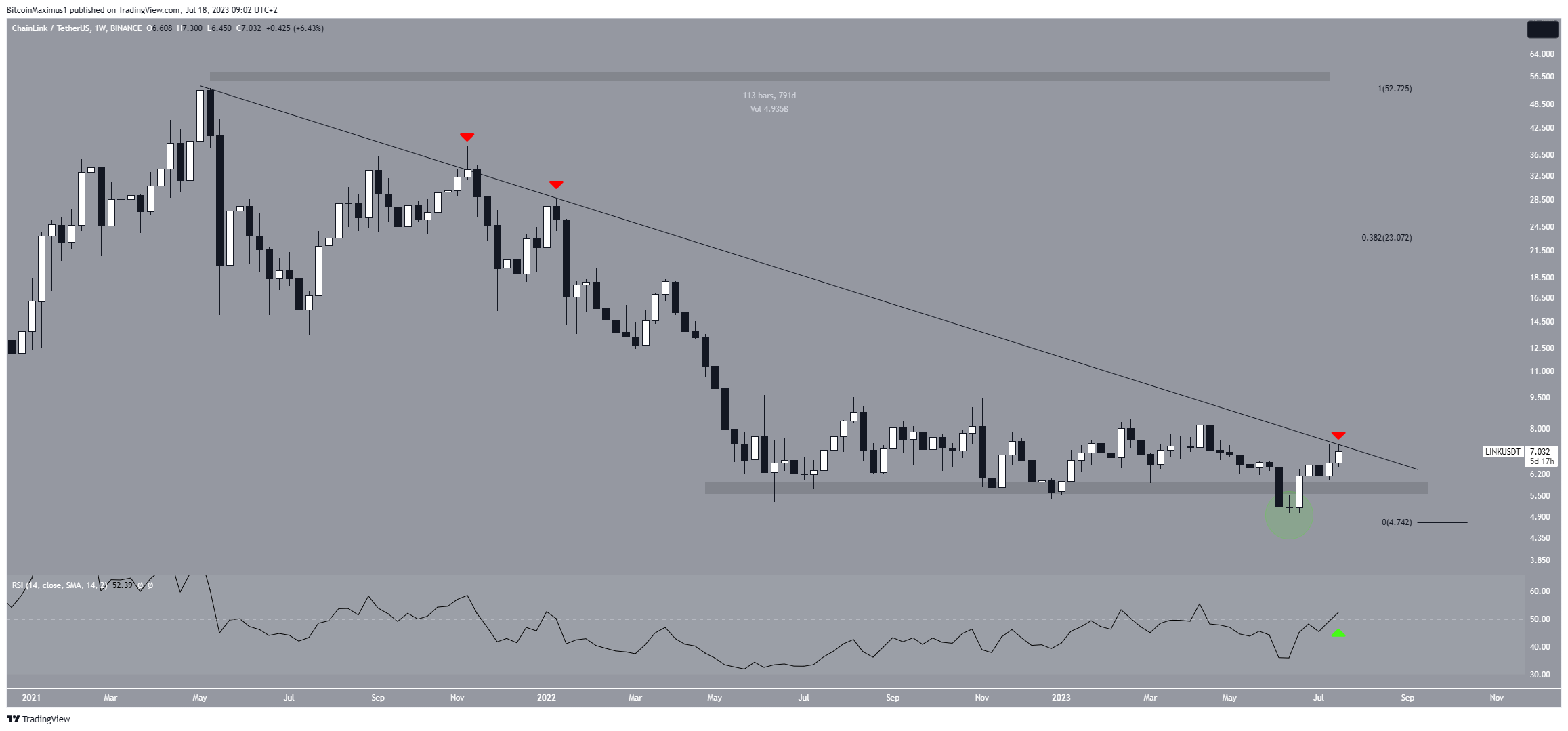

The weekly time frame technical analysis shows that the price of LINK has fallen below a descending resistance line since May 2021. The decrease led to a low of $4.75 in June 2023. This seemingly caused a breakdown from the $6 horizontal area, which has been in place since May 2022.

However, the price immediately reclaimed the area, validating it as support. This rendered the previous breakdown as a deviation (green circle). Such movements are often followed by a sharp move in the other direction, as has been the case for LINK so far.

Currently, the LINK price is making its fourth (red icons) attempt at breaking out from the line, which has been in place for 790 days. A breakout and close from it would suggest that the correction is complete and a new increase in the other direction has begun.

The weekly RSI supports the upward movement but does not confirm the possibility of a breakout. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. While the indicator is increasing and is above 50, a close above the line is required to confirm the bullish trend reversal.

Read More: Best Upcoming Airdrops in 2023

LINK Price Prediction: When Will LINK Reach a Local Top?

While the daily time frame aligns with the bullish readings from the weekly one, it also suggests that the price will reach a local top soon. The Elliott Wave theory supports this possibility.

To determine the direction of a trend, technical analysts use the Elliott Wave theory, which involves studying recurring long-term price patterns and investor psychology.

Beginning on June 10, the price has likely begun a five-wave upward movement (black), which aligns with the beginning of a bullish trend reversal. However, it also suggests that the price is in this increase’s fifth and final wave.

Therefore, if the count is correct, a significant drop will follow after the next high.

The daily RSI supports the continuing increase since it is above 50 and moving upwards.

It is possible to draw a parabola that connects all the recent lows in order to determine the slope of the increase and the trend’s direction. So, the trend is bullish as long as the parabola is in place.

Despite this bullish short-term LINK price prediction, a breakdown from the parabola will likely lead to a retracement towards $6. This would not invalidate the long-term bullish structure.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.