The digital rupee (e₹) debuted in India’s financial theater in the final quarter of 2022. Also known as the e-Rupee, the central bank digital currency (CBDC) is issued by India’s top banking authority, the Reserve Bank of India (RBI). The RBI unveiled the e-Rupee pilot on December 1, 2022, initially rolling it out to select user groups in specific cities. As of early July 2023, the pilot is still an invite-only affair — meaning you need a golden ticket from your bank to join the party.

Over the past six months, the RBI has gradually expanded its reach, inviting more cities and bank customers to the e-Rupee experience. When yours arrives, you’ll want to try your hands on the new Indian CBDC immediately — and that’s what this guide is for. It will help you develop a sound grasp on acquiring and using the digital rupee, ensuring you’re ready to make the most of it.

How to get started with the digital rupee

Step 1: Get an invite

To kickstart your digital rupee adventure, you’ll first need an invite. The digital rupee and India’s CBDC infrastructure are accessible through an invite-only pilot program. The RBI initially launched this program in Mumbai, Bengaluru, New Delhi, and Bhubaneswar, partnering with a select group of banks, including the State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank.

However, the RBI quickly expanded the pilot to other locations, including Chandigarh, Ahmedabad, Kochi, Guwahati, Gangtok, Hyderabad, Shimla, Patna, and Lucknow. The banking crew also grew, with Union Bank of India, Kotak Mahindra Bank, HDFC Bank, and Bank of Baroda joining the ranks. This is still expanding, with five more banks joining the program in mid-2023, including Axis Bank, Canara Bank, IndusInd Bank, Punjab National Bank, and Federal Bank.

Unfortunately, there is nothing you can do to ensure that you get an invite from your bank right away. When your name pops up on the list for the Closed User Group (CUG), your bank will drop you a line. You’ll receive an SMS and an email inviting you to participate in the e-rupee pilot program. So, keep an eye on your inbox and your phone notifications.

Step 2: Download the digital rupee app

Once you’ve secured your invite, it’s time to download the digital rupee app. You can find it on Google Play Store or Apple App Store by simply searching for “Digital Rupee app.”

You’ll notice that there are different apps from different banks, each with its own user interface — a slightly different color scheme, perhaps. But don’t let these superficial differences fool you. While each bank enrolled in the RBI’s CBDC pilot has its own e-Rupee app, the backend of all these apps is pretty consistent across the board.

This is probably because the RBI exclusively provides the backend, ensuring a uniform user experience, regardless of the bank they’re associated with.

Step 3: Register

When you fire up your bank’s e-Rupee app for the first time, it’ll request certain permissions. These permissions include access to your contacts and text messages. You’ll need to grant these permissions to ensure the app works as it should.

Next, you’ll be asked to agree to the app’s terms and conditions. Scroll to the bottom, hit ‘Accept,’ and you’ll be greeted with a brief overview of the e-Rupee.

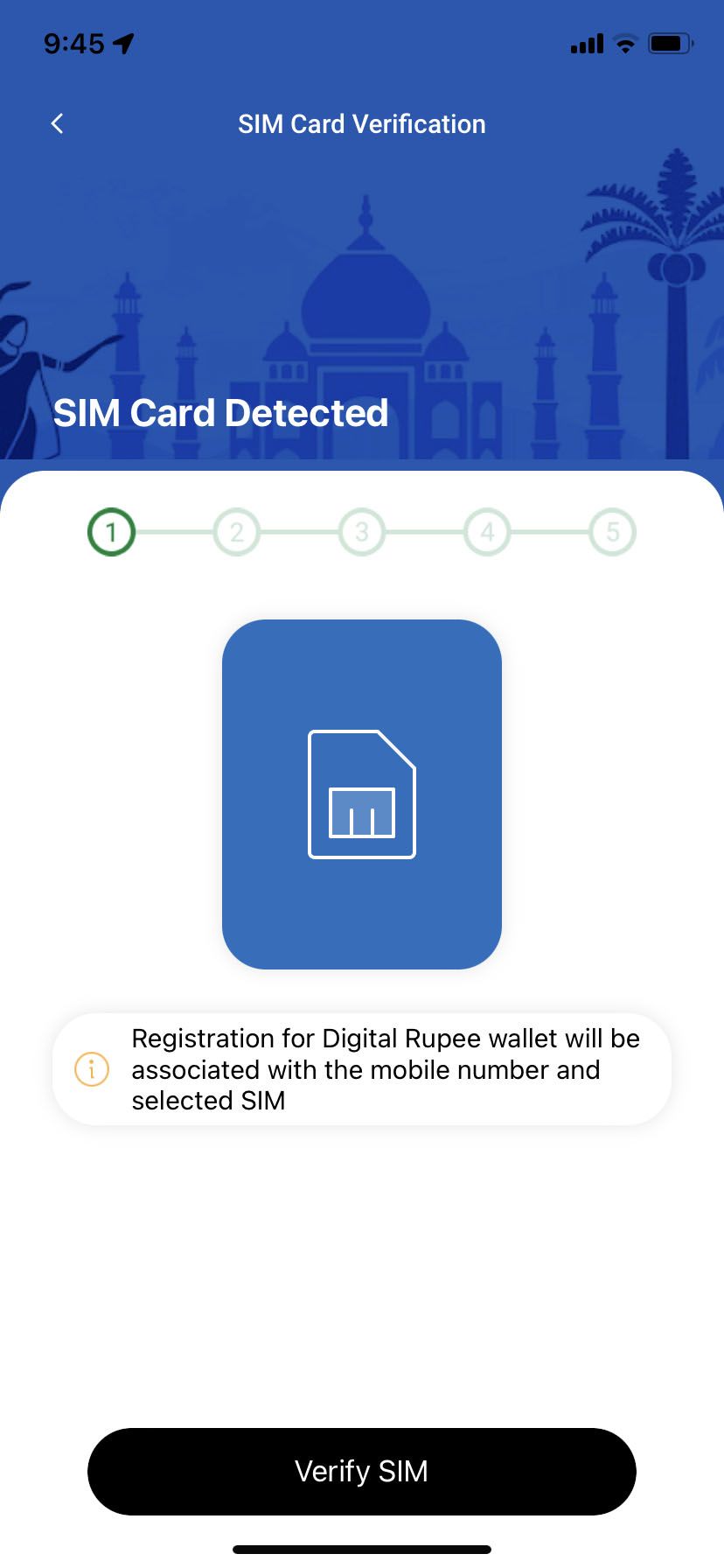

Now, it’s time to register. The app will ask you to confirm the SIM card linked to your bank account. If you’re a two-SIM kind of person, make sure you pick the right one.

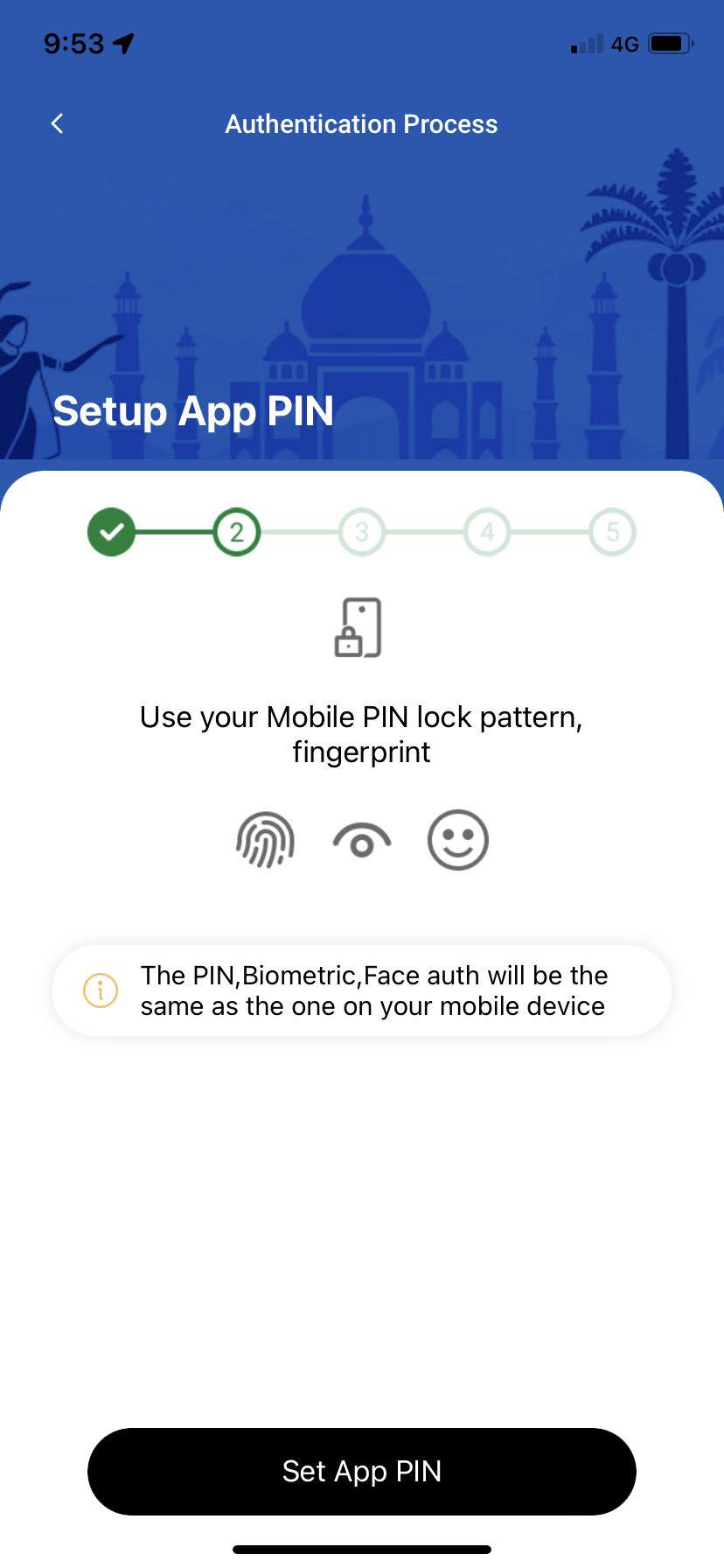

After SIM verification, you’ll set up your app PIN. This could be your device PIN, lock pattern, or even biometrics like fingerprints. This PIN lets you access the app without needing an OTP each time.

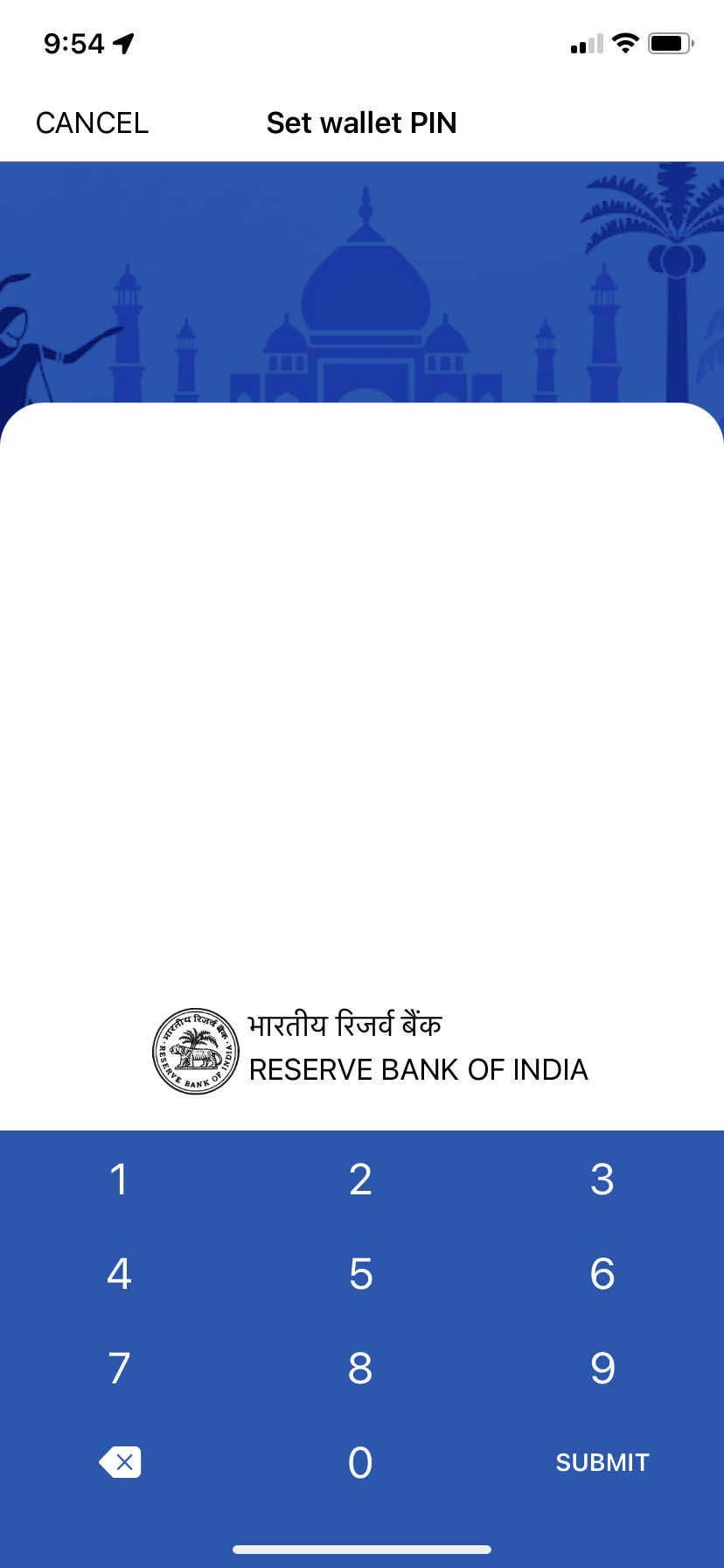

Next, you’ll enter your name and follow the on-screen instructions. When you reach the ‘Set Wallet PIN’ page, choose a unique wallet PIN (different from your app PIN).

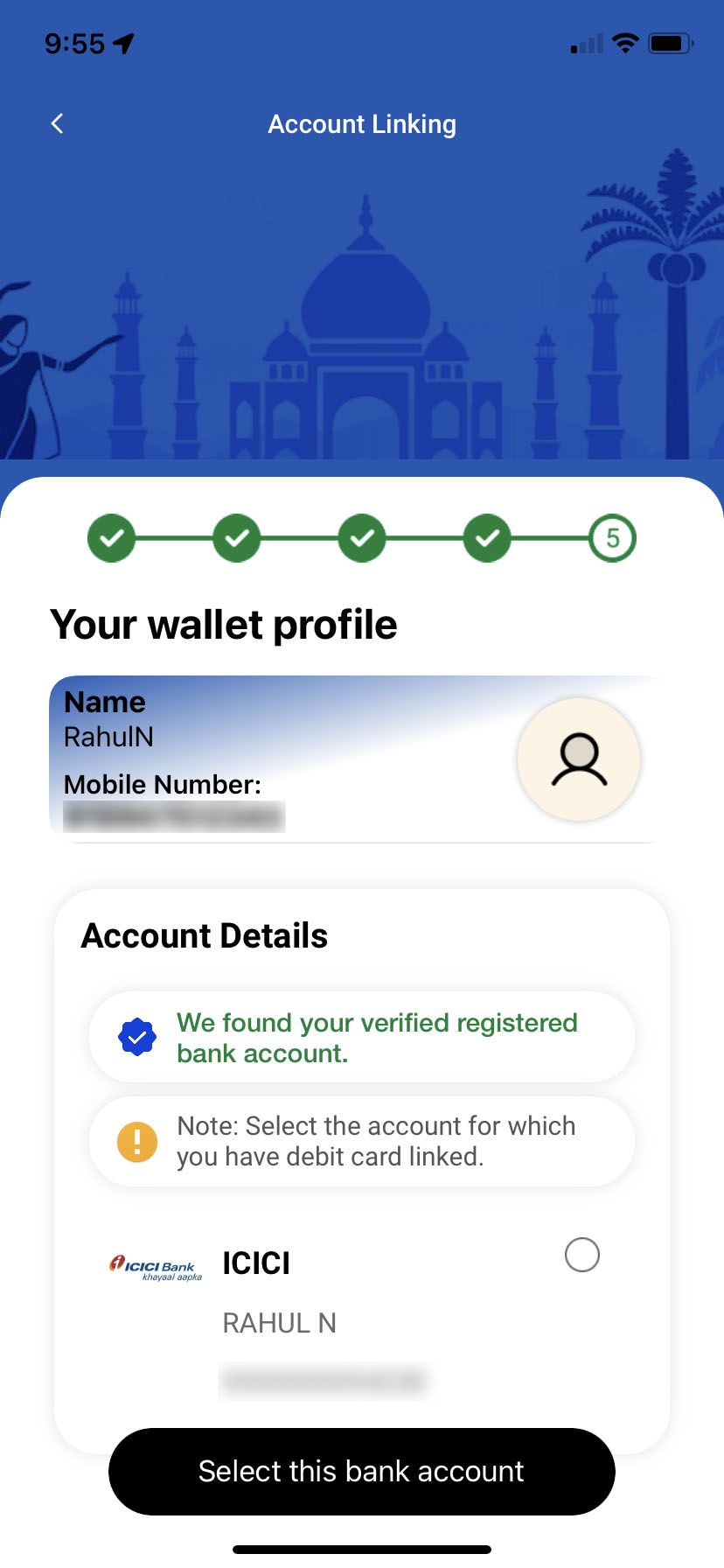

The next step is linking your bank account to the digital rupee app. The app will auto-detect the account linked to your number. If you have multiple accounts, select the one that received the pilot program invitation.

Finally, for the last step of the KYC verification process, you may have to provide your debit card details. These details include the last six digits of the card number and the expiry date. And voila! You’re all registered.

So, get your invite, download your bank’s e-Rupee app, register, and you’re all set to try out the Indian CBDC.

How to use the digital rupee

As a participant in the e₹ pilot program, you can use the digital rupee for both person-to-merchant (P2M) and person-to-person (P2P) transactions. This means you can pay for goods and services at retail outlets, shopping malls, and other businesses that display a QR code for digital rupee payments. Just ensure the retailer you’re shopping at has a digital rupee account.

Additionally, you can also transfer funds between accounts, essentially using e₹ in the same manner as physical cash.

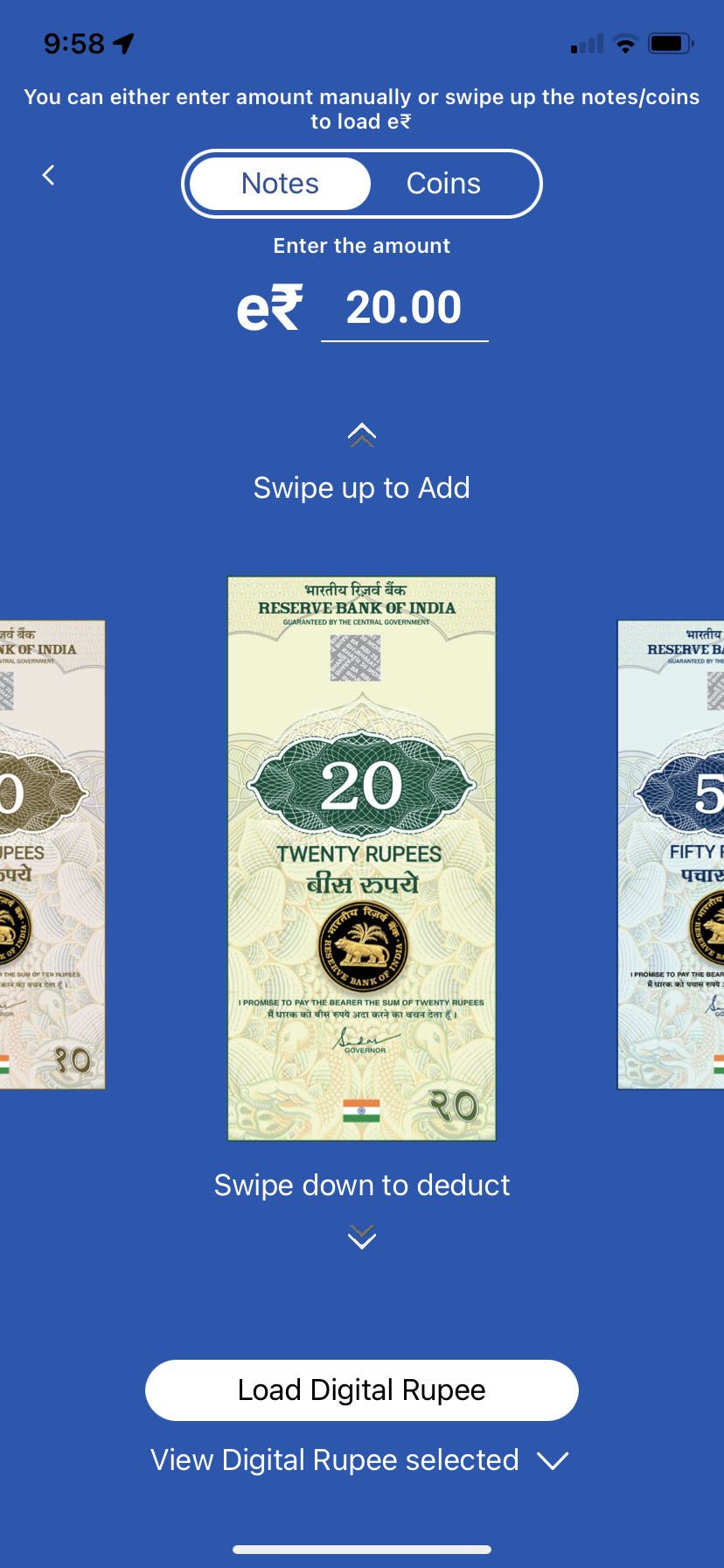

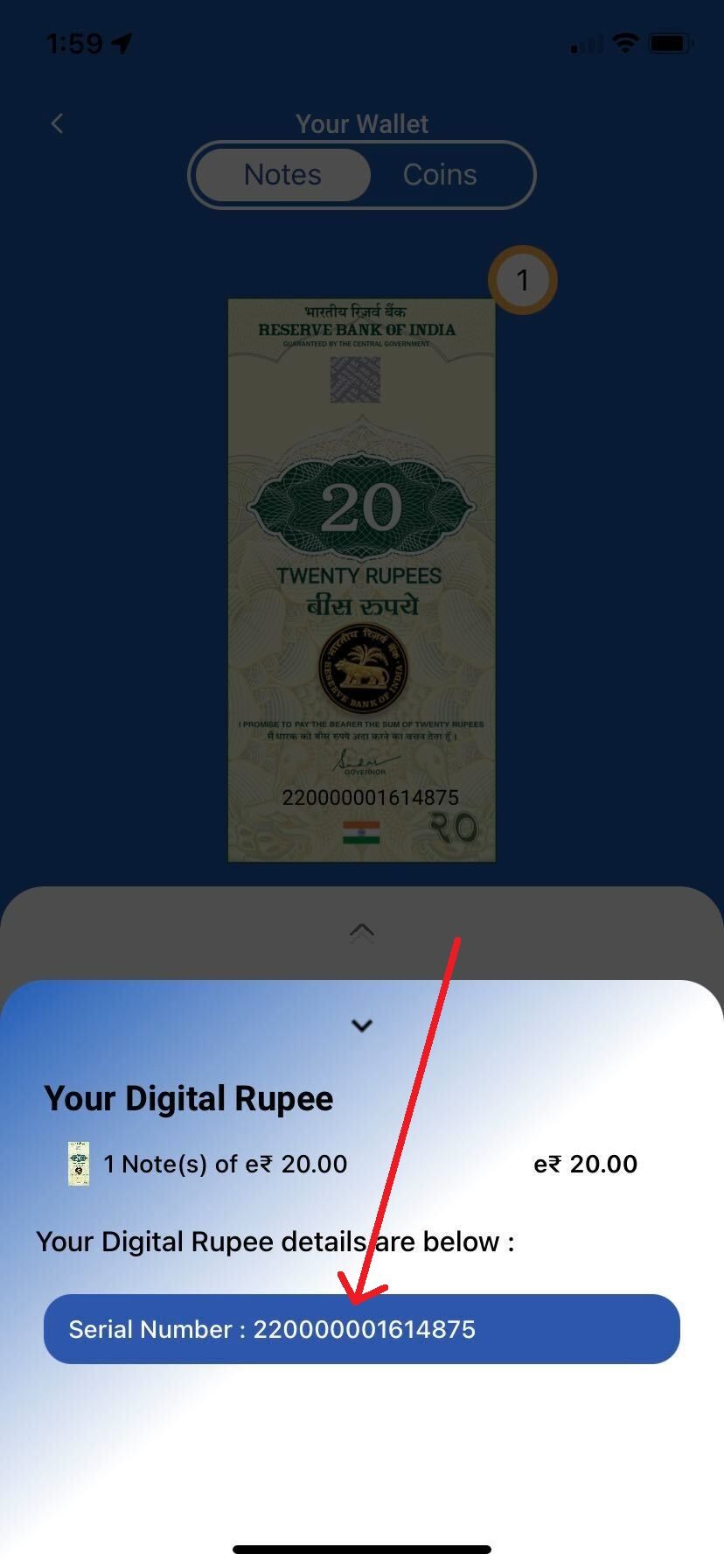

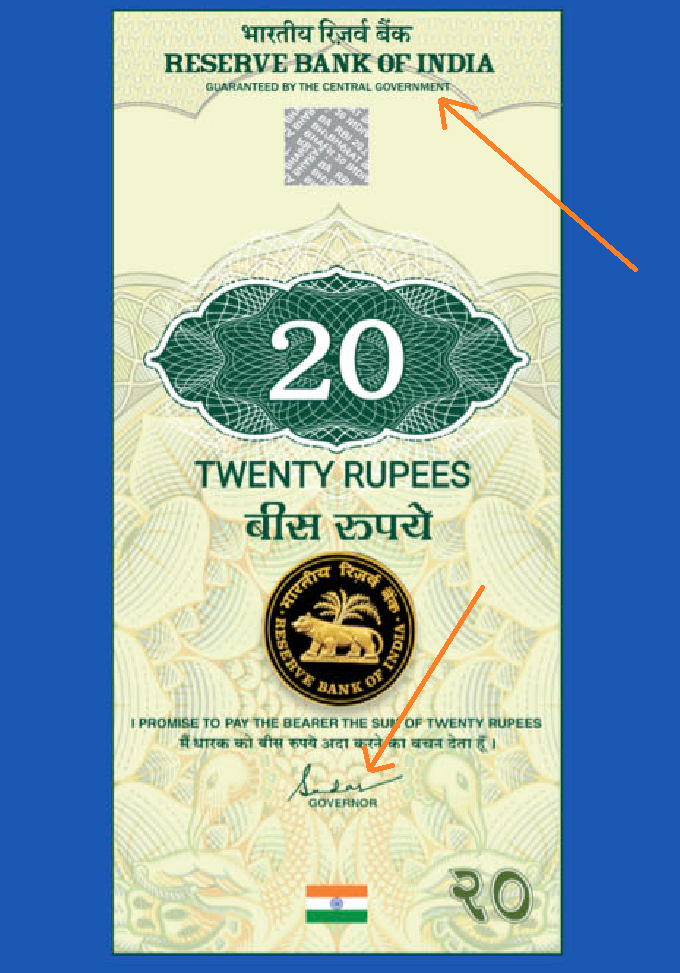

The digital rupee mirrors the denominations of its physical counterpart. You’ll encounter digital tokens from e₹0.50, e₹1, e₹2, e₹5, e₹10, e₹20, e₹50, e₹100, e₹200, e₹500, all the way up to e₹2,000.

Every digital rupee token is tagged with a unique serial number, serving as its digital identifier. This unique serial number allows for the tracking of the individual token on the blockchain, enhancing security and providing a traceable path for each token.

And being a legal tender, e-rupee tokens carry the RBI name and logo, along with the RBI Governor’s signature, in the same way, physical rupee notes do.

How can you own digital rupees?

Let’s talk about how to fill up your digital rupee wallet. The wallet is automatically set up when you register on your bank’s digital rupee app. You can start adding funds to it in two ways — either by receiving funds from another user or by transferring funds from your bank account.

Loading your digital rupee wallet is as straightforward as topping up any prepaid or UPI wallet. You can use your debit card or any UPI app like GPay or Amazon Pay.

How can you send and receive digital rupees?

Digital rupee transactions work the same way as any normal cash transaction, but digitally. Let’s say you want to send e₹700 to a friend. You can do this by sending one e₹500 token and one e₹200 token. Or, you could send seven e₹100 tokens or three e₹200 tokens and one e₹100 token, or even 700 e₹1 tokens — the choice is yours.

But what if you need to send an amount that doesn’t fit neatly into these denominations, like e₹10.79 or e₹10.09? The RBI has thought of that too. The system rounds off the amount to the nearest available denomination. So, if you’re sending e₹10.79, the system will round it off to e₹11.00, and if you’re sending e₹10.09, it will be rounded down to e₹10.00.

You can send and receive money using a QR code or a phone number. However, as of now, you can only transact with other participants of the pilot program.

Can the digital rupee be converted to cash?

Absolutely, you can convert your e-Rupees back into physical cash. This is because the digital rupee is a legal tender. It is also essentially a digital version of the physical rupee we use every day. Once the digital rupee is rolled out across the country, you’ll be able to visit any local bank and convert your digital rupees into cash.

Moreover, you can redeem any portion, or even all, of the funds in your e-Rupee wallet whenever you wish. The redeemed amount will be directly deposited into your linked bank account.

How does the digital rupee work?

The digital rupee, or e₹, is the digital counterpart of India’s legal tender, mirroring the denominations of physical cash currently in circulation. These digital tokens, issued by the RBI, represent the money we use daily.

Without diving into the technical nitty-gritty, the RBI distributes these tokens through Token Service Providers (TSPs), who then pass them on to end users. Participating banks in the e₹ pilot program will acquire these tokens from the RBI via the TSP merchants.

This online issuance of e₹ helps the RBI bypass operational costs associated with physical cash, such as printing, storage, and transportation. To store and use e₹, you’ll need a digital wallet, which is essentially the digital rupee app you can download onto your mobile devices. This wallet stores your e₹, enabling you to conduct financial transactions digitally.

A step towards greater financial inclusion?

The digital rupee is a significant step towards a more inclusive and efficient financial system in India. The RBI appears to be doing its bit to make the app and corresponding ecosystem user-friendly and secure. The digital rupee promises to offer faster transactions, cost-effective global transfers, and 24/7 availability, outpacing traditional banking methods. It also eliminates the need for physical manufacturing, reducing costs and avoiding physical wear and tear. Furthermore, it can streamline government payouts, making processes like subsidies, tax refunds, and scholarships more efficient.

As the pilot program expands, an increasing number of people will have the opportunity to experience the benefits. This new avatar brings forth a fresh set of advantages. It is a transformed version of their familiar currency. However, the success of this pioneering initiative largely hinges on its accessibility and user-friendliness. For the digital rupee to have any mainstream appeal, the RBI must design a system that’s simple to navigate for anyone with a smartphone — including those who were otherwise left behind the traditional banking system.