The reality of investing is realizing that most people aren’t able to beat the market. Therefore, investors created hedge funds for people who would like to trade but without the necessary overhead. GSD Capital is a quantitative hedge fund that employs advanced methods to generate returns. Learn about this AI-powered investment management company in this comprehensive GSD Capital review.

Methodology

This GSD Capital review was conducted based on a diligent process, with the platform assessed against multiple criteria. Many factors were taken into account when gauging the reliability of this platform.

The information is peer-reviewed and fact-checked to ensure accuracy and reliability. Some of the characteristics considered included:

• Security

• Comparison to competitors

• Features

• Pricing

GSD Capital is regulated in the U.K. and takes measures to provide security for its creditors. The assets are segregated and crypto deposits are held with Ledger and insured.

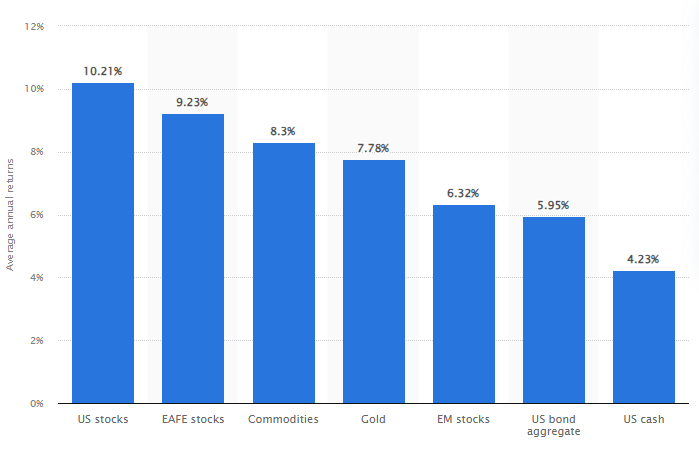

Additionally, the fund has average monthly returns between 8-15% depending on the accounts. This performance outpaces assets like stocks, commodities, and gold, which have returns around 10% and below annually.

The platform has a team of experts, many with PHDs, all with experience in trading. This is only enhanced by the use of artificial intelligence. All of the aforementioned qualities reflect GSD Capital’s ability to offer customers a unique and useful product.

To learn more about BeInCrypto’s verification process, click this link.

What is GSD Capital?

GSD Capital is a quantitative hedge fund particularly focused on trading enhanced with artificial intelligence (AI). A hedge fund is an investment vehicle primarily available to accredited and institutional investors, utilizing diverse strategies to generate returns irrespective of market trends, often employing leverage and derivatives.

However, this fund is available publicly and has made a name for itself at the nexus of technology and finance. It manages investments and seeks returns in the financial market using cutting-edge AI and quantitative approaches.

GSD Capital is set to consume the vast wealth in the market available to be earned through our strategy.

Timothy Goldberg, co-founder and current CIO

GSD Capital leverages a blend of deep learning, supervised learning, and reinforcement learning algorithms for trading, which is similar to Google’s DeepMind AlphaGo. As of February 2024, GSD Capital has:

- About $1.19 Billion in assets under management (AUM)

- More than $1.27 Billion in principal and returns paid

- Around 1,758 partners in various countries across the globe

Team and history

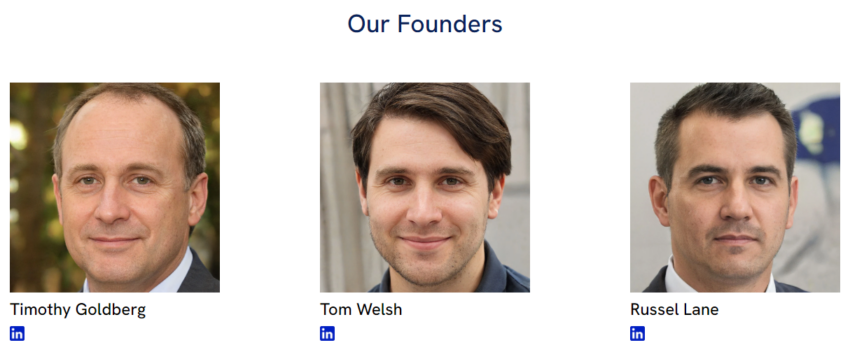

Established in 2019 by Timothy Goldberg and with a team of skilled traders and analysts, GSD Capital initially provided exclusive investment management services to institutional investors. However, the firm expanded its offerings to individual investors globally by 2021.

As the Chief Investment Officer at GSD Capital, Timothy Goldberg oversees trading and investment strategies, bringing over 25 years of experience in managing assets for both institutional and retail clients across a variety of investment approaches.

Tom Welsh, serving as a senior trader and the head of technology, guides the technology team in developing and refining AI technology, in addition to leading the traders who implement this tech in their operations.

Russel Lane, a seasoned member of the trading team, has amassed more than 20 years of experience in asset management, with a particular focus on risk management.

Additionally, over 60% of quantitative researchers at GSD Capital hold a PhD, while more than 90% of them possess an advanced degree. Over 60% of the heads of research and engineering functions at the firm also reached their positions within 10 years of graduating from university.

GSD Capital features

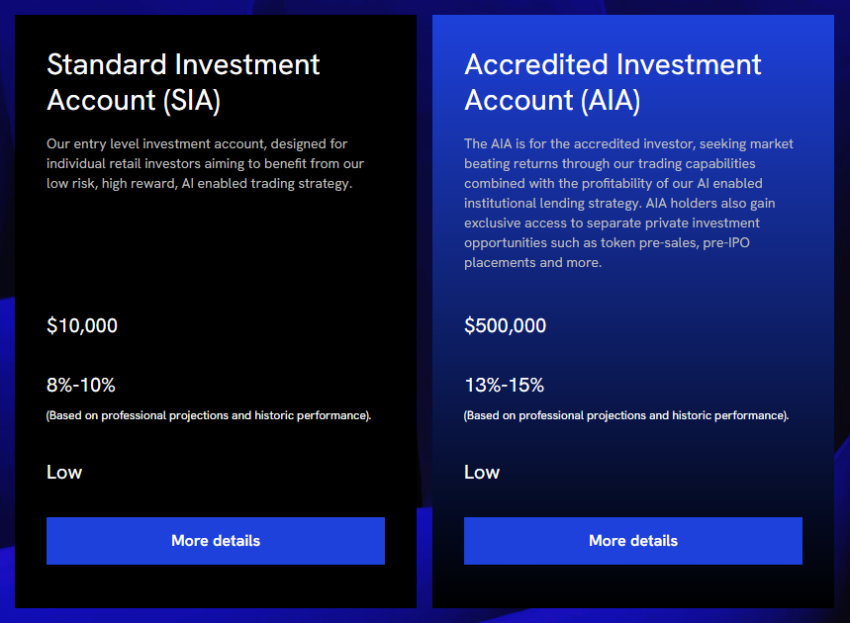

No GSD Capital review worth its salt is complete without covering the firm’s value propositions. As it stands in 2024, users can participate using one of two accounts, depending on the amount of capital they are willing to invest.

Standard Investment Account (SIA)

The SIA account is an entry-level investment option for retail investors exclusively engaging in futures trading. It provides a focused exposure with a low-risk profile, targeting returns of approximately 8-10%. The performance fee is 0.5%, and returns are distributed daily.

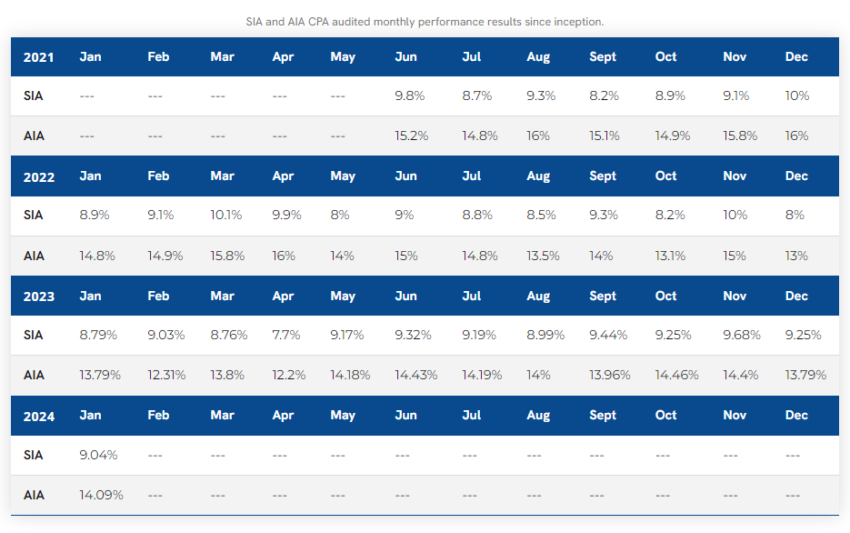

Since its launch, the SIA account has achieved a remarkable growth of 280.37% as of Dec. 31, 2023. The account requires a minimum investment of $10,000.

Accredited Investment Account (SIA)

The AIA account is for accredited investors. It requires a minimum investment of $500,000. This account utilizes a 70% futures trading and 30% interbank lending strategy. AIA account holders will also incur a 0.5% performance fee, about 13-15% monthly returns, and daily distributions.

AIA holders also get exclusive access to various private investment possibilities, including token pre-sales, pre-IPO placements, and more. Lastly, the AIA account has generated a 447.21% return since the fund’s inception.

Algorithmic trading

GSD Capital employs a strategy that aims for diversified returns by trading across global commodities, currencies, and cryptocurrency markets. The firm leverages an AI-enabled, automated approach, conducting trades on a daily basis across various market structures.

This integration of artificial intelligence, under the watchful eye of experienced professionals, is central to GSD Capital’s strategy, providing a significant competitive advantage that is reflected in superior trading returns.

The foundation of its trading methodology rests on the analysis of momentum and technical patterns, supplemented by machine learning and predictive analytics based on fundamental market regimes. This approach helps in assigning appropriate risk weights to each trade.

GSD Capital’s proprietary AI trading systems process millions of data points, enabling the execution of trades at optimal pricing. This capability is geared towards capitalizing on short-term momentum and market volatility, with the goal of forecasting price movements more accurately and managing risk more effectively.

GSD Capital’s continuous analytics, research, and optimization efforts include an ongoing process of data accumulation and analysis. By cataloging new market movements and patterns, the system enhances its ability to navigate future market scenarios.

Through deep reinforcement learning, GSD Capital’s trading systems are in a constant state of evolution, learning from the market to make increasingly informed trading decisions.

Investor protection

GSD Capital places a high emphasis on prioritizing client needs. The fund implements numerous safeguards to protect its client’s assets.

To further protect client investments, assets are stored with insured custodians and kept separate from GSD Capital’s own investment activities. This segregation acts as a protective measure, ensuring that client funds remain unaffected by the firm’s business risks.

Additionally, GSD Capital undergoes regular institutional risk assessments of its trading practices and overall investment strategy. These assessments are performed quarterly by independent auditors, who have consistently found the firm’s investment offerings to be safe and in compliance with regulatory standards.

Inter-bank lending

GSD Capital functions within the money market, acting as a lender to financial institutions seeking overnight liquidity. The firm employs sophisticated algorithms to manage the majority of the lending process, from initial screening to the final execution of transactions.

Through this strategy, GSD Capital consistently achieves single-digit percentage returns on a daily basis, capitalizing on the opportunities presented in the short-term lending market.

Trusted Contact Person (TCP)

Another useful feature that comes with utilizing GSD Capital is the Trusted Contact Person (TCP). A (TCP) is an individual, at least 18 years old, whom you can designate for GSD Capital to reach out to if there are concerns about potential financial exploitation or questions regarding your mental or physical health.

This is particularly relevant as some individuals may experience a decline in cognitive abilities as they age. A TCP can assist both you and GSD Capital under such circumstances. Choosing to appoint one or more TCPs is entirely up to you and is not mandatory.

You have the flexibility to modify or revoke your TCP designations at any moment through written notification to GSD Capital. It’s important to note that a TCP does not have the authority to make investment decisions or to withdraw funds from your account.

By designating a TCP, you grant GSD Capital the permission to temporarily halt withdrawals from your account or, in certain situations, pause transactions — should there be reasonable suspicion of attempted or actual financial exploitation in your account or other scenarios deemed necessary for your protection.

How to sign up for GSD Capital in 2024?

1. Go to the GSD Capital homepage.

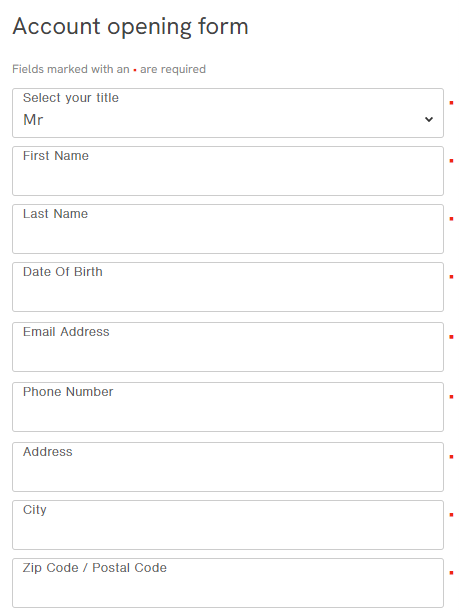

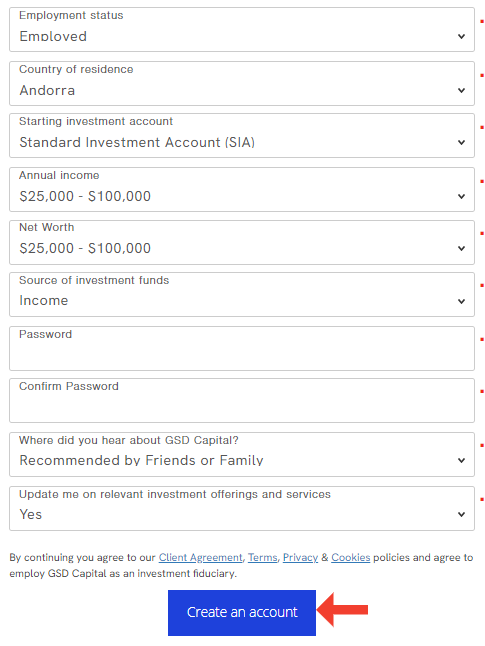

2. Fill out the form. All items with red dots are necessary to complete registration.

3. Click the blue button to complete registration and create an account.

Deposits and withdrawals

GSD Capital credits daily returns to client accounts at the close of each trading day. It’s important to note that returns are not generated on weekends and bank holidays when markets are closed. The firm also practices monthly compounding for all client accounts during the first week of each month.

GSD Capital adopts a performance-based fee structure, charging 0.5% on monthly returns. These fees are deducted before daily returns are credited to client accounts.

An upper limit of $5 million is set for investment accounts at GSD Capital. Should a client’s invested capital reach this ceiling, mandatory monthly withdrawals of any returns exceeding this limit are required.

Clients are obliged to conduct all withdrawals from their investment account in USDC or USDT, with a minimum withdrawal amount set at $100. GSD Capital ensures that no fees are charged for these withdrawals. However, for withdrawals beyond a certain threshold, the firm reserves the right to conduct enhanced due diligence as a precaution against money laundering and terrorist financing, aligning with relevant regulations.

Additionally, GSD Capital enforces a three-month lock-up period for newly funded accounts, meaning withdrawals can only commence three months following the initial deposit.

Regulatory compliance and safety

Client assets are securely held in cold storage accounts managed by a qualified custodian, Ledger, chosen by GSD Capital. Moreover, these assets are insured against malicious loss, with coverage extending up to U.S. $2 billion, providing an added layer of security for clients.

GSD Capital is licensed to offer investment management services within the regulatory scope of the Bank of England and the Financial Services Act 2016.

The terms of this agreement are subject to legal jurisdiction and will be interpreted following the laws of England and Wales. It is also important to note that although the fund is regulated in the U.K., GSD Capital offers its services to investors regardless of their country.

How does GSD Capital compare to others?

| Vehicles/Assets | Returns |

|---|---|

| GSD Capital | 8-10% or 13-15% (monthly) |

| Banks | 0.5-5% (annually) |

| S&P 500 | 10% (historical annual average) |

| U.S. Stocks | 10% (historical annual average) |

| Commodities | 8% (historical annual average) |

| Gold | 7% (historical annual average) |

When making comparisons with GSD Capital, it is important to frame it in terms of performance. In other words, how would your money perform with GSD Capital versus putting it into another asset or investment vehicle? While banks typically offer returns ranging from 0.5% to 5% at best annually, GSD Capital’s approach yields monthly returns of 8-10% or 13-15%.

Furthermore, in a comparison of investment performance, GSD Capital’s SIA and AIA accounts significantly outpaced the S&P 500 in 2023. The SIA account, with its AI-driven strategy, yielded an annual return (compounded) of approximately 182.89%, while the more aggressive AIA account achieved an even higher return of around 371.63%.

In contrast, the S&P 500, a broad representation of the U.S. stock market and a benchmark for many investment funds, posted a healthy return of 24.23% in the same period.

When you broaden the scope to include other assets, GDS Capital’s performance is overwhelmingly superior to other passive investment strategies. According to Statista, assets like commodities, gold, and U.S. stocks have an average return of around 8%, 7%, and 10%, respectively.

Invest responsibly

It is important to keep in mind that investing is inherently risky, and you can lose money. Profits are never guaranteed. Therefore, investors should never risk more capital than they can comfortably afford to lose.

Users should always do their due diligence before engaging in any financial activities. You should conduct your own research before making any serious decisions. If necessary, seek the consultation of a financial expert.

GSD Capital review: A new type of hedge fund?

As GSD Capital has shown, hedge funds can be a superior investment vehicle than passive investing. This trend is only enhanced when factoring in the benefits of quantitative trading strategies and artificial intelligence. Furthermore, when you take into account access to a team of experienced trading experts, GSD Capital offers an enticing proposition, which is seemingly superior to trying to beat the market yourself.

Frequently asked questions

Yes. GSD Capital is licensed in the U.K. It is authorized to conduct investment management services. It is important to note that while GSD Capital is licensed in the U.K. the fund services customers in other countries.

GSD Capital is a hedge fund that utilizes artificial intelligence, governed by experienced traders to generate returns for its investors. The fund has been in operation since 2021. It was previously a private fund, but has since opened its doors to the public.

GSD Capital trades in global commodities, currencies, and cryptocurrency markets. The fund utilizes AI and advanced trading strategies and algorithms to increase returns and mitigate risks. The AI is supervised by trained professionals with years of experience in finance.

A hedge fund is an investment fund typically open to accredited investors and institutional investors. It employs various strategies to seek positive returns regardless of market conditions, often using leverage and derivatives. Unlike mutual funds, hedge funds are not subject to the same regulatory restrictions, allowing for greater flexibility in investment strategies and structures.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.