With Bitcoin and most cryptocurrencies, users need to pay a nominal fee to make transactions. This fee is used to economically reward other participants in the crypto network that verify the integrity of past and future transactions. This guide covers how Bitcoin transaction fees work in 2025.

KEY TAKEAWAYS

► Bitcoin transaction fees are important for preventing denial of service (DoS) attacks and providing economic incentives to secure the blockchain.

► Unlike traditional wire transfers, Bitcoin fees are determined by the size of the transaction in bytes rather than the amount being transferred.

► The combined block rewards and transaction fees create a security model that makes executing a 51% attack economically unfeasible.

► Transaction fees fluctuate based on network congestion, with mechanisms like the mempool and wallet fee estimators helping users optimize their fees.

What are Bitcoin transaction fees?

Bitcoin transaction fees are a way to prevent denial of service attacks (DoS) and provide economic security to the Bitcoin blockchain. When you create a Bitcoin transaction, it must go into a block. However, blocks are limited in size and can only support a limited number of transactions.

Therefore, if you want your transaction included in a block, you must increase the amount of Bitcoin you send to the miner. Think of this as an incentive to execute your transaction.

In contrast to a wire transfer, the transaction fees you pay on the Bitcoin network do not depend on the amount you’re transferring. Instead, the size of the transaction (in bytes) is what matters.

If the mempool is particularly busy on a certain day, you may have to pay a large transaction fee. The largest transaction fee to date was well over $3 million. Note that this is very much the exception, not the rule!

Transaction fees explained

It is important to distinguish a few points made to help readers further understand why you must pay a transaction fee and what they actually do. In brief:

- Transaction fees protect against DoS attacks

- Provide economic security

Anti-DoS attacks

Imagine a business that does not charge for its products or services. Naturally, this would lead to some customers taking more than their fair share and denying that product or service to other customers. This is the tragedy of the commons.

Similarly, if Bitcoin did not charge transaction fees, anyone could submit a transaction at no cost. In fact, they could submit so many transactions that other users would not be able to send their own. This is called a denial of service attack.

A DoS attack, denial os services, is an attack on the availability of the system.

Jeff Crume, Engineer at IBM Security: IBM Technology

When a blockchain charges transaction fees, it increases the cost of attacking its availability. This is somewhat of a blockchain dilemma. The more transaction fees you increase, the harder it is for users to submit transactions. The lower the transaction fees, the easier it is to create a DoS attack.

Economic security

Bitcoin miners must validate transactions. When they do their job properly, this ensures that someone can not create a double spend (i.e., spend more funds than they have) or change the transaction information or blockchain history. This action provides security for Bitcoin.

In order for miners to do their job, we, as users, must pay them to validate our transactions. Ordinarily, when a miner mines or creates a block in the blockchain, they receive a coinbase for their services. This is simply a stipend paid out at every block.

However, miners can also receive transaction fees. Together, the coinbase (i.e., the first transaction in each block) and transaction fees equal the cost of security. We can conceptualize this as (coinbase + transaction fees = security).

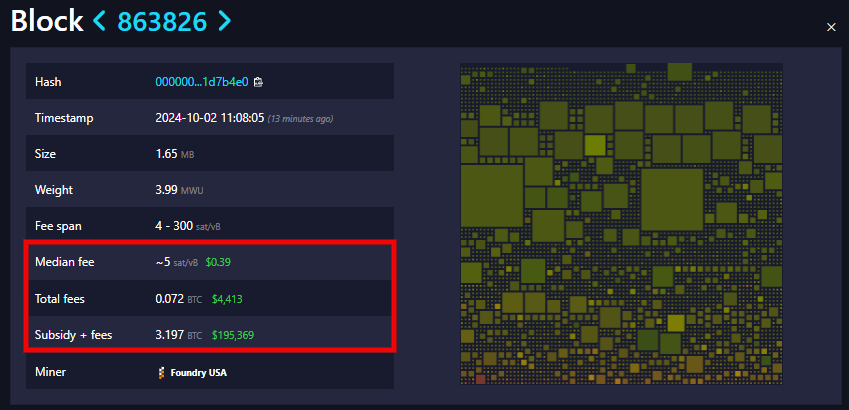

The cost of security is effectively the cost of attacking Bitcoin, in a sense. If the block reward (i.e., coinbase) is 3.125 BTC, and the price of BTC is $60,000, then the miner will receive $187,000. If the transaction fees made from that block is $3,000, then the total profit from mining that block is $190,000.

This presents a decent income for miners. If an attacker wanted to attack the network, they would have to provide a bribe greater than what could be attained by mining, or they would have to rent a majority of the hash power, which would represent another additional cost.

The high cost of attacking Bitcoin reinforces its security. An attacker would need to outspend the combined incentives of all honest miners, which is prohibitively expensive given the network’s current scale.

Decoding Bitcoin transactions

Unlike fiat currency, there is no physical exchange of money in crypto transactions and no central authority to verify their existence or transfer. In the case of fiat currency, customers store funds in a bank, and the bank verifies whether there are sufficient funds in the account before allowing any user to make a payment.

When you send money from one bank account to another, the transaction settles between the two banks, and the funds go into the receiver’s account. Bitcoin is decentralized and does not use any central authority. When a user sends a transaction, multiple node operators check the ownership of the coins.

The same process also checks whether the tokens were sent to someone else by the same account and if they are in any other pending transaction. This prevents double-spending.

Every Bitcoin transaction consists of three components: the transaction input, transaction output, and amount. This is very similar to a traditional wire transfer, where the three major components are the sender’s account number, the receiver’s account number, and the amount to send.

The address where the payment originated is the transaction input. The address that receives the Bitcoin is the transaction output. The amount is the number of Bitcoin transferred in the process.

In a wire transfer, the total amount consists of the amount to be sent plus a small charge. Similarly, in a digital currency transaction, an outgoing transaction is composed of the Bitcoin to be transferred and a small transaction fee.

How block rewards work

Satoshi Nakamoto, the pseudonymous founder of Bitcoin, determined the cryptocurrency would have a fixed supply. The maximum limit of Bitcoin is 21 million BTC.

Historically, central banks and the U.S. Federal Reserve have been known to print new currency in times of crisis. New Bitcoin, on the other hand, can only be added to the network through mining. Mining Bitcoin is computationally intensive and requires the use of powerful hardware.

Miners receive block rewards for verifying and adding new transaction blocks to the blockchain. The first Bitcoin block was mined on Jan. 3, 2009, with a block reward of 50 BTC. The next Bitcoin block was mined on the network six days later.

Since then, block rewards have been halved periodically to slow down the creation of new Bitcoin. The reward is halved after every 210,000 blocks, with three halvings recorded so far.

Block rewards will eventually go down to zero when the last Bitcoin is mined. At that time, transaction fees will serve as the only source of income for miners.

Understanding Bitcoin wallets

A Bitcoin wallet is similar to any physical wallet that you use to store money in the form of banknotes and coins. However, Bitcoin wallets differ in that they are completely digital. They are used to send and receive units of digital currency back and forth and typically reside on an electronic device such as a mobile phone or computer.

Contrary to popular misconceptions, a digital wallet does not store cryptocurrency. Instead, it provides an interface to access and authenticate the user with the Bitcoin blockchain.

Every crypto wallet consists of two sets of keys: a public and a private key. The public key is used to accept incoming transactions, while the private key is a secret alphanumeric string used to prove ownership of the user’s wealth.

A user can share their public key with another user to receive funds in their wallet, similar to how email addresses work. Meanwhile, the private key is the digital signature that verifies or approves an outgoing transaction from a digital currency wallet.

Without the private key, you cannot spend Bitcoin or other cryptocurrencies you own. That’s why keeping your private key secure is extremely important. If someone gains access to the private key, they have complete access to the wallet and any coins held in it. “Not your keys, not your Bitcoin.”

Nodes and miners: Maintaining network integrity

Nodes in a digital currency network are similar to bank branches. Simply put, a node is a computer that maintains an up-to-date copy of the blockchain and relays any new information to other nodes on the network.

Some nodes may participate in verifying each new transaction rather than simply maintaining past records. These computers are colloquially called miners. A miner uses computational power to solve mathematical puzzles that help verify the integrity of incoming transactions.

Given that a copy of the Bitcoin blockchain is distributed among nodes all over the world, the technology offers an unprecedented level of transparency. Unlike the banking system, blockchains allow you to view any wallet’s token balance and past transactions.

Cryptocurrency transactions are grouped in blocks, and new blocks are added to the blockchain roughly every ten minutes. Bitcoin has a fixed block size, which means that only a limited number of transactions can be processed every few minutes.

Any leftover transactions that do not fit in one block will have to wait until they are picked up by a miner. This is because miners can pick and choose transactions based on the reward they receive for doing so. The sender always has the choice to pay a higher-than-average fee to prioritize their transaction over others.

It is recommended that you wait for six confirmations before considering a transaction as mined. As its name suggests, the blockchain is simply a long and ordered series of blocks. The more blocks that pass, the greater the finality of the transaction.

Mempool: A transaction waiting area

The mempool is the “pool” where all unconfirmed Bitcoin transactions are kept before being batched for processing by miners. It can be thought of as a waiting area for all new transactions. When there is a large influx of new transactions, the number of transactions pending in the mempool rises correspondingly.

In a wire transfer, a fee is charged by the bank for facilitating the payment. Bitcoin, meanwhile, requires a user-decided fee to be attached to each transaction. As mentioned above, a miner picks transactions that best incentivize them for their efforts.

If the transaction pool is empty, miners usually include any and all transactions in their mined blocks. During busier times, low-fee transactions can be neglected for hours or days before a miner includes them in a block.

While an individual can set a transaction fee to zero, their transaction may never be processed by a miner. As a result, transaction fees vary depending on network traffic, similar to a highway that could get congested.

In other words, the fee a user has to pay will be low if there are only a few pending transactions in the mempool. On the other hand, they will be high if there is a large backlog of transactions. The mempool was adopted under Bitcoin Improvement Proposal (BIP) No. 35 to allow different nodes to access each other’s mempool and prioritize transaction processing.

BIPs are software upgrades undertaken by the Bitcoin core development team to ensure the network is modernized over time. Since BIP 35 was implemented, miners can decide the order in which they wish to process new transactions.

Bitcoin fees must be sustainable

In summary, the transaction fee you pay depends entirely on the size of the transaction, which is often out of your control. Thankfully, though, most standalone hardware or software wallets suggest the optimal fee based on current network conditions. While paying fees is never desirable for an end user, Bitcoin transaction fees play a key part in maintaining and supporting the network.

Frequently asked questions

What are Bitcoin transaction fees?

What determines the cost of Bitcoin’s transaction fees?

Can I choose the transaction fees for my Bitcoin transaction?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.