The Cardano ecosystem is growing rapidly, with many new innovative products. One of these is ErgoDEX (Spectrum Finance), a decentralized exchange that makes use of Cardano’s unique design. In this article, you’ll find everything about how ErgoDEX works and the underlying system that powers this new type of exchange.

What is ErgoDEX?

ErgoDEX is a non-custodial, decentralized cryptocurrency exchange that offers AMM (automated market maker) and order book trading systems. Ergo is the first DEX to offer liquidity across all DEXes built on the Cardano blockchain.

There are two kinds of cryptocurrency exchanges in fintech space. The first is a decentralized exchange or automated market maker (AMM). The second is an order-book centralized exchange, similar to the ones in traditional finance.

Automated market maker (AMM) is a market algorithm that decentralized exchanges use liquidity pools to allow users to perform a transaction.

Order-book exchanges come from the traditional stock market. Programmable blockchains, such as Cardano, allow the implementation of order-book exchange and features such as partial filling of orders through smart contracts.

ErgoDEX is the first crypto exchange based on the Cardano network to use both systems while keeping the DApp decentralized.

ErgoDEX is based on the Ergo network, a non-interactive proofs of proof-of-work (NIPoPoW) blockchain, and has the native token ergo (ERG). The goal of the Ergo network is to build a secure and functional decentralized finance for everyone.

ErgoDex rebrands to Spectrum Finance

According to an announcement from the official Twitter account, ErgoDex has rebranded itself to Spectrum Finance. What’s more, they have been in testnet on the Cardano blockchain since May of 2022. The team has provided regular updates since the rebrand, adding new feaures, such as:

- “Create pool” functionality

- 7 supported languages

- Verified token list

- Liquidity locker

- Pools statistics

- Mobile version

- Transactions history

If you want to know more bout decentralized exchanges and AMMs, learn everything you need to know at the BeInCrypto Telegram group.

Why is ErgoDEX different from other AMM exchanges?

The exchange uses the eUTXO ledger model to combine the contracts from the AMM DEXs with the order contracts from order book DEXs. This feature of combining liquidity from the two types of decentralized exchanges on Cardano was not possible before ErgoDEX (Spectrum Finance).

ErgoDEX tokenomics

ErgoDEX native token is ERG, which has a total maximum supply of 97 million ERG and will be mined over a time period of eight years.

As of November 2021, the circulating ERGs supply is 32 million, and the rest will be mined over the next few years. When the proof-of-work (PoW) mechanism stops mining tokens, the Storage Rent fees and transaction fees will support the ErgoDEX ecosystem.

The Storage Rent is specifically designed to produce the necessary token liquidity for incentives and to keep miners busy. Storage Rent is also a measure to help reduce the unused data bytes from the blockchain.

Once every four years, the ErgoDEX user will pay 0.13 ERGs for each unused uTXO box. However, users can move their coins when the four-year deadline approaches to avoid paying the fee.

The ErgoDEX ecosystem consists of:

- Miners

- UI providers

- Off-chain executors

- Liquidity Providers (LPs)

- Traders

Miners receive rewards in ERG for processing and validating transactions. UI providers earn the fees from operations processed through the UI. Off-chain executors receive the fees from the AMM and Order Book service in native tokens.

For AMM operations, the user defines the fee in ERGs when they deposit, redeem, or exchange funds. For Order Book operations, the users are charged a fee for each exchange they perform. LPs are rewarded with ERGs for providing liquidity.

When all this system is set in place, then traders can benefit from ErgoDEX’s services.

Ergo and Cardano

Ergo focuses on enabling secure financial contracts that provide trust and protection for the traders. As the first blockchain to adopt both smart contracts and the eUTXO (extended unspent transaction output) model, similar to Cardano, it enables PoW compatibility between the two blockchains.

Smart contracts may benefit from the security features of a PoW consensus for parts of their execution. Ergo combines the PoW security features with the implementations of the eUTXO model, hence providing the best security from both the PoW and PoS mechanisms.

ErgoDEX is streamlining IDOs

AMM exchanges are most known for the features that enable anyone to set up a liquidity pool, which allows the creation of initial DEX offerings (IDOs). Unfortunately, some projects take advantage of this feature and list tokens with malicious intent.

Both AMM and order-book exchanges have their drawbacks, but Spectrum Finance innovates on the way traders perform crypto exchanges.

The decentralized eUTXO model offered by ErgoDEX can support partial order filling and buyback during an IDO, which represents an extra layer of security and protects investors from scam projects and rug pulls.

ErgoDex security

Often, scam IDOs try to sell their tokens through a contract on an AMM exchange. Then, pool admins drain the funds of the liquidity pool and disappear. This practice created a lack of security on AMM exchanges, and investors were left unprotected.

Thanks to its complex model, Ergo solves this security and trust issue by allowing buyback orders. Investors can retrieve their funds within a predefined time frame and have the option to exit the ICO with a minimal loss.

ErgoDEX offers more protection to its buyers and keeps out malicious project owners, and creates a healthy and organic ecosystem for new IDOs.

Atomic swaps and cross-chain liquidity

ErgoDEX enables traders to perform atomic swaps. Called atomic cross-chain trading, this mechanism allows traders to exchange contracts from two different blockchains automatically. Atomic swaps reduce the need for centralized, order-book exchanges.

Traders can connect their wallets and directly perform secure and efficient atomic swaps on ErgoDEX. The eUTXO model allows shared liquidity between exchanges based on Ergo and Cardano blockchains.

How to use ErgoDex

Although the DEX is not yet fully functional, traders can test some of the already implemented functionalities.

Install necessary browser extensions

Traders looking to interact with ErgoDEX need to install two browser extensions using Chrome, Brave, or Sidekick:

- Yoroi Nightly — Yoroi wallet’s test environment

- Yoroi-Ergo dApp Connector Nightly — The DApp connector for ErgoDEX UI to connect to your wallet

Note that the ErgoDEX team works to release a new Yoroi version that won’t require users to install a connector. Please follow the latest updates for the exact wallet version.

Create a new ERG wallet

Using Yoroi Nightly, you will need to create a new ERG wallet and send 1 ERG to cover the network fees.

Test tokens on ErgoDEX

Users can test tokens using the mint.ergodex.io faucet. The faucet provides 10 WT_ERG and 10 WT_ADA tokens for each request. You will need to enter your wallet’s address to receive the test tokens from the faucet.

Note that the testing tokens from the faucet have no real value.

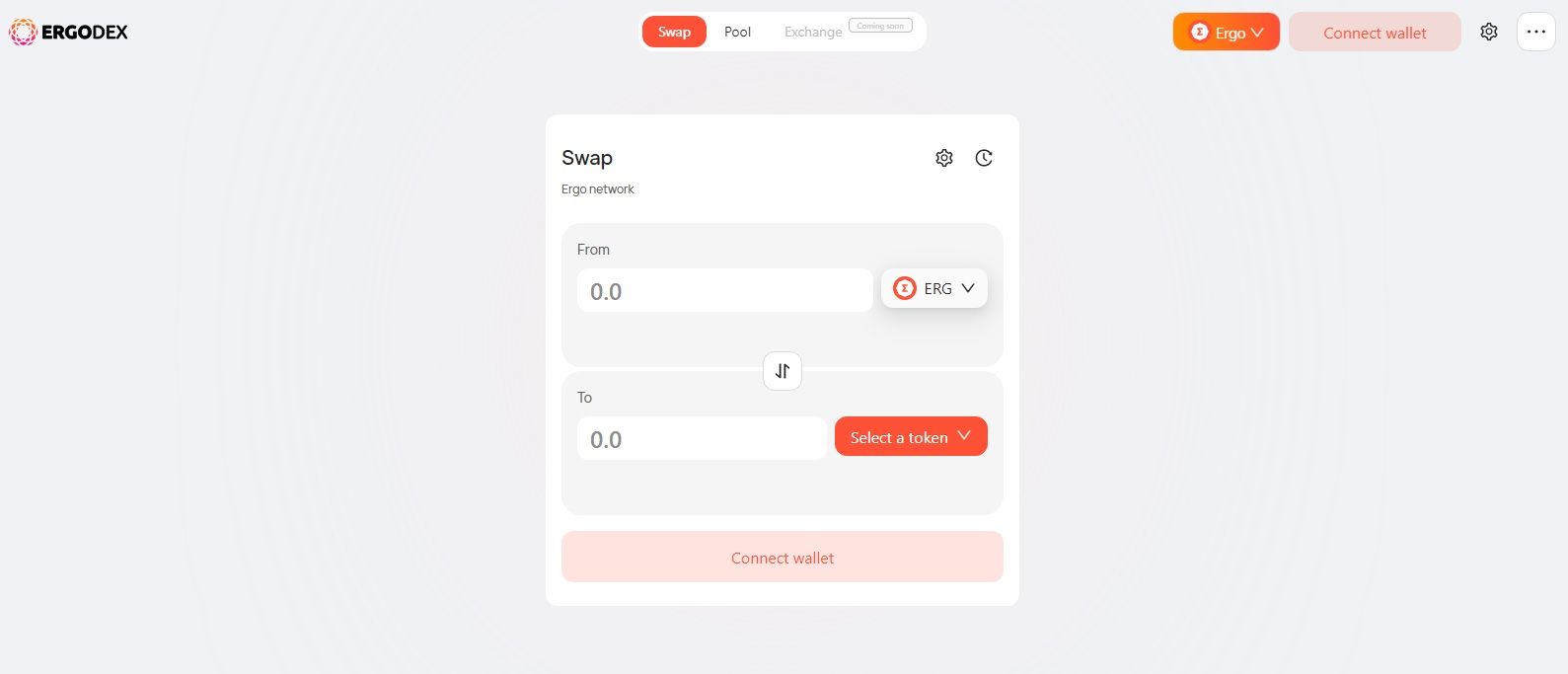

Swap tokens on ErgoDEX

Go to app.ergodex.io/swap, connect your Yoroi Nightly wallet and start swapping the available tokens.

When will ErgoDex launch?

On August 11, 2021, ErgoDEX Beta UI was launched. The beta UI used only the Automated Market Maker(AMM) model and needed the Yoroi wallet test environment (Yoroi Nightly) and DApp connector (Yoroi-Ergo dApp Connector Nightly) to function.

On November 9, 2021, the ErgoDEX new UI was launched, which has a new elegant UI, and tokens got updated with their logos.

The ErgoDEX team is now working to implement the order-book exchange model and the shared liquidity with the AMM liquidity pools. After the implementation of the order-book model, the next milestone will be Cardano integration.

As of November 2021, traders can use ErgoDEX to swap ERG, SigRSV, SigUSD, and LPs and contribute to the ERG/SigUSD and ERG/SigRSV liquidity pools.

ErgoDEX: The future standard for DEXs?

ErgoDEX brings a whole new perspective to cryptocurrency trading and investors’ security. The ground-breaking technology implemented by the DEX promises a much safer future for investors and project developers within the Cardano network. The project is still in development, and Cardano enthusiasts should follow the ErgoDEX team for further developments.

Frequently asked questions

Is ErgoDEX the same as Ergo?

What is Ergo Dex?

What is Spectrum Finance?

What is an AMM?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.