Crypto trading doesn’t take a holiday. Unlike traditional financial markets that pause for festivities, the crypto world buzzes on. This constant action gives rise to specific trends as traders worldwide adjust their strategies for the holidays. From shifting trading volumes to the impact of new tech, this guide unpacks the key historical trends that shape crypto trading during these peak times, offering insights to help you make informed decisions.

Top crypto trading exchanges

Best for HODL, stake, earn and multiplying crypto

Best for beginner

Best for demo and spot trading

Why trade crypto during the holidays?

As already alluded to, crypto trading during the holidays presents a novel opportunity —so long as you are aware of trends and implications and can act accordingly. In general, the price of bitcoin tends to rise during holiday periods, thanks to increased demand.

However, it’s important not to get caught up in the hype: crypto trading in the holidays can be risky, thanks to the potential for increased volatility or a lack of liquidity. Here are five key trends you should know about if you’re gearing up to trade decentralized assets over the festive season.

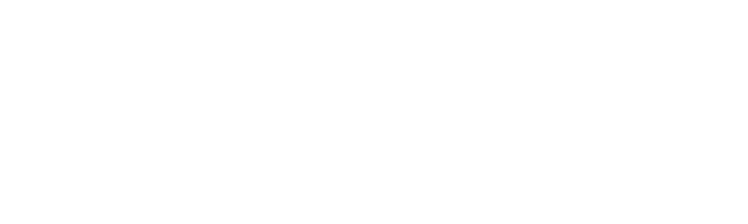

1. The calendar effect: Price movements during major holidays

The notion of the “calendar effect” has its roots in traditional financial markets. Historically, certain times of the year, such as the turn of a quarter or specific holidays, have been observed to influence asset prices. In the crypto realm, this effect is particularly pronounced, given the market’s uninterrupted nature. Unlike traditional markets that close for holidays, cryptocurrencies continue their incessant dance of trade, resulting in unique market behaviors during festive times.

The phenomenon explained

Cryptocurrencies like bitcoin, ethereum, and others are often subject to shifts in trading volume and price volatility during major holidays. Bitcoin, often seen as the bellwether for the crypto market, provides a lucid example. If we were to superimpose its historical price movements over a calendar marking major global holidays, it would be common to see heightened activity around these dates. These price movements are not just random blips but are often sustained shifts, be it a rally or a correction, making them a focal point for traders and analysts.

Underlying factors

But what drives this ‘calendar effect’ in the crypto world? A few hypotheses can be considered:

- Increased retail activity: With the holidays comes a break from the usual routine. Retail traders, who might otherwise be occupied with their day-to-day commitments, have more time on their hands. This increased free time can lead to more active participation in the market. For many, holidays might be the only time they can truly focus on their portfolios, leading to increased buying or selling activity.

- Macroeconomic forces: Holidays, especially ones like Christmas, are also times of heightened economic activity. People spend more, leading to increased cash flows in the market. This spending spree, coupled with the sentiment around holidays, can influence larger financial trends. In the crypto domain, this could translate to increased investments, as individuals might allocate a part of their holiday bonuses or savings into cryptocurrencies.

- Sentimental trading: The festive mood can also influence trader sentiment. Optimism around holidays can lead to bullish behaviors, while uncertainties in the new year might result in more conservative or bearish trends.

Implications for traders

Understanding the calendar effect can be crucial for crypto traders. While it’s not a foolproof strategy to bank on holidays for making trading decisions, being aware of potential volatility can aid in better preparation. For instance, setting tighter stop-losses or looking for sudden market moves are prudent strategies during these times.

2. The bored-market hypothesis: Leisure time trading spikes

The bored-market hypothesis offers an intriguing lens through which we can examine market behaviors, especially in cryptocurrency. Rooted in behavioral economics, this hypothesis highlights the interplay between leisure time and trading activity.

The idea is straightforward: when people have more free time, they tend to divert some of it towards market activities. Let’s delve deeper into how this plays out in the crypto space during the holidays.

Understanding the hypothesis

In traditional markets, the “bored-market hypothesis” was posited as a way to explain unexpected spikes in trading volumes during times when other forms of entertainment or engagement might be scarce. Think of it as a rainy day when you’re stuck indoors, and you decide to reorganize your bookshelf or closet – not because you had planned to but because other distractions are unavailable.

Now, translate this to the crypto realm. The market’s digital nature, combined with its global accessibility, means that anyone with an internet connection can trade from the comfort of their home, holiday cabin, or beach resort.

Holidays: A breeding ground for boredom-driven trades

During the holiday season, many individuals find themselves on a break from work or daily chores. While the first few days might be packed with festivities or travel, there often come moments of downtime. It’s in these pockets of leisure that the bored-market hypothesis comes to life.

With smartphones and trading apps at their fingertips, individuals might decide to check on their crypto portfolios, make new investments, or even dabble in day trading. The ease of access, combined with the allure of potential profits, can make the crypto market an enticing avenue to divert one’s holiday leisure time.

Implications and patterns

Several crypto exchanges have reported upticks in user activity during major holidays. This is not limited to checking portfolio balances but extends to executing trades. These trading spikes can lead to increased volatility, especially in the altcoin market, where trading volumes are generally lower than that of bitcoin.

Furthermore, with the growing popularity of decentralized finance (DeFi) platforms and applications, users might also explore new investment avenues, stake their assets, or engage in yield farming during their free time, amplifying the effects of the bored-market hypothesis.

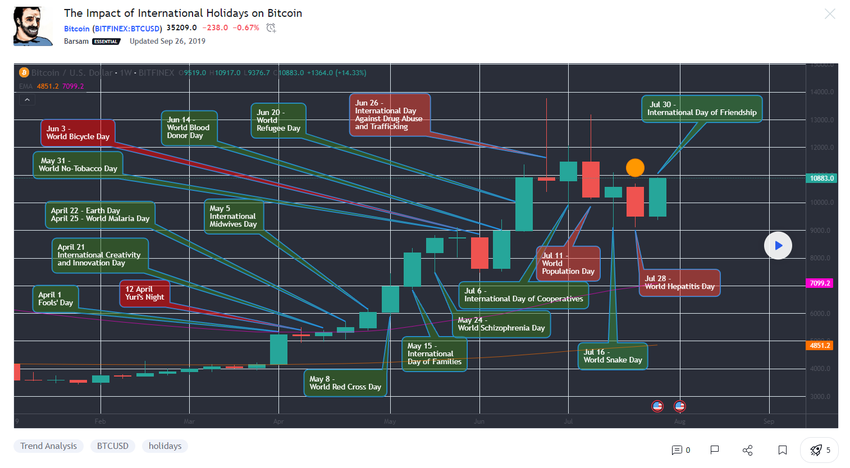

3. East vs. West: Geographical shifts in trading activity

The cryptocurrency market’s sprawling landscape presents a fascinating interplay of cultural, economic, and regional influences. One of the most captivating aspects of this global arena is how holidays in various regions shape trading patterns. Let’s dive into the East vs. West dynamics, exploring how regional holidays and shifting institutional influences impact crypto trading behaviors.

Regional holidays: Localized market fluctuations

Unlike traditional markets that largely center around specific geographies and their associated business hours, the crypto market is truly global. This means holidays in one region can influence the market dynamics in noticeable ways.

Take, for instance, the Chinese New Year, a festivity deeply ingrained in Asian culture. As families gather and businesses momentarily pause, there is a concurrent shift in the trading patterns, with Asian traders becoming particularly active or potentially less so, depending on local customs and sentiments.

In contrast, Western holidays like Christmas or Thanksgiving, which mark significant breaks in Europe and the U.S., lead to distinctive trading behaviors reflective of the Western trader demographic.

The shift from East to West

The past few years have brought about an intriguing shift in crypto trading dynamics, signaling a potential westward movement. There are several factors at play:

- Institutional Influence: Western institutions, particularly those based in the U.S., have increasingly shown interest in the crypto realm. Their participation, armed with hefty investment portfolios and often guided by traditional market wisdom, can bring about notable shifts in trading patterns, especially during Western holidays.

- Regulatory landscape: With regulatory frameworks in the West evolving to accommodate and, in some cases, foster cryptocurrency growth, there’s been a boost in institutional and retail confidence. This regulatory clarity, juxtaposed with the more restrictive measures in some Eastern countries, could influence a westward tilt in trading activity.

- Alignment with U.S. market hours: As crypto becomes more intertwined with traditional financial systems, there’s a growing alignment with U.S. market hours. This synchronization, especially during U.S. holidays, can have ripple effects across the global crypto market.

Implications for traders

For traders, understanding these geographical shifts is paramount. Knowing when specific regions will likely be more active can offer insights into potential liquidity changes, price movements, and trading opportunities. For example, a trader might anticipate heightened volatility during the Chinese New Year and devise their trading strategies accordingly.

4. The weekend paradox: Algorithms and market makers take charge

Weekends and extended holiday periods usher in a set of dynamics distinct from the typical weekday bustle. As the majority of institutional and professional traders take a step back, a fascinating dance between algorithmic bots and market makers comes to the fore, sculpting the weekend trading patterns in the crypto domain. Let’s explore this phenomenon, aptly termed the “weekend paradox,” to understand its underpinnings and implications.

Algorithmic trading: The automated pulse of crypto weekends

Algorithmic trading, a practice that involves the execution of trades using pre-defined criteria and computational algorithms, has steadily carved a significant niche within the crypto trading ecosystem. During weekends, this role becomes even more pronounced.

With many professional traders off their desks, these bots step in, ensuring the crypto market doesn’t miss a beat. They operate round-the-clock, responding in real-time to market data, from price fluctuations to trading volumes. Given their nature, they can swiftly capitalize on market opportunities, often much faster than a human trader might.

It’s noteworthy that the U.S. Securities and Exchange Commission’s report underscored the extensive reach of these algorithmic trading centers within the crypto realm. Such a significant presence means that during off-peak times, the market pulse, to a large extent, echoes the rhythms set by these bots.

Market makers: Guardians of liquidity

In the absence of human traders, there’s another critical player that steps up to ensure the market’s fluidity: the market makers. Their role is indispensable, especially during weekends and holidays when trading volumes might naturally dip.

By continuously buying and selling assets, market makers perform a balancing act. They provide the necessary liquidity that ensures trades can be executed without dramatic price slippages. In essence, market makers act as both buyers and sellers, filling the void left by human traders and ensuring that the market remains stable and active, even during quieter periods.

Implications for the average trader

This weekend dynamic, steered largely by algorithms and market makers, holds significance for the average trader. It means that while human touch may be reduced, the market’s volatility and movements are very much alive, driven by an intricate interplay of automated systems and liquidity providers. Traders must be cognizant of this shift, adjusting their strategies to account for potential swift price movements or unexpected liquidity events.

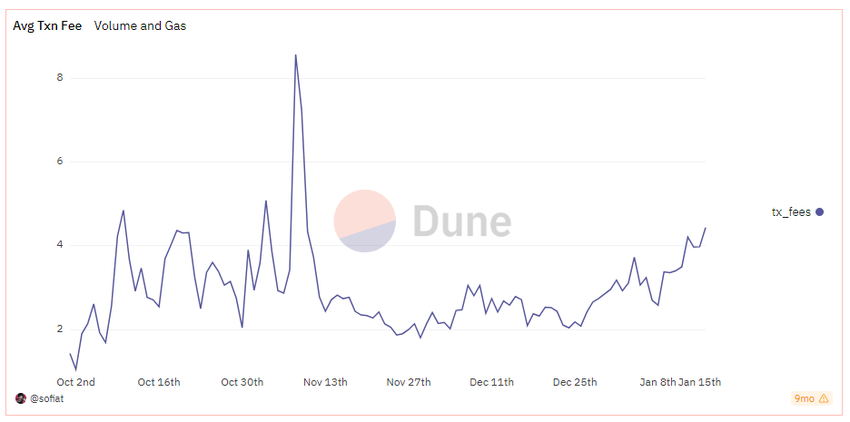

5. Ethereum’s gas fee surges: A holiday caution

The decentralized world of cryptocurrencies offers myriad opportunities for traders, but it also presents specific challenges that need to be navigated judiciously. One such challenge, particularly for those deeply entrenched in the Ethereum ecosystem, is the unpredictability of gas fees. While Ethereum’s vast suite of decentralized applications (DApps) and its preeminent role in the trading sphere make it a hotspot of activity, this popularity can lead to unforeseen complications during peak periods, such as the holidays. Let’s delve into the intricacies of Ethereum’s gas fee surges during holiday seasons and what it means for the astute trader.

Understanding Ethereum’s gas fees

Before dissecting the holiday dynamics, it’s pivotal to understand what gas fees in the Ethereum network represent. Simply put, gas fees are transaction fees that users pay to miners on the Ethereum blockchain for the computational work required to process and validate transactions. The more complex the transaction or contract interaction, the higher the gas fee. These fees are not static; they fluctuate based on network demand. Think of it as a supply-demand scenario, where higher transaction demands often lead to increased gas prices.

Holiday surges: The double-edged sword

Holidays are synonymous with relaxation, family gatherings, and, often, more free time. This free time might translate to increased activity in the crypto realm, especially with traders aiming to capitalize on potential market movements. The Ethereum network, with its plethora of DApps and trading opportunities, naturally becomes a focal point for many.

However, this heightened activity can lead to an influx of transactions waiting to be processed, resulting in congestion. And just as rush hour traffic can slow down a commute, this congestion can cause a spike in gas fees. The network, in essence, prioritizes transactions offering higher fees, leading to a competitive escalation of costs.

Strategizing for cost-effective trading

For traders, especially those looking to optimize costs, anticipating these surges becomes paramount. A proactive approach might involve:

- Monitoring network activity: Tools and platforms provide real-time insights into Ethereum’s current gas fees, enabling traders to time their transactions judiciously.

- Opt for off-peak hours: If possible, conducting transactions during quieter periods might offer reduced fees.

- Stay updated: As the network evolves and follows a roadmap towards Ethereum 2.0, staying informed can provide a competitive edge.

Navigating the waves of holiday crypto trading

The holiday season in the crypto world is a dance of historical trends and patterns that differentiate it from its traditional counterparts. As we’ve observed, holidays bring about unique dynamics, from the calendar effect to algorithmic dominations during weekends. Understanding these patterns can help traders make informed decisions. However, like all trading insights, they should be approached with caution and due diligence. Knowledge is key, but the market cannot be predicted with 100% accuracy. As the crypto realm responds to global festivities, staying attuned to holiday trends can be crucial for novice and seasoned traders.