As crypto regulations evolve at different paces across the globe, many investors are looking to move their assets to locations offering favourable tax benefits and strong digital rights protections. This list sets out the top crypto friendly countries in 2025.

KEY TAKEAWAYS

► Crypto friendly countries provide favorable tax exemptions from certain taxes on cryptocurrency transactions for individuals and businesses.

► El Salvador, Switzerland, and Germany are top destinations for crypto investors due to their unique approaches to cryptocurrency regulation.

► Countries like Singapore, Malta, and Portugal are attracting crypto businesses and investors by offering support for blockchain innovation.

► Tax benefits, privacy laws, digital rights protections, and transparent legal systems are important when choosing a crypto friendly country.

Top crypto friendly countries

1. El Salvador

After becoming the first country in the world to qualify Bitcoin as a legal tender, El Salvador aims to attract foreign investors and has a tax exemption in place for them. The nation exempts Bitcoin profits from any capital gains or income tax.

The world is still waiting for El Salvador’s legal framework to enforce these official statements, but the crypto world is praising it as one of the best crypto tax-free countries.

2. Switzerland

Switzerland is the crypto-valley of Europe and is seen as an innovation hub. The Swiss Federal Tax Administration sees crypto transactions to be the same as traditional fiat transactions and exempts them from tax reporting.

Cryptocurrency investors like Switzerland for its lack of taxation on profits made from crypto trading. Many big crypto foundations are based here, including Ethereum, Tezos, and the Diem Association.

However, do note that the profits of crypto business and professional trading are liable to income taxation, which differs from region to region, and an annual wealth tax.

3. Germany

Germany is one of the top crypto friendly countries in 2025. The European nation has a unique take on crypto taxation, encouraging individual investors. If held for more than a year, the laws exempt Bitcoin and other cryptocurrencies from capital gains tax.

If the funds are exchanged for fiat or for other cryptos within one year, you are still exempt from paying tax if your profit is under €600 (~ $700). Beyond that gains limit, investors have to report their income for tax. However, businesses must report and pay corporate income taxes for crypto gains, and it works the same way as any other asset.

4. Malta

Home to many crypto and blockchain companies, the famous blockchain island of Europe has many laws which favor crypto investors and entrepreneurs. Overseas companies operating in Malta and foreign residents receive several privileges. They do not have to pay income and capital gains tax in Malta for long-term investments in digital currencies.

However, crypto trades do receive 35% in income tax as they are the same as stock trading by legal definition. But this too can be lowered to 0–5%, if you benefit from the structuring options offered by the country’s financial system. Malta sees Bitcoin and other financial tokens as different assets. Financial tokens can be dividends, interest or premiums, and regular income tax applies to it.

Non-domicile corporations are subject to a 5% income tax. Overall, Malta is one of the top crypto friendly countries and a tax haven for foreign entities, companies, and residents.

5. Singapore

Known as one of the most developed economies in the world, Singapore is also one of the best places for business.

Singapore is a fintech hub in the Southeast Asia region. It doesn’t have a capital gains tax. Cryptocurrency funds of individuals and companies are not liable to taxation. But Singapore-based companies are liable to income tax, if they operate as a crypto trading company or if they accept crypto payments.

Bitcoin comes under intangible property, not legal tender. The laws view crypto payments as barter trades. It taxes goods and services, but not payment tokens.

The country’s central bank, the Monetary Authority of Singapore (MAS), aims to develop a balanced environment for crypto. The MAS doesn’t look to heavily regulate crypto, but rather to monitor it as a preventive measure to spot money laundering and illegal activities. Bitcoin falls under goods and, as such, experiences goods and services tax.

6. Portugal

Portugal is one of the most attractive crypto friendly countries in the world. Since 2016, the Portuguese Tax Authority (PTA) has exempted crypto transactions from capital gains and income tax. Businesses that accept digital currencies for their goods and services are liable to income tax.

7. Slovenia

Slovenia is another small European country with an attractive taxing system for digital assets. The country’s lawmakers are still working on a legal framework to make the tax law clear for all individuals and businesses interested in conducting business there.

Slovenia exempts individuals from capital gains tax when selling Bitcoin, as these gains are not seen as income.

Note that companies that receive crypto payments are eligible to pay corporate income tax. ICOs are also subject to taxation.

The country doesn’t allow companies to conduct only cryptocurrency transactions, such as accepting Bitcoin as the only means of payment. Other commercial activity that involves cryptocurrency, such as crypto mining, is subject to a 25% income tax.

8. Bermuda

Bermuda is a popular destination for cryptocurrency holders, as it has comparatively favorable standards as far as financial regimes worldwide go. In 2018, Bermuda released the Digital Asset Business Act, which stands as the country’s regulations for digital assets. Famous for its lack of income and capital gains taxes, crypto transactions are also tax-free in Bermuda.

Famous for becoming the first country in the world to accept taxes and fees in cryptocurrency, Bermuda is a popular destination for crypto investors. Bermuda also accepts payments for governmental services in USD Coin (USDC).

9. Belarus

The president of Belarus, Alexander Lukashenko, is keen to turn the country into a crypto-based digital economy. In 2017, he signed a law to legalize cryptocurrencies. The same decree also exempted businesses and individuals from crypto taxes up until 2023.

In Belarus, crypto mining and investments are exempted from income tax and capital gains.

What are crypto friendly countries?

Crypto-friendly countries are nations that provide favorable conditions for the use, trade, and development of cryptocurrencies and blockchain technologies. These include:

- Offering tax exemptions or reduced tax burdens for businesses and individuals involved in the crypto space, or even being tax-free.

- Clear, fair, and progressive regulations that encourage innovation, the growth of decentralized finance (DeFi) ecosystems, all while protecting consumers.

- Supports crypto-related businesses by providing strong legal frameworks, enabling access to banking services, offering crypto-specific licenses, and promoting blockchain research and development.

- Have open policies regarding the use of cryptocurrencies for payments, trading, and investment while maintaining a balanced approach to compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

These nations actively support blockchain education, innovation hubs, and a thriving community for crypto entrepreneurs, investors, and developers. While it is likely that most countries will not have all of the aforementioned criteria, having a few makes a huge difference.

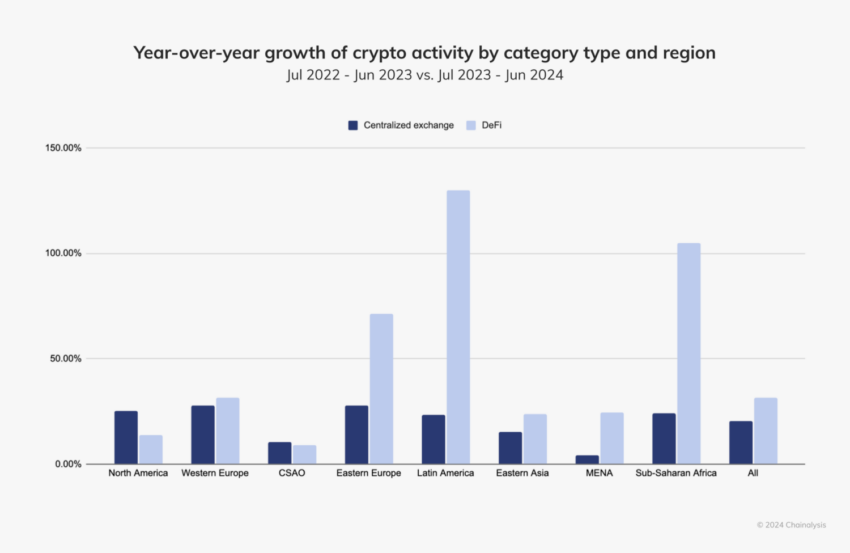

As you can see in the chart, regions where heavy-handed enforcement and regulation have been on the uptick (e.g., North America, Western Europe, etc.), have seen stunted growth in crypto activity.

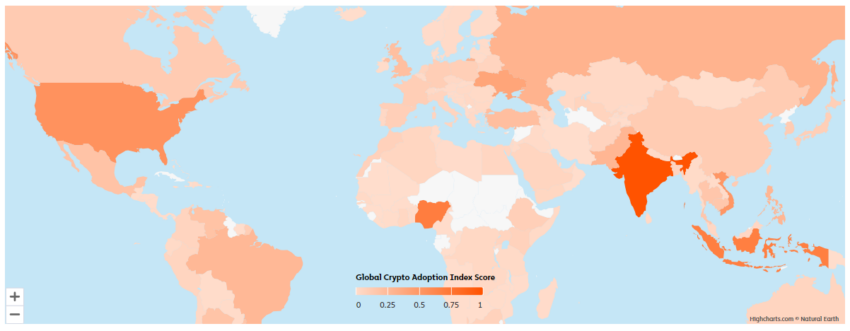

Specifically with regard to the U.S., where crypto venture capital funding has dominated, adoption has waned in favor of regions like Asia, which now dominates.

How to choose a crypto friendly countries

The aforementioned criteria are a good place to start when you are deciding where to move, start a business, or engage in any other crypto-related activities. However, you may want to make your next move based on a few other factors that are crypto-adjacent.

As cryptocurrency was started from cypherpunk ideals, things like privacy, digital rights, or an open and transparent legal system are great properties for choosing your next move in addition to crypto friendly ideals.

Such nations should have clear and enforceable laws against censorship that promote freedom of speech and the use of decentralized internet services, which are important for maintaining privacy and the ethos of web3.

Furthermore, the country should also provide laws for protecting intellectual property. This allows startups and developers to thrive without fear of unfair litigation or government overreach.

Lastly, the ability to understand and predict how the legal system will work in a given situation should not be overlooked. In countries where the rule of law is inconsistent, opaque, or corrupt, crypto investors and entrepreneurs may face heightened risks.

Remember, it is important to understand that a country with lax crypto regulations does not equate to crypto friendly.

What’s the best crypto friendly country for investors?

Certain countries, like those listed above, have already adopted crypto friendly legislation regarding taxation and aim to become financial innovation hubs. Others offer low income tax for crypto gains to attract more investors. The ability to perform crypto transactions with a low (or no) capital gains tax is certainly an incentive for entrepreneurs or traders looking to relocate. But which crypto friendly country is the one for you? That’s something each investor has to consider. Relocating is a decision that requires careful consideration and research and should not be taken lightly.

Frequently asked questions

What are crypto friendly countires?

Is the United States crypto-friendly?

Do you have to pay taxes on crypto?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.