This COTI price prediction takes COTI’s utility, fundamentals, tokenomics, trading popularity, on-chain parameters, and price charts into account. COTI stands for Currency of the Internet. The protocol aims to become a decentralized payment setup that supports low-cost transactions. It caters to merchants and consumers alike, helping crypto make strides as a medium of exchange. The all-encompassing narrative regarding decentralized finance is what makes COTI and its native token such a desirable long-term option. Now let us read through this COTI price prediction to understand how it looks as a prospect.

KEY TAKEAWAYS

➤ COTI did not grow as expected in 2024 due to significant competition in the crowded DEFI space.

➤ Taking this performance into account, our 2025 price prediction put’s COTI’s minimum and maximum prices at $0.4300 and $0.8595, respectively.

➤ All price predictions should be used as a guide only. The crypto market is inherently volatile. Always do your own research and never invest more than you can afford to lose.

- COTI long-term price prediction until 2035

- COTI technical analysis

- COTI price prediction 2024 (concluded)

- COTI price prediction 2025

- COTI price prediction 2030

- COTI price prediction: the role of fundamentals

- COTI price action and tokenomics

- How accurate is the COTI price prediction?

- Frequently asked questions

COTI long-term price prediction until 2035

If you are interested in tracing the COTI’s path till 2035, the following information may help:

| Year | | Maximum price of COTI | | Minimum price of COTI |

| 2025 | $0.8595 | 0.4300 |

| 2026 | $0.945 | 0.644 |

| 2027 | $1.039 | 0.88 |

| 2028 | $1.3851 | $1.007 |

| 2029 | $1.66 | 1.040 |

| 2030 | $1.8450 | $1.50 |

| 2031 | $2.36 | $1.77 |

| 2032 | $2.59 | $1.95 |

| 2033 | $3.88 | $2.60 |

| 2034 | $4.85 | $3.90 |

| 2035 | $7.28 | $5.35 |

The price action of COTI depends on its growth as a DeFi and enterprise-level fintech project. The COTI price prediction model takes all those factors and even the possible growth of competitors into consideration. Also, the average price of COTI each year should ideally fall between its highest price and the minimum price. Yet, we expect variations depending on the nature of the crypto market.

COTI technical analysis

Now, let’s shift our attention to COTI’s technical analysis. We will take a closer look at the price action in this segment to prepare a practical COTI price prediction model.

The weekly chart for mid-term COTI price prediction (pattern hunting)

Outlook: Bullish

If we look at the daily chart, a clear pattern surfaces:

Once listed, COTI makes a high from the listed level. It then goes on to make another high and then peaks. This is followed by a lower high. That’s the key pattern we identified as early as 2023. Do note that the pattern still holds in 2025.

Let us mark the pattern as A, B, C (the peak), B1, and so on. So, we are looking for the next A1 on this chart.

Now let us track the distance between A to B, B to C, and then C to B1 to extrapolate a path from B1 to A1.

A to B = 189 days and a 514.57% growth; B to C = 231 days and a 15.96% growth; B 1 to C = 161 days and a 105.41% growth.

Calculations for the next high

COTI took 420 days from A to C and a 602.19% growth rate. Therefore, the next point, A1, regardless of the point where itwas created, should be reached within 420 days (approximately) from C. Also, point C should be 602.19% higher than A1 to fulfill the pattern.

Now, point C is at $0.6821, or COTI’s all-time high. And if the point A1 is X, then X = (0.6821 x 100)/ 702.19 = 0.0971.

Hence, the next high for COTI could be at $0.0971, 420 days from C. Now, we can extrapolate and see where A1 lands.

This comes out as a COTI price prediction for the initial years. That way, the pattern of A-B-C-B1-A1 will be complete.

Here is the plotted graph with pointers:

Calculating the next low

We can now find the distance between B and X (the immediate low). This will help us find the next low after the high of B2 is formed. This would also help locate the ideal percentage drop for the subsequent years.

From B to X, it took COTI 133 days and an 85.13% drop.

However, COTI has very strong support at $0.2906. Therefore, after reaching a high in B2, per the pattern, it didn’t drop 85.13% after 133 days. Instead, after 133 days, it settled at 0.2906 (X1) — thereby breaking the pattern and defying the previous low. Even though this level was reached, the pattern continues to hold.

COTI price prediction 2024 (concluded)

Several DeFi projects are growing at pace. So, COTI was not able to keep the same momentum as the first pattern.

Based on the path (s) etched by the pattern, the COTI price prediction for 2024 was expected to make a high of over $0.65, preferably by July 22, 2024. But it didn’t due to volatile market conditions and could only reach $0.27 in 2024.

COTI price prediction 2025

Outlook: Bullish

If the same path holds post-2024, the next high could be at $0.8595. This would be as per Fib levels and the original pattern timeline of 189 days between A and B.

By 2025, according to the current market scenario, COTI should form a new all-time high of $0.8595.

Project ROI from the current level: 258%

COTI price prediction 2030

Outlook: Bullish

If we further extend the Fib pattern, as per the new high made in 2025, the probable high for 2028 would be at $1.3851. The low that year could be the retraced path to $1.007. This still looks optimistic as the level coincides with the 78.6% Fib level and is still higher than the high projected in 2025.

If COTI follows the same path, the maximum price as per COTI price prediction 2030 could be around $1.8450. Projected lows could be around $1.50. This shows that COTI would have asserted the long-term up trend by this time.

Projected ROI from the current level: 668%

Now let us move to the fundamentals.

COTI price prediction: the role of fundamentals

COTI is a layer-1 protocol for enterprises and users driven by the COTI treasury. The protocol came into existence in 2017, built atop the Ethereum blockchain.

Did you know? In 2019, it transitioned to its own mainnet. As such, it is now a coin rather than a token.

Here are the fundamental factors you need to know about COTI:

- Supports transactions at 10,000 TPS.

- Boasts the effective PoT or proof-of-trust consensus.

- It aims to focus on payments and being a financial ecosystem.

- COTI coins support staking.

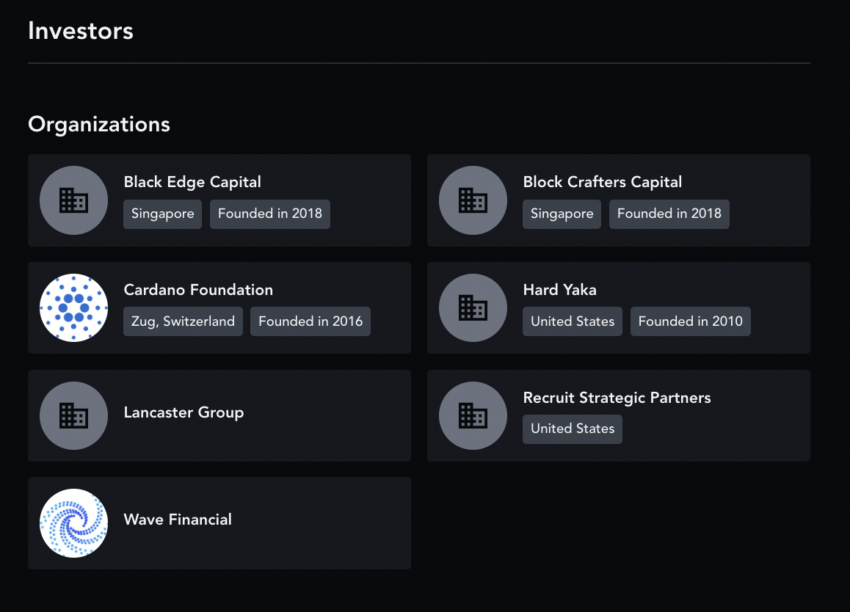

- Has Cardano Foundation as a celebrated investor.

- COTI is the official issuer of the Cardano-powered stablecoin Djed.

- The COTI coin has a native blockchain. It is also compatible with ERC-20 and the Binance Smart Chain standards.

COTI price action and tokenomics

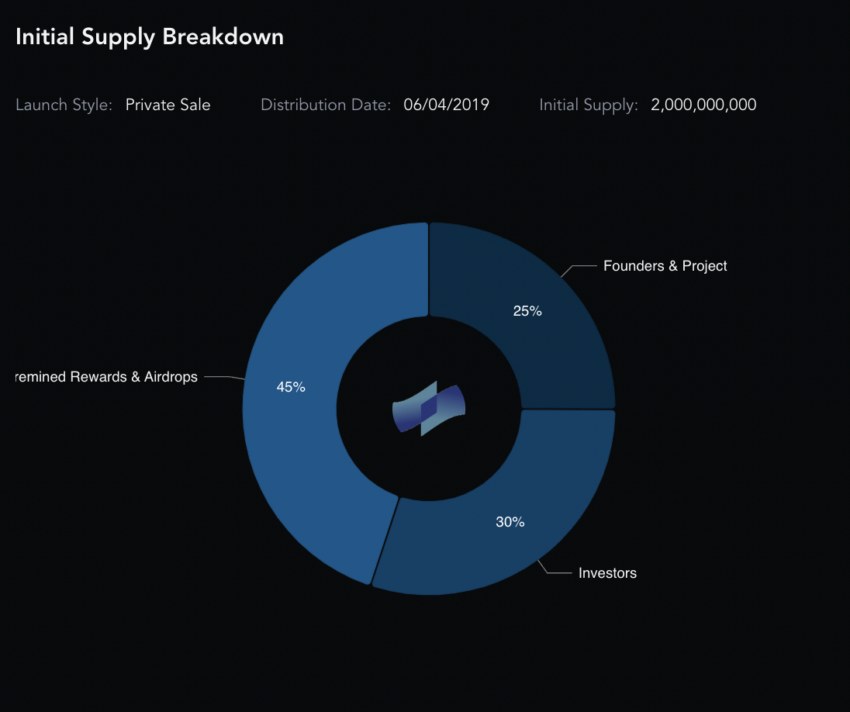

COTI has a fixed supply of 2 billion coins.

Here is what the initial supply spread looked like. The project and founders only held 25% starting out, which is a good sign for the price action.

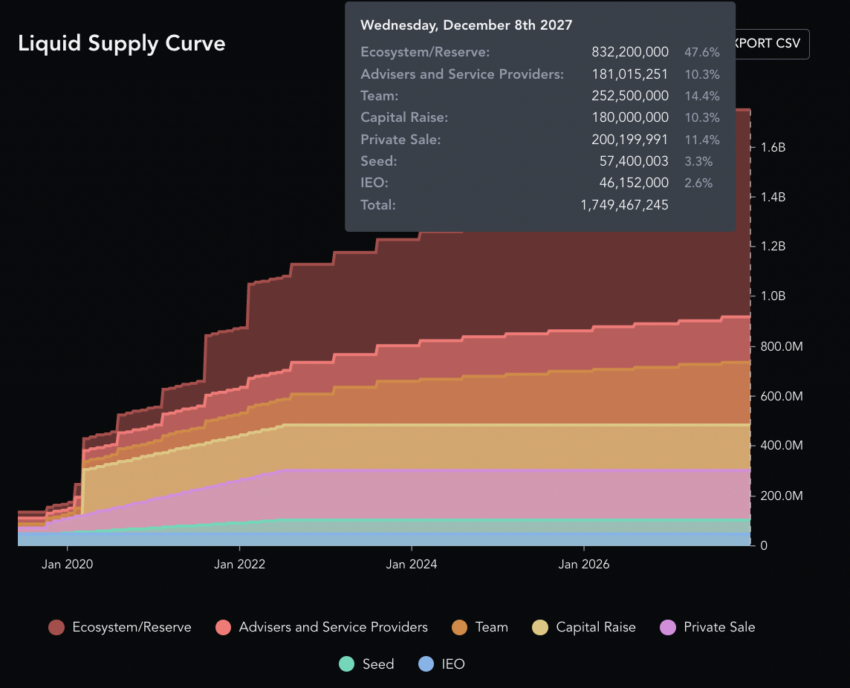

Also, as it’s a fixed-supply coin, scarcity will kick in once the total supply equals the circulating supply. However, that holds only if COTI is still in demand. Supply saturation should come by 2027.

How accurate is the COTI price prediction?

The COTI price forecast considers long-term and short-term technical indicators. It covers much more, including coin fundamentals, on-chain metrics, and other insights. Therefore, this COTI price prediction model covers all the important resources to help you track future prices. However, you should always take price projections with a pinch of salt, as the crypto market has a tendency to throw in a few surprises.

Disclaimer: This analysis focuses on COTI, a blockchain platform specializing in fast and scalable payment solutions. While COTI’s unique approach to enabling enterprise-grade payment systems shows promise, its price is subject to the volatility of the crypto market. Always research thoroughly (DYOR) and consult a financial advisor before investing.

Frequently asked questions

Does COTI have a future?

Can COTI reach 100?

Will COTI coins go up?

Is COTI built on Cardano?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.