Users can now buy Bitcoin with Apple Pay. But is buying Bitcoin and cryptocurrencies with Apple Pay a good idea? How can you buy crypto with Apple Pay? And which are the best platforms that you can use Apple Pay on? Apple Pay works with any card reader that accepts contactless payments. That means users can purchase nearly anything they want using their phone, so long as the transaction size doesn’t exceed the limit associated with the bank card in question.

Since its release back in 2014, Apple Pay has become one of the most popular payment services in the world. It is now just as common to see someone paying for something by tapping their phone on a card reader than pulling out their actual bank card. But what about Apple Pay and crypto? Let’s take a look.

KEY TAKEAWAYS

➤ It is now easier than ever to buy crypto. Users can purchase Bitcoin and other digital assets with just a few simple clicks using Apple Pay.

➤ Some of the top platforms which allow you to buy Bitcoin with Apple Pay include Kraken, Coinbase, and OKX.

➤ While Apple Pay offers arguably one of the most seamless ways for users looking to buy crypto with ease, you may incur slightly higher fees when choosing this payment method.

How to buy Bitcoin with Apple Pay

Several trading platforms/wallets have made it easy to purchase cryptocurrencies using Apple Pay. For most centralized cryptocurrency exchanges, the process of buying crypto using Apple Pay is very similar.

It is also easy to buy crypto using non-custodial crypto wallet platforms such as MetaMask. These platforms do not require users to conduct KYC upon setting up an account. Users buy crypto using Apple Pay instantly, though they may have to provide some personal information to third-party providers.

For reference, with non-custodial wallets, only the user can access the wallet’s private keys. Thus that user has sole control over their crypto. With a wallet on an exchange, this is not the case. The exchange has custody of a user’s crypto and holds the private keys to the wallet.

For reference, with non-custodial wallets, only the user can access the wallet’s private keys. Thus that user has sole control over their crypto. With a wallet on an exchange, this is not the case. The exchange has custody of a user’s crypto and holds the private keys to the wallet.

Here are the top seven platforms that let you buy crypto using Apple Pay.

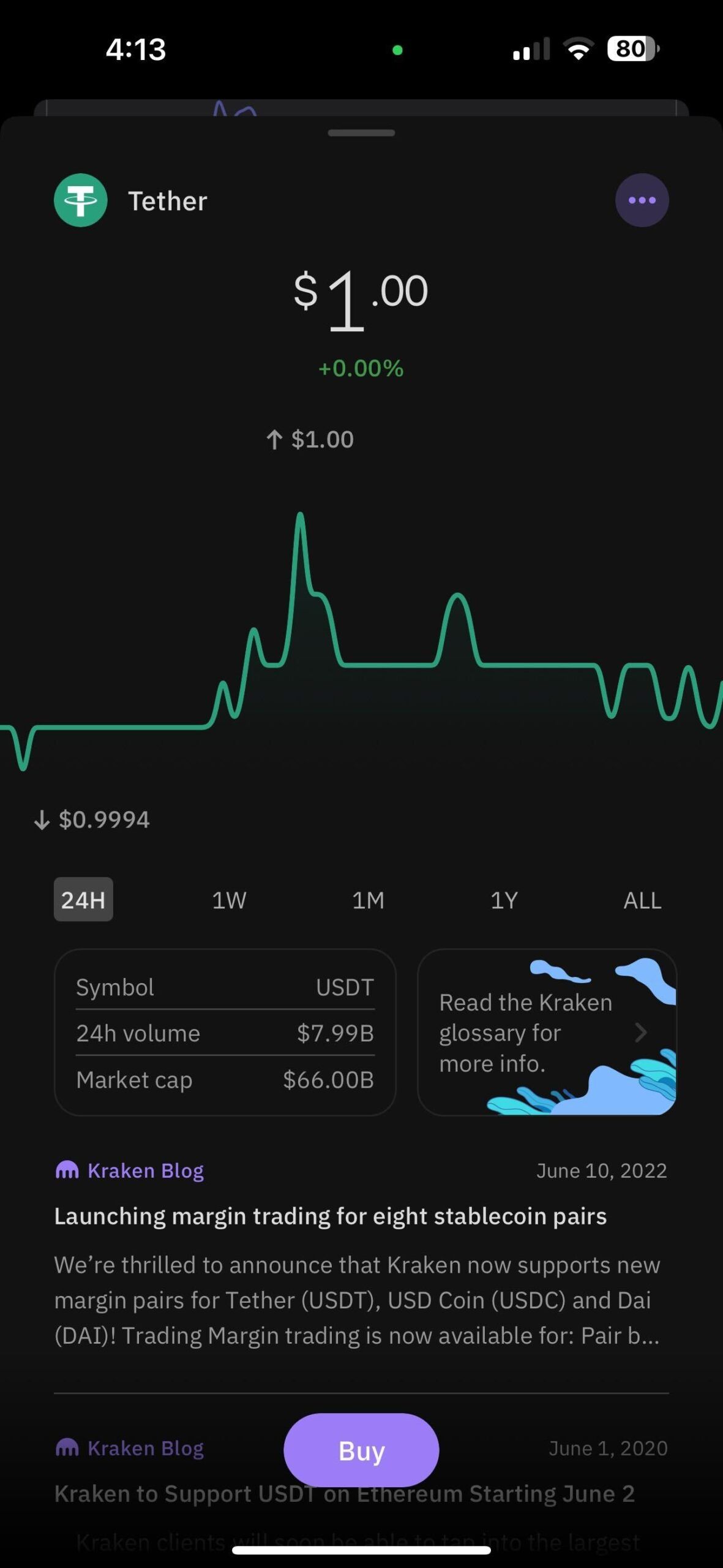

1. Kraken

Jesse Powell and Thanh Luu founded Kraken, a U.S.-based exchange, in 2011. It launched in September 2013, offering bitcoin, litecoin, and euro trades. Kraken is one of the first Bitcoin exchanges to be listed on Bloomberg Terminal.

Hummingbird Ventures and Bitcoin Opportunity Fund made a $5 million Series A investment in Kraken in March 2014. In 2016, the SBI Group was the lead investor in Kraken’s Series B round. Early in 2021, Kraken partnered with Tribe Capital to seek out further capital from investors at a valuation of above $20 billion.

In July 2015, Kraken shifted its focus to other markets due to issues with U.S. regulators. What’s more, Kraken has undergone regular audits by Armanino LLP, showing it has sufficient cryptocurrency reserves to support its operations.

Website: www.kraken.com

Funding limits are determined by various factors, including your residency, verification level, and the asset you are attempting to deposit or withdraw. Limits for crypto vs. fiat, daily, monthly, and annual activity are calculated separately. The monthly and daily deposit and withdrawal limits for express accounts are $9,000 each. Intermediate accounts can be as high as $500,000 per month, while pro accounts can be as high as $100,000,000 monthly.

How to buy Bitcoin using Apple Pay on Kraken

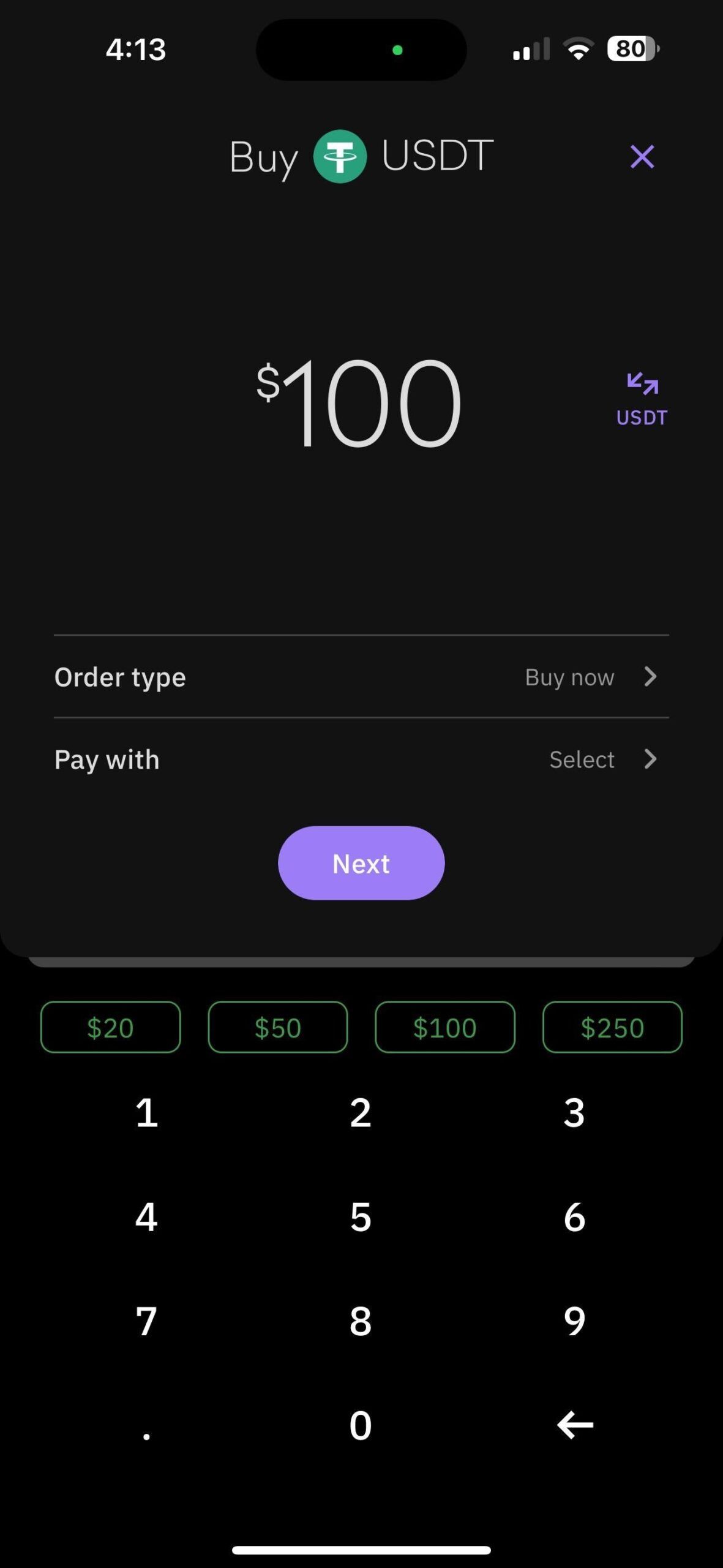

1) First, open up the Kraken app on your iPhone. Select the crypto you want and press the “Buy” button at the bottom of the screen.

2) Enter the amount of cryptocurrency you would like to purchase.

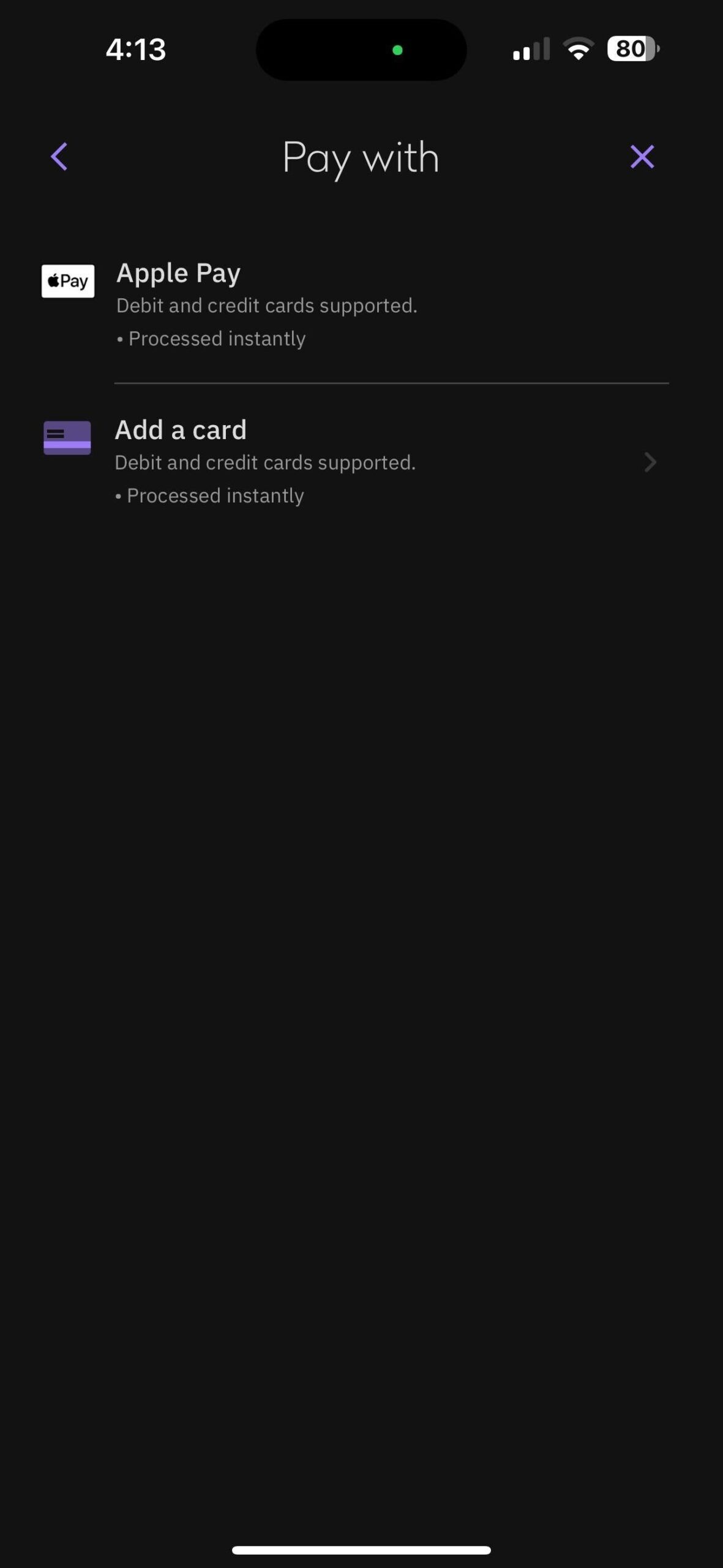

3) Finally, select Apple Pay to complete your purchase.

Kraken charges & fees

A number of factors, including transaction size, transacted assets, payment method, and market conditions, among others, determine fees on Kraken. Kraken’s maker-taker fees, which max out at 0.26%, are among the lowest in the industry. Furthermore, Kraken charges a fee of 0.5% plus 0.9% or 1.5% for ACH purchases.

The fee for purchasing, selling, or converting all crypto assets using your Apple Pay or Google Pay wallet is displayed on the final confirmation page before you complete the transaction. That being said, digital wallet purchases have no hidden or additional fees. The total value displayed on the confirmation page is what Kraken will charge to your wallet.

Pros and cons of buying crypto using Apple Pay on Kraken

| Pros | Cons |

| The platform is highly secure. A Global Settings Lock (GSL) prevents unauthorized changes to your Kraken account and conceals sensitive account information. Kraken also offers 2FA withdrawal email confirmation, air-gapped cold storage, strict monitoring, precise API key permission control, and SSL encryption. | U.S. services may not fully support all buy, sell, send, receive, exchange, futures trading, Cryptowatch, and staking features. This varies based on the account level, region, cryptocurrency, fiat currency, and type of transaction. For instance, margin trading is only available to U.S. clients who meet certain criteria, whereas futures trading is completely unavailable to U.S. clients. |

| Kraken facilitates trading in 176 countries. However, the functions vary depending on location and verification level. For example, Kraken is not available in New York or Washington. | |

| Several cryptocurrencies and fiat currencies are supported for account funding. In addition, Kraken’s funding and withdrawal options include SEPA bank transfer, SWIFT, wire transfers, ACH, Fedwire, Silvergate Exchange Network, Etana Custody, and e-Transfer. |

2. Coinbase

Coinbase is one of the oldest and largest cryptocurrency exchanges in the world. Its trading platform has been operational since 2012. The largest U.S.-based cryptocurrency exchange generated a splash amongst Wall Street and retail investors alike in 2021 when it went public on the Nasdaq.

According to CoinGecko, Coinbase has the second highest trading volumes of any crypto exchange, second only to global behemoth Binance.

Users holding crypto in their Coinbase exchange account hold their crypto in a “custodial” wallet. That means users do not theoretically have complete control over their crypto. Rather, they have a claim to crypto being stored in a wallet managed by Coinbase. However, Coinbase also has its own non-custodial wallet platform called Coinbase Wallet.

Some crypto investors may see Coinbase’s custodial exchange wallet as a drawback. However, there is a convenience element for beginners. Investors storing their crypto in their Coinbase exchange account aren’t responsible for managing/recording their private keys.

Coinbase account holders must provide identification documents to gain full account access, given that Coinbase is subject to KYC regulations. This puts users in a better position to regain access to their accounts if locked out. But for crypto purists who place a high value on anonymity, KYC could be a deterrent against using the Coinbase platform.

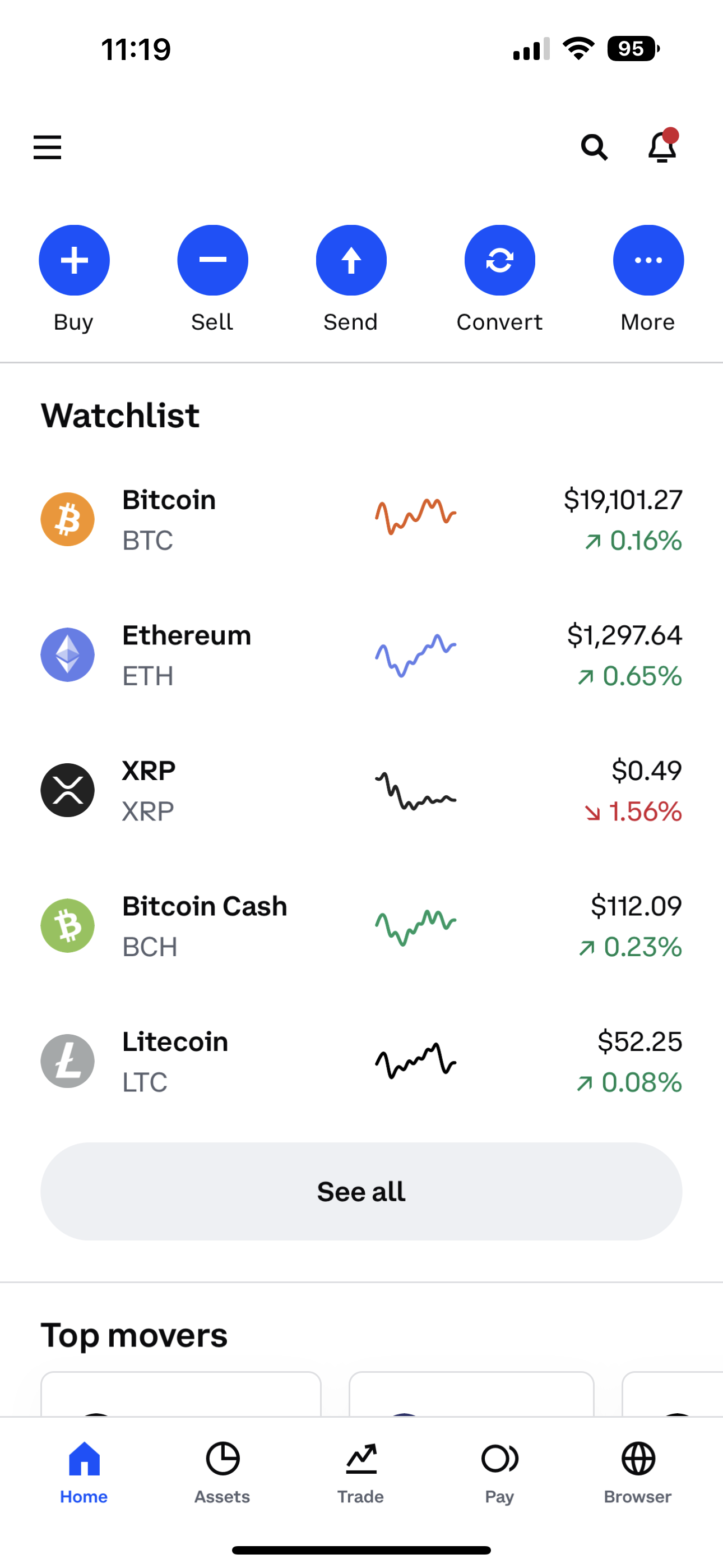

How to buy Bitcoin using Apple Pay on Coinbase

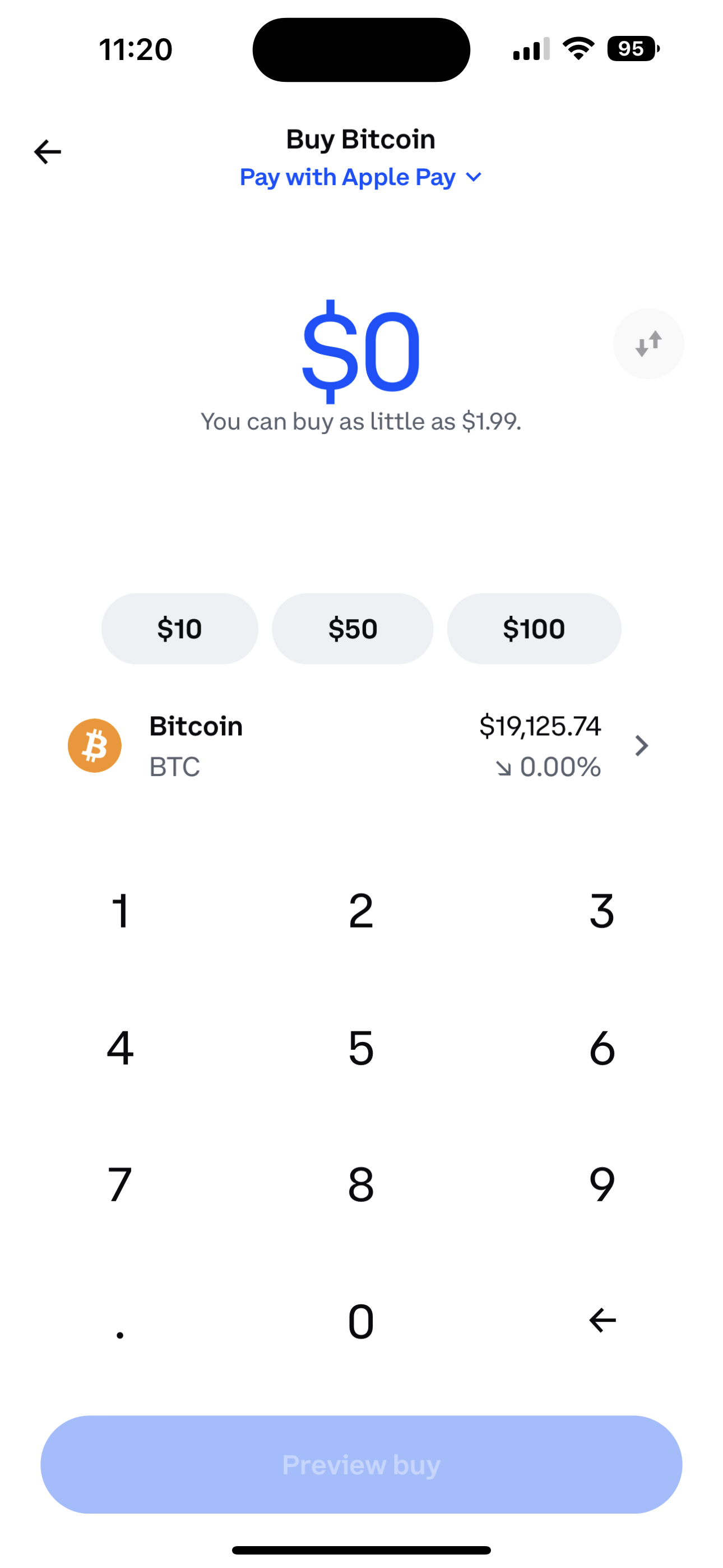

1) Open up the Coinbase application on your iPhone. In the top left of the home panel, press the “Buy” button.

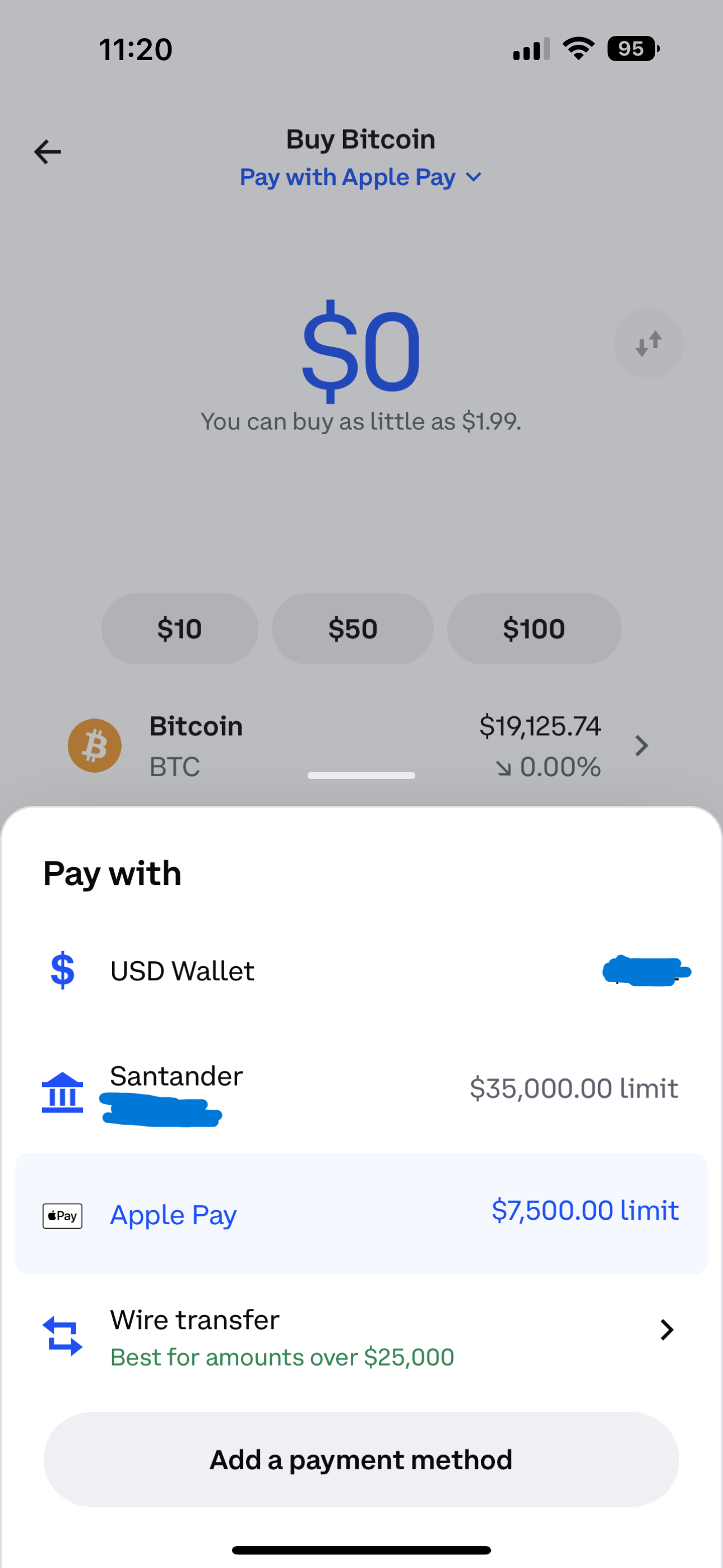

2) Enter the amount of bitcoin (or other cryptocurrencies) you want to buy. Then press “Pay with” to choose your payment method.

3) Select Apple Pay as the payment method.

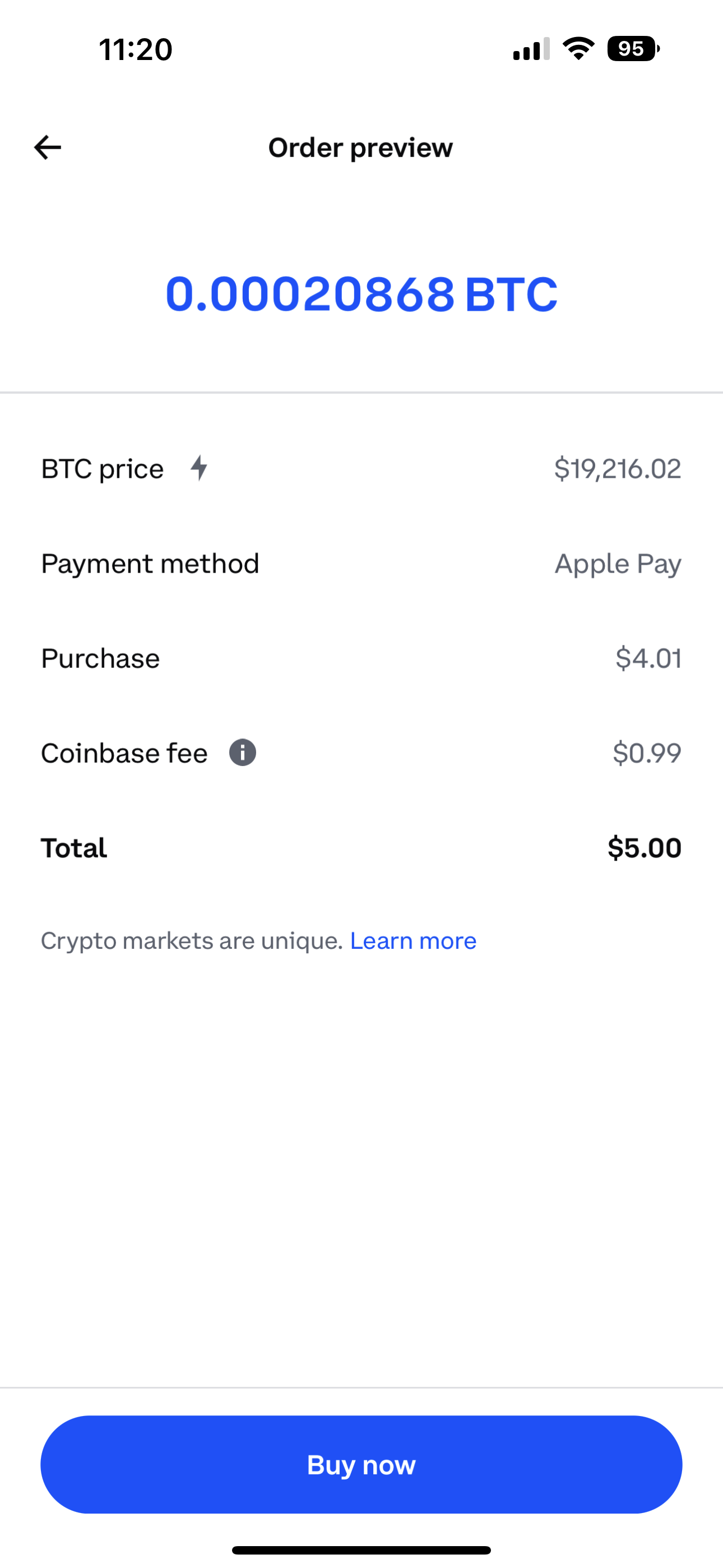

4) Once you have done this, press the “Preview buy” button. Coinbase will now offer an exchange rate and detail the service fee for the card purchase. If you press the “Buy now” button, Apple Pay will pop up on the phone so that you can confirm the purchase.

Coinbase charges & fees

Coinbase has faced criticism for what some claim is a confusing fee structure. The exchange calculates its fees at the time of order placement based on a combination of factors. This includes factors such as location, payment method, order size, and market conditions.

U.S.-based users buying crypto on Coinbase via Apple Pay face a 3.99% conversion fee. That might be enough to deter some investors from using Apple Pay on the platform.

Users also pay spread fees and maker-taker fees to compensate Coinbase for its market-making activities. This can be up to 2%. Coinbase charges 1% on crypto withdrawals. That comes on top of the standard network fees crypto users must pay to process their transactions on the blockchain.

Pros and cons of buying crypto using Apple Pay on Coinbase

| Pros | Cons |

| Convenience: Buying Bitcoin via Coinbase using Apple Pay is ideal for retail investors looking to make small, ad hoc crypto purchases. The platform’s mobile app is one of the most user-friendly on the market. . | Less suitable for large purchases: Crypto purchases using Apple Pay are limited by the daily transaction limit of the associated debit/credit card. Coinbase recommends bank account/wire transfers for those looking to make larger crypto purchases than their daily debit card limit enables. |

| Range of assets: Users can use Apple Pay to buy any of the cryptos that trade on the Coinbase exchange. | Limited Apple Pay usages: It can only be used to buy cryptocurrency directly. Apple Pay cannot be used to add cash to your Coinbase account, withdraw cash, or sell crypto. |

| Easily earn yield on crypto assets: For example, the platform allows users to easily stake their ETH and SOL coins for 4% APY. Users can also benefit from a variable APY via Coinbase’s DeFi Yield product on their DAI and USDT holdings. | High transaction fees: 3.99% service charge on card purchases is amongst the highest of the major crypto exchanges. Its other fees (market making and crypto withdrawal) are also high by industry standards. |

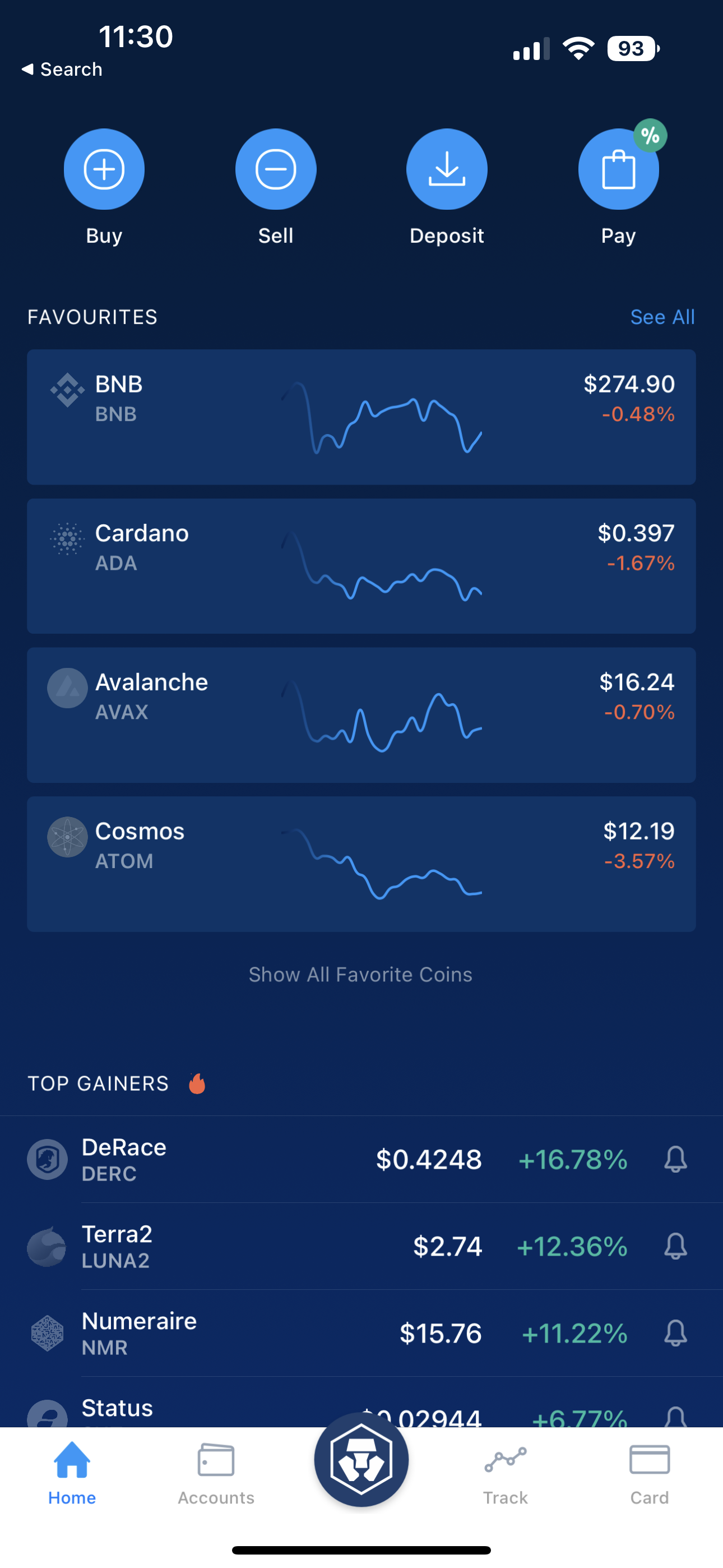

3. Crypto.com

Crypto.com is a Singapore-based cryptocurrency exchange and financial services platform founded back in 2016. The platform boasts over 50 million users. According to CoinGecko, the exchange ranks 11th in terms of daily transaction volumes, excluding Binance’s U.S. subsidiary, Binance.US.

The platform has a popular Visa Card program. Users can get as much as 5% cash back on all purchases, plus other benefits. To receive these perks, users need to own and stake Crypto.com’s native cryptocurrency CRO. The platform also has an attractive “earn” program, where users can earn yields of up to 14.5% on cryptocurrencies and 8.5% on stablecoins.

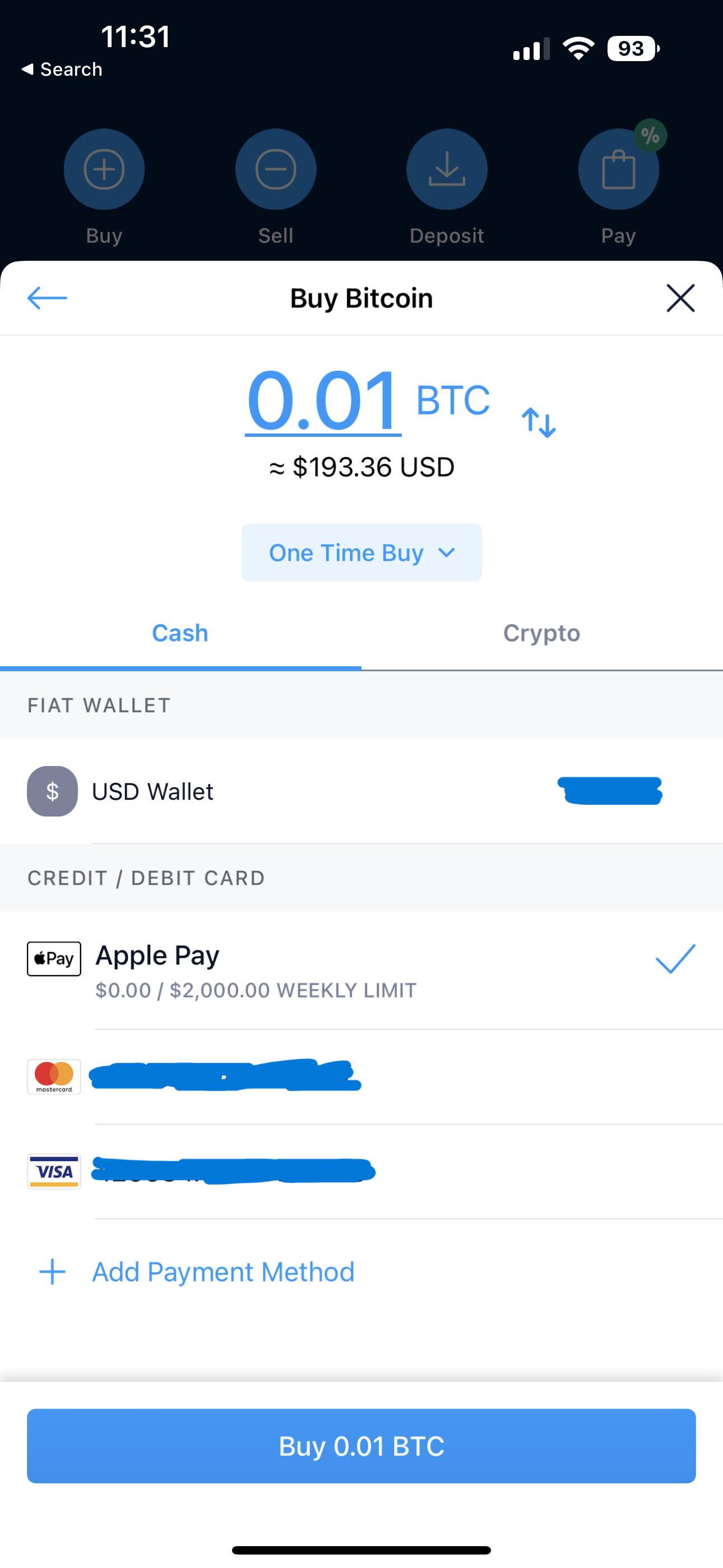

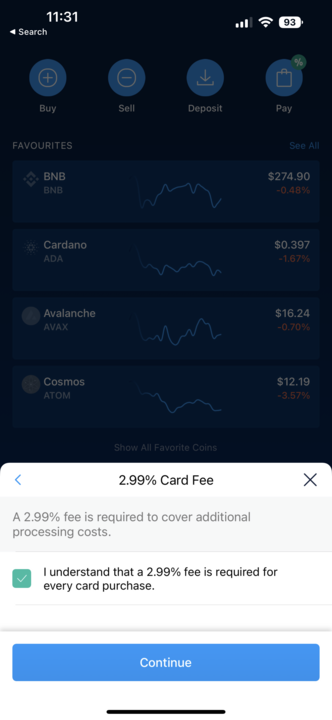

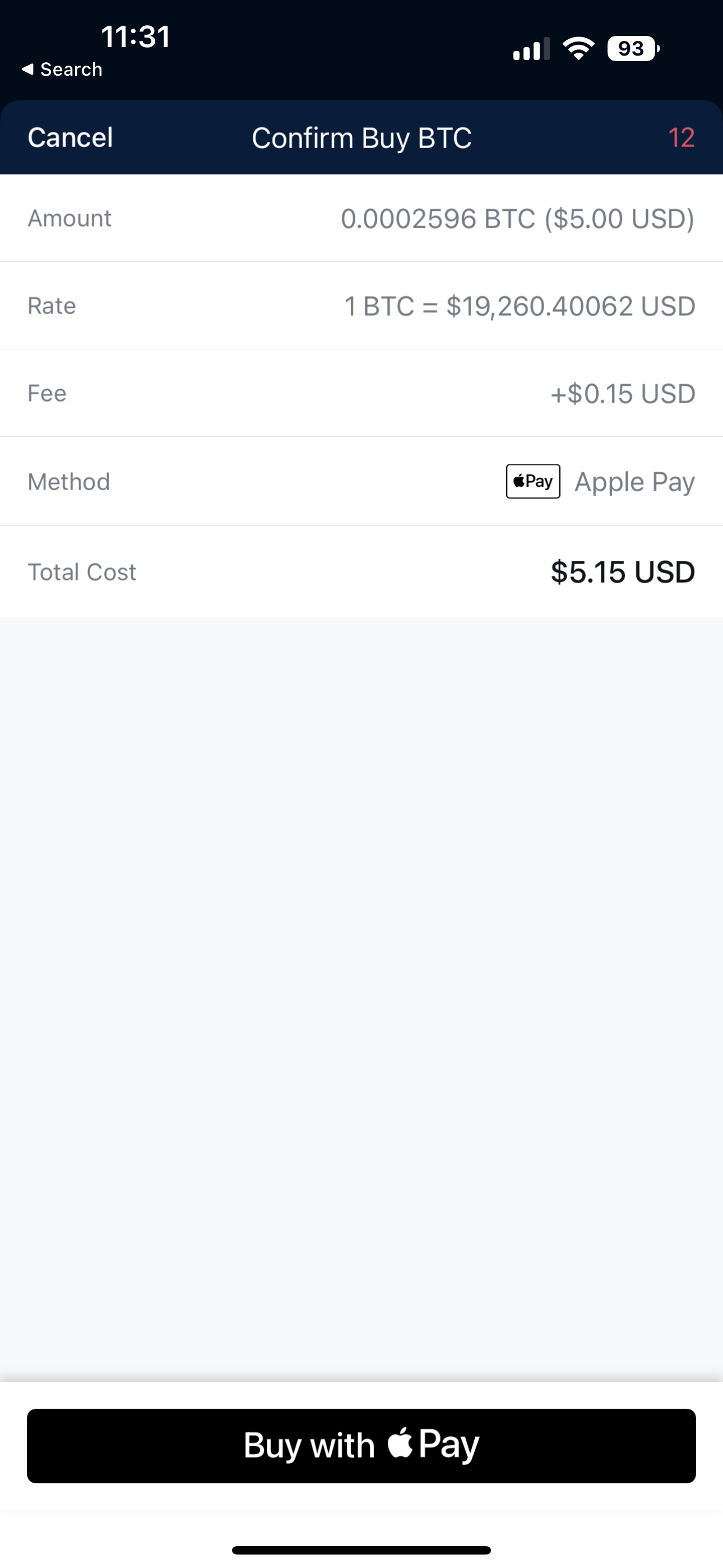

How to buy Bitcoin using Apple Pay on Crypto.com

- Open the Crypto.com application on your iPhone. Go to the home panel and press on the “Buy” button at the top left.

2) Enter the amount of cryptocurrency you want to buy and select Apple Pay as your payment method. Then press the “Buy” button at the bottom.

3) You will be prompted to accept Crypto.com’s 2.99% service fee for card purchases. Tick the relevant box and press continue.

4) You will then be given a final prompt to confirm that you are happy with the exchange rate and Crypto.com fee. Press the “Buy with Apple Pay” button at the bottom. Apple Pay will then pop up to confirm the transaction.

Crypto charges & fees

Crypto.com charges a variable fee on all crypto withdrawals. For Bitcoin withdrawals, 0.0005 is charged. Users will also have to pay standard network fees in order for their transactions to be processed on the blockchain.

Crypto.com’s 2.99% processing fee for card purchases includes Apple Pay purchases. Users can avoid these fees if they fund their Crypto.com account via bank transfer. However, this process is more sluggish than a bank card purchase (including via Apple Pay).

Pros and cons of using Apple Pay on Crypto.com

| Pros | Cons |

| Beginner friendly and convenient interface | Daily crypto purchase limits via Apple Pay: These depend on your Crypto.com Visa Card tier. For those without a card or with the lowest tier Midnight Blue, purchases are limited to $750 weekly. Ruby Steel card holders can purchase up to $2,000 worth of crypto per week using Apple Pay. |

| Wide range of crypto assets: Over 250 cryptocurrencies are available for purchase (including via Apple Pay) | Purchasing crypto using Apple Pay on the Crypto.com platform will incur users a 2.99% service charge levied on all card purchases. Crypto.com’s normal trading fees are fairly competitive by industry standards. |

| Like with Coinbase, Crypto.com users will need to pass various KYC requirements. For some crypto users who prioritize anonymity, this may deter them from using the platform. |

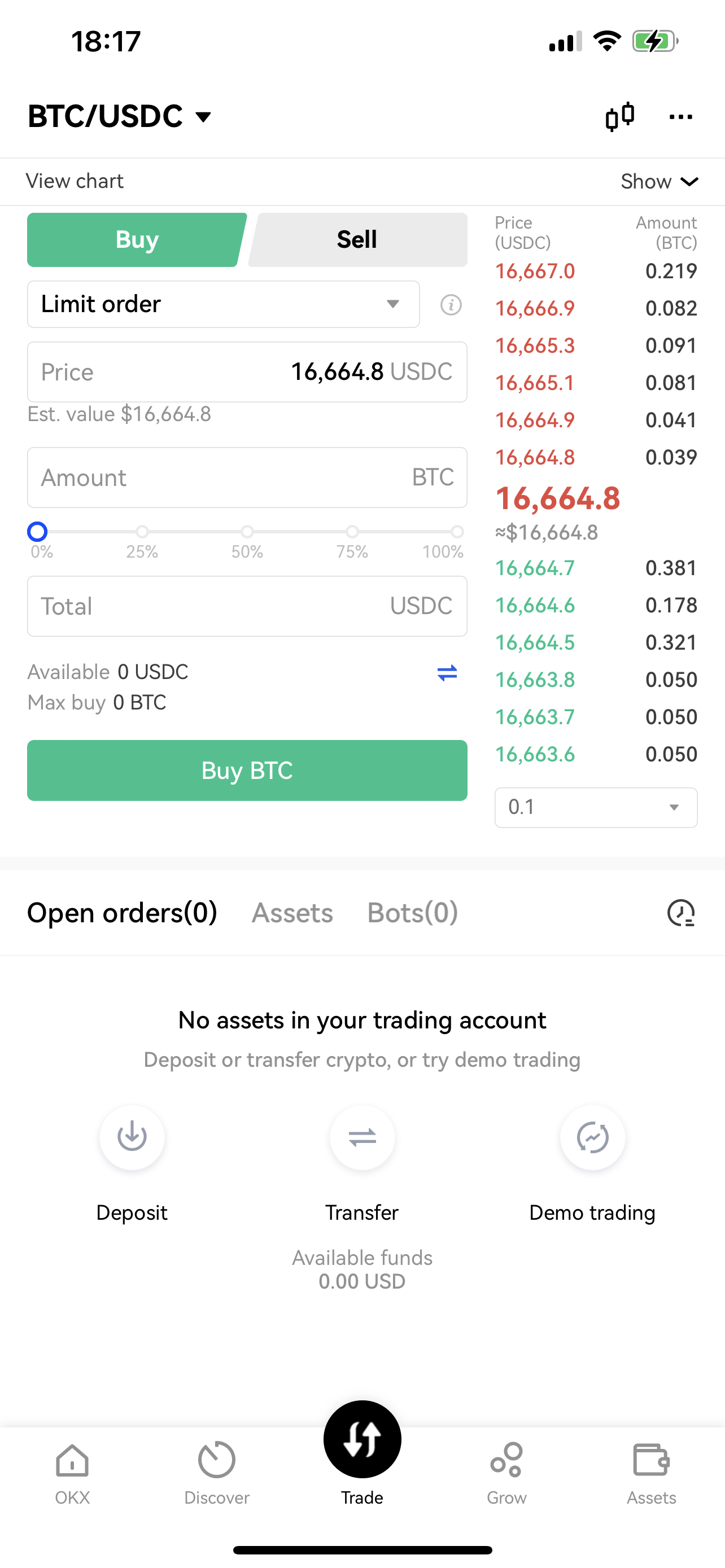

4. OKX

OKX is a Seychelles-based cryptocurrency and derivatives exchange. Formerly known as “OKEx,” Star Xu founded the exchange in 2017. Xu previously worked at Yahoo as a development engineer and then as the Chief Technical Officer of Docin.

OKX supports services in over 60 countries and offers cryptocurrency trading, futures trading, options trading, cloud mining, and margin trading. In addition to many trading options, OKX also supports more than 300 cryptocurrencies.

OKB is the ERC-20 exchange native token of OKX. It is used to offer customers discounts on their trades. Trading fees for OKX traders can be reduced by up to 25% by holding OKB in a sub-account. OKX Earn enables OKB holders to earn interest on their savings. Additionally, OKX Jumpstart enables holders of OKB to stake their assets and get incentive tokens from emerging blockchain initiatives.

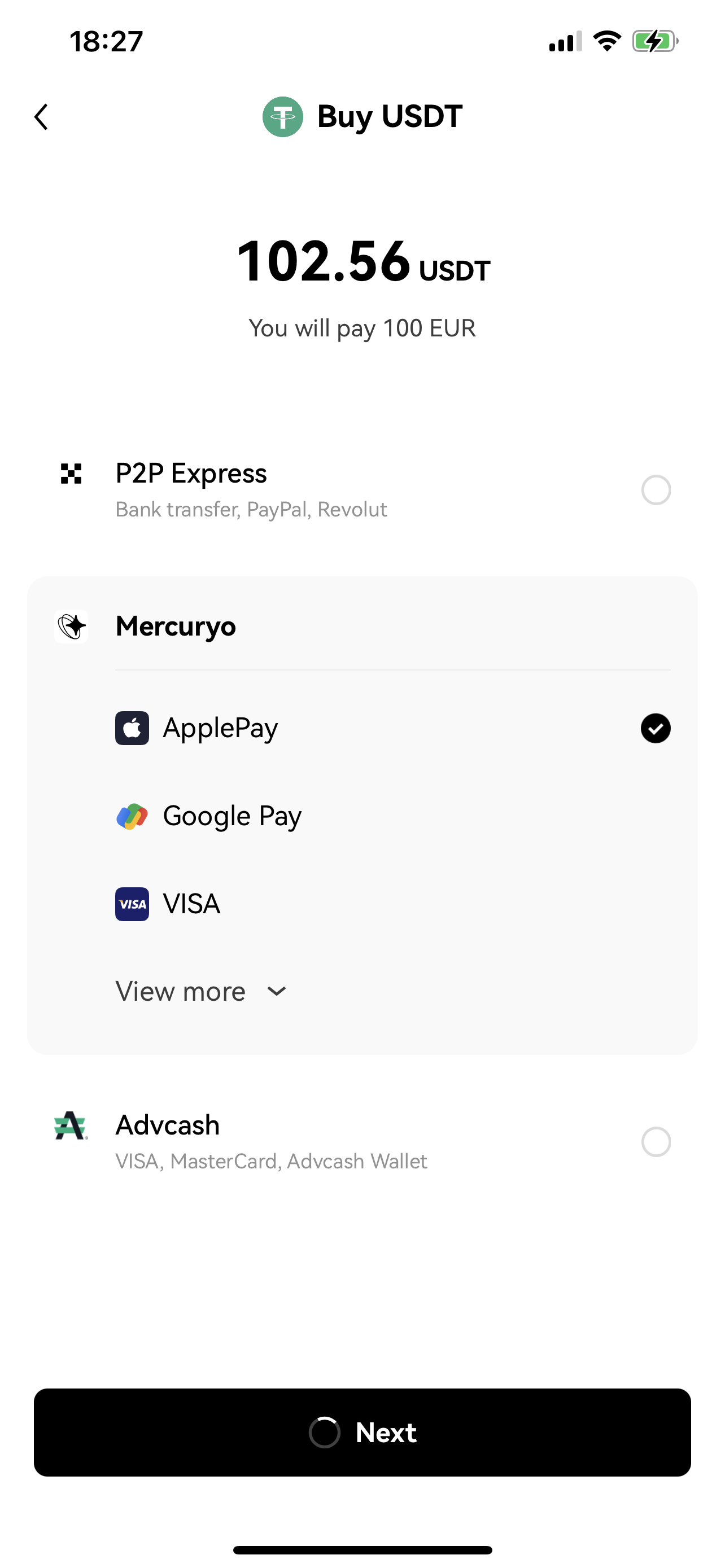

How to buy Bitcoin using Apple Pay on OKX

2) Secondly, enter the amount of Bitcoin (or other cryptocurrencies) you want to buy. Then select “Apple Pay” to choose your payment method.

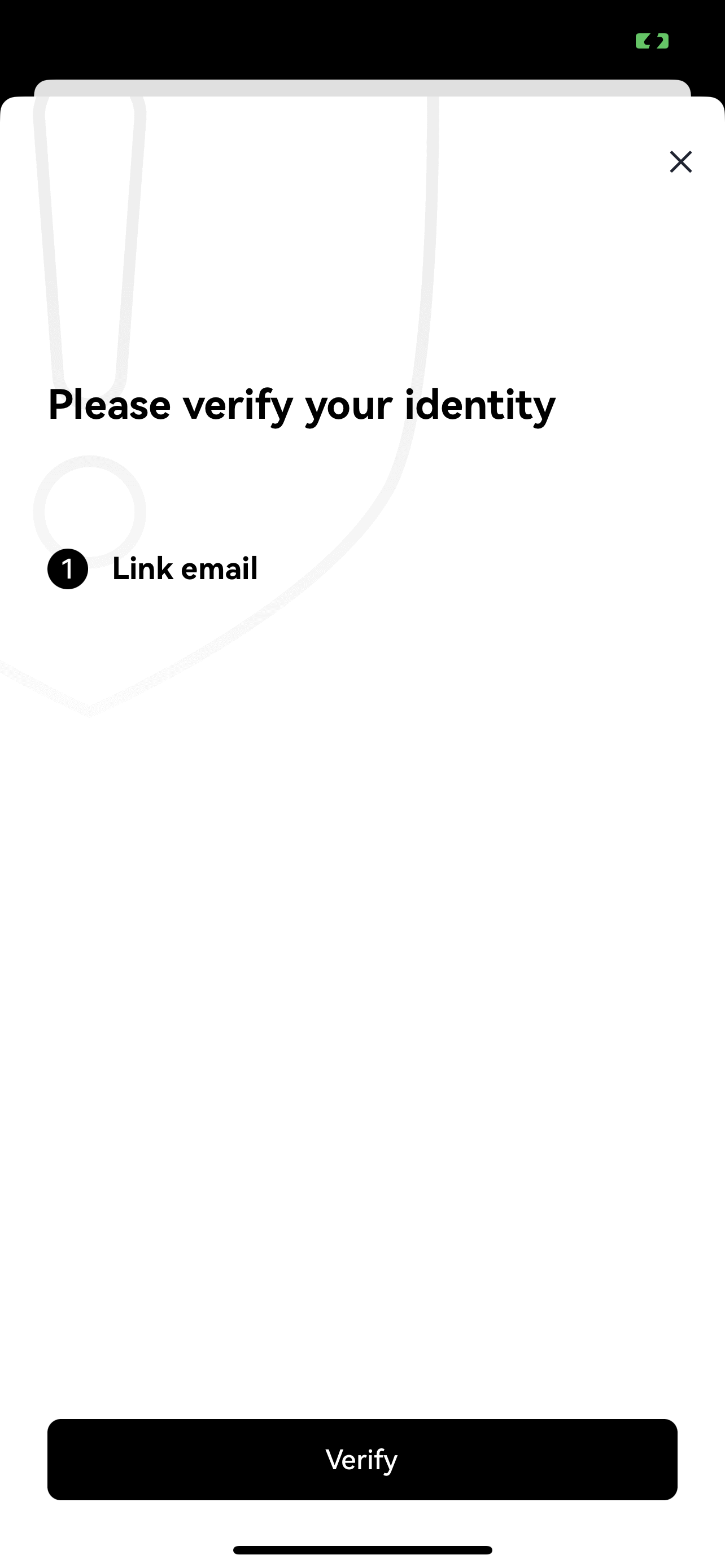

3) Thirdly, OKX will ask you to verify your identity. Enter your email to receive the verification code.

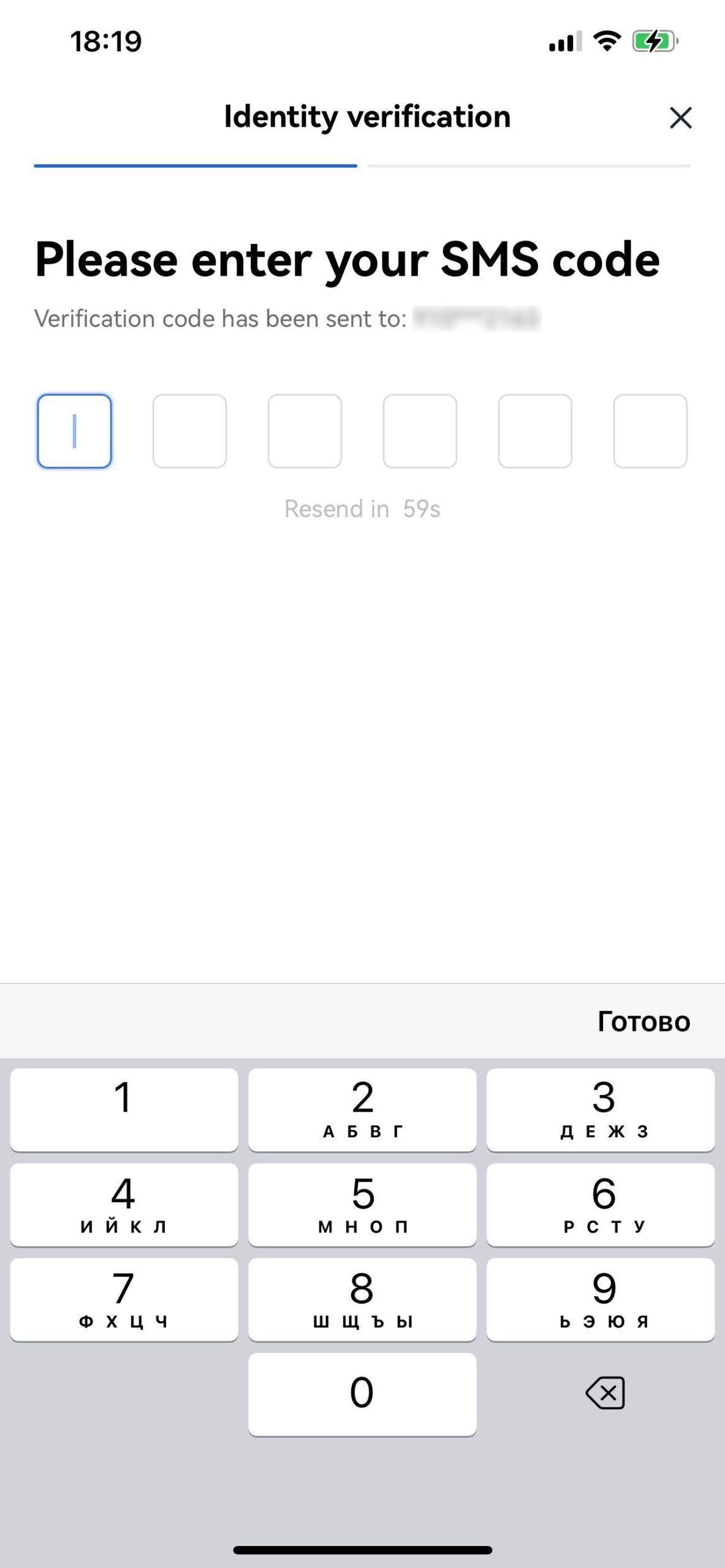

4) Next, enter the verification code.

5) Finally, your order will be processed after you submit the verification information.

Regular and VIP users pay varying trading costs on OKX. VIP customers have access to 30-day trading volumes and daily asset balances. Meanwhile, regular users are divided into levels based on their overall account holdings. Fee tiers depend on spot trading volume, the total trading volume of futures and perpetual contracts, options trading volume, and total assets. Users who meet OKX-defined parameters in relation to these tiers benefit from the highest fee discounts.

For example, the most a “Regular user” at the lowest level (Lv1) will pay in spot trading fees is 0.08% in maker fees and 0.1% in taker fees. A “VIP user” at the highest level (VIP 8) will pay -0.005 in maker fees and 0.02% in taker fees. These fees vary when trading futures, perpetuals, and options. Users must also pay withdrawal fees; this is used to pay miners as a reward, not OKX.

Pros and cons of buying crypto using Apple Pay on OKX

| Pros | Cons |

| Wide range of assets and services: Supports services in over 60 countries and more than 300 cryptos | U.S. restrictions: OKX is not available to users in the U.S. However, you can access OKX and its services in more than 60 countries worldwide. |

| Beginner friendly: Purchasing crypto is super simple and the Apple Pay functionality works seamlessly. | Low liquidity on some currency trades: Because OKX offers such a wide array of cryptocurrencies, some currency trades have constrained liquidity pools. |

5. BitPay

BitPay is a U.S.-based Bitcoin-focused payments service and crypto wallet provider. The platform offers services to both individuals and businesses. The company was founded in 2011, making it a relative veteran in cryptocurrency. Individuals can use BitPay to buy, store, and swap crypto.

Users can also spend their cryptocurrency using BitPay’s crypto debit card. Based on the merchant, users can also receive a variable level of cashback. BitPay users can also make use of the platform’s non-custodial wallet and browser extension that facilitates easy online payments.

The wallet in which your crypto is stored on the BitPay platform is non-custodial. That means the user is tasked with safely storing and securing the private keys to their wallet.

How to buy Bitcoin using Apple Pay on BitPay

1) Open the BitPay application on your iPhone. Go to the home panel and press the “Buy” button in the top left.

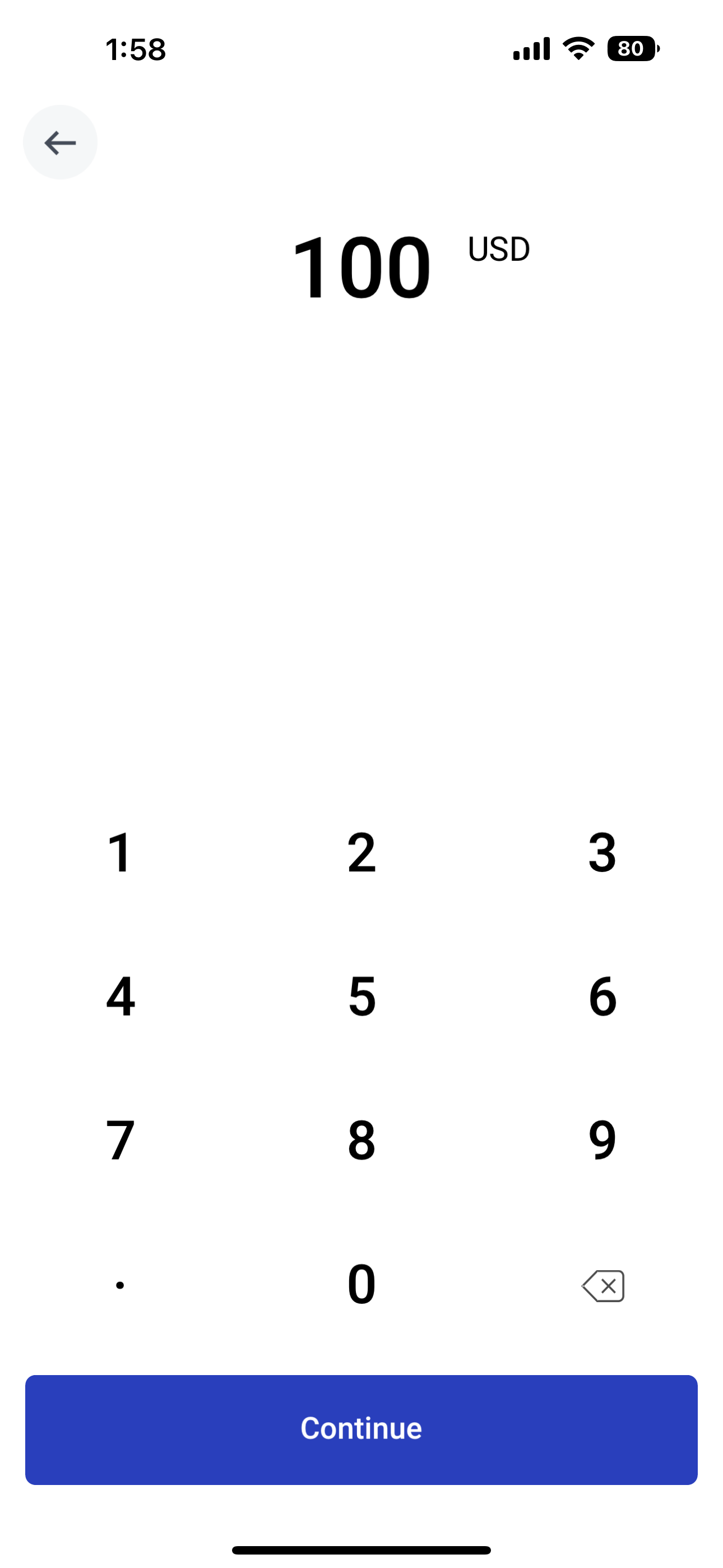

2) Enter the amount of cryptocurrency you want to buy and press “Continue.”

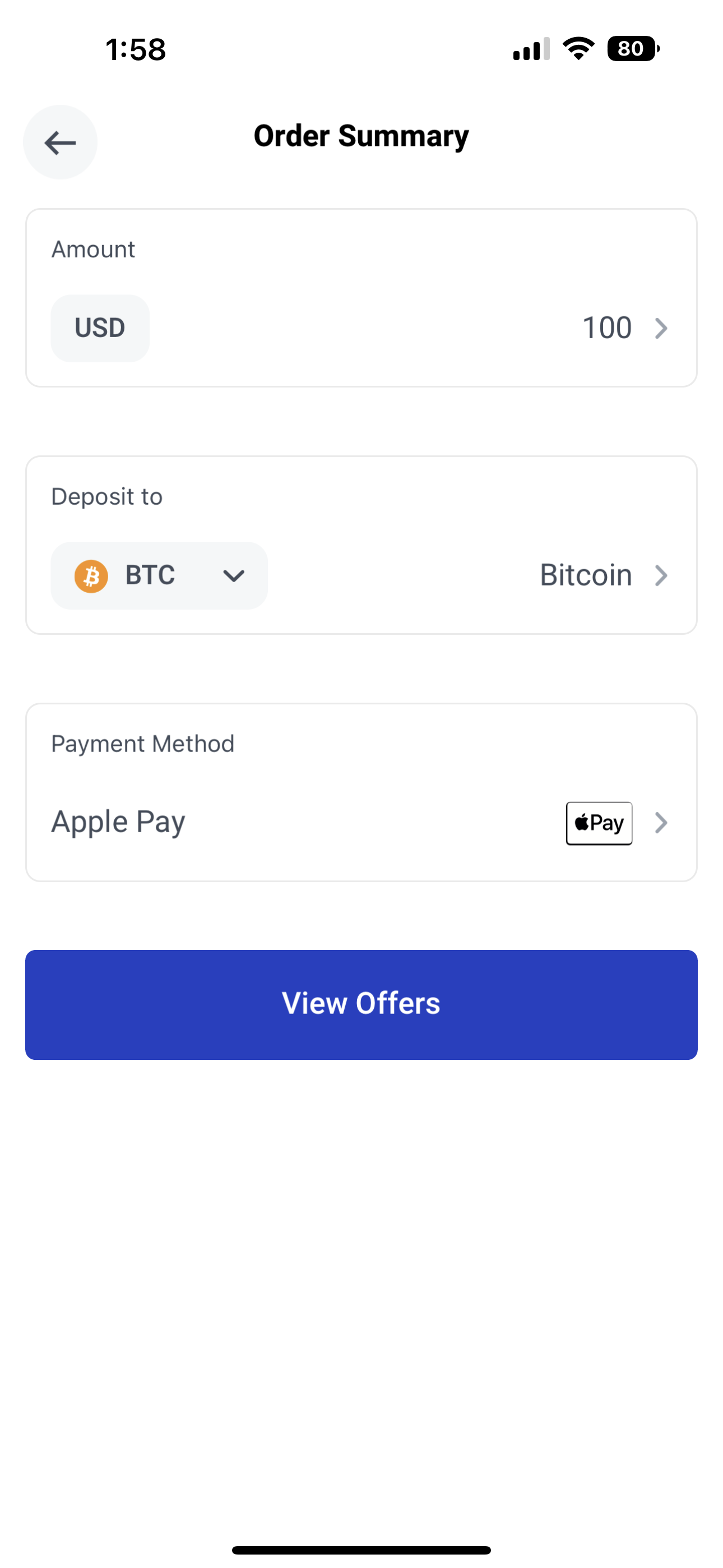

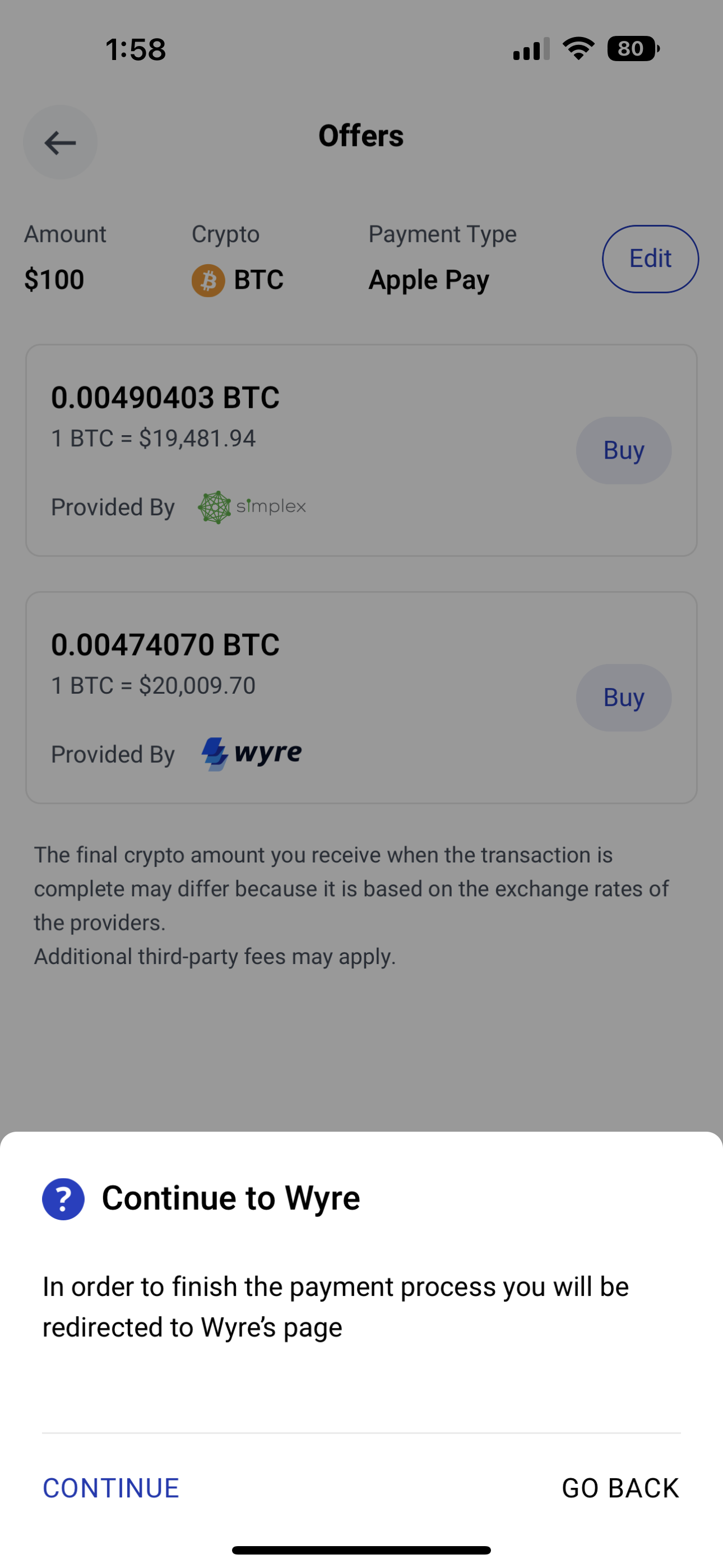

3) Select the cryptocurrency and crypto wallet you want to add. Then select Apple Pay as the payment method and press “View Offers.”

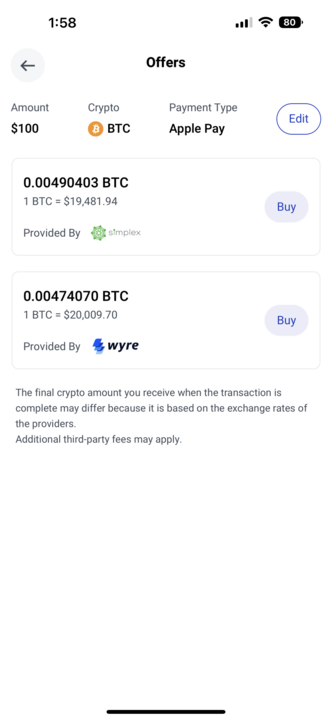

4) You will be presented with various exchange rate offers. Press the “Buy” button on the one you prefer.

5) BitPay will inform you that you will be redirected to the partner’s website to complete the transaction. Press “Continue” to proceed.

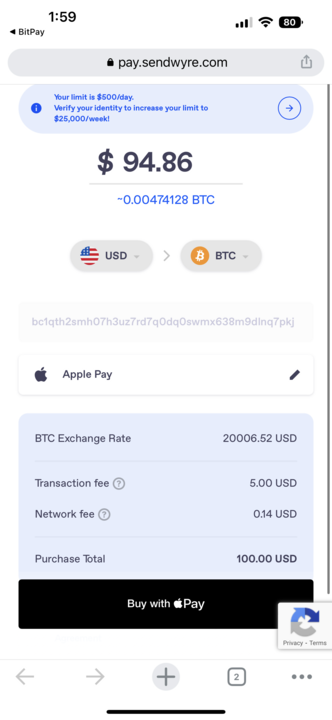

6) You will be directed to the partner’s website. Here, you will receive a breakdown of the fees you will pay and the exchange rate you will get. To complete the purchase using Apple Pay, press the “Buy with Apple Pay” button at the bottom. Apple Pay will pop up, and you can verify the transaction as normal.

BitPay charges and fees

All fees and charges are included in the exchange rate offered to users looking to buy crypto using a bank card (including Apple Pay). The fee users will pay depends on which third-party fiat-to-crypto payment processor the user chooses on the BitPay platform.

BitPay partner Simplex charges a minimum of $10 per crypto purchase or 5% of the transaction’s total value. BitPay charges an extra 1% of the total transaction value on top of this.

Pros and cons of buying crypto using Apple Pay on BitPay

| Pros | Cons |

| Convenient and user friendly | ID process for larger payments |

| Transparent fee structure | Lack of crypto options; many competitors offer a wider range of assets |

6. MetaMask

MetaMask is a non-custodial cryptocurrency wallet that was founded back in 2016. It allows its users to interact with the Ethereum network and dozens of other blockchains via its browser extension or mobile application.

The wallet gained significant traction in 2020 as interest in decentralized finance (DeFi) spiked. MetaMask users can easily interact with DeFi applications across numerous blockchains using the wallet. Thus, the wallet is often referred to as one of the market’s leading “web3” wallets. MetaMask wallet users can also use the platform to buy, send, receive, and swap cryptocurrencies.

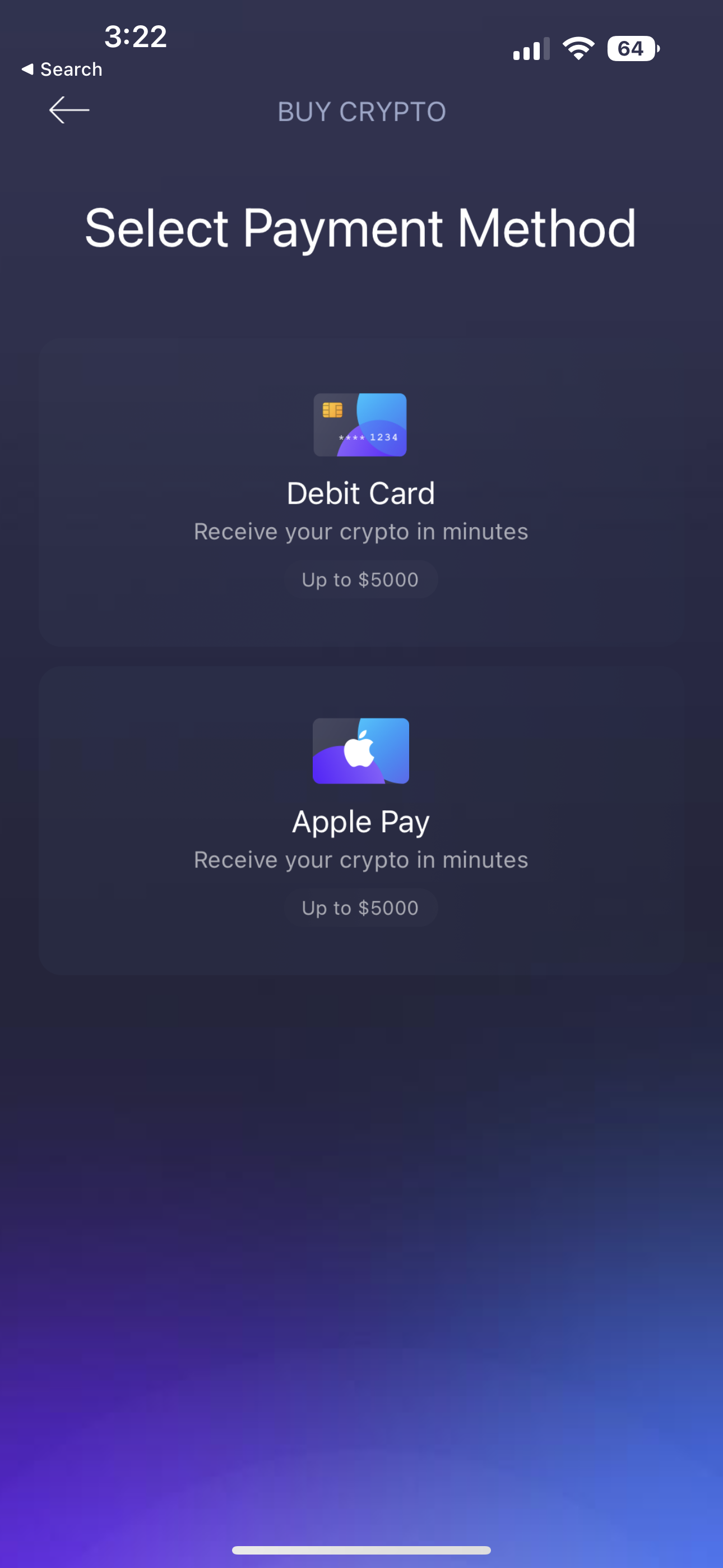

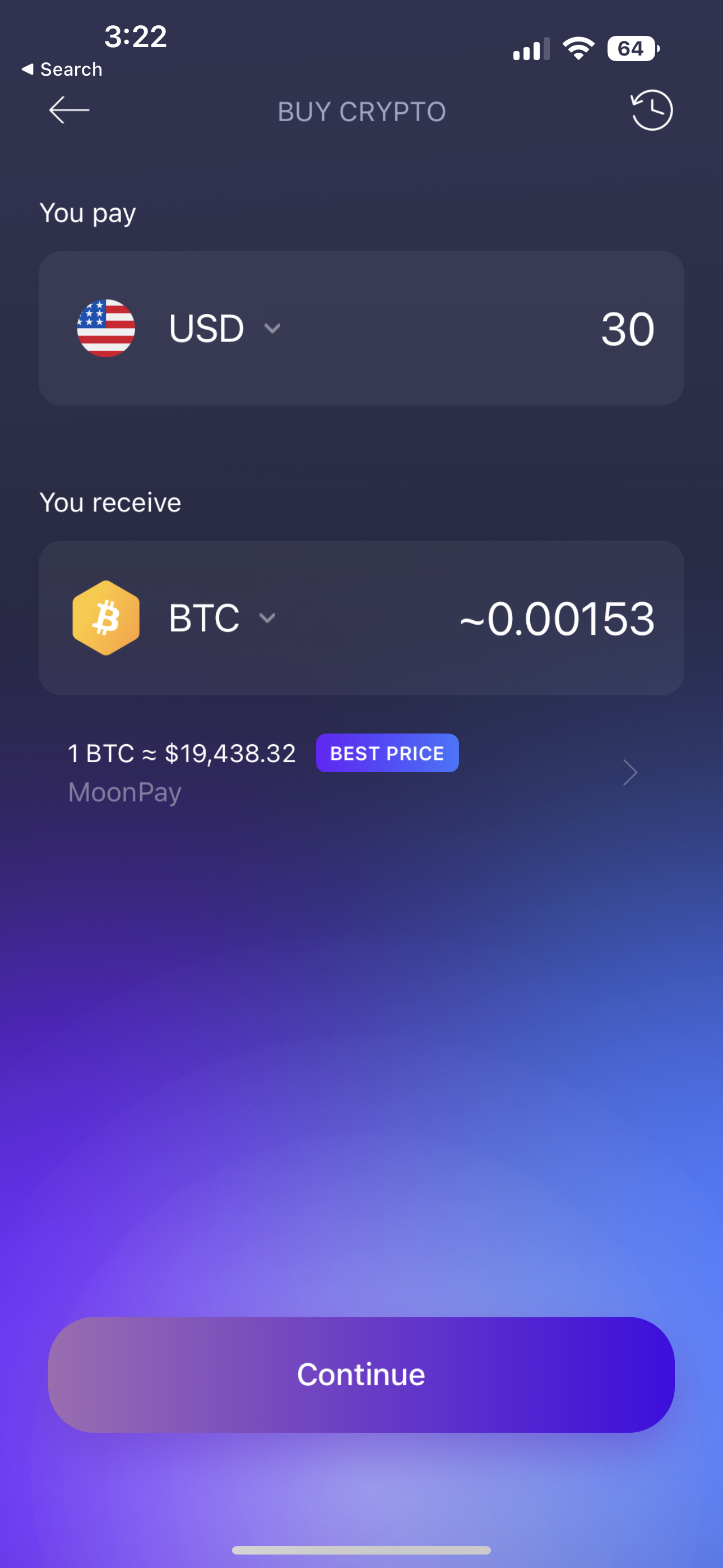

How to buy crypto using Apple Pay on MetaMask

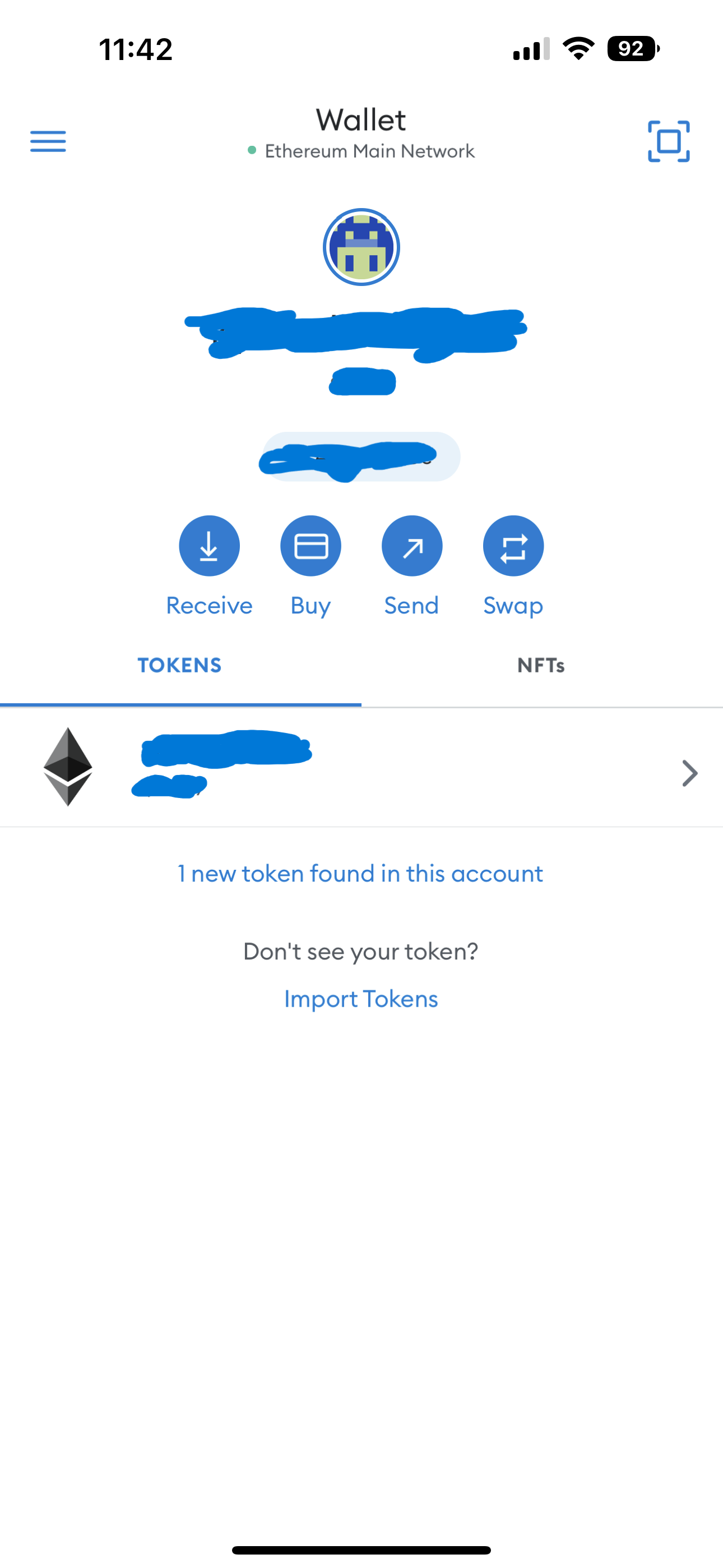

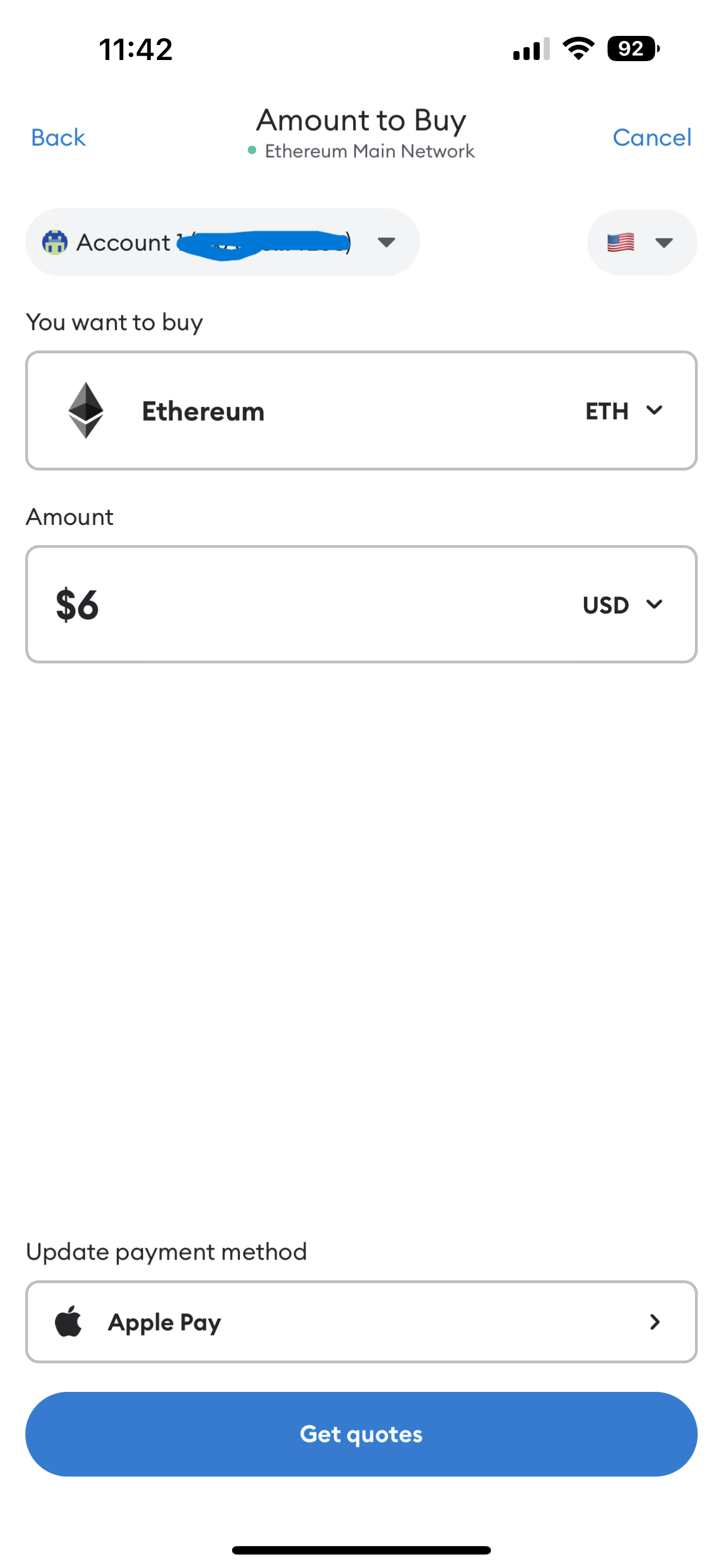

1) Open the MetaMask wallet application on your iPhone. Click on the “Buy” button.

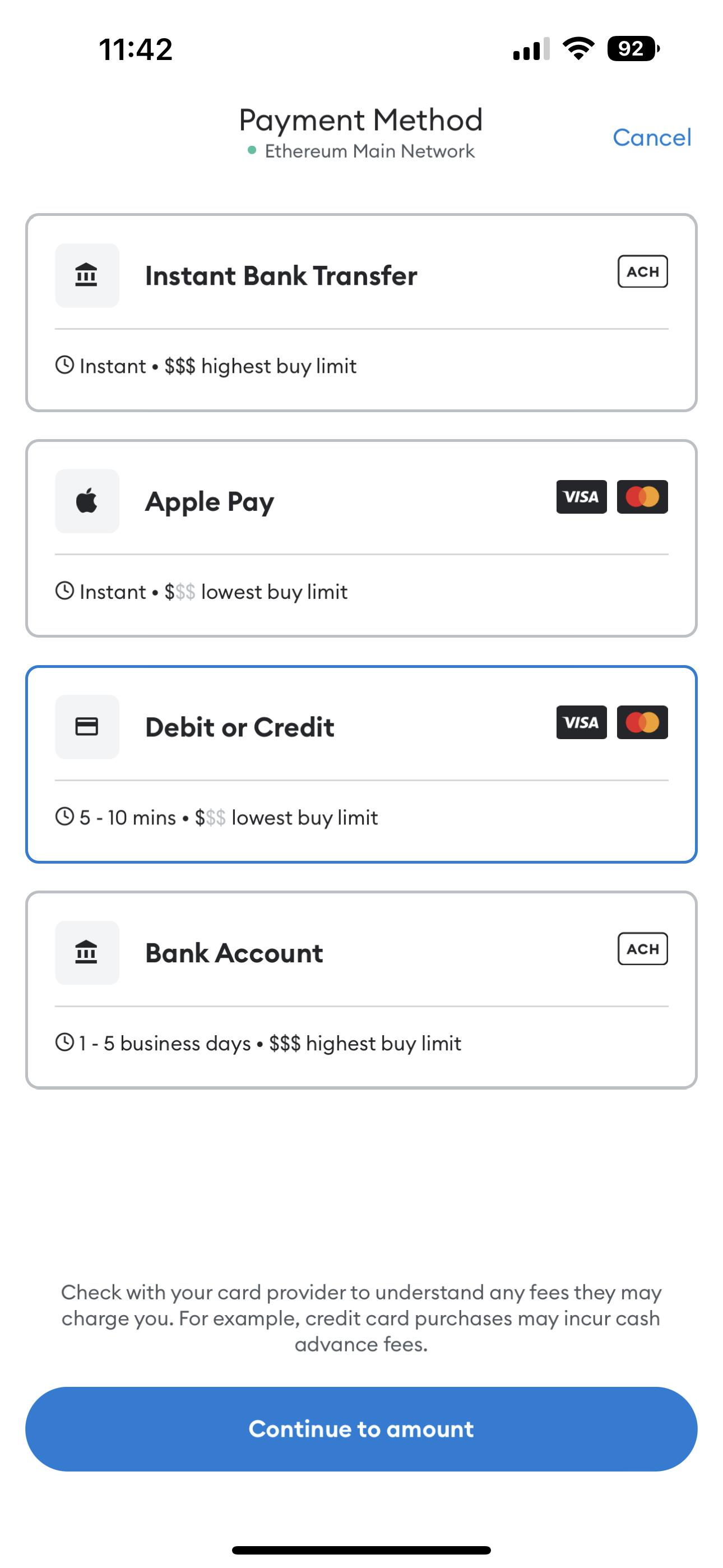

2) Select Apple Pay as your payment method. Now press “Continue to amount.”

3) Select the cryptocurrency you want to buy and the fiat currency with which you want to buy it. Then, enter the amount you would like to purchase. Now press “Get quotes.”

4) MetaMask will now fetch cryptocurrency exchange rate quotes.

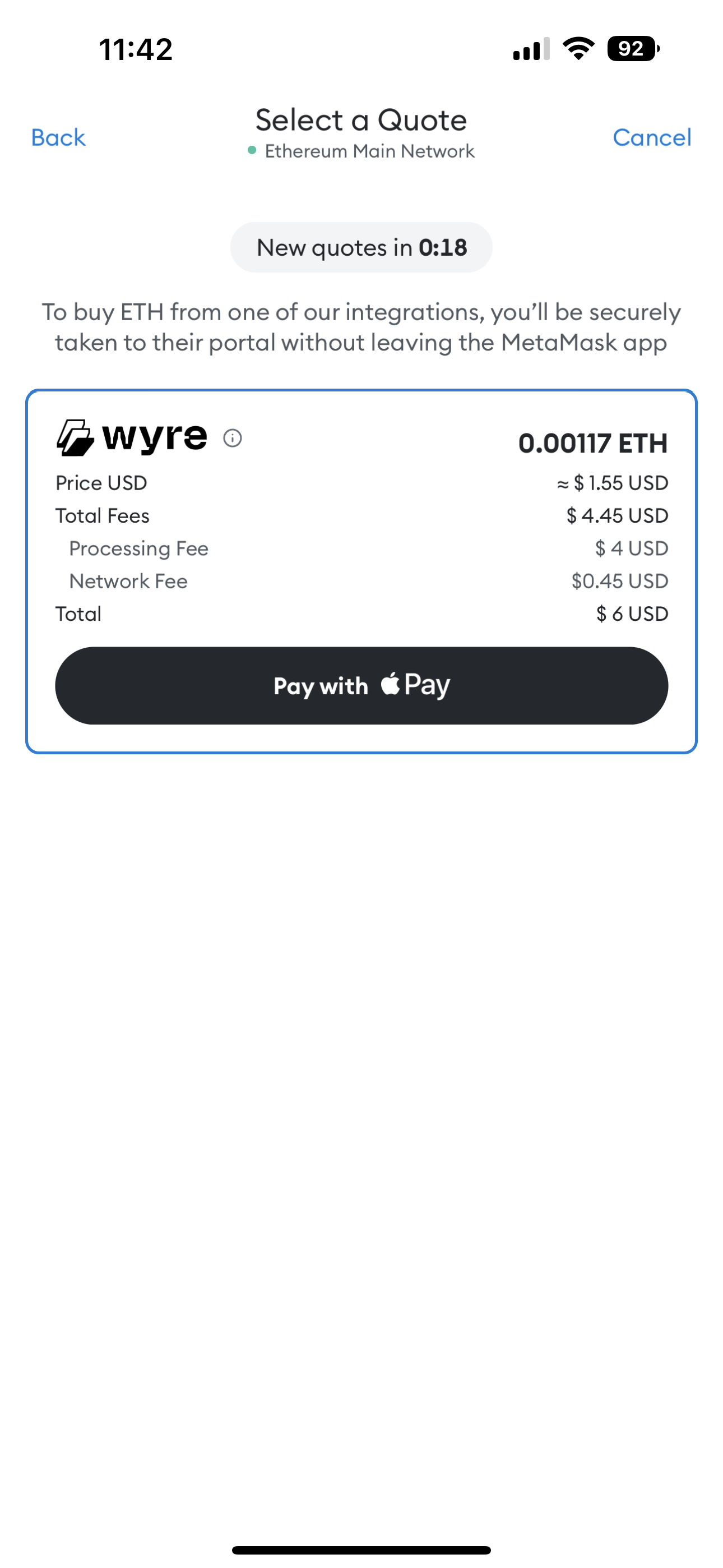

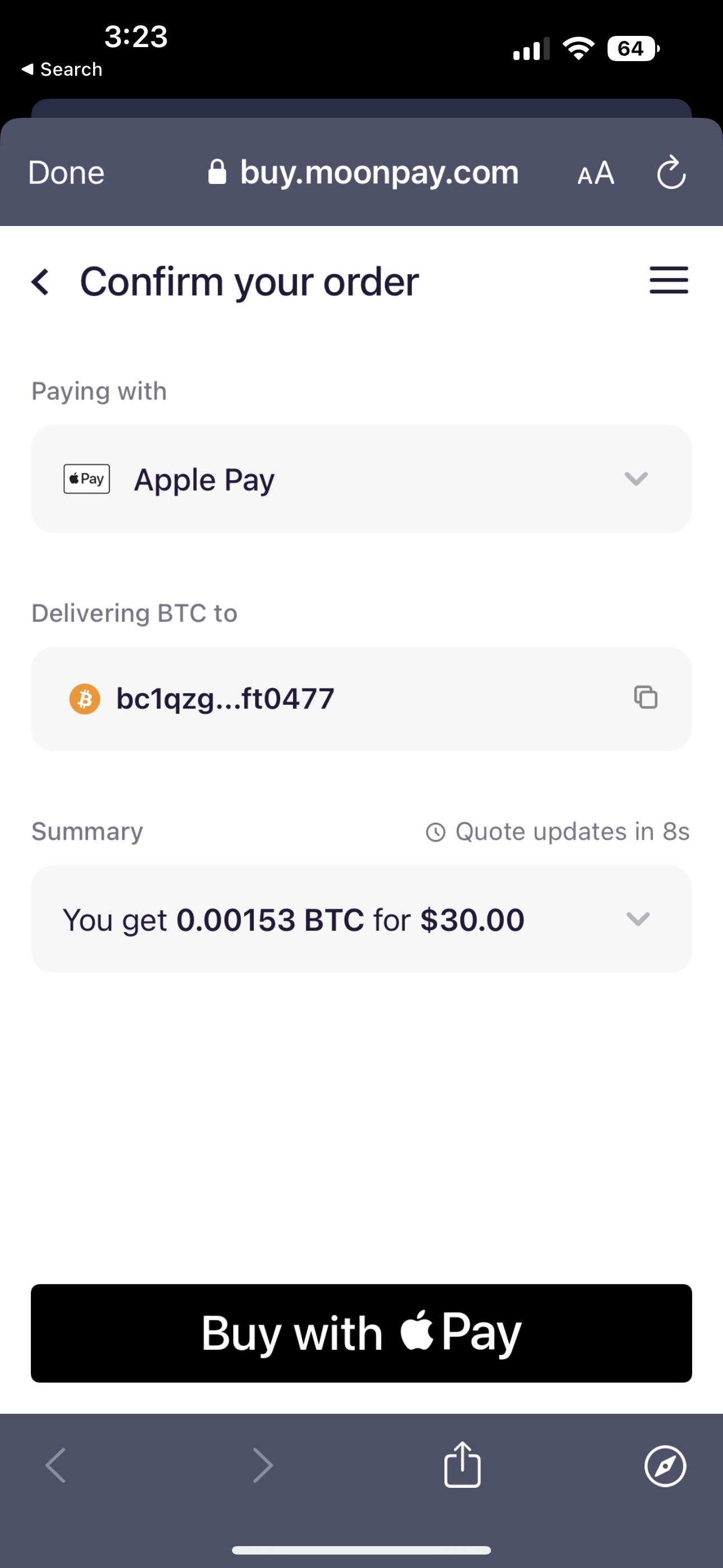

5) You will be presented with a selection of exchange rates and fees from different MetaMask partners. Select your preferred quote from one of MetaMask’s partners. You will be taken to a portal to complete the transaction using Apple Pay.

MetaMask charges & fees

MetaMask has integrations with Coinbase, Transak, Moonpay, and Wyre for buying crypto directly in-platform. Users are able to buy crypto using Apple Pay with all four. Fees will vary depending on which MetaMask partner users opt to purchase with. MetaMask charges a 0.875% fee on all cryptocurrency swaps.

Pros and cons of buying crypto using Apple Pay on MetaMask

| Pros | Cons |

| User friendly: Easy to set up and manage | Does not support Bitcoin (although users could convert their BTC to wrapped Bitcoin, an ERC-20 token compatible with the Ethereum blockchain) |

| The wallet supports multiple blockchains beyond Ethereum, including Binance’s BNB network, Polygon, Avalanche, and more. | Third party KYC requirements: MetaMask does not ask for any personal information to set up an account. However, if you want to purchase crypto via the MetaMask platform through one of MetaMask’s partners, such as MoonPay or Wyre, you must provide some personal information. |

| High fees and limited customer support |

7. Exodus

Exodus is a self-described web3 wallet. It allows users to receive, send, store, and buy bitcoin, other cryptocurrencies, and NFTs. The wallet comes in three forms: a browser extension, a mobile wallet, and a desktop wallet.

Like MetaMask, the wallet seamlessly integrates with a wide range of decentralized applications (DApps), including various DeFi protocols. Exodus is a non-custodial wallet, meaning users have sole access to and the responsibility of securely storing their private keys.

How to buy crypto using Apple Pay on Exodus?

1) Open the Exodus Wallet application on your iPhone. Press where it says “Buy Crypto.”

2) Select Apple Pay as your payment method.

3) Choose the currency you want to buy crypto with and the amount you want to buy. You will then instantly receive a quote exchange rate from one of Exodus’ partners. Press continue to jump to the partner’s website and complete the transaction.

4) Press “Buy with Apple Pay” once on the partner’s page to finalize the transaction.

Exodus charges & fees

Exodus doesn’t charge fees for buying cryptocurrency via its platform. Rather, the wallet provider connects its users to two third-party fiat-to-crypto payment processors, Ramp and MoonPay. Both of these crypto payment processors charge a fee, which may vary according to market conditions.

Pros and cons of buying crypto using Apple Pay on Exodus

| Pros | Cons |

| User-friendly and easy to get started | High card purchase fees paid to Exodus’ partners. Users buying crypto via Apple Pay in their Exodus wallet typically do not get competitive cryptocurrency exchange rates. |

| Compared to comparable web3 wallet services, Exodus provides high levels of customer support, available 24/7 | Setting up a wallet on Exodus does not require the user to enter any personal identification. However, buying crypto using Exodus partners Ramp and MoonPay will require the user to enter some personal information. |

| Users can only purchase up to $5,000 in crypto via Apple Pay per transaction/day. |

What is Apple Pay?

Cryptocurrency investors may be tempted to use Apple Pay for crypto purchases for speed, security, and convenience. A number of crypto trading/investing platforms offer highly simplified processes for using Apple Pay to purchase crypto. It can be a great option for those keen to gain crypto exposure in a stress-free, intuitive way.

Apple Pay and its rivals, such as Google Pay, which is used on non-Apple devices, have grown in popularity in recent years. The process is more streamlined than entering a physical bank card into a machine and then entering the pin. Physical bank cards are easily lost, and pins are easily forgotten.

Meanwhile, contactless physical bank cards introduce new risks. If an owner lost their physical bank card, anyone who finds it could immediately start spending the money on the card without knowing its pin. In contrast, Apple Pay introduces an additional security barrier (such as a pin or biometric test) prior to the approval of a transaction.

Should you buy Bitcoin using Apple Pay?

The likes of Coinbase, Crypto.com, BitPay, and MetaMask all offer users a convenient, fast way to buy crypto using Apply Pay. For small, infrequent crypto purchases, the higher fees associated with buying crypto using Apple Pay or any debit/credit card might not faze a beginner investor. It is much easier to pay an extra few dollars in fees than to have to go through the whole process of sending money to the crypto exchange/wallet platform via bank/crypto transfer.

The calculation changes as a user’s crypto investment intentions become more serious. For those wishing to invest significant sums in crypto, the best option would likely be to transfer money to a traditional exchange and then buy crypto using their exchange cash balance. These users will still be exposed to spread and maker-taker fees. But these fees are traditionally much lower than those associated with buying crypto directly via a bank card or Apple Pay. Overall, it’s important you weigh up each of these factors and choose a payment method that works best for you.