Bitcoin futures is a financial derivatives product that was first introduced in 2017. But what are Bitcoin futures, and how do they work? Here’s everything you need to know in 2025.

KEY TAKEAWAYS

► Bitcoin futures allow traders to speculate on the future price of Bitcoin without owning the actual asset.

► These futures contracts are primarily settled in cash and were first introduced by CME Group in 2017.

► Traders can take either long or short positions, allowing for potential profits in both rising and falling markets.

► Despite the advantages, trading BTC futures requires a deep understanding of market mechanics, technical skills, and often involves higher margin requirements.

What are Bitcoin futures?

Bitcoin futures involve two parties and a contract to buy or sell Bitcoin at a specific price at a future date.

In late 2017, the CME Group introduced Bitcoin futures contracts. The contracts traded on the Globex electronic trading platform and were settled in cash. Bitcoin futures are based on the CME CF Bitcoin Reference Rate.

Trading BTC futures does not involve actual Bitcoin. Since the futures are agreements that settle financially in cash, no Bitcoin is actually involved. Just as in other futures contracts, you predict the price of BTC and do not buy or sell the underlying cryptocurrency asset itself.

You can take a long position if you anticipate an increase in the Bitcoin price, or if you are holding Bitcoin, take a short position to reduce the risk of probable losses.

The price of a Bitcoin futures contract is broadly proportional to the price of Bitcoin. Trading Bitcoin futures is, therefore, an alternative to spot trading, which involves the actual buying or selling of crypto.

Spot trading only offers fundamental trade orders like buying low and selling high. Traders tend to make a profit during a market pump. On the other hand, trading futures offers many benefits, including low spreads and access to leverage during bull and bear markets.

Some futures contracts require physical delivery of assets involved, while others are done in cash. Most CEXs settle contracts in stablecoins or other cryptocurrencies.

How do futures contracts work?

Future contracts often feature two leading traders, usually called hedgers and speculators. Hedgers are interested in the underlying asset, and they seek to hedge out the risk of price changes, while speculators do not have any practical use of the assets pegged to the futures contract. Instead, these people speculate and buy futures to sell them later with profit to interested parties.

Say a farmer would like to sell a large volume of corn at the next harvest. Although the corn has not been produced yet, the farmer wants to ensure that a proper price is paid for it in the future.

A buyer is looking for corn from the next crop. They are willing to pay the current market price for it or something similar. In this case, the seller and the buyer can form a futures contract at a specific price. This will protect both the seller and the buyer against volatile price movements.

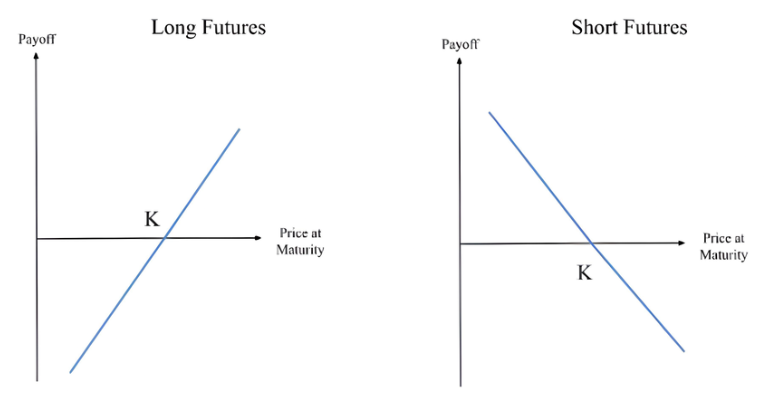

In a futures contract, you can enter a long or short position.

- Long is when a party promises to buy the asset at a specific date and a certain time.

- Short is when a party aims to sell the asset at a specific date and price.

Types of Bitcoin futures

There are several types of Bitcoin futures markets today, and different platforms offer different derivatives trading. The most common products are standard futures contracts and perpetual contracts.

These two are the popular derivatives usually traded in the investment space today. However, these two have distinct features, and you must clearly understand them before putting your money in them.

Futures contracts vs. perpetual contracts

| Futures contracts | Perpetual contracts |

|---|---|

| Agreed upon expiry date | No expiry date |

| Do not require price synchronization | Use a funding rate mechanism |

| Price naturally converges with the spot price | Moves from the spot price during volatile periods |

Bitcoin perpetual swaps do not have an expiry date set for the contract. It is basically infinite; there’s no end. On the other hand, futures contracts for Bitcoin have an agreed-upon expiration date. So, there’s a period to honor the agreement. This typically takes up to a month or more.

Since perpetual swaps don’t have expiration dates, exchanges use a price-syncing system called the funding rate mechanism. This mechanism stabilizes the short and long positions of perpetual swaps by either adding or subtracting trades. It is more like a fee that helps maintain the short and long positions of the perpetual contracts.

Another notable feature of perpetual swaps is that they typically keep a track record of the spot market, which might be attractive to crypto traders. However, volatility is the major risk attached to this. As a result, the price of a perpetual swaps contract tends to move away from the spot price during market volatility.

Similar to Bitcoin futures, in a perpetual swap, there’s a constant elimination of re-establishing long and short positions. This process ensures the perpetual price converges with the spot price by an exchange of coin swaps between traders in long and short positions.

There is no need to maintain a price sync with Bitcoin futures since the terms of the contract and the asset involved automatically converge as the expiration date appears.

How do Bitcoin futures work?

Let’s say we purchase Bitcoin at a $40,000 futures contract, to be settled two months out.

Our futures contract obligates us to purchase $40,000 in Bitcoin in two months. If the price is then trading at $50,000, we have made a $10,000 profit per share. But if it has dropped to $30,000 by that time, we must still purchase it at $40,000, effectively losing $10,000 per position.

If we believe the price will drop, we could sell at a $40.000 futures contract under the same conditions. This means that if Bitcoin has fallen to $30.000 by the expiry date, we can still sell for $40.000, thus making a $10.000 profit. The reverse applies: Bitcoin should be above $40.000 at expiry.

To accept this obligation, we put up some money, which is called a “margin.” Margin is the least collateral you must have in your account to execute trades. The more money you put into the trade, the higher the margin an exchange would need to complete a trade.

Usually, the margin is between 5% and 15% of the value of the underlying asset, so let’s take 5%, for example. We buy a futures contract for $1000 x $40,000. The value of these positions would be $40 million, but we only put up 5% of the contract.

Leverage

The higher the leverage, the more exposed you are to high profit or loss. Furthermore, the amount you can trade depends on the margin amount available to you. Binance, for example, offers leverage of about 125 times the trading amount. Leverage determines the level of volatility for your trade.

Pros and cons of Bitcoin futures

Trading Bitcoin futures has many advantages and disadvantages. For experienced crypto traders, trading futures can be highly profitable. However, there are a number of risks attached. Here’s a quick summary of the pros and cons.

| Pros | Cons |

|---|---|

| Regulated | More technical |

| More flexible than trading BTC | High investment requirements |

| Leverage increases profits |

Pro: Regulation

One major edge benefit of Bitcoin is that it is regulated by the Commodity Futures Trading Commission (CFTC). This might be a turn-off for those who invest in crypto; however, it is a huge plus for Bitcoin enthusiasts. The good news is that CFTC regulation isn’t as strict as regulation of other investments like stocks and bonds.

These regulations introduce a guide that controls the contract and allows both speculators and investors in the futures contracts to comply. The rules are crystal clear, and the consequences of breaking them are presented well in advance.

Pro: Flexibility

Another massive benefit of trading Bitcoin futures is that you’re actually not trading Bitcoin itself. Thus, you do not need to have a wallet or provide any physical or underlying asset to exchange Bitcoin. This completely erases the risk of holding Bitcoin, which increases and reduces in price at any given time.

Pro: Trading with leveraged positions increases profits

Most platforms offering Bitcoin futures provide what is called position limits and leverage to increase the chances of you making a profit.

Binance, the largest crypto exchange by trading volume, has an adjustable position limit toggle feature that allows you to manually reconfigure position limits based on past trading history and margin amounts. The platform also offers up to 125x trading leverage.

Con: Highly technical

Trading Bitcoin futures requires a substantial level of technical skills. You need to understand how the crypto market works, study several market predictions, and have a solid trading plan. Essentially, futures are speculative, but it is possible to utilize helpful market info from professionals.

Con: High investor requirements

As much as Bitcoin futures ease the process of making money on the market, they’re not accessible to everyone. While you can start with a low amount on centralized exchanges like Binance, future trading requires about 50% marginal security.

This is quite expensive for regular traders, especially when compared with a 10% margin for other assets. These requirements discourage many crypto investors from participating.

Relationship between Bitcoin futures and Bitcoin price

Ultimately, BTC future contracts should track the price of Bitcoin. However, the price might vary throughout its settlement date. As a result, Bitcoin futures contracts can impact BTC’s spot price.

This is usually caused by rapid fluctuations in volatility. Supply and demand issues for Bitcoin can lead to spreads widening or shrinking in the Bitcoin futures contracts.

Other price changes include what’s known as “gaps.” These are periods where no trading is happening, so there’s no pricing data for those time gaps. They are only on traditional platforms like CME because they have certain trading hours, unlike the broader crypto market, which trades 24/7.

Where can you trade Bitcoin futures?

| Platforms | Platform | Futures type | Settlement | Fees |

|---|---|---|---|---|

| CBOE | Derivatives exchange | Traditional | Cash | Depends |

| CME | Derivatives exchange | Traditional | Cash | $1.25 per contract |

| OKX | CEX | Perpetual | Crypto | 0.14%/0.23% |

| Binance | CEX | Perpetual | Crypto | 0.02%/0.05% |

| Bybit | CEX | Perpetual | Crypto | 0.02%/0.055% |

Whether you’re looking for a seamless, regulated, or centralized exchange, many platforms offer access to trade Bitcoin futures.

- CBOE: The Cboe Global Markets (CBOE) was the first U.S.-based exchange to offer Bitcoin futures contracts. It started offering the product on Dec. 10, 2017. CME followed a week later.

- CME: This is another platform that offers access to trade Bitcoin futures. It implements the Bitcoin Reference Rate, the volume-weighted average price for Bitcoin sourced from multiple exchanges, and is usually calculated daily between 3 pm and 4 pm.

- OKX: This is one of the most popular platforms offering seamless access to trade futures.

- Binance: Binance, the biggest crypto exchange, also allows traders to trade futures, offering many attractive features, including leverage of 125x the Margin.

- Bybit: Bybit offers margin and futures trading at up to 100x leverage. Its users can get 100x leverage on Bitcoin and 50x leverage on other crypto assets.

Is Bitcoin futures a good move for you?

Bitcoin futures offer a great way to gain exposure to BTC without directly holding the asset. However, trading futures carries significant risk and should be considered with caution, especially trading with leverage. If you decide to trade BTC futures, ensure you understand the process completely. Never invest or risk more than you can afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.