Crypto mining is a tricky business. Mining hardware costs, data regulations, tax incentives—these factors can give even the most seasoned miner a headache. That’s why choosing the best countries for crypto mining isn’t just about following a map to the lowest electricity rates; it’s about planting roots in the right soil. In this guide, we will highlight some of the prime destinations that will check the key boxes for miners in 2024.

Top countries to mine crypto currency in 2024

Iceland

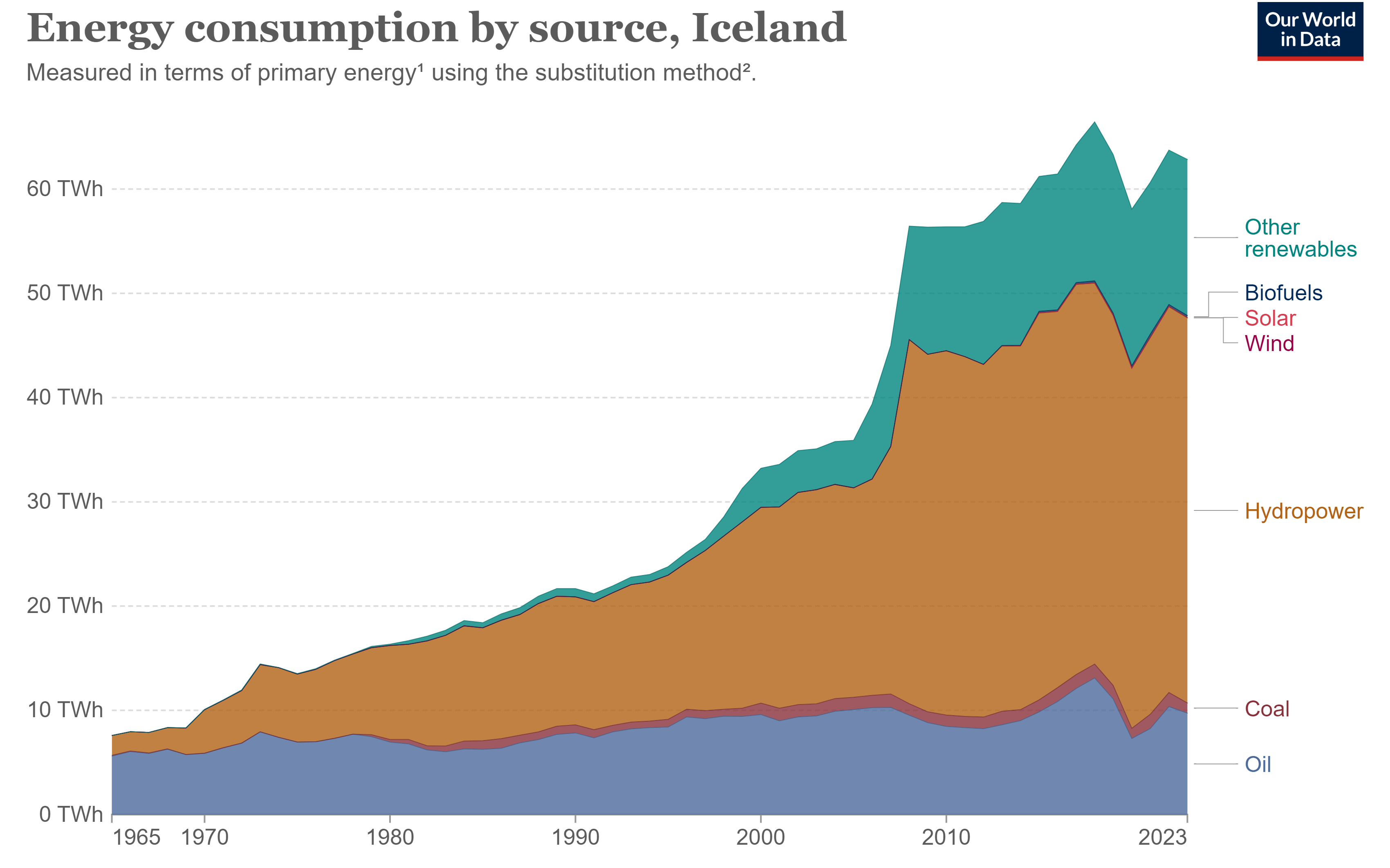

Iceland has long established itself as a premier spot for crypto mining. The country uses mostly renewable energy sources, which is good for the environment. All that natural geothermal and hydro energy just spurting out of the land provides affordable and sustainable energy to power the intensive mining process.

The chilly climate also air conditions all that hot mining hardware for free—no need to blast AC and rack up a giant electricity bill. Between sustainable power access, built-in cooling, and low electricity costs, Iceland’s got the cost side nailed.

Furthermore, the Iceland government is all-in on crypto mining. The country has stable crypto regulation to support the industry. This red carpet treatment makes companies feel confident staking a claim there. No surprise mining heavyweights are increasingly investing in sophisticated mining halls across the frosty land.

Apart from environmental factors and a crypto-friendly government, the nation also offers an impressive technological infrastructure and skilled workforce that facilitates the growth of the mining sector.

The United States

The past few years have been big for the United States regarding mining, with several crypto mining companies setting up shops in the country. mostly due to an abundance of landmass. You should also remember that cryptocurrencies are prominent in the United States. Ergo, the country is a great choice for when it’s time to sell Bitcoins you mined.

Currently, the United States is ranked among the most profitable countries where you can still mine cryptocurrency. According to some estimates, the average cost to mine one BTC in the U.S. is around $11,000.

However, the cost usually varies from state to state. There are a couple of reasons for this. They include the landmass available, the weather conditions, the availability of hydropower, and the electricity costs (which also vary between states).

Washington state leads the nation in hydroelectricity, with about 1,233 dams in the state alone. About 80 percent of the electricity generated in this state is renewable. So, it’s no surprise that it’s the cheapest state to mine. The government might not have laws concerning crypto mining just yet, but it’s obvious that the activity is here to stay.

Republic of Georgia

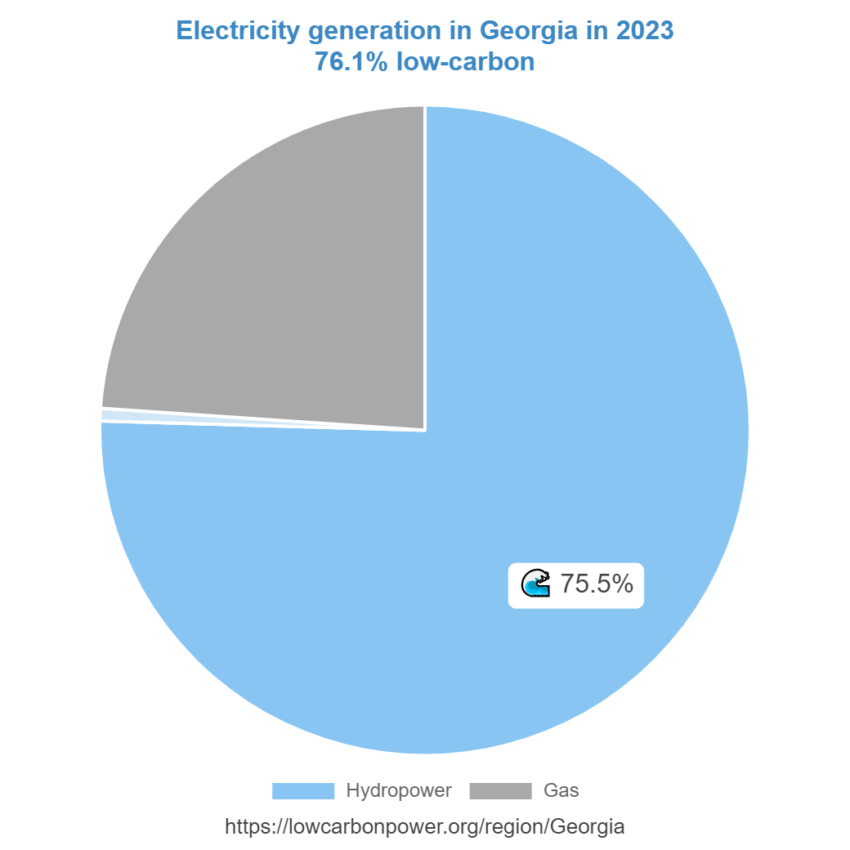

Georgia has one of the lowest costs to mine Bitcoin. For eco-conscious miners, Georgia remains an appealing location as the country sources over 75% of its energy from hydropower dams. Just 23.9% derives from fossil fuels like coal and natural gas, according to data sourced from Ember via LowCarbonPower.

On top of clean energy access, Georgia also provides relatively affordable utility rates at about $0.094 per kilowatt-hour. This competitive electricity pricing attracts mining farms to tap into the country’s abundant hydropower grid.

Additionally, Georgia is a crypto-friendly country. The regulatory framework is currently, by and large, favorable for miners. The National Bank of Georgia oversees crypto taxation, and mining companies are required to obtain licenses before setting up shop.

With plentiful hydroelectric energy supplies and receptive governmental policies, Georgia has surfaced as a mining gem for both profit-focused and sustainability-minded operators. For Bitcoin extracted via clean dams rather than dirty fuels, Georgia checks critical boxes.

Iran

Iran might be on the brink of an economic and political crisis, but its crypto mining is still very strong. Concerning regulations, Bitcoin mining is legal, and the Iranian government officially recognizes it as an industrial activity.

Iran has also been a major flourishing ground for mining, as miners worldwide have moved in there partially because of the country’s cheap electricity rates. Households pay about $0.01 per kilowatt-hour in the Middle Eastern country.

These affordable rates and the increase in miners migrating to Iran have seen the country’s energy demand jump. This prompted the government to create a new price model for mining facilities and a new consumption threshold for miners. Notwithstanding, Iran is still one of the best countries to mine cryptocurrency.

Russia

After China’s crypto mining ban, Russia seized the global stage to emerge as one of the world’s largest mining destinations. It now wields over 2 gigawatts of capacity, second only to the 3-5 gigawatts of the United States. This mining rise defied restrictive Russian cryptocurrency laws barring crypto payments.

Now in 2024, Russia’s State Duma moves to formally legislate the swelling crypto mining sector by half-year’s end. For those out of the loop, the State Duma is the lower house of the country’s Federal Assembly.

This regulatory shepherding acknowledges the industry’s growth. Regional mining hubs like the resource-rich Far East also advocate for miner-friendly energy tariffs.

The government’s policy on mining aligns with its broader strategy to leverage cryptocurrencies for international transactions, especially with pro-Russian states. This is partly driven by Russia’s exclusion from the international SWIFT payment system due to the war in Ukraine.

So while ordinary Russians still cannot legally buy goods with Bitcoin, the state selectively tapped crypto’s transactional power for its own interests. Whether clandestinely evading sanctions or prospecting for minerals, Russia is signaling stepped-up support for crypto mining.

Key factors while choosing a crypto mining location

When you are prospecting for the hottest crypto mining locations, three crucial factors separate prime destinations from the rest:

- profitability

- climate

- market prominence

Profitability

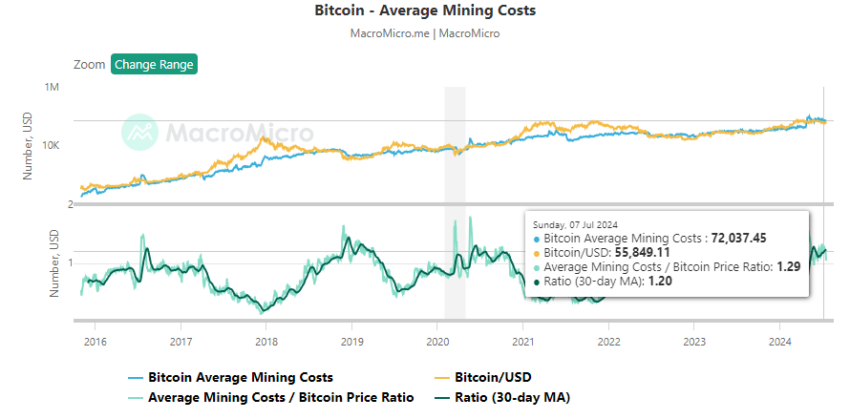

Keeping mining operations lucrative means relentlessly hunting lower utility costs. Electricity eats the biggest chunk of budgets. This makes it increasingly difficult to turn a profit, depending on your location.

However, because Bitcoin miners are competing in a very commoditized global business, they inherently require extremely cheap electricity and therefore can’t compete with normal users of electricity. As a result, Bitcoin miners seek out inefficiencies around the world where electricity is being underutilized, wasted, and thrown away nearly for free.

Lyn Alden, Investment manager: Broken Money

Some of the other mining costs include equipment, startup capital (loans), and maintenance, which can all increase with time. Because of that, countries like Iceland have emerged as cheap power havens ideal for cushioning profit margins.

Climate

Crypto mining rigs usually produce substantial heat. This heat is a byproduct of the intensive computational operations involved in mining. To prevent overheating, cooling systems are vital infrastructure for mining facilities. Options include fans or more advanced liquid immersion cooling set-ups.

Yet quality cooling tech comes at a steep price. Naturally, cold regions have an edge in this aspect as they offer free “air conditioning” for mining hardware. Operators can slash cooling costs by huge margins by simply setting up operations in chilly climates. They can also avoid expensive immersion rigs by leveraging the brisk ambient air. This allows more megawatts to channel directly into mining rather than cooling systems. The cold converts into coins.

Market prominence

Apart from rock-bottom power bills, the ideal crypto-mining setup needs governmental support and a friendly regulatory framework. Scan for regions with crypto-friendly legislation, incentives, and active mining communities. Places that roll out the blockchain red carpet attract talent, investment, and additional infrastructure far beyond just inexpensive energy.

Put simply, you should conduct due diligence before digging in. Experienced miners usually evaluate locales through the dual lens of profitability and market strength. Places that substantially check both boxes offer the bedrock to build for the long term. Rather than chasing quick hits, miners who plant roots in the proverbial fertile soil can extract value for years to come.

Crypto mining is a dynamic industry, so plan accordingly

While countries like Iceland and the Republic of Georgia are top choices because of renewable energy sources, countries like the U.S., Russia, and Iran make up some of the best countries for crypto mining because of their profitability.

In addition to renewable energy sources and mining profitability, some of these top choices also have lower energy costs, favorable mining regulations, and good internet connectivity.

Remember, today’s best spots might be tomorrow’s old news. So, keep your ear to the ground and your eyes on the broader crypto space’s ever-changing horizon. Staying informed and adapting to the fast-changing crypto mining market will allow you to navigate the best countries.

Frequently asked questions

What is the main risk of mining cryptocurrency?

What are the crypto mining costs in the United States in 2024?

What unique advantage does Venezuela offer for Bitcoin mining?

Why is Iran an attractive location for cryptocurrency mining?

Is Bitcoin legal in Kuwait?

What challenges do miners face in Iceland, despite its favorable conditions?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.