Artificial intelligence (AI) is becoming more prevalent in our day-to-day lives. From Alexa helping to keep track of your shopping list to using AI bots for customer service, there’s no doubt that AI is here to stay. Now that we are used to smart home assistants like Siri and Cortana, it’s easy to see how quickly this technology has grown over the past few years.

Investors could possibly gain a lot from investing in these businesses. Here, we offer an overview of AI and list nine of the best artificial intelligence stocks.

What is artificial intelligence?

Artificial intelligence (AI) is a form of computer technology that allows machines to mimic human thinking and problem-solving. It can be used to automate tasks, such as identifying security threats in images or creating custom music playlists based on a user’s preferences.

With machine learning, AI can adjust based on new information it collects over time. For example, an AI system could use machine learning to identify objects in an image after being shown thousands of pictures.

The benefits of artificial intelligence are broad-ranging. For example, It has the potential to reduce labor costs by automating repetitive tasks, improving efficiency, increasing productivity, and modernizing industries like healthcare, manufacturing, and transportation.

However, there are also risks when it comes to artificial intelligence. It may lead some people out of work due to automation. Furthermore, it may cause other issues involving privacy protection and cybersecurity if not correctly handled by businesses using the technology.

Top 9 artificial intelligence stocks to invest in 2026

The following is a list of nine companies that are working with AI technology.

1. Nvidia (NVDA)

Available on:

*

Disclaimer

Your capital is at risk.

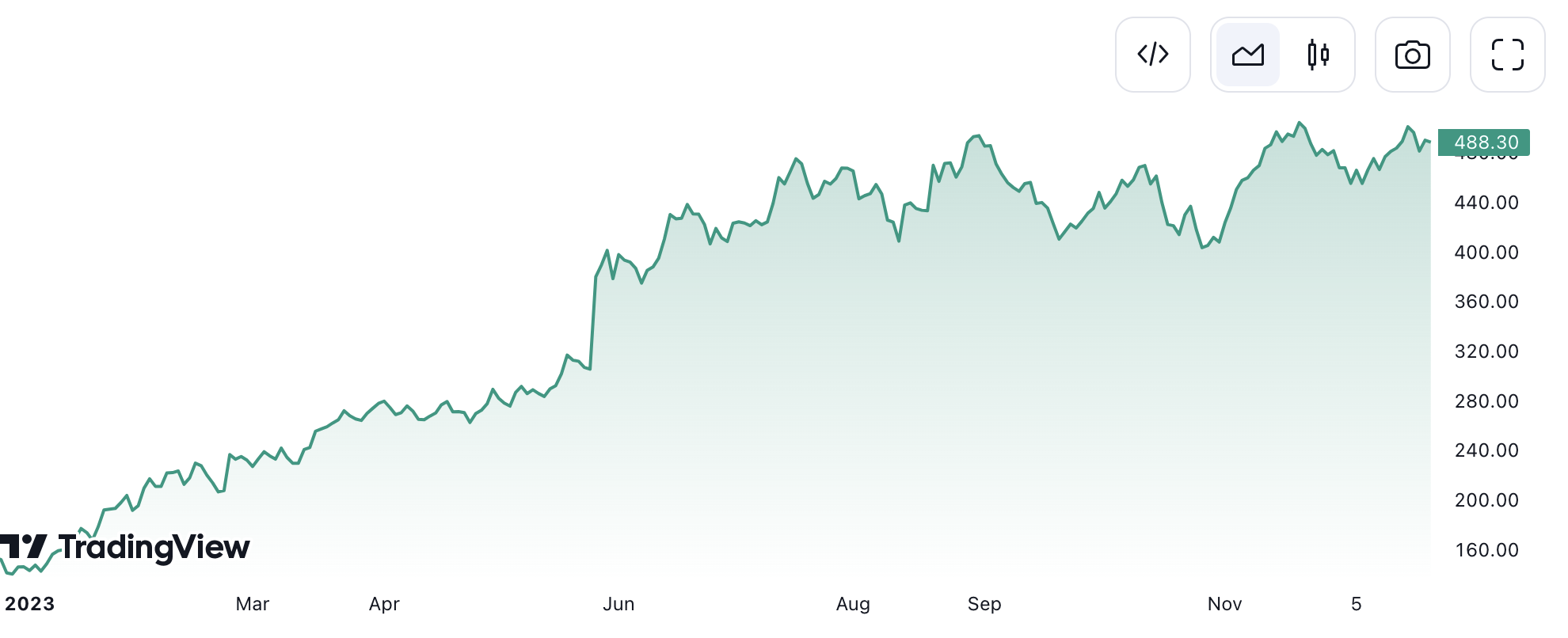

The stock performance chart for Nvidia Corporation (NVDA) illustrates a period of significant growth starting from March 2023. Initially, the stock is noted at a price of $234.36. As the year progresses, there’s a clear upward trajectory in the stock’s value.

Despite the usual market fluctuations, the overall trend remains positive, culminating in a price of $488.30 by early December 2023. This near doubling in the stock price reflects Nvidia’s strong market performance during this timeframe. Moreover, Nvidia is a graphics chip giant that has heavily invested in the AI market for years.

“The pace of progress in artificial intelligence (I’m not referring to narrow AI) is incredibly fast. Unless you have direct exposure to groups like Deepmind, you have no idea how fast—it is growing at a pace close to exponential. The risk of something seriously dangerous happening is in the five-year time frame. 10 years at most.”

Elon Musk: Forbes

The main reason why Nvidia stock might be good for investment is because of its extensive intellectual property. For instance, its portfolio is around silicon architectures, machine learning frameworks, and software development tools.

2. International Business Machine (IBM)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

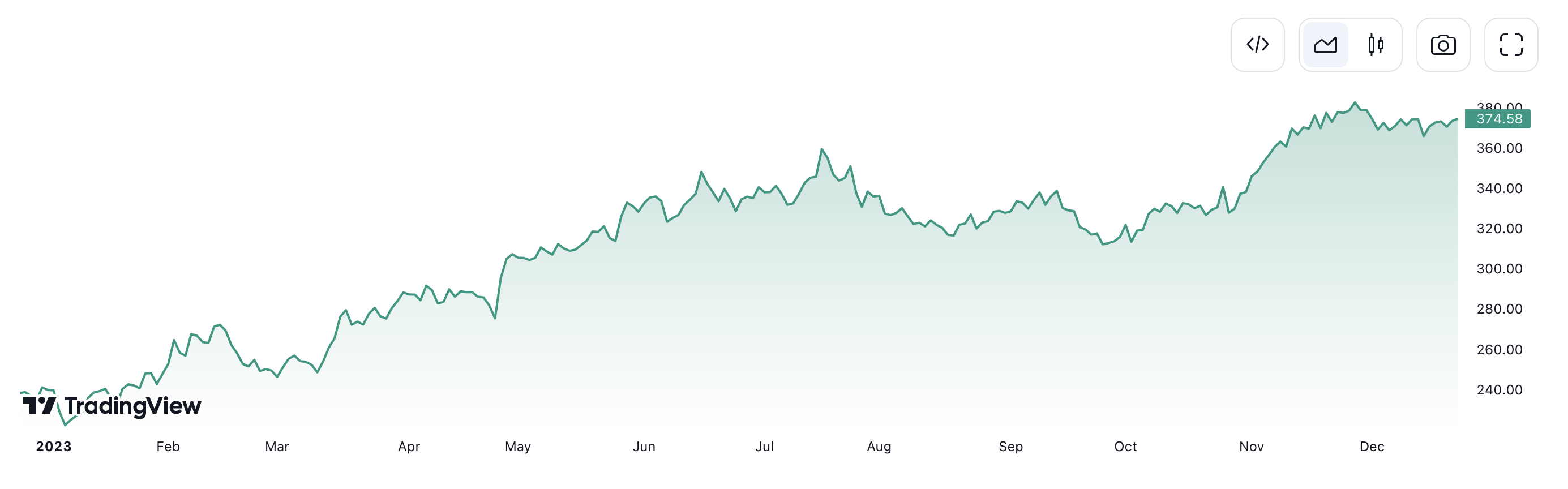

The stock price chart for IBM indicates a dynamic year in 2023. Starting in March, the stock experienced fluctuations characterized by both dips and recoveries. However, moving through the year, IBM’s stock price climbed upward.

Especially from April onwards, there was a notable ascent, reflecting a period of positive momentum for the company.

IBM has been in business since 1911, and it’s now one of the most respected technology companies in the world. The company is known for its high-quality hardware, software, and services and its contributions to AI research.

Furthermore, AI can suggest treatments based on patient health history rather than just providing treatment options based on their symptoms alone.

3. Amazon (AMZN)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

In 2023, Amazon’s stock price consistently ascended, as indicated by the prevalence of green candlesticks on the chart. While red candlesticks show some market volatility, the overall trend was positive, with increased trading volume hinting at growing investor interest. The stock peaked at $153.42, reflecting robust confidence in Amazon’s market performance.

Amazon’s offerings include Amazon Web Services (AWS). This cloud computing platform provides data storage, database services, analytics, and other functionality for large companies like Netflix and Spotify. It also offers on-demand web services such as content delivery network (CDN) storage and elastic load balancing service (ELB).

Amazon uses AI in its Alexa virtual assistant that can be used with its Amazon Echo home products. Another area where Amazon utilizes AI is in its advanced text analytics services offered through AWS Machine Learning. Its Lex software development kit (SDK) also offers chatbot creation services.

4. Microsoft Corporation (MSFT)

Available on:

*Your capital is at risk.

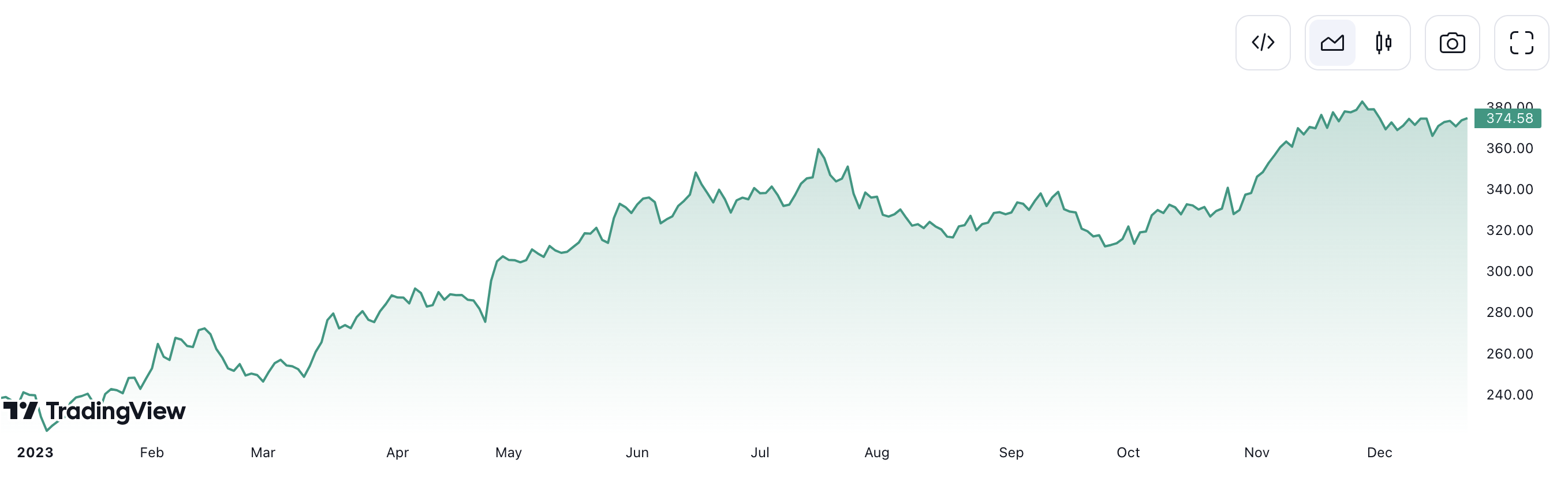

Microsoft Corporation’s (MSFT) stock closed at 374.58 USD, slightly rising after-hours to 375.05 USD. Additionally, Microsoft boasts a robust market cap of 2.784 trillion USD, a PE ratio of 36.23, and an EPS of 10.34. The stock’s 52-week range is 219.35 – 384.30 USD, with an upcoming earnings date in late January 2024. Investors note a forward dividend yield of 0.80% and a 1-year target estimate of 369.13 USD for MSFT shares.

Microsoft Corp. is one of the largest companies in the world, and it has been at the forefront of using AI for health, humanitarian, and cultural problems.

In 2019, the company announced a new supercomputer with an investment worth $1 billion, hosted on Azure, its cloud computing software. The supercomputer is intended to help developers and organizations run AI apps.

Microsoft has also collaborated with TikTok’s parent company, ByteDance, for a project known as KubeRay. This project will help companies run AI apps more efficiently as a free, open-source container management system.

5. Alphabet (GOOGL)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Alphabet’s market cap stands at 1.765 trillion USD as of Dec. 25, 2023, and is supported by a PE ratio of 27.34 and EPS of 5.22. Spanning a 52-week range of 85.57 to 143.25 USD, Alphabet does not offer a dividend yield currently, with analysts setting a 1-year target estimate at 132.50 USD.

Importantly, Alphabet Inc. is one of the most promising companies in the world of artificial intelligence. It’s one of the first companies to focus on machine learning and has used AI for ad pricing, filtering Gmail spam, and content promotion.

Alphabet Inc.’s stock price has increased 131% in five years. This price increase is because of the company’s commitment to AI research and development. It includes major projects such as Waymo, an automation vehicle company, and DeepMind.

As part of the DeepMind project, researchers and engineers have developed versatile learning algorithms that companies can use in neuroscience and machine learning.

6. Meta Platforms (META)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Meta Platforms Inc. (META) has experienced significant gains, with a year-to-date increase of 187.73%. Meta’s performance reflects robust long-term growth, boasting a 740.40% rise since its inception. The company’s market cap is nearly 910 billion USD, with a PE ratio of 31.16 and EPS of 11.34, while analysts project a 1-year target estimate at 338.84 USD.

The parent company of Facebook, Meta Platforms Inc., has increased its focus on virtual reality products. This is just one example of how they are applying AI technology to create a world where users can interact in a digital environment. They call this world “Metaverse.”

Meta leverages artificial intelligence in its ad algorithms and content feeds to enhance user engagement. Additionally, the company employs AI to identify and trace the origins of deepfakes, utilizing reverse engineering techniques and object recognition within videos, ensuring authenticity through advanced neural network technology.

7. C3 AI (AI)

Available on:

The stock has surged 162.71% over the past year. Long-term performance shows a 71.26% decrease over five years, aligning with its lifetime trend. C3.ai’s market valuation is currently 3.526 billion USD, with a future stock price target of 26.42 USD.

C3 AI is an AI software provider that develops AI algorithms to help organizations with their operations. It is based in California and offers CRM solutions to government organizations worldwide.

As a result of their experience, the Department of Defense signed a $500 million contract with C3 AI for five years. It serves 14 industries, including manufacturing, life sciences, financial services, agriculture, and health care.

8. SentinelOne (S)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

In 2023, SentinelOne, Inc. demonstrated significant financial and industry success, with a year-over-year revenue increase of 70% in the first quarter and an impressive 106% growth by the third quarter. The company exceeded top and bottom-line growth expectations, underscoring its solid execution and market position. Furthermore, SentinelOne’s product excellence was acknowledged through consecutive wins in the 2023 CRN Products of the Year Awards for cloud security and endpoint protection.

SentinelOne is a cybersecurity company, but it is not just any old cybersecurity company. It offers both cloud-native cybersecurity and on-premise for companies.

SentinelOne’s AI is used in healthcare, finance, and automotive areas by its biggest clients, Electronic Arts (EA), Autodesk, and Sysco Corporation (SYY).

9. Palantir Technologies (PLTR)

Available on:

*

Disclaimer

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. BeInNews Academy is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Palantir Technologies Inc. experienced a landmark year in 2023, with its shares climbing sharply by nearly 20% after reporting the highest profit in its two decades of operation. Amidst the AI industry’s surge, Palantir’s year-to-date stock value soared by 169%, while its Q3 revenue grew by 17% to over $558 million, surpassing market estimates and cementing its status in the data analytics and AI sector.

Peter Thiel founded Palantir, a data analytics firm, in 2003. The company specializes in data mining and leverages big data for private companies and the government. The company provides analytics and insight for a wide range of clients. It also partners with Dewpoint Therapeutics, a biotech firm for drug discovery.

Palantir is a hotbed of artificial intelligence, and it’s not just because its name sounds like the word “palladium.” The company provides analytics and insight to many clients, including the CIA and other government agencies.

The company’s Gotham platform mines for the government, while Foundry mines data for enterprise clients. Interestingly, Palantir also manages Apollo, which utilizes AI for space exploration. In fact, Apollo Edge AI has AI software, PLTRS Meta-constellation technology, for expanding satellite constellation and launching AI in space.

Artificial intelligence stocks could pay off greatly

The AI industry is very early in its life and has plenty of potential for growth. The biggest companies on the planet are using the technology in their products. As more funding enters and more breakthroughs occur, the growth of artificial intelligence stocks will only accelerate.

The list we have described above is a good place to start if you want to invest in AI stocks. Expect a lot more growth in this field in the years to come.