Developments in the mushrooming decentralized finance environment are coming thick and fast. Industry leader Compound has made more adjustments to its governance mechanism protocols and demonstrated the success of the new system. Meanwhile, Aave’s LEND token is ballooning but could start to see a selloff.

Today marks another all-time high for DeFi total value locked (TVL) as the figure touches $2.57 billion for the first time. The steep curve, which began around mid-June, appears to be flattening as the industry’s monumental growth starts to slow down slightly.

At its current rate of growth, however, the milestone $3 billion level is likely to be reached by next month. Crypto markets themselves are still relatively flat, with minimal action from most major coins and tokens. Total market capitalization has dropped back below $270 billion and all eyes remain on the booming DeFi sector.

Compound Governance Succesful

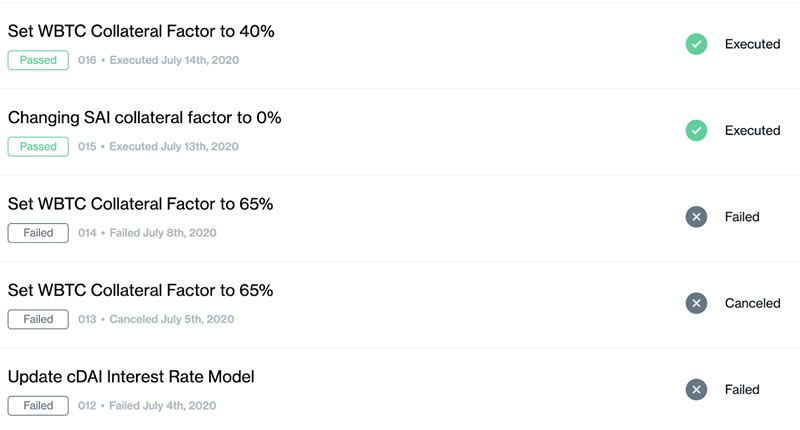

Leading DeFi protocol Compound Finance has released five new proposals through its governance system this month according to a recent blog post. Two were passed, two failed, and one was canceled.

The democratized voting system was brought about with the launch of the protocol’s COMP tokens on June 15. This enabled token holders to participate in voting on governance issues.

The first proposal, which failed to go through, was submitted by Dharma, an open-source lending and savings account built on the Compound protocol. The submission proposed three changes to the cDai interest rate model. cDai is Compound’s native tokenized version of Dai.

Dharma proposed to increase the supply annual percentage yield (APY) from 15% to 25% at 100% utilization while tweaking a few utilization rates. Around 80% of the 672,099 votes were against this proposal.

The second, proposed on July 5 from Alameda Research, was canceled. This sought to increase the wrapped Bitcoin (wBTC) collateral factor from 0% to 65%, allowing users to supply wBTC as collateral to borrow other assets from the protocol. Alamanda’s delegated COMP fell below the threshold of 100k votes which resulted in the annulment of the proposal.

Alamanda made a second, similar proposal a few days later. However, this also failed due to concerns that manipulative wBTC minting would create systemic risks for the protocol. This one was voted down by 65% of delegates.

Of the two proposals that were passed, the protocol involving the depreciation Sai by reducing its collateral factor from 35% to 0% was unanimously voted in. Sai is the single collateral version of Dai that replaced the multi-collateral version in November 2019.

The fifth proposal, submitted on July 14, was a close call. Alameda passed a proposal for a wBTC collateral factor of 40%. This one passed by a whisker, with just 50.47% on the approval side. There was support for taking the collateral factor to a higher 65%, but this level was considered a good middle ground for the community to get comfortable with using wrapped Bitcoin as collateral for borrowing.

The five proposals have demonstrated the success of the new governance system based on holdings of COMP tokens. Those that hold the most have a bigger say which works in their favor as they are unlikely to propose anything that is detrimental to the system, and in turn, their own investments.

Curv Supply Integrated

Compound, which kicked off this DeFi bubble, has also recently been integrated into institutional custodian, Curv (not to be confused with DEX liquidity pool Curve).

Curv uses multi-party computation (MPC) to remove single points of failure in public-key cryptography for better digital asset security.

Earlier this month the project announced a successful Series A fundraising round from investors including Coinbase Ventures, Digital Currency Group, and Team8. The announcement stated;

Curv has integrated Compound’s supply functionality so their institutional clients can earn interest on crypto from the safety of custody. The initial integration will support ETH, with other assets and borrowing being added in the near future.

In addition to Curv, San Francisco-based crypto exchange OKCoin has released a price oracle that allows any DeFi platform to use the exchange’s price data in their own markets. Compound CEO, Robert Leshner, was pleased with the development, adding;

Having a reliable feed for on-chain price data is critical for DeFi growth and use of Compound. This effort from OKCoin is an important contribution to the decentralized finance ecosystem.

Compound is still ranked king of the DeFi-scape with a reported TVL a touch below its all-time high of $700 million, making up a 27% market share. The protocol’s COMP tokens are currently trading at $155 according to Uniswap.info, having pulled back around 52% from its peak a week after launching last month.

LEND Hits ATH, But Selloff

In a related DeFi development, on-chain statistics are starting to show that long-time holders are selling Aave’s LEND token. In her latest Defiant newsletter, industry insider Camila Russo delved into the details on LEND’s epic run this year.

Since the beginning of this year, LEND has surged more than 1,000% against Ethereum to reach its all-time high today of 0.0013 LEND/ETH. It has been one of the best performing crypto assets of 2020 with a price chart that looks similar to Ethereum from late 2017.

TVL on the platform is also at its highest ever level at $231 million, propelling it to fourth place in the DeFi charts according to DeFi Pulse. Ongoing development, large VC investments, and a highly anticipated protocol upgrade that will grant governance rights to stakers, similar to Kyber’s recently deployed Katalyst upgrade, is driving momentum for Aave.

According to the on-chain data, large transactions have surged as expected, hitting an all-time high of $26 million on June 18, but have since dropped despite the increase in token price. Generally, active addresses with a balance tend to rise with price, however, this has not been the case with LEND, as the number of holders is dropping. The report, citing data from IntoTheBlock, concluded;

This is a clear indication of holders realizing profits by selling their LEND tokens. The amount of LEND tokens held for over a year has dropped by 42%, pointing to large players with long-term positions selling as price spikes.

It appears that the current rally could be overextended. As we have seen with countless other crypto assets, hitting all-time highs day after day is unsustainable, and what goes up in a parabolic curve, must come down at some point.