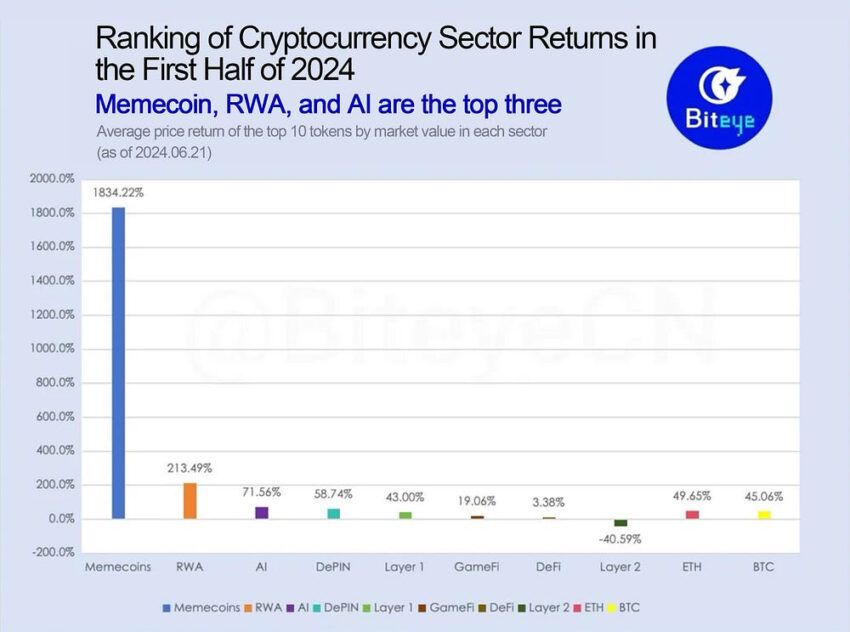

As the end of the first half of 2024 approaches, three narratives lead the profitability surge – meme coins, real-world assets (RWA), and artificial intelligence (AI). Meme coins have recorded the highest profitability, marking a pivotal shift in crypto dynamics and investor preferences.

As the year progresses, some investors might prefer to monitor these sectors closely to find further breakouts.

Meme Coins Record Over 1,800% Gains in the First Half of 2024

In the first half of 2024, meme coins exploded in profitability, achieving an average return rate of 1834.22%. New tokens like Brett (BRETT) and BOOK OF MEME (BOME) captured investors’ imaginations and wallets, with BRETT soaring an astounding 14,353.54% from its launch price.

“While it is of course not wise to be all in memes (or any sector) – memes are simply where the funds and volume are at, those that have faded them have missed out big,” MacroCRG said.

This trend highlights a market shift from conventional value investing toward speculative, trend-driven opportunities.

In an interview with BeInCrypto, Michael Telera, the Ambassador at Laika the Cosmodog, believes that while speculative assets give quick returns, fundamentally strong assets can give sustained gains.

“While this surge is noteworthy, it brings to light a critical distinction in the crypto space: the difference between short-term speculation and long-term value creation. True ecosystem projects hold the key to sustainable growth and real user value. These projects are built on robust foundations, focusing on creating a comprehensive ecosystem that benefits all stakeholders. By prioritizing long-term potential and community building, investors can achieve lasting profitability,” Telera told BeInCrypto.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

RWA emerged as the second most profitable sector, registering a 213.49% return rate. Leading institutions, including BlackRock, have propelled this sector forward.

RWA’s performance was fueled by significant asset tokenizations and positive regulatory discussions. This trend bridges blockchain technology with tangible assets, merging digital finance with the physical world.

Matthijs De Vries, the founder and CEO at Nuklai, emphasized the RWA project’s potential for sustained returns, while short-term returns may be low.

“A couple of concerns regarding RWAs are the lower yields in general. A large subset of investors in Web3 expect significant returns on short timeframes. As RWAs are more closely aligned to traditional assets and processes, they typically yield lower returns in longer time frames, with the tradeoff that the risk is lower,” De Vries told BeInCrypto.

The AI sector also showed strong performance. With a 71.56% average return rate, it ranked third. Tokens such as Arkham (ARKM) and AIOZ Network (AIOZ) posted impressive gains, reflecting the growing integration of AI with blockchain technology.

Despite the surge in these sectors, the once-dominant DeFi sector struggled, overshadowed by the returns of meme coins, RWA, and AI. Meanwhile, Bitcoin (BTC) is up by 45% year-to-date, and Ethereum (ETH) is up by 49.65% in the same time frame.

“Another concern is that regulations haven’t caught up everywhere when it comes to tokenized RWAs, with a lot of uncertainty about ownership, legal enforcement — or laws that make tokenized RWAs impossible for specific assets in certain jurisdictions,” De Vries elaborated.

Despite the excitement around these profitable sectors, investors should tread cautiously. The volatile nature of meme coins, the regulatory uncertainties of RWAs, and the nascent stage of AI integration pose risks. However, the substantial gains seen also present unique opportunities for the bold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.