Lido DAO dropped 8% in May as the current Ethereum price correction spreads towards ETH 2.0 liquidity staking protocols. However, on-chain data suggests a positive LDO price prediction may be on the cards.

Lido DAO (LDO) is a liquid staking solution for Ethereum. It enables users to stake their ETH without the constraints of minimum deposits requirement or node running costs. The underlying on-chain data has flashed some green signals in the last few days.

Here’s how social media perception and the spikes in transaction volume could validate investors’ positive Lido DAO price prediction.

Lido DAO is Experiencing Spikes in Transaction Volume

While the price has been in a downtrend since the start of May, LDO has been recording a significant surge in daily Transaction volume. The chart below illustrates how total daily LDO transactions have spiked above $30 million in four of the last nine trading days.

Notably, before May 2, the last time LDO recorded transactions surpassed $80 million was April 21, shortly before the price reached its previous local high of $2.63.

Such spikes in daily transaction volumes suggest that whales are making big bets across the ecosystem.

And if the previous price rallies are to go by, the current increase in the spate high volume transaction could soon trigger the next LDO price rebound.

Negative Social Sentiment Could Attract New Investors

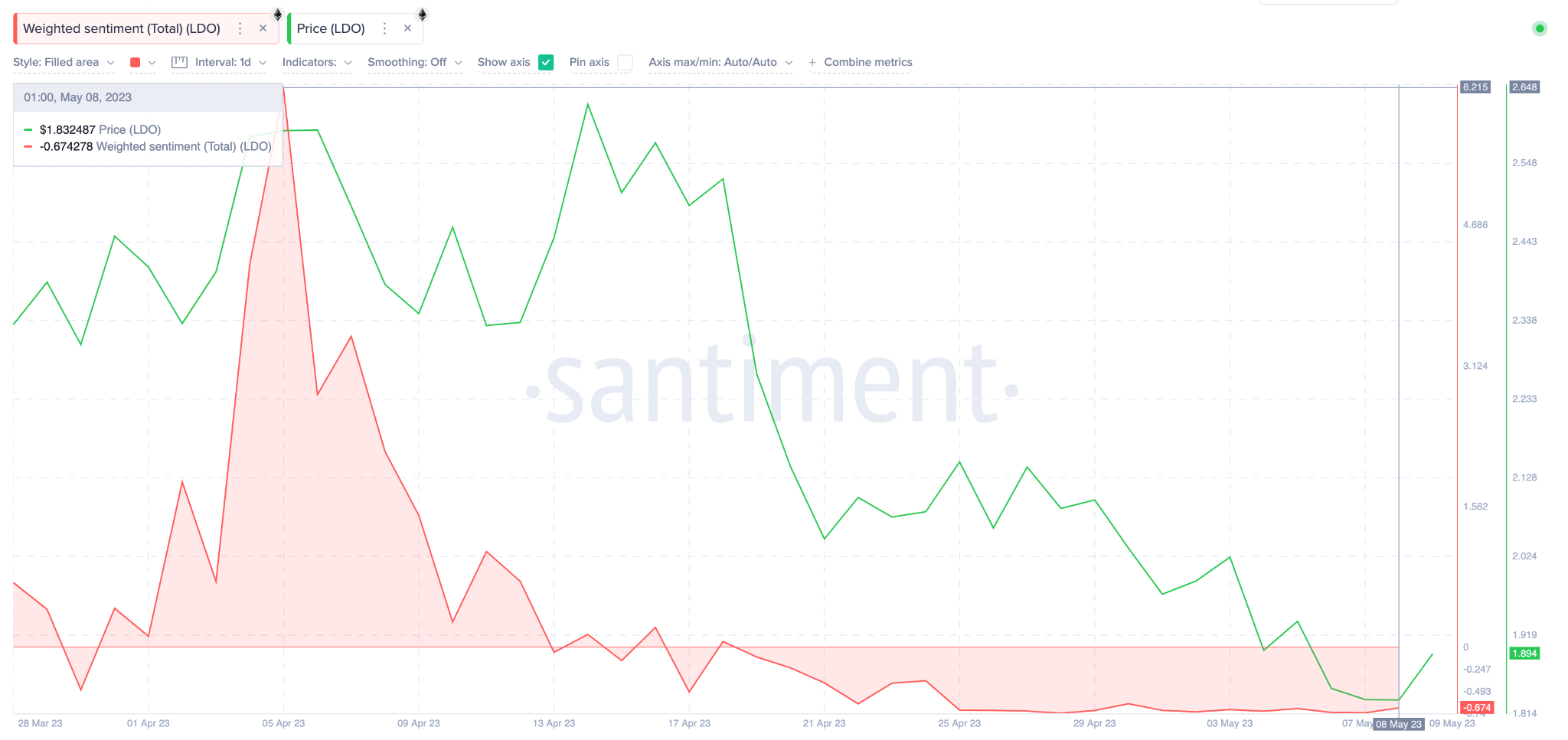

Moreso, the social perception surrounding LDO has become largely negative in recent weeks. The Weighted Sentiment, which evaluates the ratio of positive mentions to negatives, shows that most LDO stakeholders are pessimistic.

The chart below shows Lido DAO Weighted Sentiment has been trending negatively since April 17. And as of May 8, the value stood at -0.67.

When Weighted Sentiment stays negative for extended periods, as seen above, it signals widespread Fear, Uncertainty, and Doubt (FUD) across the blockchain network.

Strategic investors looking to buy the dip could consider this perfect timing to enter the market.

Once the current FUD clears, LDO could make significant price gains before the social sentiment reaches euphoric levels again.

LDO Price Prediction: A Rebound to $2.11 Looks Viable

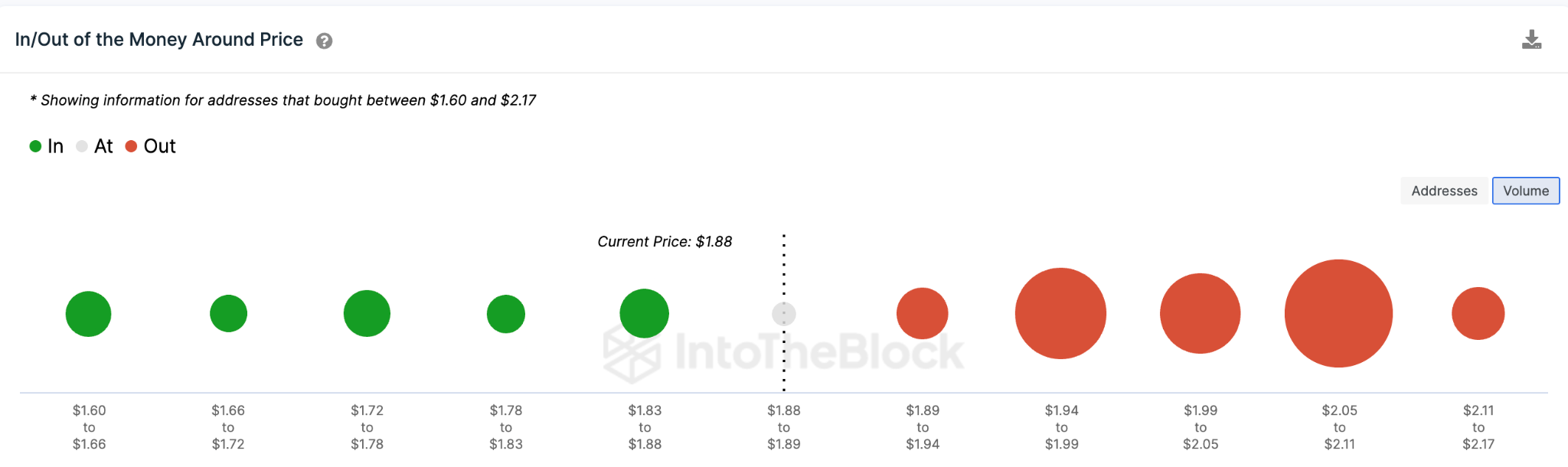

An in-depth analysis of the In/Out of the Money Around Price (IOMAP) data compiled by IntoTheBlock suggests that a rebound to $2.11 is the most likely LDO price prediction.

But first, the bulls will have to clear the initial bearish resistance of 364 investors that had bought 12.7 million tokens for an average price of $1.97.

If LDO price rises above that $1.97 as expected, holders can anticipate further gains until it reaches the next significant resistance level at $2.08.

At that zone, 1,300 investors that purchased 127 million LDO at a maximum price of $2.11 could slow down the rally while booking some profits. This cluster of holders could look to sell from as low as $1.95.

Conversely, the bears could invalidate this outlook if the LDO price drops below $1.83. However, the buy-wall mounted by 462 investors that bought 11 million coins for a minimum of $1.83 will aim to prevent this.

But if that support cannot hold, LDO may experience an unlikely downtrend toward $1.60, with resistance levels at $1.75 and $1.69 along the way.