Believe (LAUNCHCOIN) is up 15% in the last 24 hours, extending its impressive run after soaring more than 17,000% over the past month. The rally comes despite broader signs of cooling momentum on the Believe platform, which has seen a sharp drop in token launches and user activity.

LAUNCHCOIN’s EMA lines now point to consolidation, signaling a pause as traders assess the next move. With key support and resistance levels in play, LAUNCHCOIN’s performance may serve as a critical indicator of whether Believe can reclaim relevance in the competitive Solana launchpad space.

SponsoredToken Launchpad Race: Believe Surges, Then Slows

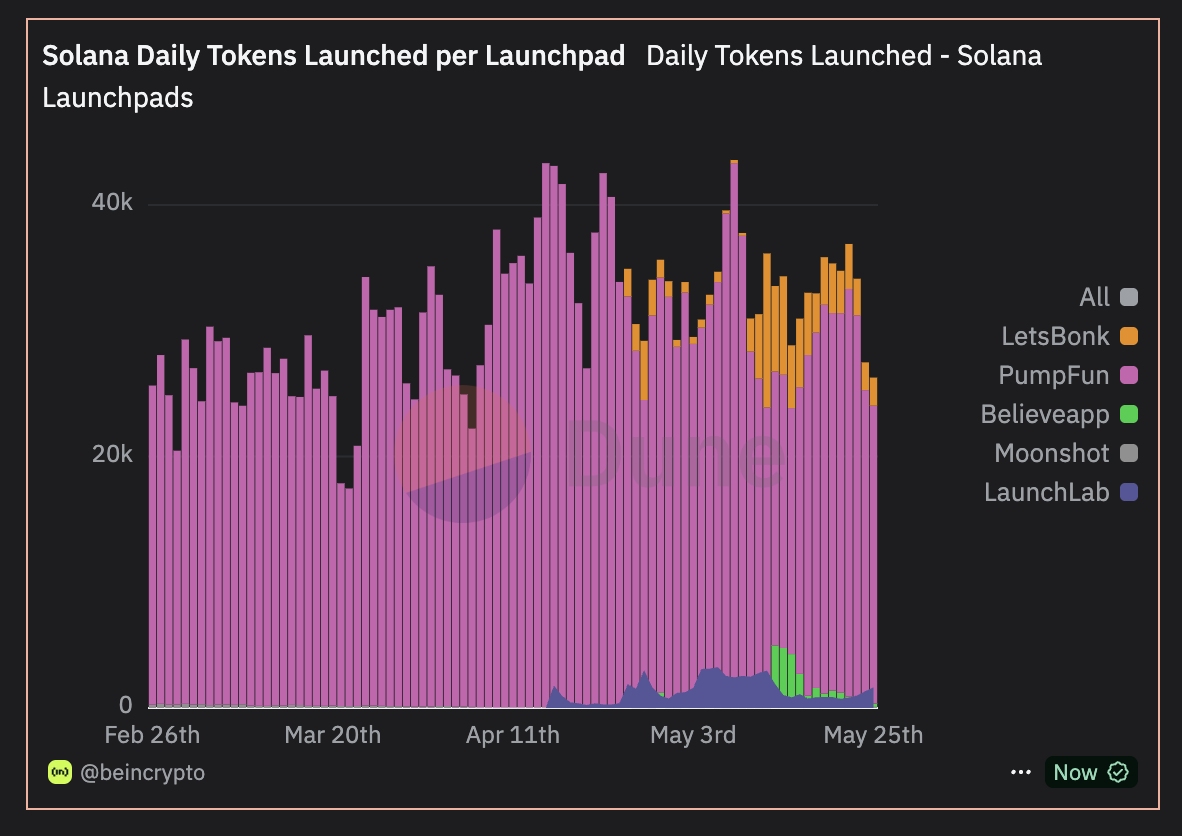

Believe App experienced a major spike in activity between May 13 and May 15, with over 4,000 tokens launched daily through its social-media-driven platform.

This rapid growth briefly made Believe one of the most active token launchpads in the Solana ecosystem, highlighting its viral appeal and ease of use.

However, that momentum has tapered off significantly—new token launches dropped to just 268 by May 25 following the platform’s decision to suspend launches via Twitter and pivot toward an API-based model.

The drop-off suggests that much of the platform’s initial traction may have been fueled by short-term hype rather than sustained user engagement.

Meanwhile, Pump.fun remains the clear market leader, consistently supporting between 20,000 and 30,000 token launches per day—an order of magnitude higher than its closest challengers.

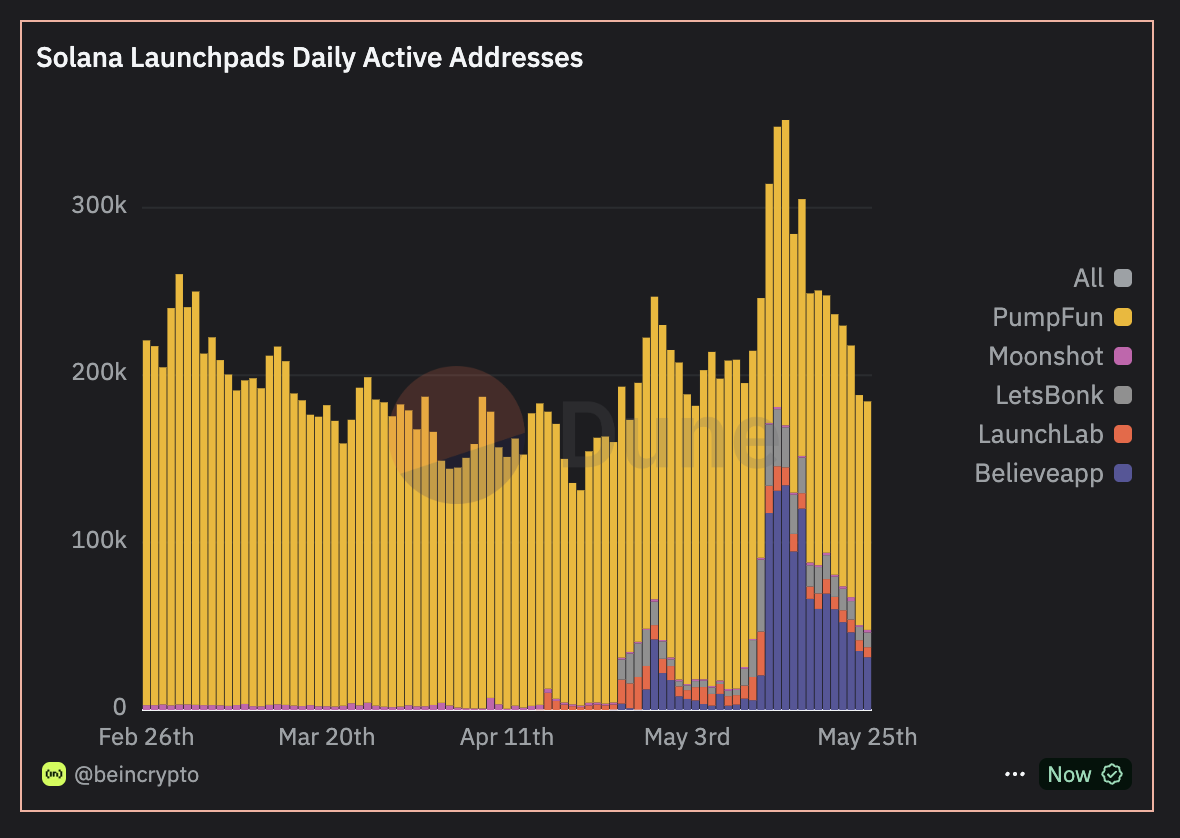

Even as Believe peaked at 134,000 daily active addresses on May 15, Pump.fun held strong with 136,519 active users as recently as May 25, indicating deeper and more durable user involvement. The contrast between the two platforms reflects the challenge of turning viral momentum into long-term traction.

Without continuous user stickiness or unique utility, Believe may struggle to maintain relevance in a space dominated by Pump.fun’s scale and consistency.

Believe Tokens Lose Steam as Competitors Take the Lead

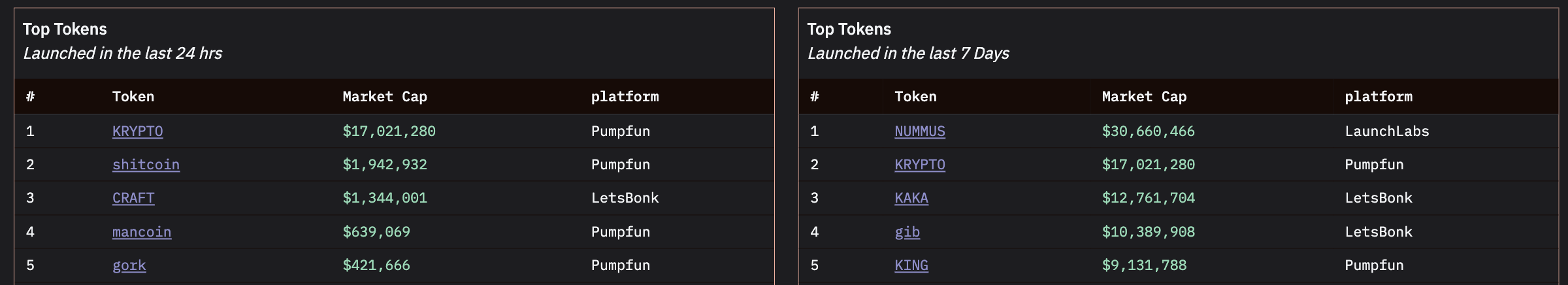

Believe-launched tokens are losing momentum, with few gaining notable traction in recent days. Over the last 24 hours, 4 of the top 5 performing tokens across major Solana launchpads came from Pump.fun, while the fifth came from LetsBonk.

In the last 7 days, Pump.fun and LetsBonk each contributed two top tokens, with one coming from LaunchLabs—leaving Believe with none among the leaders.

SponsoredThis shift shows a clear reversal in platform dominance compared to earlier weeks, when Believe tokens regularly topped performance charts.

The decline in breakout tokens from Believe suggests that the platform’s initial surge may have been driven more by speculative buzz than lasting product-market fit.

A few weeks ago, Believe dominated launchpad success metrics, but the absence of top tokens recently may reflect waning user interest or a drop in token quality.

As other platforms like Pump.fun and LetsBonk continue to produce high-performing tokens, Believe risks fading from relevance unless it can re-engage its user base or differentiate its offering.

Sponsored SponsoredLAUNCHCOIN Consolidates After Parabolic Surge

LAUNCHCOIN has surged over 17,000% in the past 30 days and is still climbing, gaining more than 15% in the last 24 hours alone.

Despite this explosive rally, its EMA lines now suggest the price is entering a consolidation phase, potentially pausing before the next major move.

The current setup shows a market in balance, with neither buyers nor sellers fully in control after the parabolic rise.

If momentum returns, LAUNCHCOIN could push toward the $0.28 level, and a breakout above that could open the door to a move as high as $0.377.

However, if selling pressure emerges and the token loses support at $0.152, a deeper pullback toward $0.11 becomes likely.