Kraken‘s co-founder Jesse Powell said he donated $1 million to Donald Trump’s presidential campaign.

While the 45th president of the US has campaigned with a crypto banner in the past few months, cryptocurrency failing to feature in the Thursday night debate has left many disappointed.

Jesse Powell’s Pro-Crypto Move: $1 Million to Trump

Powell said that most of his $1 million donation to Trump’s presidential bid was in Ethereum (ETH). His support for Trump comes as crypto proponents advocate for the end of an anti-crypto era. The Kraken executive cited attacks by Senator Elizabeth Warren and Gary Gensler, chair of the US Securities and Exchange Commission (SEC).

“I am excited to join other leaders from our community to unite behind the only pro-crypto major party candidate in the 2024 Presidential election so the United States can continue to remain a leader in blockchain technology,” Powell wrote.

According to the Kraken executive, President Joe Biden’s administration has done nothing to curb “a campaign of unchecked regulation by enforcement.” This negligence has shrunk the competitiveness of the US, Powell said, compared to other major economies in the world which continue to advance clear rules for digital assets regulation.

The announcement came hours after the Thursday night debate between President Biden and his opponent, Trump. To the surprise and disappointment of the crypto community, the debate only focused on the economy, abortion, immigration, and foreign policy, leaving out cryptocurrency and digital assets in general. A poll by MicroStrategy founder and chairman Michael Saylor ahead of the debate highlights the dismay.

Coinbase exchange decried this oversight, acknowledging the huge population of crypto owners in the country. Per the US-based trading platform, this qualifies digital assets to feature in the conversation.

“The first Presidential Debate has just ended and crypto was not mentioned. With 52 million Americans and 19% of Georgians owning crypto, it’s time to make sure it’s part of the conversation going forward,” Coinbase remarked.

Other community members on X shared Coinbase’s sentiment, with the oversight provoking a sell-off among PolitiFi token holders. TRUMP, MAGA, BODEN, TREMP, and STRUMP tokens plummeted, some to double-digit extremes.

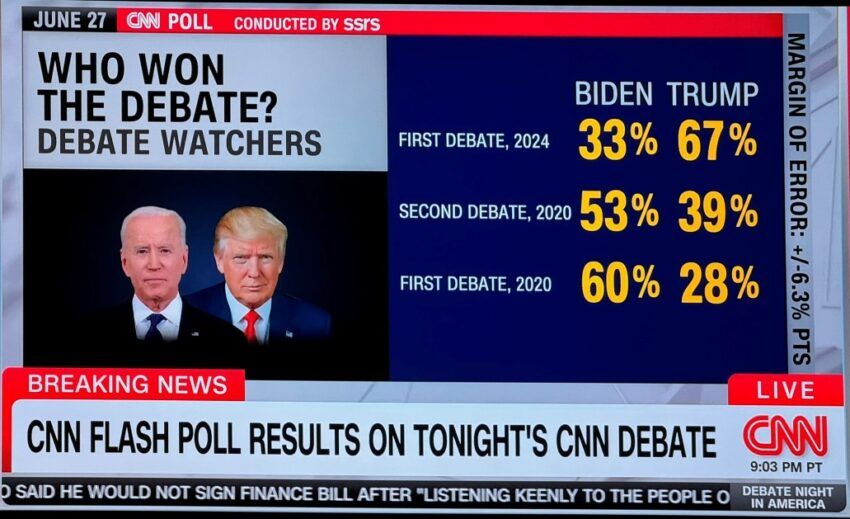

Notably, this was the first debate between the two presidential aspirants. Another is slated for September before the November elections. The general sentiment is that Trump won the first round, clocking 67% against 33% for Biden, according to CNN flash polls.

Also Read: Crypto Regulation: What Are the Benefits and Drawbacks?

Donations Soar as Crypto Lobbists Speak Out

Besides Powell, the Winklevoss twins had donated $2 million worth of Bitcoin to Trump’s campaign. Quantitative trading firm Jump Crypto also donated $10 million to the crypto-focused Super Political Action Committee (PAC) Fairshake, joining Coinbase in the pro-crypto campaign. With such big bucks from crypto lobbyists, speculation is that cryptocurrency could sway round two of the debates.

“Democrats such as Elizabeth Warren drove the Bitcoin and Ethereum industry into the arms of Trump with vicious threats against the basic rights and freedom of everyday Americans. The Democrats best start undoing the damage with reasonable legislation. The United States could establish itself as a world leader if it passed liberal legislation and its judicial and executive branches made it clear that innovators are free to innovate in the so-called land of free. That would go a long way towards mainstreaming crypto worldwide, not just the US,” Felix Mohr, Managing Director at MohrWolfe, told BeInCrypto.

Read More: Who Are Cameron and Tyler Winklevoss? A Profile on the Brothers

With crypto proving to be fundamental in US politics in 2024, Jay Jacobs, Head of Thematic and Active ETFs at BlackRock, declared BTC a hedge against geopolitical and monetary risks. Jacobs reinforced Bitcoin’s growing importance and demand.

“Bitcoin is a nascent asset. It’s only one-tenth of the size of the gold market. Therefore, it has high volatility and behaves a bit differently than stocks and bonds. A lot of investors look at it as a potential hedge against geopolitical and monetary risks. Other investors look at it as a way to play future adoption of blockchain technology. In either case, investors must take a measured approach to Bitcoin, considering both the risks and the potential returns of the asset,” Jacob said in the video.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.