A large quantity of newly launched Arbitrum ARB tokens has been sold by a single entity. However, it has had little impact on daily price action.

As is often the case with airdrops, the tokens are sold to markets pretty quickly. This causes a massive dump from the launch price in a very short time.

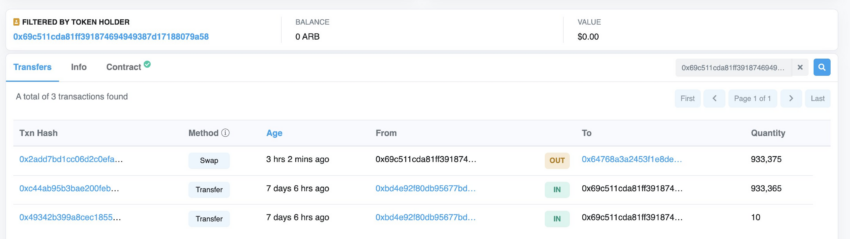

On March 31, a single whale converted almost a million ARB tokens into Ethereum. A whopping 933,375 ARB was exchanged for 708 ETH a few hours ago. Additionally, the transaction was worth around $1.27 million at current prices.

Furthermore, the move was observed by ‘Lookonchain’ which described the entity as a “super airdrop hunter.”

Observers have speculated that it could be the Arbitrum hacker offloading their ill-gotten gains.

Korean Exchanges Accumulating Arbitrum?

The on-chain analytics feed found another super airdrop hunter that received 1.4 million ARB worth $1.9 million on March 24. These were sent to Uniswap to provide liquidity but have yet to be sold or converted.

The Arbitrum airdrop occurred on March 23 when the initial price of the token was as high as $8.60. However, in true airdrop fashion, most of them were instantly sold, causing an 85% price crash from which it has not recovered.

According to industry outlet Wu Blockchain, Korean crypto exchange Upbit may have been hoarding ARB tokens. On March 31, Wu reported the address had been accumulating massive amounts of ARB over the past day, adding:

“Now it holds 59M ($84.4M) ARB, based on the activity, it might be Upbit’s hot wallet. This Korea’s largest exchange now holds the second most ARB after Binance.”

This could be a sign that Korean exchanges are expecting an uptick in demand for Arbitrum tokens.

According to L2beat, Arbitrum One remains the most popular layer-2 network in terms of total value locked. It has an L2 market share of 67% with $6.13 billion in TVL. However, the spike occurred on the same day as the airdrop, suggesting that its own tokens are making up around $2 billion of that.

ARB Price Outlook

ARB is currently trading at $1.39, following a 3.7% gain on the day. Nevertheless, it has been a flat line around current levels since the massive dump following the airdrop.

ARB is currently down 84% from that peak price and appears to have found equilibrium. There are 1.27 billion tokens circulating out of a total of 10 billion. Its market cap is around $1.77 billion at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.