Crypto data platform Kaiko recently reported that the introduction of spot Solana exchange-traded funds (ETFs) did not significantly impact the market.

Despite initial enthusiasm and a brief price spike, Solana’s (SOL) market dynamics quickly returned to their prior state, reflecting skepticism and regulatory challenges.

Solana’s Brief Surge: Investor Hopes Fade Quickly Despite ETF News

On June 27, VanEck filed for the first spot Solana ETF with the US Securities and Exchange Commission (SEC). A similar filing from 21Shares followed on June 28.

These filings initially generated excitement, causing Solana’s price to spike by 6%. However, Kaiko reveals the impact was fleeting, and market dynamics soon returned to their previous state.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

“The filings provided a temporary boost to market sentiment, which had been dampened by fears of a broad selloff due to Mt. Gox repayments,” the report reads.

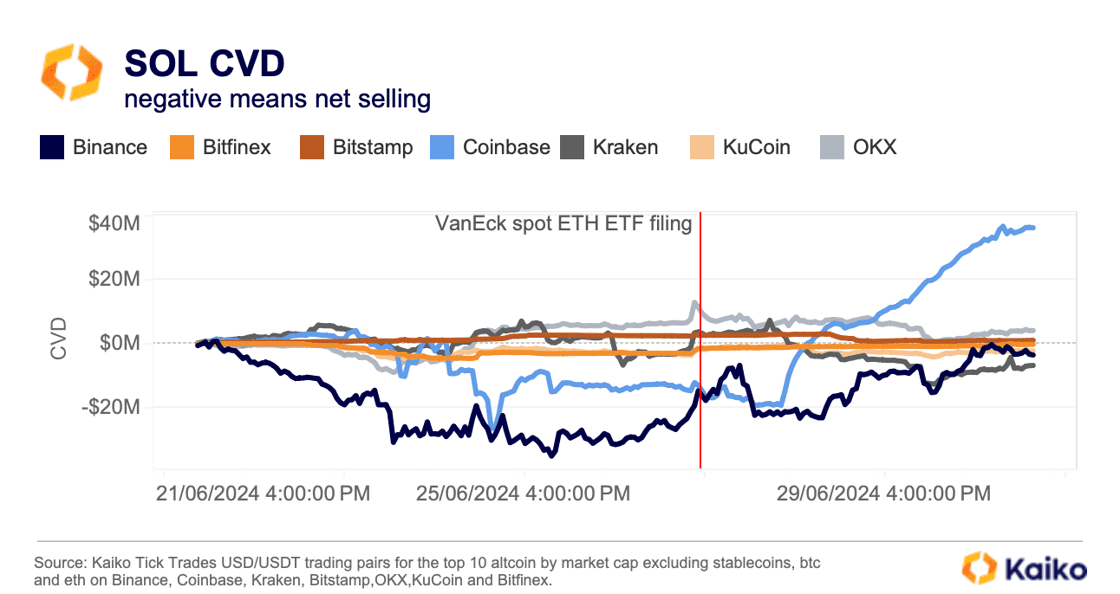

This temporary shift was reflected in Solana’s cumulative volume delta (CVD) data, which measures cryptocurrencies’ net buying and selling. According to Kaiko, Solana recorded a net positive CVD of $29 million over the past week, primarily driven by increased spot buying on Coinbase.

Furthermore, Kaiko’s analysis suggests that investor expectations for spot Solana ETF were not as high as for other cryptocurrencies like Ethereum (ETH). Solana, often called an ‘Ethereum killer,’ struggled to maintain its momentum.

A comparative analysis with Ethereum highlighted this discrepancy. After spot Ethereum ETF received partial approval on May 23, its price showed a more sustained upward trend than Solana.

Kaiko also noted that the effect of the Solana ETF news on the derivatives market was limited. While there was a brief spike in the volume-weighted funding ratio of the SOL token on June 27, it soon returned to neutral levels. Open interest remained virtually unchanged and was 20% lower than its early June levels, underscoring the lack of sustained bullish demand.

Solana Ecosystem Continues to Expand Amid Regulatory Doubts

One possible explanation for the muted market reaction could be skepticism regarding the approval odds of a spot Solana ETF. Unlike Bitcoin and Ethereum, Solana has less data accumulated in the derivatives market, making it challenging to convince regulators about its price stability and resistance to manipulation.

Kaiko cited these regulatory hurdles as a significant factor. Industry experts share Kaiko’s cautious outlook. ETF analyst James Seyffart from Bloomberg Intelligence noted that Solana’s status as a security could significantly hinder the approval process.

“Solana’s classification as a security presents a very rocky road for ETF approval,” Seyffart remarked.

Despite the challenges, there are positive developments within the Solana ecosystem. Data from the crypto exchange Bitget report shows that Solana’s decentralized finance (DeFi) ecosystem has experienced rapid growth, with its total value locked (TVL) rising from approximately $1.3 billion at the beginning of 2024 to about $4.5 billion at the end of June.

The Solana Foundation also continues to innovate. It recently expanded its ecosystem to include Solana mobile phones, SDKs, and the newly launched Solana Blinks.

“These products lay the foundation for Solana’s mass adoption, represent Solana’s adaptation to mobile internet development, and are key to the constant increase in active addresses on the chain,” Ryan Lee, Chief Analyst at Bitget Research, told BeInCrypto.

Read more: What Is Solana (SOL)?

Nonetheless, the Solana ecosystem’s continuous growth and innovation lay the groundwork for potential future success. Additionally, as regulatory conditions change, Solana’s prospects may improve.