Ethereum (ETH) price continues to nurture a recovery, drawing tailwinds from growing demand in the ETF (exchange-traded funds) market. However, broader market jitters and selling pressure from institutions continue to act as a counterweight.

Crypto markets continue to record a sentiment shift, with the global market capitalization up almost 3%.

Ethereum Stages Recovery

Ethereum’s price has surged nearly 30% since bottoming out at $2,111 on August 5 amid ongoing recovery efforts. The daily chart reveals a pattern of higher lows in both the price and the Relative Strength Index (RSI), indicating increasing bullish momentum. This momentum could strengthen further if the RSI decisively moves above the 50 mark.

The spikes on the volume profile (orange) also show ETH bulls are waiting to interact with the Ethereum price once it enters the demand zone between $2,924 and $3,075. Notably, this order block turned into a bearish breaker when Ethereum’s price slipped below it on August 3.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

With Bitcoin taking back the $60,000 psychological level and the global market capitalization up 3%, crypto markets show a shifting sentiment. Among other reasons, tailwinds sprout from positive ETF flows, with ETH ETFs taking the lead.

As BeInCrypto reported, Ethereum led capital inflows into crypto investment products last week. It attracted $155 million out of the total $176 million.

“Ethereum has benefited the most from the recent market correction, attracting $155 million in inflows last week. This brings its year-to-date inflows to $862 million, the highest since 2021, largely driven by the recent launch of US spot-based ETFs,” a CoinShares report read.

Counterbalances to ETH Price Action

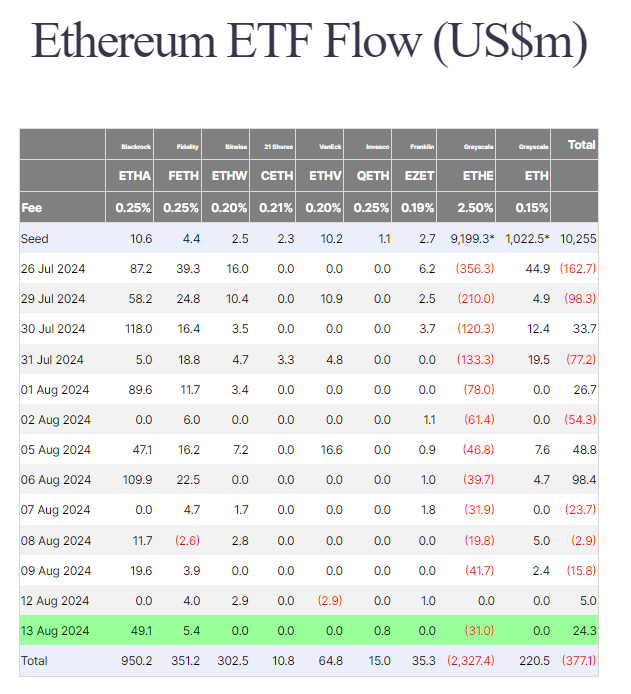

On Tuesday, spot Ethereum ETFs registered $24.34 million in net inflows, effectively beating the $5 million recorded on Monday. As per Farside Investors, BlackRock’s ETHA has consistently attracted inflows since its launch, suggesting strong investor confidence.

Specifically, ETHA recorded inflows of $49.1 million, bringing its total inflows to $950.2 million. On the other hand, Grayscale’s ETHE continues to grapple with negative flows, recording total outflows of $2.327 billion. This reflects the divergent performance between the two prominent Ethereum ETFs, with Grayscale’s case ascribed to customer redemptions as it happened for Bitcoin in January.

“Institutions have done it before with BTC. They are doing it again with ETH. They almost made people believe that BTC ETF was a failure. It is almost the same story being repeated with ETH. We might retrace the gains of this cycle and then go back higher, but until then it is painful. Seeing the next-gen financial rails hammered to ashes is very painful!” Vikas Singh expressed.

Read more: How to Invest in Ethereum ETFs?

Nevertheless, while Ethereum ETF inflows create positive momentum for ETH, the institutional sell-off acts as a counterforce, creating headwinds. According to Lookonchain, Jump Trading started selling ETH again on Wednesday. The crypto arm of a Chicago-based trading firmunstaked 7,049 ETH worth $46.44 million from Lido Finance and put it up for sale.

“Jump Trading started selling ETH again just now! They claimed 17,049 ETH ($46.44 million) from Lido and transferred it out for sale. Jump Trading currently has 21,394 wstETH ($68.58 million) left,” Lookonchain wrote.

BeInCrypto reported that the firm had applied to redeem over 14,000 ETH, valued at over $48 million, on August 7. Thiswas the same day it unstaked 11,500 ETH, valued at $29 million from Lido Finance, and moved it to a centralized exchange. It also sold ETH worth over $231 million on August 5.

Moving locked assets to centralized exchanges often indicates an intention to sell, potentially putting downward pressure on ETH’s price. These sell-offs against ETF investor demand have capped Ethereum’s upside below $2,800, with potential for range-bound movement amidst these counterbalances.