During early Monday in Asian trading hours, Ethereum (ETH) plummeted to its lowest since January 2024, hitting a low of around $2,100. This sharp drop occurred in just a 15-minute window around 01:00 UTC, with Ethereum’s value nosediving from $2,540 to $2,100—a 15% fall.

This swift descent shocked traders, struggling to believe the rapid decline.

Jump Trading and Other Institutions Trigger Ethereum Sell-Offs

Alongside Ethereum, major assets like Bitcoin (BTC) and Solana (SOL) each shed 10% of their value over the same period. Among the top ten cryptocurrencies by market capitalization, Ethereum was the worst affected.

Over the last 24 hours, the crypto market experienced severe liquidations, losing over $830 million. According to Coinglass data, Ethereum traders accounted for $308 million of these losses.

“We’ve observed ETH gas fees soar to 985 Gwei, then stabilize around 60 Gwei, largely due to the liquidation of stETH and WBTC on lending protocols like Lido. If the next bull run requires a similar level of liquidation, ETH might need to drop to $1,770. However, this is not the end. Investors must actively monitor institutional activity and track broader market uncertainties,” Iris Cheung, Orbiter Finance Co-Founder, told BeInCrypto.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

DeFi Mochi, a crypto analyst, attributes Ethereum’s drastic drop primarily to large fund sell-offs. Key players such as Paradigm and Grayscale significantly contributed to the downturn.

Paradigm offloaded 46,000 ETH at roughly $3,000, totaling approximately $138 million. Similarly, Grayscale sold 372,000 ETH valued at around $1.1 billion.

“Grayscale has over $5 billion worth of ETH to potentially unload,” DeFi Mochi warned.

Additionally, according to Spot On Chain, Jump Trading has been actively dumping its Ethereum holdings. In the days leading up to the market dip, the firm executed significant movements of Ethereum to centralized exchanges (CEXs).

Over ten days, Jump Trading engaged in various transactions, including redeeming and unstaking significant amounts of Wrapped Staked Ethereum (WSTETH) and Staked Ethereum (STETH) through platforms like Lido Finance. These activities culminated in a net deposit of 72,213 ETH, worth about $231 million, to several major CEXs, including Binance and Coinbase.

Moreover, an unknown “smart money” entity also participated in the pre-crash sell-off. This entity deposited 2,500 ETH worth $7.27 million into Binance just before the market downturn. The strategic timing of this transaction, right before a 21% drop in Ethereum’s price, highlights the calculated moves by informed players in the crypto space.

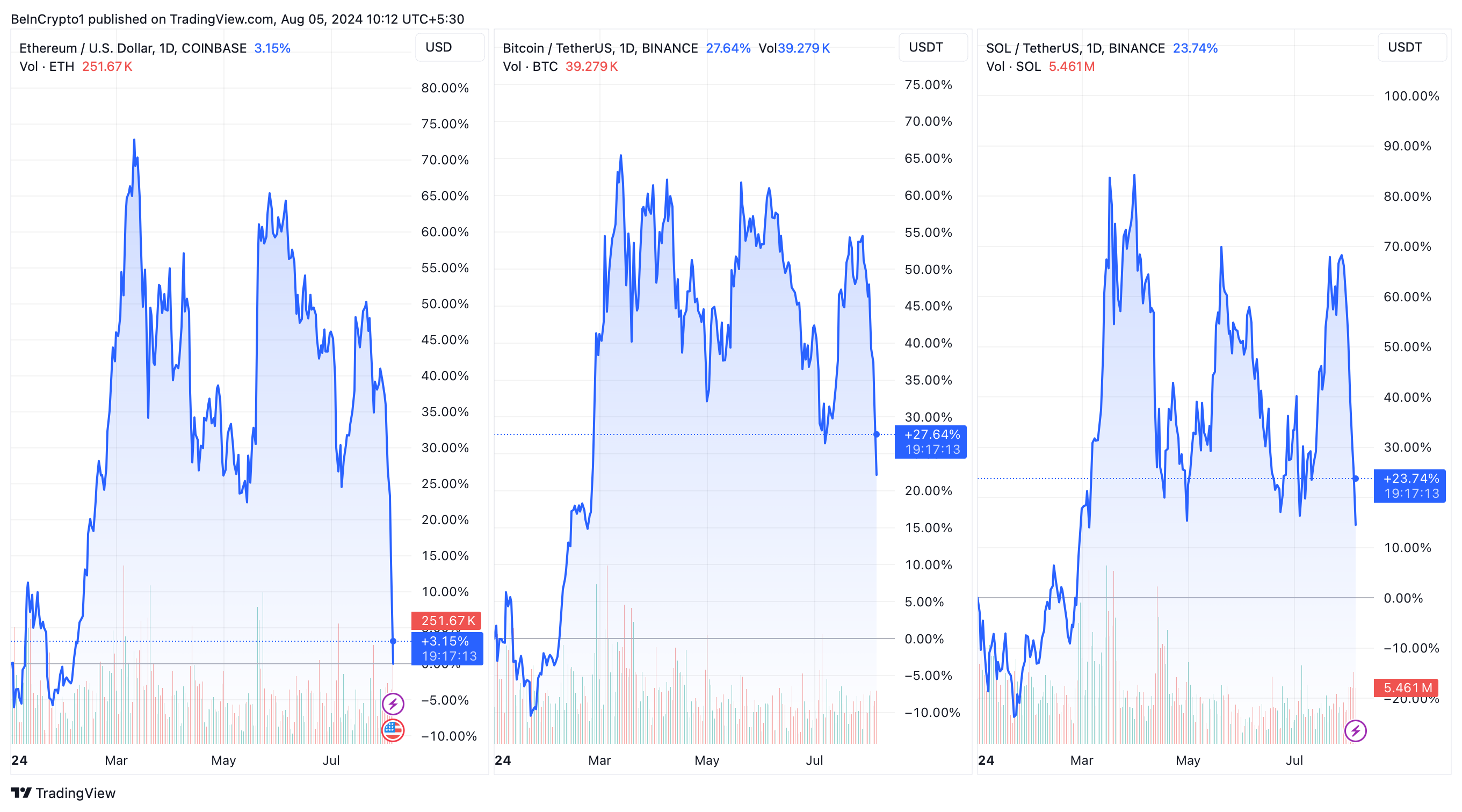

It is worth noting that Ethereum has lagged behind its counterparts this year. While Bitcoin and Solana have recorded year-to-date gains of 27% and 24%, respectively, Ethereum has barely maintained its value.

Read more: Which Are the Best Altcoins To Invest in August 2024?

Global economic strains and geopolitical tensions, particularly between Iran and Israel, exacerbate broader market instability. Unexpected hawkish shifts by the Bank of Japan, along with the US Federal Reserve’s reluctance to cut interest rates, have heightened market uncertainty.

That being said, the crypto market’s fear and greed index falls to 26, signaling a widespread fear.

“The Bank of Japan’s interest rate hike triggered this broad-based correction, impacting both crypto and traditional markets. While the sudden drop is alarming, history suggests swift market recoveries are possible,” CEO of crypto derivatives exchange Pi42 told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.