In the intricate realm of cryptocurrency regulation, John Deaton is a vocal and relentless industry advocate. An experienced lawyer, Deaton has carved out a niche for himself, consistently pushing for rules that are transparent and adaptable to the dynamic nature of cryptocurrencies. And warning against regulatory overreach.

John Deaton, a pro-crypto lawyer, firmly backs embattled cryptocurrency platforms like Ripple and the exchange Coinbase. With more than a quarter of a million Twitter followers and a widely read blog, he effectively leverages these platforms to share insights and foster discourse on the future of cryptocurrencies.

The Man Behind the Tweets

Deeply familiar with the complex world of cryptocurrency legislation, Deaton’s influence reaches far beyond his digital footprint. He wields his pen with purpose, authoring amicus briefs and extending support to his clients as a “friend of the court.” His staunch public defense of these exchanges testifies to his unwavering commitment.

The Litigation Landscape: Ripple and Coinbase

Deaton’s interventions have proven critical in the high-stakes lawsuits embroiling Ripple (XRP) and Coinbase. His passionate defense of these exchanges has helped shape the narrative around cryptocurrency regulation.

In the Ripple case, Deaton has countered the SEC’s charges of unregistered securities offerings with sharp, well-structured rebuttals. In a similar vein, Deaton has led the charge in Coinbase’s clash with the SEC over its Lend product, questioning the regulator’s overreach.

His stance on the Coinbase vs. SEC battle is clear and summed up in a recent tweet:

“All differences must be set aside to unite [against] the common enemy. The SEC’s gross overreach is the enemy of many different companies, projects, Platforms, industry associations, retail investors, and blockchain users. Innovation must win. Then, and only then, may the best tech win.”

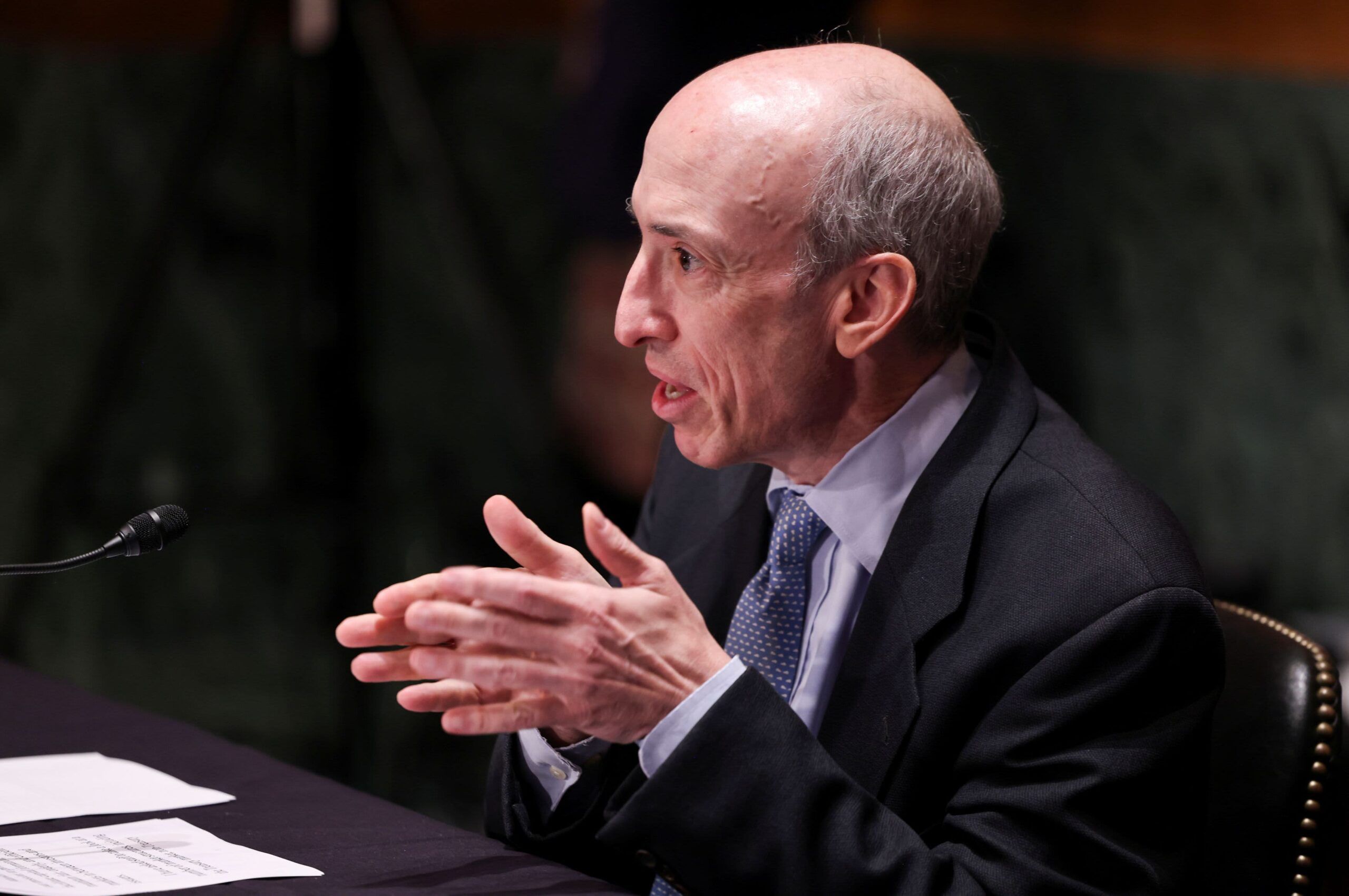

Gary Gensler’s SEC and Crypto Regulations

In order to fully grasp Deaton’s viewpoint, one needs a clear understanding of the current regulatory climate. Gary Gensler, the SEC chair, is at the helm and steering the ship.

Interestingly enough, back in 2018, Gensler, serving as an MIT professor, emphasized the strong need for clarity in crypto regulations. Yet, as he ascended to his role as chair, his path has taken a surprising turn, veering far off the course he once advocated.

“In 2018, [Gensler] stated that the crypto market desperately needed clarity, but today as chairman, he claims it has always been crystal clear. He is engaging in a jurisdictional land grab of a market he has no business regulating,” contends Deaton.

Gensler’s Shift and the Stifling of Cryptocurrency Innovation

Deaton voices his concern over Gensler’s altered stance, arguing that the SEC’s overreach is stifling innovation in the crypto space. “In 2018, Gensler said 75% of the market were not securities. Today he claims all tokens except Bitcoin are securities,” Deaton observes.

These shifting viewpoints have sparked criticism and allegations of hypocrisy. Critics argue that Gensler’s present stance could potentially stifle innovation and breed uncertainty, the very issues he once warned against.

The crypto industry questions whether Gensler’s initial support for clear regulations was mere rhetoric. Or if his new role has swayed his view on the crypto market’s potential and challenges.

Cryptocurrency and the True Nature of Securities

Deaton stresses the distinction between an asset being sold as a security and being a security itself. “Any asset can be sold as a security. Orange groves, whiskey, condos, beavers (pelts), and Bitcoin have all been sold as securities, but it didn’t make all beavers securities. Also, they need to stop focusing on the token itself,” he asserts.

Distinguishing Cryptocurrencies: Securities vs. Commodities

Understanding the difference between a security and a commodity is critical for an asset due to different regulatory implications.

A security, as defined by the SEC, generally refers to a financial instrument or contract that provides an individual with an ownership position in a publicly traded corporation (stocks), a creditor relationship with a governmental body, or a corporation (bonds). Or represents rights to ownership as represented by an option.

In crypto, a token’s classification as a security hinges on the Howey Test. A Supreme Court-created criterion for identifying investment contracts. If it is deemed a security, then the SEC would regulate its sale and trading.

On the other hand, a commodity refers to goods used in commerce that are interchangeable with other goods of the same type. Commodities are often the building blocks for more complex goods and services. In the context of cryptocurrency, Bitcoin is an example of a commodity. It doesn’t represent a stake in a project or a company (like a security would), but rather is a type of digital asset in and of itself. Commodities in America are generally regulated by the Commodity Futures Trading Commission (CFTC).

Categorizing a cryptocurrency as a security or commodity guides its trading norms and regulatory oversight. Given that different governing bodies and laws apply to each.

The Path Forward: Courts or Congress?

Highlighting the role of judicial rulings, Deaton notes their potential to foster crypto adoption in the United States.

He says, “We will not see mass adoption in the United States until the courts start handing the SEC losses. Congress isn’t going to act until, at the earliest, late 2025.”

John Deaton’s insightful advocacy and robust defense of the crypto industry establish him as a crucial voice in cryptocurrency debates. As legal battles persist, his voice promises to continue influencing the shape of this rapidly evolving space.